GLD Not Done Falling

Image Source: Pixabay

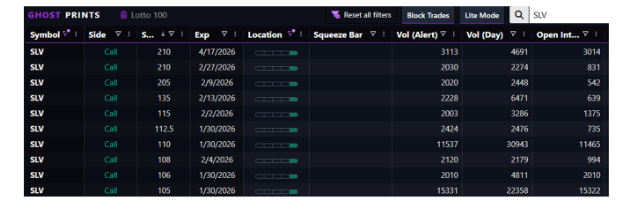

The Ghost Prints Console has been warning us for weeks. Heavy put buying in GLD and SLV was a dead giveaway about the growing nervousness of the precious metals trade.

Yesterday that nervousness turned into a fever. Selling fever.

It carried into today and took all too many 401(k)s with it.

The options market had been screaming warnings for the last 48 hours. Most traders ignored them. The ones paying attention saw too much danger in what was coming.

Even today, somewhere, someone is loading up on SLV, thinking they are getting a bargain.

They. Are. Not.

Simply put, there are better trades out there.

The Desperate Trade That Told the Story

Wednesday, January 29th. A massive order hit GLD. 33,000 contracts.

They bought April 520 calls and sold 545 calls. A $25-wide spread. Way out of the money. Way out in time.

This wasn't confidence. This was desperation. Today’s market was not kind to those speculators.

The trade structure revealed everything. Implied volatility had hit 100 percentile. The highest all year. Options were expensive. The skew had flattened. There was no edge anywhere near current prices.

So they went hunting. Out to April for lower volatility. Out to 520 strikes to find any positive skew. Spreading it 25 points wide just to lower the cost.

The gamma effect was minimal. The chance of this working was slim. But it was the only viable trade left in gold.

That's when you know the party's over. Anyone who showed up the next day had the door slammed in their face.

What the Market Was Actually Saying

Wednesday's trading showed traders scrambling. They were selling wider and wider spreads. Pushing further out in time. Reaching for strikes that made no sense just weeks ago.

Why? The leverage was starting to unwind.

Silver showed the same pattern. Over 50,000 contracts on SLV. Buying strikes anywhere from 105 to 210. More longshot, desperate plays.

These weren't serious bullish bets. These were roll-the-dice, last-ditch efforts to stay in a game that was ending.

On Thursday, the unwinding began, and the price drop accelerated. The leverage coming out of the futures market has the paper market collapsing.

The Question Nobody Wanted to Answer

So how do you catch a falling knife?

The old saw goes that you let it hit the ground, and then pick it up.

Silver should realistically be around $45. It could get halved from current levels before it feels grounded. The leverage that drove it up is now working in reverse.

This isn't about manipulation. This is about understanding what the options market reveals. Good traders weren't buying SLV at these levels. They saw the warning signs Wednesday.

The frothiness had reached extremes. Even if you wanted to buy calls, volatility pushed you so far out of the money that edges disappeared. The only trades left were lottery tickets predicated on continued leverage.

Today we're watching that leverage get destroyed.

The Lesson in Reading Ghost Prints

That 33,000-contract GLD spread told you everything. When institutional traders are forced into positions that wide, that far out, with that little gamma potential, they're not expressing confidence.

They're expressing necessity. And desperation.

The trade failed from day one. There was no mechanism for an efficient play in gold or silver. The gamma squeeze was cooked. Volatility ramped too high, too fast.

Smart money could see it in the option flows. The desperate widening of spreads. The pushing into higher vol environments. The flattening skew that killed all edge.

This is why we track unusual options activity. Not to follow the trades blindly, but to understand what the structure reveals about market conditions.

The knife is still falling. Don’t reach for it.

More By This Author:

The Volatility Beast Is Back

How I Avoided The Silver Massacre

Two-Tier Volatility Strategy