Gold – Consolidation Triangle Rather Suggests Continuation Of The Rally

Image Source: Pixabay

Gold prices have taken a dip as hopes for a rate cut diminish following the reduction of broader conflict risks in the Middle East. As the attention is now turning to the upcoming Fed meeting, gold is now hovering above the USD 2,300 psychological mark looking for further stabilization and new input. Gold – Consolidation triangle rather suggests continuation of the rally.

Review

Since the low on February 14th at USD 1,985, gold has surged by approximately 22.5% in the past two and a half months. So far, the peak of the breakout rally was seen on Friday, April 12th, with prices around USD 2,431. Subsequently, on the same day in the late afternoon, there was a sharp reversal and a price drop to USD 2,334. Although bulls managed to drive the gold price just above USD 2,400 in the following trading week, the all-time high was slightly missed with a peak at USD 2,416.

At the beginning of last week’s trading, profit-taking caused another significant price drop, reaching lows around USD 2,291 on Tuesday morning. By the end of the week, prices managed to recover slowly but steadily, reaching highs of USD 2,352. Thus, the gold price achieved a first stabilization above the psychological mark of USD 2,300 after its recent pullback. However, the previously very bullish picture is now a bit tarnished.

The anticipated breakout rally has materialized

In the bigger picture, starting from its last panic low on October 6th, 2023, at USD 1,810, gold has appreciated by USD 621 or 34.3% per ounce within approximately six months. The breakout rally, anticipated and announced in advance, has thus materialized, although our target price of USD 2,535 has so far been missed by nearly USD 100.

Given the increasing reversal signals, the probabilities have risen that gold has reached the peak of its upward movement at USD 2,431 and is now already in correction back to the breakout level in the range around USD 2,100.

Of course, the tense geopolitical situation could trigger a renewed rise at any time. The slightly oversold technical chart and a possible consolidation triangle at a high level also favor a continuation of the recovery and also suggest the possibility of a rally continuation.

Nevertheless, it is now crucial to be very cautious and vigilant because from a seasonal perspective, after a strong rally, gold usually finds an important peak in spring between March and May and then corrects at least until midsummer.

Chart Analysis – Gold in US-Dollar

Weekly chart: Stochastic still bullish embedded.

(Click on image to enlarge)

Gold in US-Dollar, weekly chart as of April 29th, 2024. Source: Tradingview

On the weekly chart, at the end of February, gold finally broke clearly and sustainably above the strong resistance zone around USD 2,075 after numerous attempts. This breakthrough triggered a sharp rally and propelled gold prices almost vertically to a new all-time high of USD 2,431 within just a few weeks.

We had derived our target price for this breakout rally at USD 2,535 from the inverse head and shoulders formation. This classic pattern had occupied the gold market for three and a half years since the summer of 2020, leading to a challenging correction between USD 2,075 and USD 1,615. In hindsight, we might have better positioned the neckline of this formation slightly lower in the range around USD 2,025 rather than exactly at the peaks at USD 2,075, as this would have landed us closer to the current high point at USD 2,431 with our price target.

In the bigger picture, however, this level is likely only a temporary new all-time high. Unless gold manages to break out upwards shortly, the new all-time high may remain unattainable in the coming months or until autumn, though.

Overall, while the weekly chart remains bullish, the reversal signals are increasing somewhat. Only if a weekly closing price above USD 2,380 is achieved soon could the rally continue. Otherwise, the correction in the gold market will likely gradually expand in the coming weeks and find its low in the range between USD 2,075 and USD 2,150.

Daily chart: Slightly oversold setup favors further recovery.

(Click on image to enlarge)

Gold in US-Dollar, daily chart as of April 29th, 2024. Source: Tradingview

On the daily chart, it’s easier to observe that a first series of lower highs and lower lows has emerged in the gold market over the past two weeks. This defines a minor downtrend. Nevertheless, gold prices could still range and recover between USD 2,300 to USD 2,400 as part of an extended topping formation.

Similarly, the price action since April 12th may simply represent a consolidation in the form of a bullish triangle or a bullish flag at a high level. Only a deeper low clearly below USD 2,180 would confirm that the bears have indeed taken control of the gold market.

Considering the slightly oversold nature of the daily stochastic indicator and the increasing likelihood of a continuation of the ongoing countermove or recovery, it might take another one to three weeks before the situation in the gold market becomes unambiguous again.

Even though the bulls have initially succeeded in stabilizing above USD 2,300, a rise above USD 2,380 would still be necessary to breathe new life into the interrupted rally.

Overall, the daily chart leans slightly bearish. The distance to the 200-day moving average (USD 2,032) is considerable, indicating significant correction potential. While an intermediate recovery could delay the continuation of the correction, the probabilities of a rally continuation remain manageable below USD 2,380. However, prices above USD 2,400 would be a clear signal for gold’s victory lap and new all-time highs.

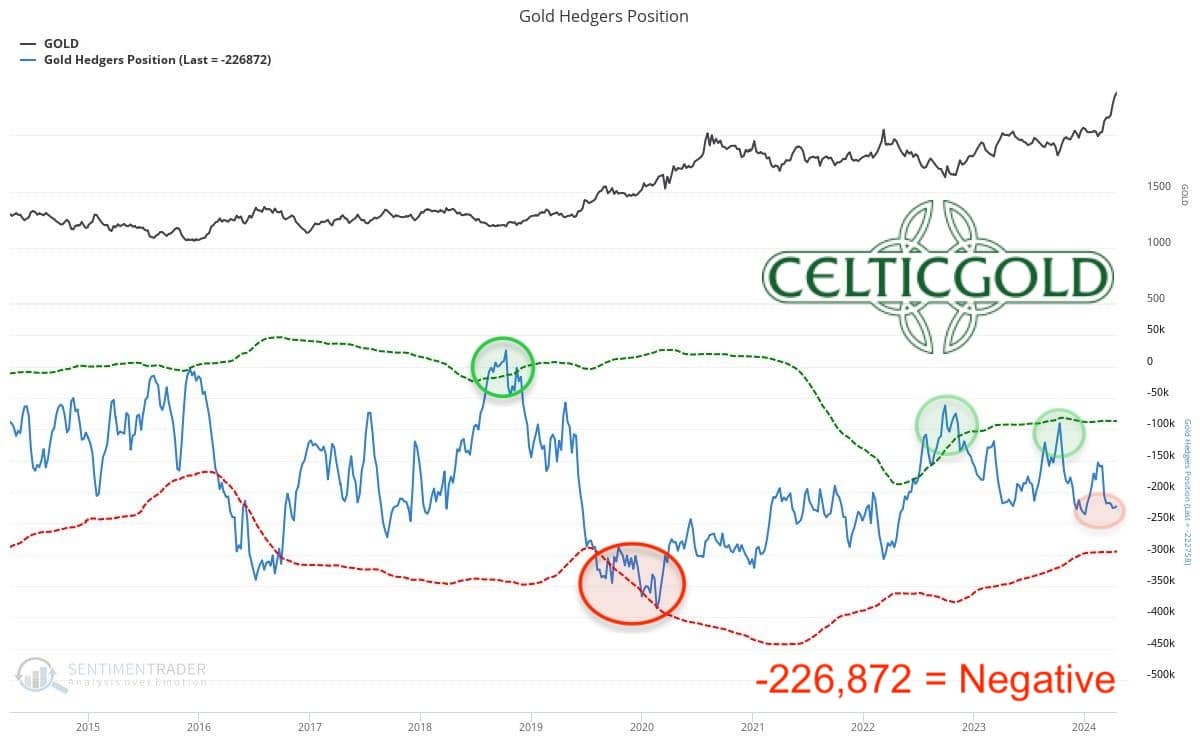

Commitments of Traders for Gold – Bearish

(Click on image to enlarge)

Commitments of Traders (COT) for gold as of April 29th, 2024. Source: Sentimentrader

As of the closing price of USD 2,322 on April 23rd, commercial traders held a cumulative short position of 226,872 gold futures contracts. Given the rapid price increase of the last two months, this positioning appears surprisingly moderate. Nevertheless, overall, there remains a clearly bearish positioning.

Overall, the current Commitments of Traders (CoT) report is negative and opposes further rising prices.

Sentiment for Gold – Too optimistic

(Click on image to enlarge)

Sentiment Optix for gold as of April 29th, 2024. Source: Sentimentrader

With a value of 67, the sentiment index for the gold market has nearly reached its extreme zone. However, there is still some room before reaching excessive optimism. Typically, strong upward movements in the gold market end in euphoria and blind greed. This is not yet the case! Nevertheless, the sentiment barometer is sending a warning signal.

The sentiment in the gold market has become overly optimistic. However, a strongly exaggerated euphoria is not (yet) evident.

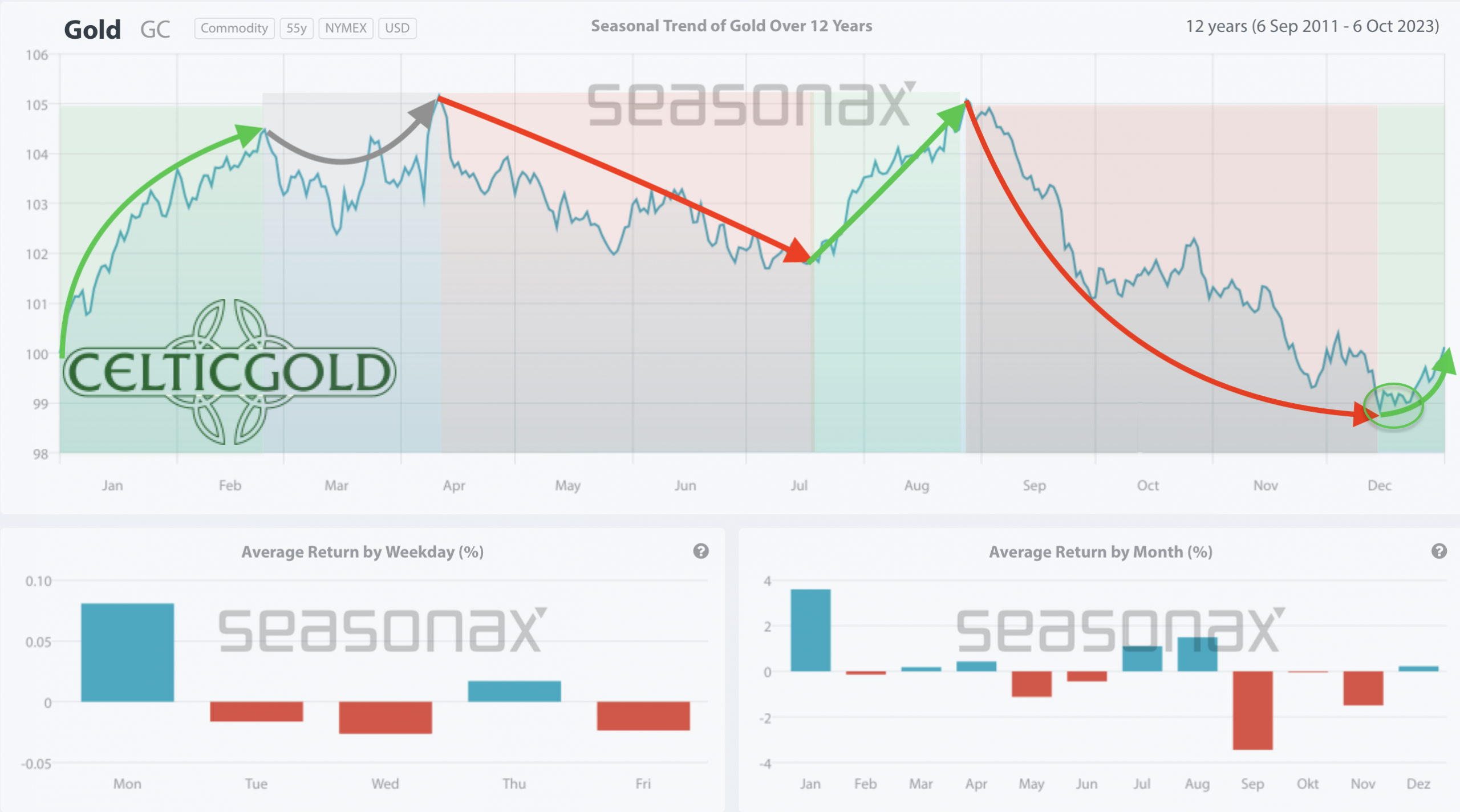

Seasonality for Gold – Negative

(Click on image to enlarge)

Seasonality for gold over the last 12-years as of April 29th, 2024. Source: Sentimentrader

Statistically, the seasonally favorable phase for the gold price typically ends between late February and early May. From this perspective, there isn’t much time left for the gold bulls to stage a final overextension.

The longer gold trades below the recent new all-time high of USD 2,431, the higher the probability becomes that the classic spring top was already seen on April 12th and that gold prices may now correct into June and July.

Based on the last 54 years, the seasonal component for the next three months is negative.

Macro update – The Crack-Up-Boom might need to let off some steam before continuing.

Around 4 years ago, we clearly and unequivocally communicated that the financial markets would transition into a Crack-Up-Boom, as massive monetary expansion by central banks worldwide was initiated in response to the Covid crisis. At that time, we were among the few who correctly prophesied this development and were repeatedly asked for a fundamental explanation of the Crack-Up-Boom in many interviews.

However, in recent days and weeks, we have noticed that the term “Crack-Up-Boom” is now being used almost casually by a significantly larger number of analysts. Although the realization of the Crack-Up-Boom has not necessarily become mainstream yet, it seems to have entered the awareness of a somewhat broader investor base due to the strong price increases in stocks, Bitcoin, and precious metals. Nevertheless, since the market always seeks the path of surprise rather than consensus, from a sentiment perspective, we see some warning signs in the short to medium term that at least speak for a temporary interruption of the ongoing Crack-Up-Boom.

For instance, the Federal Reserve in America may, due to the extremely tangled and highly complex situation, possibly lose control at least temporarily, surprising the markets. Despite persistent high inflation, the Fed may soon be forced to lower interest rates to stabilize the markets. For example, last week saw the bankruptcy of Republic First Bancorp, another US regional bank.

Japanese Yen has lost 65% in less than 3 years!

Meanwhile, the currency crisis in Japan continues to escalate, as the currency of the former third-largest economy in the world has lost almost 65% of its value in less than 3 years. The weak yen supports the hugely important “Carry Trade,” which is one of the most significant pillars for the speculative bubble in Western financial markets. How long the Bank of Japan can stoically accept the continuous impoverishment of the population due to currency devaluation is extremely questionable.

Hence, behind the scenes, tensions in the financial system continue to swell. Simultaneously, there are constantly new geopolitical hotspots and armed conflicts, all of which are essentially attributable to the unspoken Third World War between the US and China.

China keeps buying gold

(Click on image to enlarge)

Chinese gold purchases. Source: Steno Research, Bloomberg & Macrobond

China has been reacting to the increasing tensions between East and West for years with strong gold purchases. And just very recently, the total amount of gold exported from Hong Kong to mainland China in March increased by 40.2% to 63.5 tons. As well, imports from the mainland increased by 40% to about 7.63 tons. Overall, the amount of gold flowing from Hong Kong to the mainland was 171.91 tons, an annual increase of 28% in the first quarter!

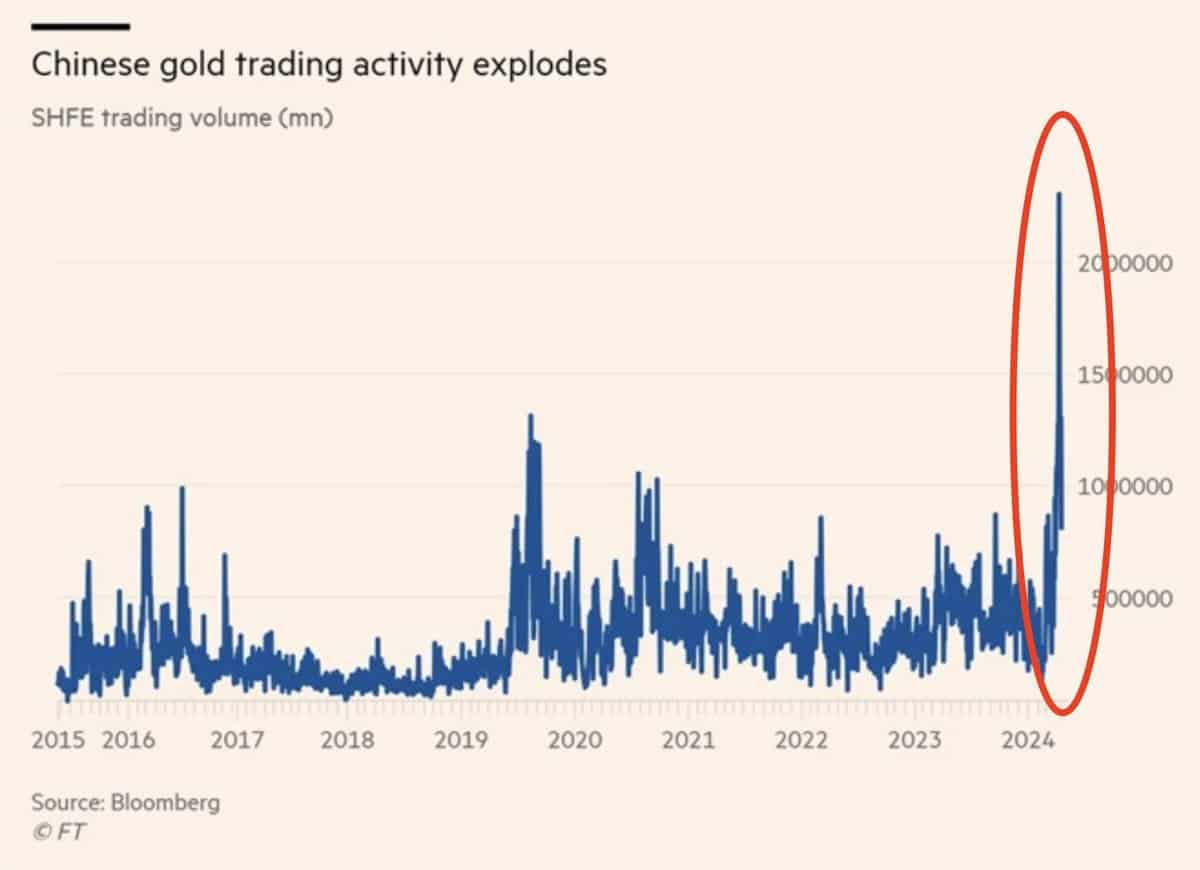

(Click on image to enlarge)

Chinese gold trading activity. Source: Bloomberg & FT

Looking back, with plans to introduce the Shanghai Gold Exchange, physical trading initially increased gradually. Since the summer of 2019 and the subsequent US repro crisis, there has been another surge, followed by the official opening of the gold exchange in October 2022. And since February 2024, trading activities have skyrocketed completely. Due to the strong gold price, the Chinese Renminbi has depreciated by around 45% against gold in the last 24 months. This has triggered an incredible buying frenzy in China, which has now checkmated Western paper gold trading.

The Fed is backed into a corner

In the West, on the other hand, the increasing war economy leads to high military spending, which is channeled directly into the weapon industry through fiscal stimulation in a way never seen before yet bypassing the population. The booming weapon business keeps the economy running and inflation rates high but also leads to significant inequality among populations. Interest rate cuts would only accelerate this division because those who hold assets such as stocks, real estate, physical precious metals, and Bitcoin can benefit from inflation and even increase their wealth. However, those who do not have these assets and rely on monthly salary payments are defenseless against inflation.

And herein lies the problem of the Fed. If it stimulates too early, the Crack-Up-Boom escalates; if it waits too long, it risks a deflationary implosion. We assume that the Fed will stay on hold longer than it would be necessary, especially as some sectors of the economy appear immune to interest rates. This, however, increases the odds of either stagflation or a bumpy landing. Most importantly, the narrow line of believing one could actually manage the complex situation has always led to loss of control and crashes in the past.

Sell in May and go away

Looking at the financial markets in search of the right strategy for the coming months, tackling the difficult puzzle in a simple and straightforward manner might be the best approach. Therefore, the age-old stock market adage “Sell in May and go away” probably gives the best advice in this complex situation. Given the strong price increases in almost all asset classes, there is no need to be aggressively positioned and fully invested from spring onwards. Perhaps one might miss out on a few percentage points on the upside, but until autumn, there is likely to be at least a somewhat larger breather in the markets. If there is a significant pullback or even a crash, being in a position of increased liquidity provides an ideal opportunity to scoop up some bargains in the fall.

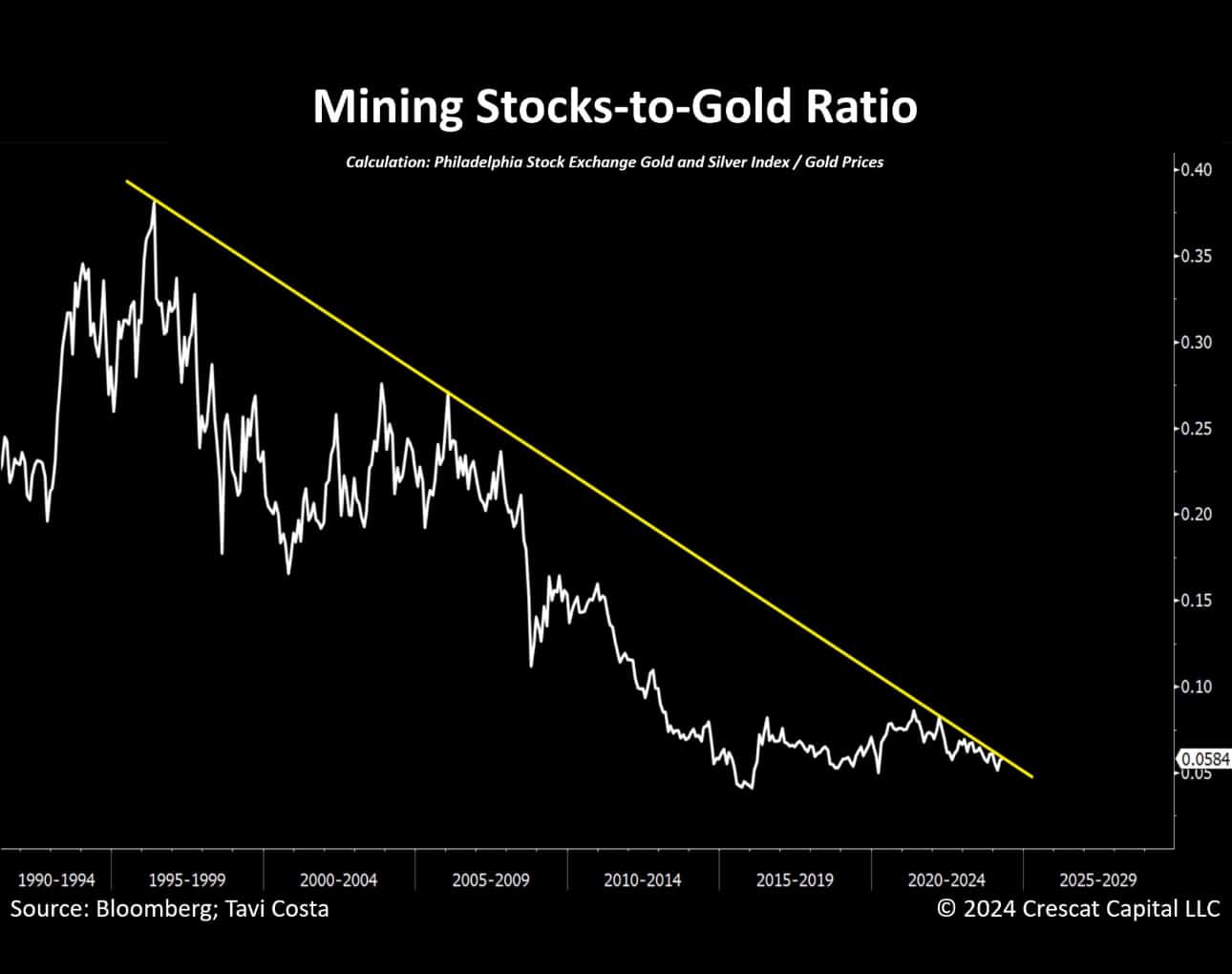

Conclusion: Gold – Consolidation triangle rather suggests continuation of the rally.

(Click on image to enlarge)

Mining Stocks vs. Gold Ratio, as of April 25th 2024. Source: Tavi Costa

Overall, in our considerations at the moment, we’re honestly somewhat torn. On the one hand, there are numerous signals for a reversal and thus a short-term trend change in the gold market. On the other hand, we still lack the typical exaggeration of the silver price nearing the finish line. Additionally, the major mining stocks, which have lagged significantly behind the strong gold price so far, seem to have picked up momentum only in the last two weeks.

(Click on image to enlarge)

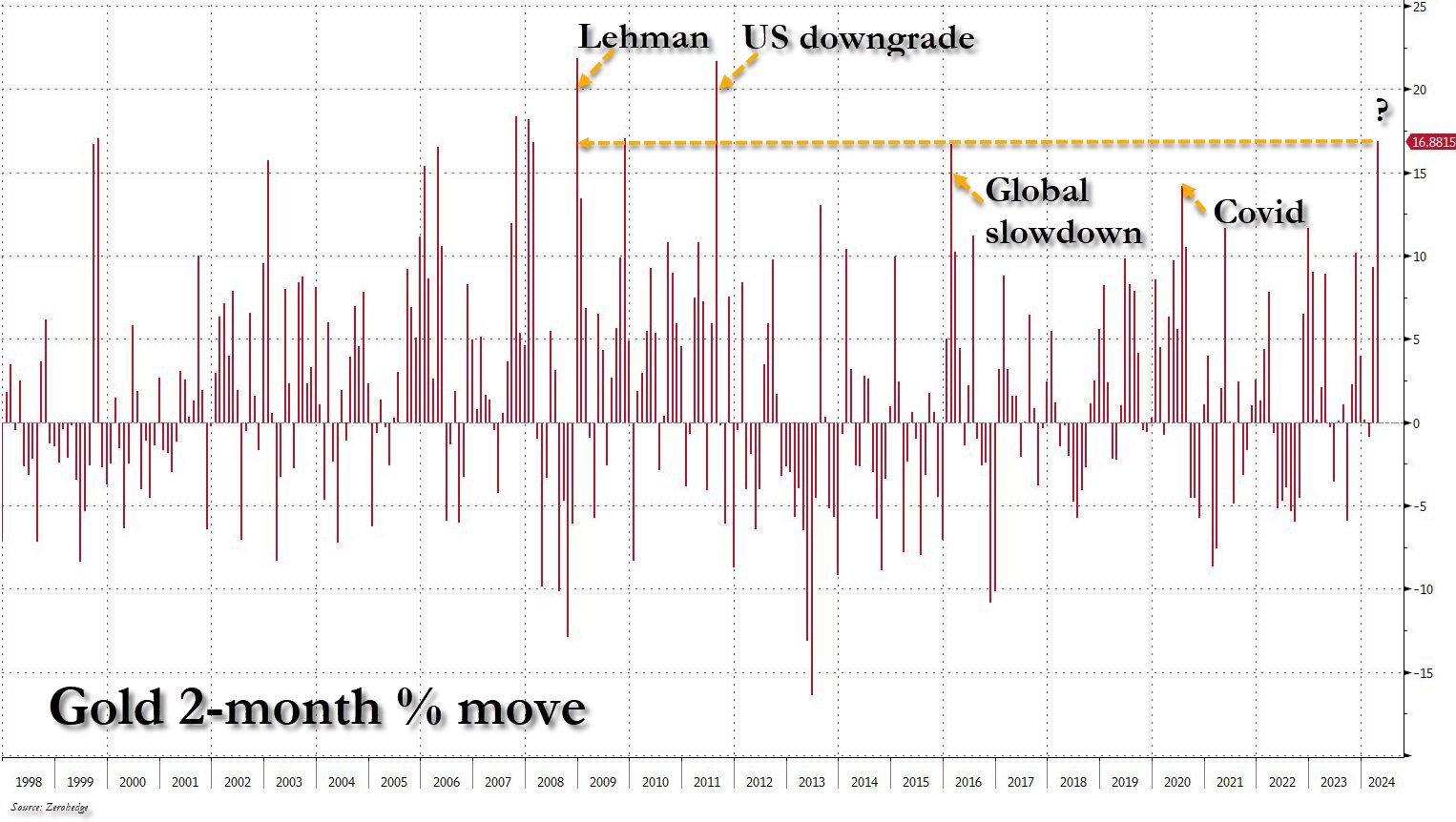

Gold 2-month % move. Source: Zerohedge

Another argument for the continuation of the rally is the fact that sharp gold price rises in the past have usually peaked with a major fundamental event. So far, the gold price has risen sharply, but apart from the buying spree in China and increasing geopolitical tensions, a strong fundamental event is still missing that would underline the rally.

Therefore, if the stock markets can hold up reasonably well until later in May, there’s actually nothing stopping the gold price from potentially achieving another, higher high. That would mean that the final low of the pullback could be found in the next few days, possibly around the lower Bollinger Band on the daily chart at approximately USD 2,280ish. Perhaps the low at USD 2,291 has already been seen, and the gold price is now just consolidating within the outlined triangle.

The next step would then be the final exaggeration of the wave up that began last October. If gold can indeed take another victory lap, then our target price in the range of USD 2,535 would be extremely realistic. Even higher prices could be conceivable in the next two months. Similarly, the silver price would have to skyrocket to at least USD 35ish.

Below USD 2,280, the bears are in control

However, if this does not happen, for example, because the stock markets crash earlier, then the precious metals sector is likely to come under pressure from profit-taking and reallocations due to margin calls. In that case, the top at USD 2,431 last Friday would have been seen, and we would already be in the typical spring correction, which usually lasts about six to eight weeks or maybe even a little longer. In June or July, gold might then aim for a temporary recovery towards approximately USD 2,300 to USD 2,400, starting from a low between approximately USD 2,075 and USD 2,150.

This short-term rather bearish scenario would also imply that the next major new uptrend could be pushed back a fair bit. Perhaps only in the fall, when there is more stress in the stock markets, new rescue measures could initiate the next bullish surge.

Crack-Up-Boom will continue

In the grand scheme of things, financial markets will continue to move upwards within the Crack-Up-Boom. We clearly and unequivocally communicated this almost 4 years ago. And despite the sometimes extreme fluctuations and high volatilities, nothing has changed so far. But just like with a pressure cooker, occasionally, the hot air or pressure needs to be released. This could start in the next few weeks and months with profit-taking and then lead to a somewhat more painful pullback, especially in the very well-performing tech stocks and Bitcoin.

More By This Author:

Bitcoin – Potential Correction Despite ETFs And HalvingGold – This Breakout Is Unambiguous

Gold - Monthly Closing Above USD 2,000 Triggers Breakout Rally

Disclaimer: All published information represents the opinion and analysis of Mr Florian Grummes & his partners, based on data available to him, at the time of writing. Mr. Grummes’s ...

more