GDXJ Outpaced GLD: You Know What Comes Next

Image Source: Pixabay

Junior gold miners are outperforming gold itself right now. That does not happen by accident.

When GDXJ pulls ahead of GLD, it signals something institutional money already knows.

The commodity trend has legs.

But while GLD and all the well-known plays are rushing to dangerous levels, now is a good time to look for the stocks everyone else missed.

The Signal Everyone Missed

Silver stocks underperformed silver's massive rally. Gold miners did the opposite. They outpaced gold's advance.

This creates a specific setup. Institutional capital moves into junior miners before the next phase of a commodity cycle. They pay premiums for leverage to the underlying metal. They accept higher volatility for higher potential returns.

The divergence tells you where smart money sees value. Not in the metal itself. In the companies extracting it from the ground.

Three Stocks Catching Institutional Flow

While most traders chase established names, we caught unusual activity in three low-priced mining stocks. NAK. TRX. USAR. Combined market caps under $500 million. Combined options volume on Monday: over 99 times normal levels.

Northern Dynasty Minerals broke out on 26,000 call contracts bought at the ask. That is 15 times the average daily options volume. The $2.50 and $3.00 strikes saw concentrated institutional buying before the stock pushed through $2.50.

This company holds a 10% stake in Alaska's Pebble Project. Copper, gold, molybdenum, silver, and uranium. Everything currently driving the commodity trend sits in their mineral claims.

The trade setup is clean. NAK closed at $2.57. Technical breakout above $3.00 projects to $3.25-$3.75 based on the symmetrical triangle pattern. March $3.00 calls traded for $0.43. If the stock reaches $3.75, those options become worth at least $0.75. That is a double on a defined risk position.

The gamma component matters here. When market makers hedge 26,000 newly opened call positions, they buy the underlying stock. That buying pressure compounds as the stock approaches strike prices with heavy open interest. NAK has moderate short interest, so this is not a short squeeze play. This is pure gamma pressure from options positioning.

TRX: The Cleanest Signal

TRX Gold showed the most definitive institutional flow of the three. 19,000 contracts. 99 times the average volume. 50% filled at the ask. Put activity was negligible at 263 contracts.

The stock broke out on Friday and continued on Monday, surging to $1.40 on the February $1.50 calls. This gold producer operates the Buckreef Project in Tanzania. The concentrated buying at one strike creates significant upside potential if TRX breaks $1.50.

March $1.50 calls traded for $0.43. You get 53 days to work with a defined risk of $43 per contract. The setup plays gamma acceleration above $1.50, where market makers must hedge their short option positions by buying shares.

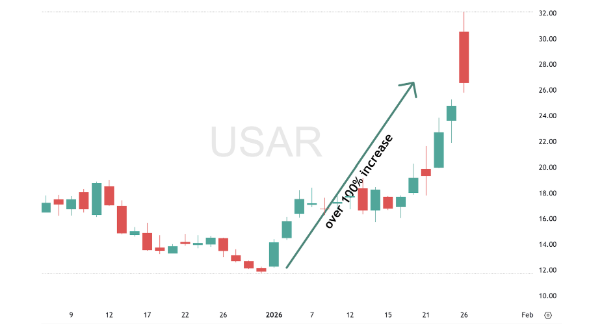

USAR: The Complex Setup

USA Rare Earth moved 16% Monday on news. Options activity showed a two-sided flow. Both calls and puts surged. This makes USAR the trickiest of the three.

When you see balanced activity across strikes, it signals uncertainty rather than directional conviction. The smart play here requires patience. Watch for a close near Monday's highs or a breakthrough in the coming sessions as confirmation. Alternatively, wait for a pullback to the $26.35 gap support level and look for a bounce.

USAR represents the same commodity thesis as NAK and TRX. Critical metals exposure. Low price point. Potential for explosive moves. But the options flow suggests institutional money is less certain about timing.

The Bigger Trade

These three stocks share one critical characteristic. They all broke out on massive volume with coordinated options positioning before most traders noticed.

NAK gained 21% in a session. TRX jumped 16%. USAR spiked 16%. The scanner identified unusual activity when these stocks were still forming bases below breakout levels.

Charts show you the move after it happens. Options flow shows you institutional positioning before the move begins. When 26,000 calls get bought at the ask in a $2 stock, that is not retail speculation. That is smart money taking leveraged exposure to a sector rotation they see coming.

The junior gold miners outperforming gold confirms what these unusual options prints already told us. The commodity trend is not done. It is accelerating into names most traders have never heard of.

More By This Author:

Ford's 180K Put BombStop Waiting For A Crisis That Ended Three Years Ago

0DTE Hits Stocks Monday