Futures Tread Water Amid Peripheral Bond Rout As Key CPI Print Looms

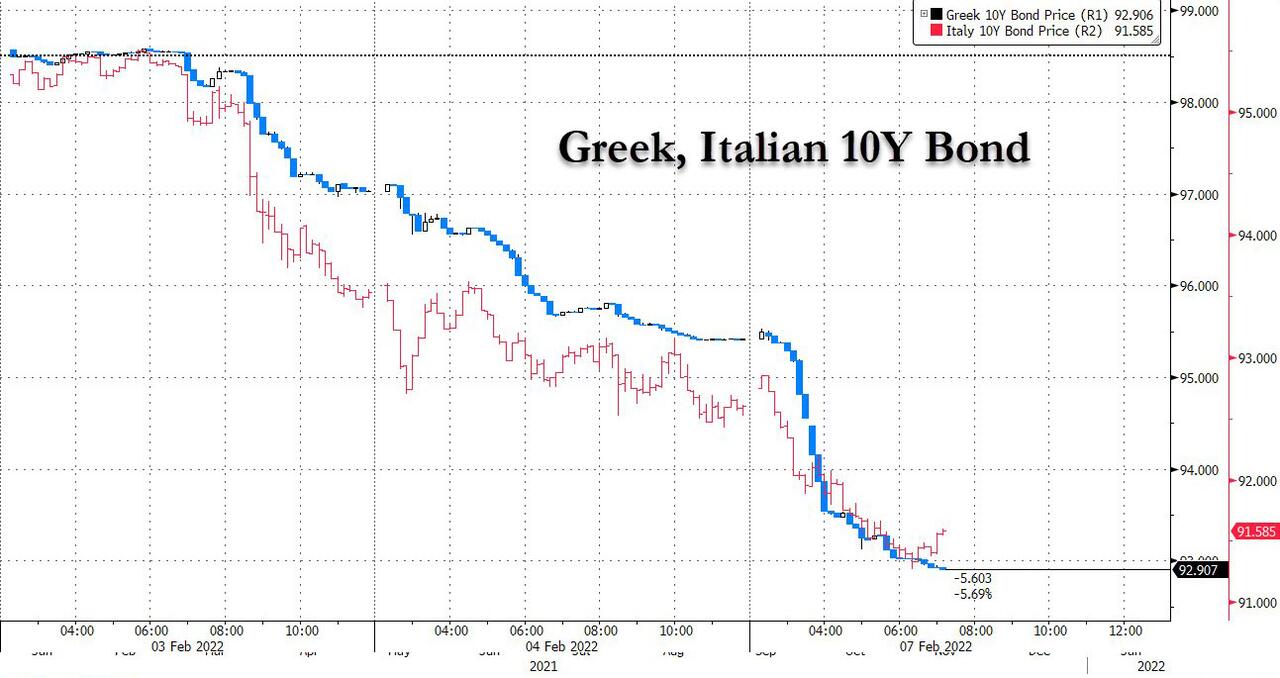

U.S. index futures swung around in a volatile, illiquid overnight session, and at last check were flat despite traders' concerns about growing fireworks in the European bond market where Italian and Greek bond plunged amid fears of ECB rate hikes as soon as October, while waiting for Thursday's key CPI data and further corporate earnings. S&P 500 futures were up 2 points or 0.05%, Nasdaq futures were up 26 points or 0.18% and Dow futures were up fractionally as markets now expect more than five quarter-point Federal Reserve interest-rate hikes in 2022 to keep inflation on check following a strong U.S. jobs report. Treasury yields and the dollar were stable, while the euro snapped a six-day strengthening run. WTI crude fell after last week's rally. Chinese shares climbed on their return from a weeklong holiday. Bitcoin extended its recovery surge.

(Click on image to enlarge)

In the premarket, Peloton was in focus, soaring 27% on reports it's evaluating interest from potential suitors including Amazon and Nike. That's a relief for investors in the one-time pandemic darling, which has lost more than 80% since its January 2021 high thanks to easing restrictions and, Mr. Big's heart attack. But the breather might not last long as sellside analysts warn that regulators will probably crank up the resistance hard on any deal that involves Big Tech. Other notable premarket movers:

- Alibaba (BABA) declined 4% in U.S. premarket trading after Citigroup analysts saw its additional American depositary share registration in the U.S. as a sign that SoftBank Group Corp. may intend to sell part of its stake.

- Cryptocurrency-exposed stocks rise in premarket trading Monday as Bitcoin gains for a fifth straight day to climb back above the $42,000 level. Hive Blockchain (HIVE) +6.5%, Bit Digital (BTBT) +6.5%, Hut 8 Mining (HUT) +6%.

- Snowflake (SNOW) gains 3.8% in premarket trading after Morgan Stanley upgraded to overweight, citing a pullback in the stock and saying the software solutions provider is executing ahead of plan.

- Iveric bio(ISEE) has a “blockbuster opportunity” in the field of geographic atrophy (GA), Morgan Stanley writes in a note as it initiates coverage with an overweight recommendation and a $25 price target.

- Shares of airlines jump in premarket trading after Spirit Airlines and Frontier Group announced a definitive merger agreement whereby Frontier will buy Spirit at an implied value of $25.83 per share

“We continue to be more focused on what growth is going to do rather than rates and believe investors are still too optimistic, particularly as it relates to consumption,” Morgan Stanley strategists led by Michael Wilson write. “Exacerbating that risk is the fact that inventories are now rising rapidly,” they add, keeping a “defensive Posture.”

European equities reverse opening gains, with the Euro Stoxx 50 dipping into the red having initially rallied 0.8%, while the Stoxx Europe 600 Index was little changed, with basic resources outperforming on stronger iron ore prices. Italy's FTSE MIB lags, dropping more than 1.5%. Utilities were trading lower, dragged down by Enel, after Fitch cut its debt rating while real estate and energy are the worst performing sectors. Strategists from JPMorgan reiterated upside ahead for the region’s stocks on a positive macro-economic backdrop, strong earnings and cheaper relative valuations. Here are some of the biggest European movers today:

- Konecranes shares rise as much as 9% on a Reuters report from late Friday, saying the EU is close to clearing the company’s deal with Cargotec.

- Kone shares are up 5%

- Adevinta, Rightmove and Schibsted rise after UBS upgraded all three to buy from neutral, saying that the European online classifieds sector is trading at an attractive entry point.

- Faurecia gains as much as 3.6% in Paris trading after the French car-parts supplier set out financial targets after taking control of German rival Hella.

- H&M rises as much as 3% after local Swedish business daily Dagens Industri named the shares its pick of the week in an article, seeing a buying opportunity for the fashion retailer.

- Reckitt climbs as much as 2.4% after Bloomberg reported that the British consumer-goods company is weighing options for its infant nutrition unit, including a potential sale.

- Tobii rises as much as 21% after the firm said it is negotiations with Sony to provide its eye-tracking technology in the next PlayStation VR headset.

Asian equities slipped following their best weekly rally in five months, as traders eyed key U.S. inflation data due later this week for more clues on the Federal Reserve’s plan to raise interest rates. Chinese stocks rallied as the market reopened after a week-long holiday. The MSCI Asia Pacific Index fell as much as 0.5%, dragged by losses in technology shares. Stocks fell in South Korea, Japan and Hong Kong, while the mainland’s CSI 300 Index surged 1.5% in catch-up trade after the Lunar New Year break. Read: China Stocks Climb Most in Two Months in Holiday Catch-Up Trade Bonds dropped after a strong U.S. jobs report Friday increased bets of tighter monetary policy, and as traders look ahead this week to U.S. consumer-price figures expected to show the biggest rise since 1982. Decisions are also due from several Asian central banks. “Rising bond yields will remain a key theme into the trading session,” said Jun Rong Yeap, a market strategist at IG Asia. “The week ahead will bring focus to a series of central banks’ decisions in the region in the likes of India, Thailand and Indonesia, all seemingly set to hold their accommodative policies in place for now.” Alibaba Group was the single-largest drag on the regional benchmark Monday, falling 4.5% after registering one billion American depositary shares that hadn’t been registered before. This suggested to Citi that SoftBank may intend to sell some of its Alibaba shares.

Japanese equities fell, slipping after their best weekly gain since mid-October, with electronics and chemical makers the biggest drags on the Topix. Auto makers also weighed on the benchmark, which fell 0.2%. Olympus and Fast Retailing were the largest contributors to a 0.3% loss in the Nikkei 225.

Australia’s equity benchmark recovered from its initial decline to close little changed after the government said it will allow double-vaccinated visa holders to enter the country from Feb. 21, ending about two years of strict border controls. The S&P/ASX 200 Index pared earlier declines as much as 1% to close 0.1% lower with materials stocks contributing the most toward the gauge’s move. GrainCorp was among the top gainers on the gauge after the company forecast underlying profit for the full year of A$235 million to A$280 million, beating analyst estimates. Magellan was the worst performer the company announced founder Hamish Douglass would take a medical leave of absence from the asset manager, which is grappling with fund outflows and a tumbling stock price. In New Zealand, the S&P/NZX 50 index fell 0.5% to 12,279.56

India’s key stock indexes posted their biggest slump in two weeks as investors turned cautious ahead of the central bank’s monetary policy announcement on Thursday and an extended sell off by foreign funds. The S&P BSE Sensex fell 1.8% to 57,621.19 in Mumbai, while the NSE Nifty 50 Index dropped 1.7%. The key gauges fell for the third straight day, posting their biggest drop since Jan. 24. All but three of the 19 sector sub-indexes compiled by BSE Ltd. slipped, led by finance companies. “We expect that the markets will continue to remain volatile on the back of the recent interest rate movements globally,” according to Naveen Kulkarni, chief investment officer, at Axis Securities. He expects most emerging markets to witness outflows of foreign funds, leading to currency depreciation in the short term. The Reserve Bank of India’s monetary-policy panel will meet Feb. 8-10, starting a day later than initially scheduled. The decision will be announced on Thursday. The change was made as the nation mourns the death of celebrated singer Lata Mangeshkar. Banks in Mumbai bond and currency markets were shut Monday. HDFC Bank contributed the most to the Sensex’s decline, falling 3.7%, its biggest drop since April 30. Out of 30 shares in the Sensex index, five rose and 25 fell. State Bank of India, which reported December quarter earnings ahead of analysts’ expectations over the weekend, rose 0.6%.

Fixed income trades heavy with losses led by peripheral bonds which tumbled on Monday following weakness on Friday. Short-dated Italian bonds snapped almost 10bps wider to Germany, while 10y Greek spreads blow out ~20bps, helped by hawkish comments from ECB’s Knot. iTraxx Crossover widens ~17bps. Bunds bear-steepen, cheaper by 4bps at the back end. Gilts and Treasuries are calm, relatively speaking. Euribor futures drop 4-5 ticks across the red pack, money markets wager on 27bps of hikes in September.

(Click on image to enlarge)

In FX, the Bloomberg Dollar Spot Index was a tad higher as the dollar traded mixed versus its Group-of-10 peers; AUD and CAD are the strongest performers in G-10 FX, NOK and EUR underperform. The euro snapped six days of gains while the move in the common currency’s skew has been steep and a retreat for bullish wagers could be due after investors added longs in spot and options markets alike last week, after European peripheral bonds extended their declines and underperformance vs the core as markets bet on more tightening after ECB’s Knot said rate hikes are possible as soon as the fourth quarter. Australia’s dollar and sovereign yields advanced on announcement that the nation will allow double-vaccinated visa holders to enter the country from Feb. 21. A strong ex-inflation retail sales print underpinned the moves. Japan’s benchmark 10-year yield rose to the highest in six years as the Bank of Japan refrained from conducting an unscheduled bond purchase operation to stem the recent rise in yields.

In commodities, crude benchmarks are pressured, perhaps taking impetus from broader sentiment; however, we remain elevated in the broader picture and geopols continue to dominate. Overnight, Brent tested but failed to successfully surpass USD 94.00/bbl with WTI falling ~1.3% before stabilizing close to $91. Focus on Macron/Putin talks today, though the Kremlin has downplayed the chance of a 'breakthrough' while Iranian talks are to recommence Tuesday. Spot gold/silver are contained and remain near multiple DMAs while base metals benefit from the return of China. Marathon’s Galveston Bay Refinery (593k bpd) and Valero’s Texas City refinery (225k bpd) were knocked out of production due to a power outage on Friday amid severe cold weather, according to Reuters. Saudi Arabia raised oil prices for customers in Asia, US and Europe, according to Bloomberg. Indian government is to express serious concern over crude oil price volatility; government to take up this topic with oil producing nations/groups, via Reuters. Gazprom says it does not intend to hold spot gas sales sessions on its electronic platform this week, via Reuters. Turkey lifted its ban on importing scrap metals from Lebanon, according to Reuters. Base metals are mixed; LME copper falls 0.6% while LME aluminum gains 0.8%. Spot gold rises roughly $3 to trade near $1,811/oz.

Expected data on Wednesday include consumer credit, while Amgen, Hasbro, Loews and Take-Two are among companies reporting results.

Market Snapshot

- S&P 500 futures down 0.2% to 4,481.50

- STOXX Europe 600 little changed at 462.60

- MXAP little changed at 187.71

- MXAPJ down 0.1% to 614.38

- Nikkei down 0.7% to 27,248.87

- Topix down 0.2% to 1,925.99

- Hang Seng Index little changed at 24,579.55

- Shanghai Composite up 2.0% to 3,429.58

- Sensex down 1.7% to 57,660.26

- Australia S&P/ASX 200 down 0.1% to 7,110.85

- Kospi down 0.2% to 2,745.06

- German 10Y yield little changed at 0.22%

- Euro down 0.3% to $1.1420

- Brent Futures down 1.2% to $92.19/bbl

- Gold spot up 0.2% to $1,812.36

- U.S. Dollar Index up 0.11% to 95.59

Top Overnight News from Bloomberg

- French President Emmanuel Macron meets Russian President Vladimir Putin on Monday as Western leaders continue their push to deter any moves against Ukraine. Kremlin spokesman Dmitry Peskov said the talks will be “substantive and quite prolonged,” but he doesn’t expect a breakthrough

- Boris Johnson promised his Conservative Party an overhaul of his top team as he strives to keep his job after a series of gaffes and scandals. Two rapid appointments over the weekend may already be too late

- Currency analysts downplayed China’s move on Monday to set the yuan reference rate with the biggest weakening bias versus forecasts, saying it was simply a recalibration following the weeklong Lunar New year holiday

- The global stockpile of negative-yielding bonds has dropped to the lowest in more than six years after nearly $3 trillion was wiped out in just two days last week

- Fidelity International Ltd. and abrdn Plc are among the firms avoiding Asian local debt and favoring bonds elsewhere in the developing world on the view that the region will take longer to start tightening monetary policy. Bond managers are turning lukewarm on Asian debt on speculation the region will be the last in emerging markets to start raising rates

A more detailed look at global markets courtesy of Newsquawk

Asian stocks were mixed amid recent increases in global yields and after the blowout NFP data stoked bets for a more aggressive Fed rate hike in March, while geopolitical concerns also lingered. ASX 200 (-0.1%) was dragged lower by weakness in real estate, healthcare and financials although finished off its lows amid resilience in the commodity-related sectors and stronger than expected quarterly Retail Trade data. Nikkei 225 (-0.7%) suffered as Japan plans an extension of COVID-19 measures for Tokyo and other areas. Hang Seng (U/C) and Shanghai Comp. (+2.0%) were varied as Hong Kong stocks took a back seat to the outperformance in the mainland which re-opened for the first time since the Lunar New Year, while Chinese Caixin Services and Composite PMIs slowed but remained in expansion territory

Top Asian News

- Hong Kong Braces for Curbs as Cases Double Every Three Days

- H.K. Sees Record Cases; Australia Reopening: Virus Update

- Hysan to Buy 25% Stake in Henderson Land’s Project for HK$3.05b

- Taiwan FX Trading Punishment on Deutsche Bank Lifted: Reuters

Core European bourses are choppy and mixed overall, Euro Stoxx 50 -0.1%, though the periphery is pressured on domestic debt downside; FTSE MIB -1.6%. Sectors are mixed overall though Basic Resources outperform on base metals while Energy/Utilities pulls-back given benchmark pricing and Friday's upside. Stateside, US futures are pressured but have also been choppy/rangebound for the most part, RTY lags.

Top European News

- Var Energi Valued at $9.1 Billion in Rare Big Energy Listing

- U.K. House Prices Rise at Slowest Pace Since June, Halifax Says

- Ajax Shares Fall as Director Overmars Leaves Club Over Messages

- Housebuilder Taylor Wimpey Promotes Operations Head Daly as CEO

In FX, the dollar retains bulk of its stellar BLS labour report gains, but eases from best levels Loonie gets over Canadian LFS jobs release disappointment with aid from WTI crude holding a firm line. Aussie underpinned by iron ore prices, record retail sales data and plans to reopen international borders from February 21st. Euro hands back some ECB inspired upside, but even higher EGB yields should provide traction. Yuan undermined by PBoC setting a weak onshore fix, soft Chinese Caixin PMIs and more angst with the US over compliance to terms of Phase One trade deal. Turkish President Erdogan tested positive for COVID-19, according to Reuters. South Africa’s Eskom announced that loadshedding was suspended from Sunday evening amid a sufficient recovery in generation capacity, according to Reuters.

In commodities, crude benchmarks are pressured, perhaps taking impetus from broader sentiment; however, we remain elevated in the broader picture and geopols continue to dominate. Overnight, Brent tested but failed to successfully surpass USD 94.00/bbl. Focus on Macron/Putin talks today, though the Kremlin has downplayed the chance of a 'breakthrough' while Iranian talks are to recommence Tuesday. Spot gold/silver are contained and remain near multiple DMAs while base metals benefit from the return of China. Marathon’s Galveston Bay Refinery (593k bpd) and Valero’s Texas City refinery (225k bpd) were knocked out of production due to a power outage on Friday amid severe cold weather, according to Reuters. Saudi Arabia raised oil prices for customers in Asia, US and Europe, according to Bloomberg. Indian government is to express serious concern over crude oil price volatility; government to take up this topic with oil producing nations/groups, via Reuters. Gazprom says it does not intend to hold spot gas sales sessions on its electronic platform this week, via Reuters. Turkey lifted its ban on importing scrap metals from Lebanon, according to Reuters.

US Event Calendar

- 3pm: Dec. Consumer Credit, est. $25b, prior $40b

DB's Jim Reid concludes the overnight wrap

After a week for the ages that we'll fully review in the second half of this note, this week should be calmer until of course US CPI comes along on Thursday. What made last week so fascinating was the rare interplay between macro and micro. Not only did the rates world shake and reverberate (2yr bunds +35.9bps and the worse week since 2008), but on successive days we saw the biggest market cap fall in history for any company (Meta), followed by the biggest rise ever (Amazon). We have 83 S&P 500 companies reporting this week but no Goliath sized ones, so it'll be a more normal week for earnings. The macro and micro last week was enough to push the Russian/Ukraine tensions into the background but they are clearly still there so we have to watch out for that as well.

Over the weekend ECB governor Knott (a hawk) became the first ECB official to endorse a 2022 hike by suggesting that he expects a hike around Q4 and another in Spring 2023, and that they are most likely to be in 25bps increments. He also suggests bond purchases should end as soon as possible and that Euro Area inflation will remain above 4% all this year. There will be excitement about the comments in markets today but pricing is already above 50bps before year-end so as the ECB catch up with the market, will the market now go another step further?

When the dust settles we will soon move on to US CPI on Thursday. In terms of what to look out for, note that 8 of the last 10 CPI releases have seen the monthly headline figure come in above the consensus estimate on Bloomberg. Our US economists are projecting that monthly headline CPI growth will slow to +0.36% in January, with core inflation also slowing to +0.36%. However, this would still push YoY readings to 7.2% and 5.8% (consensus at 7.3% and 5.9%) respectively the highest since 1982 for both. There are plenty of wildcards in the release but we'll be watching rents/OER most as this makes up around 40% of core and around a third of the headline number. Since last summer it's been clear from our models that this was going to continue going up and up and given its weight it's very difficult for inflation to mean revert without it also doing so. It's showing no sign of this at the moment and likely won't for several months at least.

Otherwise it’s a fairly quiet week on the data front, though it’ll be worth looking out for the University of Michigan’s consumer sentiment index for February on Friday. January saw the measure fall to its lowest level in a decade, whilst longer-term inflation expectations have been picking up as well, so one to keep an eye on. Elsewhere, we’ve got the UK’s GDP release for Q4 coming out on Friday as well.

Earnings season is past the peak but will continue to be busy, with a further 83 companies in the S&P 500 and 89 in the Stoxx 600 reporting. Among the highlights to look out for will be Pfizer, BP and BNP Paribas tomorrow. Then on Wednesday, we’ll hear from Disney, L’Oréal, GlaxoSmithKline, Uber and Toyota. Finally on Thursday, there’s reports from The Coca-Cola Company, PepsiCo, AstraZeneca, Philip Morris International, Linde, Siemens, Unilever, Crédit Agricole, Société Générale, Twitter and Credit Suisse. See the day-by-day calendar for more on the week ahead.

Asian markets are a bit softer to start the week. The Nikkei (-0.84%), Kospi (-0.43%) and Hang Seng (-0.31%) are down. China has reopened after last week’s Lunar NY holiday and both the Shanghai Composite (+1.91%) and the CSI (+1.62%) are catching up. Equity futures in the US point towards a steady start with contracts on the S&P 500 (+0.08%) and Nasdaq (+0.13%) slightly higher.

In terms of economic data, China’s services sector activity dipped to 5-month lows as the Caixin services PMI edged down to +51.4 from 53.1 in December as a rise in local Covid-19 cases coupled with restrictive measures hit consumer sentiment.

Looking back on last week, the main story was the historic sell off in sovereign yields at the end of the week. Hawkish communications from the ECB and BoE, along with much stronger-than-expected employment data in the US, drove advanced economy sovereign bond yields to their highest post-pandemic levels.

Recapping region-by-region. The ECB left policy unchanged, though tilted their communications in a much more hawkish direction. President Lagarde noted that near-term risks to inflation were tilted to the upside and did not repeat her previous remarks that a 2022 hike was unlikely. The week ended with the market fully pricing liftoff in July, with an 86% probability of liftoff happening in June, and 5 full (10bps) hikes through 2022. 2yr bund yields increased +35.9bps (+8.4bps Friday), their largest weekly increase since April 2008, while 10yr bunds increased +25.0bps (+6.2bps Friday), their largest weekly increase since June 2015. Notably, 5yr bunds were the latest tenor to cross into positive territory, closing above 0 for the first time since May 2018 after increasing +35.3bps this week (+9.1bps Friday), the largest weekly increase since January 2011.

In the UK, the BoE raised the Bank Rate +25bps to 0.5% and began the passive unwind of its securities portfolio. Notably, four MPC officials dissented, instead favouring a +50bps hike. The BoE also upgraded their inflation forecasts to have CPI peaking around 7.25% in April. The market has now priced in 5 additional Bank Rate increases (25bps) through 2022. 2yr gilts increased +29.4bps this week (+11.8bps Friday), their largest weekly increase since September 2017 and 10yr gilts increased +16.7bps (+4.3bps Friday).

Treasury yields increased following the hawkish pivots from central banks across the Atlantic, albeit in smaller magnitudes. It took Friday’s employment report to really get Treasuries to join the sell-off. US nonfarm payrolls increased by +467k in January, and the prior two months were revised +709k higher, while average hourly earnings increased +0.7%, month-on-month. There was a big BLS population adjustment but the report was strong adjusting for that. This data came as FOMC officials were warning beforehand that the employment data was more than likely to surprise to the downside but would not impact the path for policy. With employment remaining robust through the worst of the Omicron wave, markets meaningfully increased the probability the FOMC would raise its policy rate by +50bps, rather than 25, at its March meeting. At the end of the week a +140% chance of a +25bp move in March was priced, while 5.3 25bps hikes were priced through the year.

2yr treasury yields climbed +16.7bps (+11.4bps Friday) and 10yr yields increased +13.9bps (+7.8bps Friday). Real 10yr yields increased +18.9bps (+7.5bps Friday) to -0.50%, the highest level since June 2020, while real 30yr yields moved into positive territory for the first time since last May, closing the week at 0.04%, after increasing +20.2bps (+6.1bps Friday).

Onto risk markets, and the S&P 500 impressively gained +1.55% (+0.52% Friday) after a week where ECB liftoff was moved to June, half the BoE wanted to hike +50bps, the Fed pricing moved toward a +50bp liftoff, and the 6th biggest company in the US lost a third of its market value. European stocks underperformed, given the sharper repricing of monetary policy expectations, with the STOXX 600 down -0.73% (-1.38% Friday), the DAX -1.43% (-1.75% Friday), and the CAC -0.21% (-0.77% Friday).

In the S&P 500, all but three sectors were higher on the week. Mega-cap tech earnings were the main focus, with sentiment breaking both ways. Meta decreased -21.42% (-0.28% Friday) following earnings that portended slowing subscriber growth and increasing streaming competition from other social media sites. Supporting sentiment, Alphabet had a strong earnings release and announced a 20-for-1 stock split, seeing their shares +7.46% higher on the week (+0.14% Friday), while Amazon shares climbed +9.49% (+13.54% Friday) on reports that they’d be raising the price of US Prime memberships and that their investment in electric carmaker Rivian was performing well. So a wild ride.

In terms of credit, after holding in well in the sell-off of two weeks ago, the asset class lagged equities last week, especially in Europe after the rates shock. Itraxx Main was +5.5bps wider on the week (+2.7bps Friday), while Xover was +29.2bps wider (+14.2bps Friday). In the US, IG CDX was +2.6bps wider (+1.3bps Friday) while HY widened +12.6bp (+9.5bp Friday). Year-to-date US HY CDX is +63bps wider and IG CDX is +14bps wider, while ITraxx Xover is +73bps wider and Main is +17bps wider. Cash index spreads were more varied last week, given $IG spreads were actually unchanged over the course of the last week, while €IG spreads were +8bps wider (+7bps Friday) and £IG spreads were +14bps (+8bps Friday). High yield spreads were somewhat similar with $HY spreads just 5bps wider on the week, while €HY spreads were +12bps wider and £HY spreads were +16bps wider. Ash indices tend to lag in fast moves.

OPEC+ agreed to a further output increase of +400k barrels per day in March broadly as expected, though production figures are bound by suppliers that are struggling to meet their quotas. All in, crude futures were +3.60% this week (+2.37% Friday).

Disclaimer: Copyright ©2009-2022 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more