Futures Slide After Dismal Target Earnings, Plunging Mortgage Apps

The brief bear market rally in US stocks was set to end with a whimper following Tuesday’s strong dead cat bounce, after Fed Chair Jerome Powell gave his most hawkish remarks to date. Hope that China lockdowns would soon end turned to skepticism, as the yuan slumped after its biggest gain since October, while dismal guidance from Target - which warned that inflation was crushing margins - confirmed what Walmart said yesterday, namely that the US consumer is running on fumes. An 11% plunge in the latest weekly mortgage applications only reaffirmed that a hard-landing is inevitable and just a matter of time. Nasdaq 100 futures dropped 1%, while S&P 500 futures slipped 0.7% after US stocks surged on Tuesday. Treasury yields hit session highs, rising back to 3.0%, and the dollar snapped a three-day losing streak. Bitcoin got hammered again, sliding back under $30k.

(Click on image to enlarge)

Among the biggest premarket movers, Target crashed 22% with Vital Knowledge calling its margin shortfall “more dramatic” than what Walmart posted on Tuesday, citing industry-wide macro problems. The retailer reduced its full-year forecast on operating income margin to about 6% of sales this year. It also reported first-quarter adjusted earnings per share that came in below expectations. Food and gas inflation is drawing money away from discretionary and general merchandise spending, forcing “aggressive” discounting to clear out product in the latter category, Vital’s Adam Crisafulli said in a note.

Elsewhere in US premarket trading, Tesla slipped 1% after its price target was cut at Piper Sandler. Meanwhile, Twitter Inc. also traded slightly lower even as the social media platform’s board said it plans to enforce its $44 billion agreement to be bought by Elon Musk. Here are some other notable premarket movers:

- US tech hardware stocks may be in focus as Jefferies Group LLC strategists have turned bullish on the likes of IBM (IBM), Cisco Systems (CSCO) and Microchip Technology (MCHP) after this year’s steep declines for US information technology shares

- National CineMedia (NCMI) shares jump as much as 33% in US premarket trading after AMC Entertainment (AMC) reported a 6.8% stake in the cinema advertising company. AMC shares gain 1.2% in premarket trading.

- DLocal Ltd. (DLO) shares gain as much as 15% in US premarket trading after the Uruguay-based payment platform posted 1Q revenue that doubled from the year-earlier period and topped expectations.

- Doximity (DOCS) shares fall as much as 19% in US premarket trading, after the online healthcare platform provider’s forecast for 1Q revenue missed the average analyst estimate, prompting analysts to slash their price targets on the stock.

- Penn National (PENN) may be active on Wednesday as Jefferies raised the recommendation to buy from hold. The company’s shares rose 4% in premarket trading.

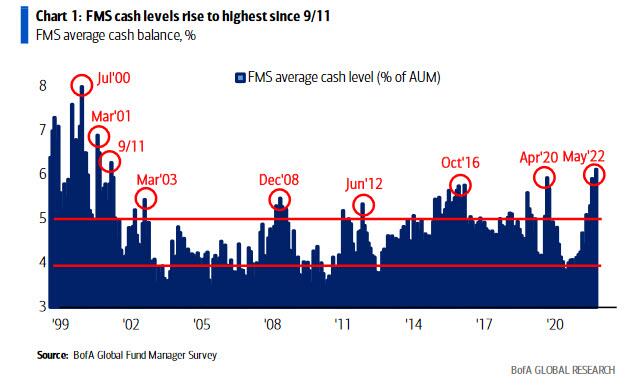

On Tuesday, Powell said the Fed will keep raising interest rates until there is “clear and convincing” evidence that inflation is in retreat, which initially pushed stocks lower but then was faded as risk closed near session highs as nothing Powell said was actually new. The S&P 500 is emerging from the longest weekly slump since 2011 as investors have been gripped by fears of hawkish monetary policy and surging inflation driving the economy into a recession. As also discussed yesterday, Bank of America’s survey published yesterday showed that fund managers are the most underweight equities since May 2020 and are piling into cash.

(Click on image to enlarge)

“This is one of the most challenging markets I have been in in my career,” Henry Peabody, fixed income portfolio manager at MFS Investment Management, said on Bloomberg Television. “I suspect at a certain point of time we’re going to have the liquidity of the markets challenged. They really haven’t been thus far.”

As the Fed embarks on interest-rate hikes, frothy growth shares, including the tech sector, have suffered in particular as higher rates mean a bigger discount for the present value of future profits. This marks a major shift in investor outlook after tech stocks had been some of the market’s best performers for years.

“Investor sentiment and confidence remain shaky, and as a result, we are likely to see volatile and choppy markets until we get further clarity on the 3Rs — rates, recession, and risk,” Mark Haefele, chief investment officer at UBS Global Wealth Management, wrote in a note.

Rebounds in risk sentiment are proving fragile amid tightening monetary settings, Russia’s war in Ukraine and China’s Covid lockdowns. In what’s seen as his most hawkish remarks to date, Powell said that the US central bank will raise interest rates until there is “clear and convincing” evidence that inflation is in retreat.

“We’ll have this kind of volatility as people jump in and look at opportunities to buy as markets decline,” Shana Sissel, director of investments at Cope Corrales, said on Bloomberg Television, referring to the Wall Street bounce. The Fed is going to struggle to achieve a soft economic landing, she added.

In Europe, the Stoxx 600 Index was little changed, with energy stocks outperforming. Spain's IBEX outperformed, adding 0.5%. ABN Amro slumped almost 10% after the Dutch lender reported first-quarter results burdened by rising costs. The Stoxx Europe 600 Basic Resources sub-index drops, underperforming other sectors in the broader regional benchmark on Wednesday as base metals ended a three-day rebound and as iron ore declined. Base metals paused a recovery from this year’s lows, with copper and aluminum stalling after hawkish remarks from Federal Reserve Chair Jerome Powell. Iron ore futures declined as investors weighed China’s faltering economy and the prospect of support measures amid a mixed outlook for steel demand. Basic resources index -0.6%, halting three days of gains; broader benchmark little changed. Siemens Gamesa jumped as much as 15% as Siemens Energy weighs a bid for the shares of the troubled Spanish wind-turbine maker it doesn’t already own. Here are the most notable movers:

- European oil and gas stocks rise amid higher crude prices and broker upgrades, while renewables rallied after Siemens Energy confirmed it was considering a buyout offer for Siemens Gamesa. Shell gains as much as 1.8%, BP +1.8%, Equinor +3.4%, Gamesa +15%, Vestas +7.7%

- Air France-KLM shares rise as much as 7.5% in Paris on news that container line CMA CGM intends to take a stake of up to 9% in the French carrier following the signing of a long-term strategic partnership in the air cargo market.

- Rockwool shares gain as much as 8.3%, most since Feb. 15, as the company boosts its sales in local currencies forecast for the full year.

- British Land shares rise as much as 4.2%, as the company’s results show a strong recovery and a good performance in the UK landlord’s portfolio, analysts say.

- Vistry shares climb as much as 8% with analysts saying the UK homebuilder’s trading update looks positive, particularly the robust momentum in its sales rate.

- The Stoxx Europe 600 Basic Resources sub-index drops, underperforming other sectors in the broader regional benchmark on Wednesday as base metals ended a three-day rebound and as iron ore declined. Rio Tinto slips as much as 1.5%, Antofagasta -2.7%, Anglo American -1.5%

- Prosus shares fall as much as 4.2% and Naspers sinks as much as 6.7% after Tencent reported first- quarter revenue and net income that both missed analyst expectations.

- TUI shares drop as much as 13% in London after the firm announced an equity raise in order to repay a chunk of government aid that helped see it through the coronavirus crisis.

- ABN Amro shares declined as much as 11% after the lender reported 1Q earnings that showed higher costs related to money laundering.

- Experian shares fall as much as 5.1% after the consumer-credit reporting company reported full-year results, with Citi saying organic growth missed consensus.

Meanwhile, UK inflation rose to its highest level since Margaret Thatcher was prime minister 40 years ago, adding to pressure for action from the government and central bank. The pound weakened and gilt yields fell as traders speculated that the Bank of England will struggle to rein in inflation and avoid a recession.

Elsewhere, the Biden administration is poised to fully block Russia’s ability to pay US bondholders after a deadline expires next week, a move that could bring Moscow closer to a default. Sri Lanka, meantime, is on the brink of reneging on $12.6 billion of overseas bonds, a warning sign to investors in other developing nations that surging inflation is set to take a painful toll.

Earlier in the session, Asian stocks advanced for a fourth session as strong US economic data allayed worries about the global growth outlook, while Chinese equities slipped. The MSCI Asia-Pacific Index rose as much as 1%, extending its rebound from an almost two-year low reached last Thursday. Materials shares led the gains, with Australia’s BHP Group climbing 3.2%. Benchmarks in most markets were in the black, with Indonesia, Taiwan and Singapore chalking up gains of at least 1%. Upbeat retail sales and industrial production data from the US underpinned sentiment, so much so that investors barely reacted to hawkish comments from Federal Reserve Chair Jerome Powell. He indicated that policy makers won’t hesitate to raise interest rates beyond neutral levels to contain inflation.

Equities in China bucked the trend. Property shares paced the drop after data showed the decline in China’s new home prices accelerated in April, while tech shares also lost steam ahead of Tencent’s earnings which missed expectations and slumped. Local investors may be underwhelmed by a lack of details from Chinese Vice Premier Liu He’s fresh vow to support tech firms. Liu said the government will support the development of digital economy companies and their public listings, in remarks reported by state media after a symposium with the heads of some the nation’s largest private firms.

Lee Chiwoong, chief economist at Mitsubishi UFJ Morgan Stanley Securities, said Liu’s comments point to an easing of the crackdown on internet firms. “The Chinese government is stepping up measures to support the economy following the slowdown,” Lee said. “As bottlenecks stemming from lockdowns in Shanghai ease, that impact will gradually show up in the economy,” Lee added. “We should be able to clearly see an economic recovery in the second half of this year.”

Japanese equities gained as investors assessed strong US economic data and comments by Federal Reserve Chair Jerome Powell on the outlook for interest rate hikes. The Topix Index rose 1% to close at 1,884.69. Tokyo time, while the Nikkei advanced 0.9% to 26,911.20. Sony Group Corp. contributed the most to the Topix gain, increasing 2.9%. Out of 2,172 shares in the index, 1,345 rose and 749 fell, while 78 were unchanged. Chinese stocks erased losses intraday after earlier disappointment over a much-anticipated meeting between Vice Premier Liu He and some of the nation’s tech giants. Overnight, data showed US retail sales grew at a solid pace in April, while factory production rose at a solid pace for a third month.

Australia's stocks also gained, with the S&P/ASX 200 index rising 1% to close at 7,182.70, extending its winning streak to a fourth day. Miners contributed the most to its advance. All sectors gained, except for consumer staples and financials. Eagers slumped after saying that its 1H profit will be lower than it was a year ago and flagged reduced new vehicle deliveries. Wage data was also in focus. Australian wages advanced at less than half the pace of consumer-price gains in the first three months of the year, reinforcing the RBA’s signal that it will stick to quarter-point hikes. In New Zealand, the S&P/NZX 50 index rose 1.1% to 11,258.28

India’s benchmark equities index fell, snapping two sessions of gains, weighed by declines in engineering company Larsen & Toubro Ltd. The S&P BSE Sensex dropped 0.2% to close at 54,208.53 in Mumbai, after rising as much as 0.9% earlier in the session. The NSE Nifty 50 Index fell 0.1% to 16,240.30. Larsen & Toubro slipped 2% and was the biggest drag on the Sensex, which saw 17 of its 30 member stocks decline. Sixteen of 19 sectoral sub-indexes compiled by BSE Ltd. dropped, led by a gauge of realty shares. State-run Life Insurance Corporation, which debuted Tuesday, rose 0.1% to 876 rupees, still below the issue price of 949 rupees. In earnings, of the 34 Nifty 50 firms that have announced results so far, 20 have either met or exceeded analyst estimates, while 14 have missed. Consumer goods company ITC Ltd. is scheduled to announce results on Wednesday.

In FX, the Bloomberg Dollar Spot Index reversed an early loss and the greenback advanced versus all of its Group-of-10 peers apart from the yen. The pound was the worst G-10 performer, tracking Gilt yields lower and paring the previous day’s gains. A widely expected jump in UK inflation prompted investors to pare back bets on BOE rate hikes. Money markets are pricing around 120bps of BOE rate hikes by December, down from 130bps from the previous day. UK inflation rose to its highest level since Margaret Thatcher was prime minister 40 years ago, adding to pressure for action from the government and central bank. Consumer prices surged 9% in the year through April. The euro fell for the first day in four and weakened beyond $1.05. The Bund curve has twist flattened as traders bet on a faster pace of ECB tightening after Bank of Finland Governor Olli Rehn said there’s broad agreement among members of the Governing Council that policy rates should exit sub-zero terrain “relatively quickly.” That’s to prevent inflation expectations from becoming de- anchored, he said. The Aussie swung between gains and losses while Australia’s bonds trimmed earlier declines after a report showed wage growth last quarter was less than economists forecast. The wage price index climbed an annual 2.4% last quarter, trailing economists’ expectations and coming in well below headline inflation of 5.1%. The yen rose as US yields declined amid fragile risk sentiment. Japanese government bonds were mixed, with a decent five-year auction lending support while an overnight rise in global yields weighed on super-long maturities.

In rates, Treasuries were under pressure, though most benchmark yields remained within 1bp of Tuesday’s closing levels. 10-year yields rose just shy of 3.00%, higher by less than 1bp with comparable bund yield +3.3bp and UK 10-year flat. TSY futures erased gains amid a series of block trades in 5- and 10-year note contracts starting at 5:20am ET, apparently selling flow. According to Bloomberg, six 5-year block trades and two 10-year block trades -- all 5,000 lots -- have printed since 5:20am, apparently seller-initiated as cash yields concurrently rebounded from near session lows. Wednesday’s $17b 20-year new-issue auction at 1pm ET may also weigh on the market. 20-year bond auction is this week’s only nominal coupon sale; WI yield ~3.37% exceeds all 20-year auction stops since then tenor was reintroduced in 2020, is ~27.5bp cheaper than last month’s result. Elsewhere, the UK yield curve bull-steepened with the short end richening ~5bps, while pound falls after inflation surged to a four-decade high. Money markets pare BOE rate-hike wagers. Bund curve bear-flattens while money markets bet on a faster pace of ECB tightening after ECB’s Rehn said the central bank needs to move quickly from negative rates.

In commodities, WTI trades within Tuesday’s range, adding 1.6% to around $114. Most base metals are in the red; LME tin falls 1.5%, underperforming peers, LME aluminum outperforms, adding 1%. Spot gold is little changed at $1,815/oz.

Looking to the day ahead now, and data releases include the UK and Canadian CPI readings for April, along with US data on housing starts and building permits for the same month. Central bank speakers include the Fed’s Harker and the ECB’s Muller. Earnings releases include Cisco, Lowe’s, Target and TJX. Finally, G7 finance ministers and central bank governors will be meeting in Germany.

Market Snapshot

- S&P 500 futures down 0.5% to 4,065.50

- STOXX Europe 600 down 0.2% to 438.11

- MXAP up 0.8% to 164.43

- MXAPJ up 0.7% to 539.81

- Nikkei up 0.9% to 26,911.20

- Topix up 1.0% to 1,884.69

- Hang Seng Index up 0.2% to 20,644.28

- Shanghai Composite down 0.2% to 3,085.98

- Sensex up 0.3% to 54,469.39

- Australia S&P/ASX 200 up 1.0% to 7,182.66

- Kospi up 0.2% to 2,625.98

- German 10Y yield little changed at 1.03%

- Euro down 0.4% to $1.0505

- Brent Futures up 1.5% to $113.66/bbl

- Gold spot down 0.0% to $1,815.04

- U.S. Dollar Index up 0.33% to 103.70

Top Overnight News from Bloomberg

- Sweden’s biggest pension company has begun buying government bonds amid a “paradigm shift” in the market that pushed yields to their highest level since 2018. The CIO views Treasuries as “quite attractive” after a prolonged period of razor-thin yields that forced the company into alternative and riskier asset classes to preserve returns across its $117 billion portfolio

- While outright China bulls may be hard to find, shifts in positioning at least point to improving sentiment. Bearish bets on stocks are being abandoned in Hong Kong, expectations for yuan volatility are falling, domestic equity traders have stopped unwinding leverage and foreigners have slowed their once-record exit from government bonds

- The EU is set to unveil a raft of measures ranging from boosting renewables and LNG imports to lowering energy demand in its quest to cut dependence on Russian supplies. The 195 billion-euro ($205 billion) plan due Wednesday will center on cutting red tape for wind and solar farms, paving the way for renewables to make up an increased target of 45% of its energy needs by 2030, according to draft documents seen by Bloomberg that are still subject to change

A more detailed look at global markets courtesy of Newsquawk

Asia-Pac stocks traded mixed as the regional bourses only partially sustained the momentum from global peers. ASX 200 was led higher by outperformance in the mining and materials related sectors, while softer than expected wage price data reduced the prospects of a more aggressive RBA rate hike next month. Nikkei 225 briefly reclaimed the 27,000 level but retreated off its highs as participants digested GDP data which printed in negative territory, albeit at a narrower than feared contraction. Hang Seng and Shanghai Comp were subdued with large-cap tech stocks pressured in Hong Kong including JD.com despite beating earnings expectations and with Tencent bracing for the expected slowest revenue growth since its listing, while the mainland was hampered by the mixed COVID-19 situation as Shanghai registered a 4th consecutive day of zero transmissions outside of quarantine, although Beijing was said to lockdown some areas in its Fengtai district for 7 days.

Top Asian News

- Shanghai authorities issued a new white list containing 864 financial institutions permitted to resume work, according to sources cited by Reuters.

- China, on May 20th, is to remove some COVID test requirements on travellers to China from the US, according to embassy.

- China's Foreign Ministry says the BRICS foreign ministers are to meet on May 19th.

- Goldman Sachs downgrades its 2022 China GDP growth forecast to 4.0% from 4.5%.

European bourses are rangebound and relatively directionless, Euro Stoxx 50 U/C, taking impetus from a mixed APAC session which failed to sustain US upside. Stateside, futures are modestly softer and a firmer Wall St. close; ES -0.2%. Limited Fed speak due and near-term focus on retail earnings. Tencent (0700 HK) Q1 2022 (CNY): adj. net profit 25.5bln (exp. 26.4bln), Revenue 135.5bln (exp. 141bln). Lowe's Companies Inc (LOW) Q1 2023 (USD): EPS 3.61 (exp. 3.22/3.23 GAAP), Revenue 23.70bln (exp. 23.76bln). SSS: Lowe's Companies: -4.0% (exp. -2.5%); Lowe's Companies (US): -3.8% (exp. -3.7%). -0.2% in the pre-market

Top European News

- UK Chancellor Sunak is reportedly mulling bringing forward the 1p income tax cut to the basic rate by one year, according to iNews citing Treasury insiders. Other reports suggest that Sunak is putting plans together to raise the warm home discount by hundreds of GBP in July ahead of lowering taxes in autumn to assist with the cost of living crisis, according to The Times.

- EU is to offer the UK new concessions on the Northern Ireland protocol but has threatened a trade war if UK PM Johnson refuses to agree to a compromise, according to The Telegraph.

In FX

- Sterling slides to the bottom of the major ranks as fractionally sub-forecast UK CPI dampens BoE rate hike expectations; Cable reverses from just over 1.2500 to sub-1.2400, EUR/GBP nearer 0.8500 after dip below 0.8400 only yesterday.

- Hawkish Fed chair Powell helps Buck bounce ahead of US housing data, DXY towards the upper end of 103.770-180 range.

- Aussie hampered by softer than expected wage metrics that might convince the RBA to refrain from 40bp hike in June, AUD/USD heavy on the 0.7000 handle.

- Yen relatively resilient in wake of Japanese GDP showing less contraction in Q1 than feared, USD/JPY closer to 129.00 than 129.50.

- Euro loses momentum irrespective of comments from ECB’s Rehn echoing Summer rate hike guidance as final Eurozone HICP is tweaked down, EUR/USD fades from 1.0550+ to test support around 1.0500.

- Loonie treads cautiously before Canadian inflation metrics as oil prices come off the boil, USD/CAD back above 1.2800 within 1.2795-1.2852 range.

In Fixed Income

- Gilts sharply outperform as UK CPI falls just shy pf consensus and dampens BoE tightening expectations.

- 10 year UK bond rebounds towards 119.50 from sub-119.00 lows, while Bunds lag below 152.50 and T-note under 119-00.

- Record high cover for 2052 German auction and low retention sets high bar for upcoming 20 year US offering.

Central Banks

- ECB's Rehn says June forecasts are seen near the adverse scenario from March, first rate increase will likely take place in the summer. Many colleagues back stance for quick moves.

- ECB's de Cos says the end of APP should be finalised early in Q3, first hike shortly afterwards. Further rises could be made in subsequent quarters of medium-term outlook remains around target; the build-up of price pressures in EZ in recent months raises the likelihood of second-round effects, which have not strongly materialised.

In commodities

- WTI and Brent are modestly supported after yesterday's lower settlement; currently, firmer by just over USD 1.00/bbl.

- Focus has been on the narrowing WTI/Brent spread, particularly going into US driving season; see link below for ING's views.

- US Energy Inventory Data (bbls): Crude -2.4mln (exp. +1.4mln), Cushing -3.1mln, Gasoline -5.1mln (exp. -1.3mln), Distillates +1.1mln (exp. unchanged).

- Spot gold and silver are modestly firmer but capped by a firmer USD, yellow metal just shy of USD 1820/oz.

US Event Calendar

- 07:00: May MBA Mortgage Applications, prior 2.0%

- 08:30: April Building Permits MoM, est. -3.0%, prior 0.4%, revised 0.3%

- 08:30: April Housing Starts MoM, est. -2.1%, prior 0.3%

- 08:30: April Building Permits, est. 1.81m, prior 1.87m, revised 1.87m

- 08:30: April Housing Starts, est. 1.76m, prior 1.79m

DB's Jim Reid concludes the overnight wrap

Another reminder of my webinar replay from last week discussing our recession call for 2023 and an update on credit spreads. In it I said that while we have high conviction that HY spreads would be +850bp in H2 2023, the outlook over the next few weeks and months may actually be positive from this starting point. I would say I am nervous of that view but I still don't think that the real economic pain comes until deeper into 2023 when the lagged impact of an aggressive Fed starts to bite. Click here to view the webinar and to download the presentation.

Good luck to Glasgow Rangers and Eintracht Frankfurt in tonight's Europa League final. These are not teams that any would have expected to reach this final and I will watch with stress free divided loyalties. My father's family were all from the former and supported Rangers while the latter play at the fabulously named Deutsche Bank Park. So good luck to both. I suspect I'll be less stress free in 11 days' time when Liverpool are out for revenge against Real Madrid in the Champions League Final. At the moment I’m feeling nervously optimistic.

Talking of which, investor optimism has returned to markets over the last 24 hours as more positive data releases raised hopes that the US economy might be more resilient in the near-term than many have feared. The economic concerns won't go away, but stronger-than-expected numbers on retail sales and industrial production helped the S&P 500 (+2.02%) close at its highest level in over a week. Remember monetary policy acts with a lag and it would be very unusual historically if the data rolled over imminently. By this time next year it will likely be a very different story.

The higher yield momentum was reinforced by a Powell speech after Europe went home but there was a steady march of slightly hawkish central bank speakers through the day. Before we review things keep an eye out for UK CPI just after this goes to press. The headline rate is expected to be a huge 9.1%. Expect a lot of headlines reporting of 40 year highs.

With regards to Powell, most in focus was his claim that policy rates would rise above neutral if that was required to tame inflation. While the sentiment was not necessarily new, his explicit comment that neutral rates are “not a stopping point” garnered focus, noting that the Fed was looking for “clear and convincing evidence” that inflation was subsiding. The rates market have already priced terminal policy rates above the Fed’s estimate of neutral, but a combination of the risk on, and stronger data meant that equities could go up alongside yields.

Earlier in the day we got a smattering of communications from Fed regional Presidents, none of which registered as materially but it reinforced the direction of travel after a month to date where markets have repriced the Fed lower. Indeed, even resident hawk, St Louis Fed President Bullard, reiterated Powell’s message in that the Fed was on course for 50bp hikes at the upcoming meetings and said that “I think we have a good plan for now”.

Sovereign bonds had already sold off significantly ahead of all that Fedspeak, aided by the broader risk-on tone yesterday, but continued drifting higher through the US session. Yields on 10yr Treasuries closed +10.4bps to a one-week high of 2.99%, driven by a +7.9bps rise in real yields to 0.24%. The moves were more pronounced at the front-end however, and the 2yr yield rose by a larger +13.1bps as investors priced in a more aggressive path of hikes over the next 12 months after data showed the economy was performing stronger than the consensus had anticipated. In terms of the headlines, retail sales were up by +0.9% in April (vs. +1.0% expected), but the growth in March was revised up to +1.4% (vs. +0.5% previously). Retail sales excluding autos and gas were up by +1.0% as well (vs. +0.7% expected), whilst the industrial production number was another that came in above expectations at +1.1% (vs. +0.5% expected).

Europe also had a large move in yields, which followed comments by Dutch central bank Governor Knot who became the first member of the Governing Council to openly float the idea of a 50bp hike. Although he said that “my preference would be to raise our policy rate by a quarter of a percentage point”, he said that “bigger increases must not be excluded” if data were to show inflation “broadening further or accumulating”. So even though he’s one of the more hawkish members of the council, that’s still a significant milestone in that larger moves are being openly discussed, and echoes what we saw with the Fed at the turn of the year when the policy trajectory became increasingly aggressive.

Market pricing reflected that shift yesterday, and for the first time overnight index swaps were pricing in that the ECB would hike by more than 100bps by their December meeting and thus catching up with the DB House View. That growing belief behind additional hikes led to a fresh selloff in sovereign bonds, with those on 10yr bunds (+10.9bps), OATs (+10.5bps) and BTPs (+11.7bps) all moving higher. The biggest moves were seen from gilts (+15.0bps) however, which followed data that pointed to an increasingly tight labour market in the UK, and overnight index swaps nearly doubled the probability of a 50bp rate hike from the BoE in June, with the odds moving from 17% on Monday to 33% yesterday.

Over in equities, stronger risk appetite led to a significant rebound yesterday, with the S&P 500 (+2.02%) hitting a one-week high, whilst the NASDAQ (+2.76%) saw an even larger rebound in spite of the simultaneous rise in yields. Walmart (-11.38%) was by far the worst performer in the S&P, which came as it cut its earnings per share forecast, which it now expected to decrease by 1%, relative to previous guidance that expected it to rise by the mid single-digits. But that was the exception, and every sector except consumer staples moved higher on the day, with the more cyclical areas leading the advance. Over in Europe the STOXX 600 (+1.22%) posted a strong performance of its own, bringing its advance to more than +5% since its recent closing low just over a week ago.

Overnight in Asia, performance in regional stock indices is diverging partly on the back of economic data. Japan’s Q1 GDP (-1.0%) contracted less than expected (-1.8%), lifting the Nikkei (+0.50%) this morning. In China, though, rising covid cases and waning optimism about government’s support of tech companies weighed on the Shanghai composite (-0.37%) and the Hang Seng (-0.66%). New home prices (-0.30%) in the country also slid for an eighth month in a row. This slight souring of sentiment has extended to S&P 500 futures (-0.23%) with the US 10y yield edging back lower by -2.2bps.

Elsewhere, tensions over Brexit ratcheted up again yesterday after UK Foreign Secretary Truss announced plans to introduce legislation that would override parts of the Northern Ireland Protocol. Truss said that the UK’s preference “remains a negotiated solution with the EU” and that the bill would contain an “explicit power to give effect to a new, revised Protocol if we can reach an accommodation”, but that “the urgency of the situation means we can’t afford to delay any longer.” Unsurprisingly the EU did not react happily, and Commission Vice President Šefčovič said in a statement that if the UK moved ahead with the bill, then “the EU will need to respond with all measures at its disposal.”

Staying on the UK, the latest employment data out yesterday pointed to an increasingly tight labour market, with the unemployment rate falling to 3.7% in the three months to March (vs. 3.8% expected), which is the lowest it’s been since 1974. Furthermore, the number of vacancies was larger than the total number of unemployed for the first time, and the more up-to-date estimate of payrolled employees in April saw an increase of +121k (vs. +51k expected). Elsewhere in Europe, the latest estimate of Euro Area GDP growth in Q1 showed a bigger than expected expansion of +0.3% (vs. +0.2% previously).

Elsewhere the chances of a Russian sovereign debt default increased, following the Treasury department confirming a temporary waiver that allowed Russia to pay US creditors would expire on May 25. Meanwhile, the US is reportedly considering a tariff on Russian oil in conjunction with European allies, as the saga about banning imports to Europe drags on.

To the day ahead now, and data releases include the UK and Canadian CPI readings for April, along with US data on housing starts and building permits for the same month. Central bank speakers include the Fed’s Harker and the ECB’s Muller. Earnings releases include Cisco, Lowe’s, Target and TJX. Finally, G7 finance ministers and central bank governors will be meeting in Germany.

Disclosure: Copyright ©2009-2022 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more