Get Paid While Owning Gold Exposure

Throughout history, gold has been the asset to which investors flocked in times of economic uncertainty. Although gold’s direct impact on currencies has diminished over the last century, precious metal is still a very important asset. Undoubtedly, gold remains relevant as a safe-haven asset.

Gold has served as a hedge against just about every type of uncertainty. It’s considered a hedge against inflation, deflation, volatility, political uncertainty, and others. Since the end of the 2007–2008 global financial crisis, gold has been at least $1,000 per ounce; it recently hit $2,000 an ounce.

The increase in gold prices is due at least in part to the ease of access made possible by exchange-traded products. ETFs that allow investors to trade gold bullion or a group of gold mining companies have become widely popular.

One such product is VanEck Vectors Gold Miners ETF (GDX). GDX holds 55 of the largest gold miners in the world, with its top 10 holdings making up nearly 65% of the portfolio by weight. The ETF has over $13 billion in assets and trades more than 20 million shares a day on average.

However, the one major drawback is that GDX hasn’t paid a dividend since 2019 (and even when it did, the dividend was small). Generally speaking, gold investments don’t offer much in the way of income, and GDX is no exception. Traditionally, it’s been difficult to get exposure to gold while also earning a dividend or some form of income.

Well, there’s a relatively easy solution to this dilemma. How about buying a covered call on GDX?

A covered call involves buying the shares of an asset while simultaneously selling calls against that asset. In that way, you own the stock but can generate cash flow from the option (in exchange for capping the upside potential of the shares).

For example, a trader recently made a sizeable covered call trade on GDX. This strategist purchased 300,000 shares of GDX at $31.40. Simultaneously, 3,000 of the January 2022 34 calls were sold for $1.48 per call. This transaction generated $444,000 in cash for the trader.

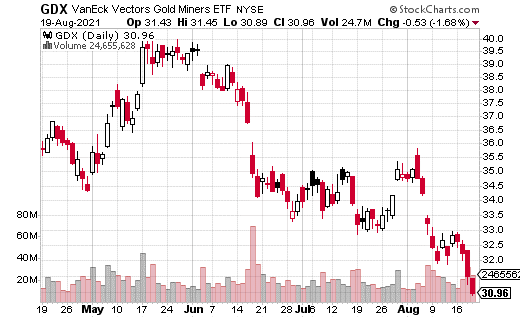

The short call option caps stock price gains at $34 through next January’s expiration, but, as you can see in the chart, that’s where GDX was essentially trading for several weeks before the recent pullback anyway. Meanwhile, the stock price can still appreciate $2.60 before the cap hits.

More importantly, in this case, the $1.48 generates a return of 4.7% over the next five months. Clearly, that’s way better than earning nothing on a long gold position. What’s more, nearly 5% in five months is a particularly solid return in an environment in which fixed income products pay very little. And don’t forget, if GDX is at $34 or above at January expiration, the entire trade can return 13%.

Disclaimer: Information contained in this email and websites maintained by Investors Alley Corp. ("Investors Alley") are provided for educational purposes only and are neither an offer ...

more