From Panic To Pivot,Wall Street’s Fastest Mood Swing Since ’04

Image Source: Pixabay

Nine Days of Green and a Whiff of Peace

Wall Street just punched its ticket to a piece of history. Nine straight green days on the S&P 500—its longest victory lap since 2004—has wiped every trace of April’s tariff tantrum off the tape and left the benchmark cruising 14 % above its April‑8 panic low. “Liberation Day” gloom has flipped into a full‑blown FOMO melt‑up.

Why the sudden euphoria? Two blast‑assist tailwinds: (1) an upside surprise on payrolls (177k vs. 138k ( 115 kwhisper) that shouts “resilient U.S. engine,” and (2) a credible olive branch out of Beijing. Word in the back‑channels is that Public‑Security supremo Wang Xiangxi could hop a plane—if not to D.C., then at least to a neutral runway—to kick‑start tariff détente. Traders don’t need a signed accord; they just need a whiff of softening from both sides to lean back into risk.

Right now, the street’s swapping raw uncertainty for anything that resembles a rulebook—even if that playbook still promises some bruises. When a credible path to a deal emerges, traders rush to re‑price the tail risks they’d been over‑insuring against.

Now, the instant markets smell an actual framework—trade deals, exemption windows, whatever—risk premia further compress, and stocks can rally further. You can almost hear the collective sigh across trading floors: traders would rather bank a loss than keep guessing whether tomorrow’s social media barage detonates supply chains altogether. Clarity, however imperfect, turns a shapeless geopolitical roulette wheel into a calculable expected‑value bet, and that’s gold for asset allocators who live on probabilistic spreadsheets. Pain with a price tag beats paranoia with no expiry every single time.

Under the hood, Big Tech is reminding everyone why it’s called “mega‑cap gravity.” Microsoft’s cloud juggernaut shoved the firm back above the $3 trn club, Meta and Alphabet are still coasting on ad‑spend momentum, and even Amazon’s tariff‑dodging inventory tricks are keeping Prime humming—for now. Apple’s China skid (-4 %) and Amazon’s softer guide (-0.8 %) show who’s wearing the most tariff beta in the Magnificent Seven, but both giants can still yank levers: Cupertino is fast‑tracking India/Vietnam assembly (margin hit: a manageable 100 bps), while Seattle’s “forward‑buying” spree front‑loads imports before duty rates bite.

Net net, necessity breeds resilience. Smartphones, cloud slots, and e‑commerce carts remain non‑negotiables for consumers juggling sticker shock. That keeps the tech‑led risk bid alive—even if profit‑lines get nicked at the margin—so long as rate expectations stay pinned and a real trade thaw looks feasible.

The bottom line is that the “sell America” narrative has just rolled over. Equity bulls have momentum; FX bears no longer find a smoking gun. Unless the next data batch finally reflects tariff fallout—or Beijing’s feelers go radio‑silent—this rally still has fuel. I’m happy to ride the tape higher, but the stop sits tight: one ugly headline on tariffs this could swing from longest winning streak to fastest rug‑pull in a heartbeat. For now, the path of least resistance points up—just remember markets, like traders, rarely stay married to a position for long.

Calm Before the Storm: April Jobs Snapshot

April’s jobs numbers were solid, not spectacular. Payrolls rose by 177 k—better than expected—though downward revisions to February–March trimmed 58 k off the headline glow. Average job gains now sit around 155 k a month, a shade firmer than in March, suggesting the labour market is still grinding along despite the tariff noise gathering on the horizon.

The unemployment rate held at 4.2 %. Household employment jumped 436 k, the labour force swelled 518 k, and participation edged up to 62.6 %. Broader U‑6 unemployment actually dipped to 7.8 %, its best showing since January.

Wages cooled a touch: hourly earnings rose 0.2 % on the month and 3.8 % year‑on‑year, but weekly earnings accelerated to 4.1 % thanks to steady hours worked (34.3). Sector hiring was steady but subdued; manufacturers, retail, and the federal government slipped, while education, health care, and leisure added fewer jobs than earlier in the year.

For the Fed, this report changes little. The labour market hasn’t cracked, yet it’s not running hot enough to force a policy rethink. With tariff effects still working their way through supply chains, the FOMC is likely to stay put and keep monitoring inflation and activity data. Futures markets still point to the first rate cut in July, and that feels reasonable unless the incoming data roll over sooner.

Bottom line: jobs are holding up for now, but the real test comes once the full tariff hit shows up in corporate margins and hiring plans. Today looks calm; the storm could still follow.

Could Fentanyl Be the First Step Out of the Trade Freeze?

Beijing may have found a practical way to break the trade deadlock: offer real help on the U.S. fentanyl crisis. Xi Jinping’s top security official, Wang Xiaohong, is quietly asking what concrete steps Washington wants—everything from tighter controls on chemical precursors to joint enforcement channels. If Wang travels to meet Trump’s team (or even a third‑country rendezvous), it would signal that China is ready to swap gestures for concessions.

Why does this matter? Because tariffs at 145 % on Chinese goods—and 125 % in retaliation—are hurting both economies. A verifiable fentanyl crackdown would give the White House a public‑health win and let Beijing claim it’s being constructive, creating room for phased tariff roll‑backs. Even talk of such a deal can calm markets: businesses prefer known costs over endless uncertainty, and any outline of cooperation replaces guesswork with a timeline they can plan around.

In short, a fentanyl agreement could serve as the icebreaker both sides need. It wouldn’t solve every dispute, but it would turn a zero‑dialogue standoff into negotiations where specific trade-offs—lower duties for stricter drug controls—can finally be put on paper. Pain with a price tag beats policy fog every time.

Why the Dollar Stayed Flat

April’s jobs report was solid, but most traders think the numbers reflect hiring decisions made before Trump’s early‑April tariff spike. They’re focused on what the data will look like once those tariffs feed through, so they weren’t eager to chase the dollar higher.

In Asia, currencies moved the other way. A stronger Chinese yuan lifted regional FX and relieved some pressure on Japanese officials to keep the yen weak on a competitive export basis. Each time the yuan strengthens, USD/JPY struggles to climb; attempts to push above 146 fizzled for exactly that reason.

Positioning is the real plot twist. CFTC figures show leveraged funds stuffed into yen longs—the most crowded corner on the sheet. When the BoJ went dovish, those overextended longs bailed in a hurry, sparking a textbook USD/JPY short‑squeeze. The rally sputtered once the stop‑hunt ran out of fuel above 145: no fresh macro tailwind to keep dollar bulls engaged, and mean‑reversion desks simply stepped back. Beyond the yen’s usual risk‑on/risk‑off swings, there’s still no new catalyst—so without another positioning shake‑out, upside momentum looks capped for now.

Looking ahead, you’ve got a clear split in the policy map: the Fed, ECB, and friends are easing, while the BoJ is dropping hints—ever so gingerly—about nudging rates higher once the tariff smoke clears. That “soft divergence” props up the yen and caps the dollar. I still favour a firmer yen over time, but calling a quick drop back to 140 is a mug’s game with headline risk sky‑high. Expect the next few weeks to be more whiplash than trend: two‑way chop, not a straight runway.

The euro’s swagger has slipped. Multiple sluggish sessions have hammered home the point: once U.S. asset markets snap back to “normal,” EUR/USD feels like dead weight. The 1.13 shelf is the fulcrum—break it cleanly and the technical vacuum below could drag us sub 1.12 in short order.

Oil’s Tipping Point: Riyadh Holds the Remote

WTI has slipped through the US$60 trapdoor—down a good ten bucks since early April—and the market is white‑knuckling every headline out of Riyadh. Why the angst? Two pressure points. First, global demand is taking body blows from Trump’s fast‑escalating tariff war. Second, chatter says OPEC+ might fast‑forward the unwind of those 2.2 mb/d “voluntary” cuts to punish serial quota‑cheaters (Iraq, Kazakhstan, the UAE). We’ll find out at tomorrow’s policy huddle whether the Saudis really want to crack the whip or just rattle it.

But let’s be clear: cheap crude hurts Riyadh more than most. The Kingdom needs roughly US$92/bbl to balance its budget and about US$85 to square its current account. With WTI in the high‑50s, Vision 2030’s giga‑projects are already hitting the brakes.

Even if the laggards suddenly toe the line, don’t assume prices snap back. Washington wants cheap energy, and Gulf producers still lean on U.S. security guarantees; the White House bears down, they listen. Trump’s mid‑May trip to Saudi, the UAE and Qatar will be soaked in commercial deals, and crude pricing will be front‑and‑center. In that sense the U.S. President has become an unofficial swing vote inside OPEC+.

Could Riyadh pull another 2014 and flood the market? Unlikely. Back then the goal was to kneecap shale; today OPEC+ is already parking 5.6 mb/d of capacity. A scorched‑earth policy would wound everyone, including Saudi coffers. Bringing Iraq, Kazakhstan and the UAE back in line doesn’t need a supply tsunami—just a reminder that stable prices serve all.

Until Riyadh balances politics, fiscal math and Washington’s price ceiling, crude will trade with a bearish bias. The cartel may tweak volumes, but with Trump effectively at the OPEC+ table, rallies now look more like short‑selling invitations than the start of a new bull run.

Chart of The Week

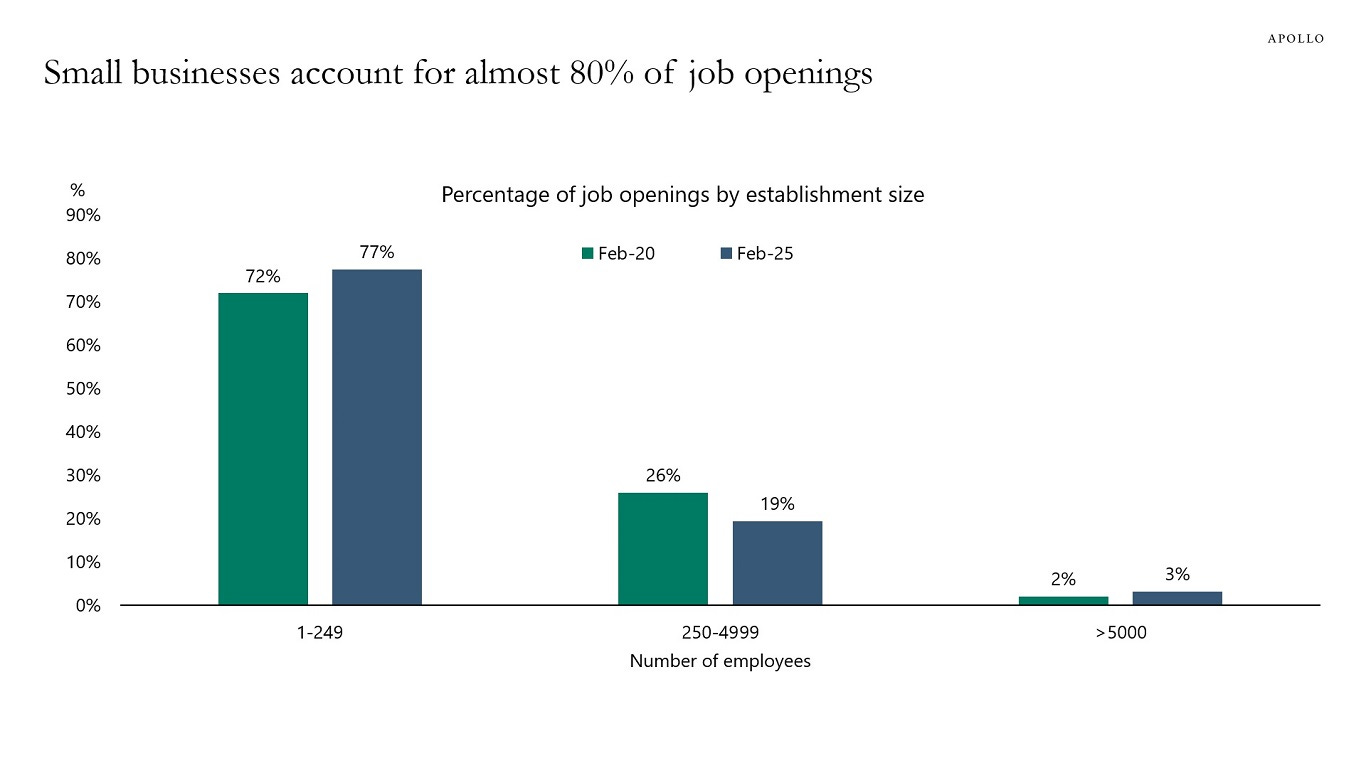

Nearly 80% of all job openings today live in firms with sub-250 headcounts—and that slice has swelled steadily over the past five years. What started as a niche hiring surge has morphed into a structural shift: Main Street’s mom-and-pop outfits now dominate the labor lead indicators.

(Click on image to enlarge)

Sources: JOLTS, BLS, Haver Analytics, Apollo Chief Economist

Why it matters: small businesses are far more sensitive to credit conditions, wage pressures and local demand swings. As these leaner outfits gobble up an outsized share of vacancies, the Phillips-curve signals we’re watching—wage growth, turnover rates, even tightness in advertised pay—are being driven by a far more fragmented, credit-constrained cohort. That changes the policy calculus. A rate-hike pinch that might barely slow a Fortune 500 giant can snuff out expansion plans at a 50-employee retailer or startup.

From a market angle, keep your eyes peeled on small-biz sentiment surveys and regional bank loan spreads. If Main Street starts squealing, it’ll filter through to consumer credit delinquencies, upstream supply-chain orders and, eventually, the darkening line items of Q2 GDP. In short, ignoring the SMB hiring juggernaut isn’t just a blind spot—it’s betting on yesterday’s data.

A Formal Critique of America’s “Sugar‑Daddy” Role and the Emerging Backlash

For much of the post‑war era, the United States has anchored a security and trade architecture that effectively socialized global public goods while privatizing many of the benefits abroad. Washington’s blue‑water navy secured sea‑lanes; the dollar’s reserve status underpinned cross‑border finance; and an open U.S. consumer market absorbed surplus production from allies rebuilding after World War II and, later, from emerging economies pursuing export‑led growth. In return, American policymakers accumulated diplomatic leverage, and U.S. multinationals harvested scale advantages. Yet the current moment reveals a widening perception gap: ordinary voters increasingly view this arrangement as a loss‑making enterprise, while a transnational policy elite—sometimes caricatured as “mini‑Schwabs”—continues to defend it as enlightened multilateralism.

At the heart of the critique is a basic cost‑benefit asymmetry. Maintaining forward‑deployed forces, underwriting international institutions, and recycling persistent current‑account deficits through Treasury issuance have all carried fiscal and social costs. Although the U.S. captured intangible strategic returns, the tangible burdens—ballooning federal debt, trade‑exposed manufacturing job losses, and intermittent military entanglements—fell disproportionately on domestic constituencies with limited voice in global forums. The last two decades, marked by overseas interventions and the collateral damage of globalization, sharpened the impression that American households foot the bill while a cosmopolitan class—whether ensconced in Brussels, New York, or Silicon Valley—reaps outsized gains.

Media consolidation has compounded credibility issues. With a handful of conglomerates shaping most international coverage, narratives can converge quickly around consensus viewpoints that often reflect the priorities of multinational business and policy circles. This accelerates the perception that criticism of the prevailing order is filtered—or dismissed—as populist agitation. Meanwhile, emerging digital platforms amplify alternative voices, but also magnify confirmation bias, deepening the schism between institutional messaging and public sentiment.

Fiscal arithmetic is now forcing a reckoning. Even before the pandemic‑era stimulus surge, entitlement pressures and defense outlays were on an unsustainable trajectory. Every basis‑point move higher in Treasury yields squeezes discretionary spending or pushes new borrowing into the market at less‑favorable terms. Simultaneously, the U.S. faces the inflationary feedback loop of dollar‑denominated commodity pricing and persistent global supply‑chain vulnerabilities—a loop accentuated whenever geopolitical flashpoints threaten energy or shipping flows the U.S. has long subsidized.

Market Implications

-

Higher Policy‑Risk Premiums

Political volatility translates into wider spreads for assets most sensitive to trade policy, tariffs, and cross‑border capital flow restrictions. Equity sectors reliant on imported intermediate goods or foreign labor arbitrage face persistent valuation discounts. -

Safe‑Haven Re‑Pricing

While no rival asset matches the breadth, depth, and liquidity of U.S. Treasuries, diversification pressures are visible in elevated gold allocations, incremental accumulation of reserve currencies such as the euro and renminbi, and the tentative exploration of central‑bank digital currencies aimed at reducing dollar reliance. -

Defense and Industrial‑Policy Beneficiaries

The prospect of allies “paying their share” paradoxically boosts near‑term Pentagon budgets—deterrence without broad coalition support is more expensive—and channels fiscal stimulus toward domestic semiconductor fabs, rare‑earth processing, and strategic manufacturing. -

Media‑Trust Arbitrage

Investors increasingly seek primary‑source data and specialized research outlets to avoid narrative slippage. Firms that can curate high‑integrity information or leverage alternative data gain relative pricing power in a fragmented trust landscape.

The United States remains the cornerstone of the global financial system, yet its willingness to underwrite that system without recalibration is waning. Domestic constituencies are questioning the net return on decades of open‑ended commitments, and political leaders—across the spectrum—are responding with policies that blend strategic retrenchment and targeted protectionism. Markets must now price not only interest‑rate trajectories and growth differentials, but also the political risk that Washington may increasingly demand tangible reciprocity from partners once accustomed to American largesse. The next macro regime will be shaped less in alpine conference halls and more on the factory floors and town halls that have shouldered the hidden costs of globalization.

More By This Author:

Ripped From The Brink: Tech Flexes As Tariff Fear Fades

S&P 500 On Track For Longest Winning Streak Since March 2022 — And The Tape's Got Fire In Its Veins

Tariff Tensions Ease On The Fast Lane — Asia Accelerates As Auto Relief Ignites Hope