Forex Today: US Dollar Consolidates Losses Ahead Of September Jobs Report

Image Source: Unsplash

Here is what you need to know on Friday, October 6:

The US Dollar (USD) weakened against its major rivals for the second consecutive on Thursday before finding a foothold early Friday. The USD Index holds steady at around 106.50 in the European morning and the 10-year US Treasury bond yield fluctuates at around 4.75 as markets await the September jobs report, which will include Nonfarm Payrolls (NFP) and wage inflation figures.

US Dollar price this week

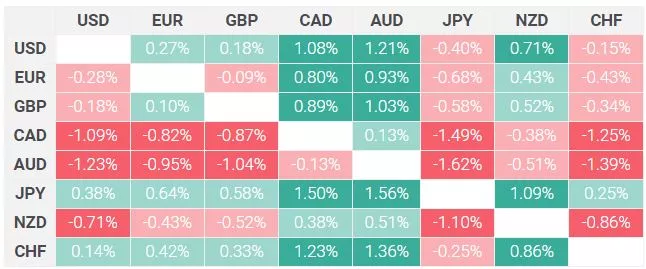

The table below shows the percentage change of the US Dollar (USD) against listed major currencies this week. The US Dollar was the strongest against the Australian Dollar.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

Wall Street's main indexes opened deep in red on Thursday but managed to erase the majority of daily losses. Meanwhile, the 10-year US yields continued to stretch lower and made it difficult for USD. US stock index futures trade modestly lower early Friday, pointing to a cautious market stance. Markets expect NFP to rise 170,000 in September and see the Unemployment Rate declining to 3.7% from 3.8% in August. Meanwhile, International Monetary Fund (IMF) chief Kristalina Georgieva noted that the current pace of global growth was "quite weak" and warned of significant risks on the fiscal front in many countries, due to increased debt burdens on higher interest rates.

In its bi-annual Financial Stability Review (FSR), the Reserve Bank of Australia (RBA) said that global financial stability risks were elevated and growing. Following a two-day rebound, AUD/USD lost its bullish momentum and stabilized at around 0.6350 on the last trading day of the week.

USD/CAD rose to its highest level since March near 1.3800 on Thursday before staging a downward correction in the Asian session on Friday. Statistics Canada will also release the September labor market data later in the day.

USD/JPY closed in negative territory on Thursday but regained its traction and advanced to the 149.00 area on Friday. Japanese Finance Minister Shunichi Suzuki declined once again on Thursday to comment on whether Japan intervened in the foreign exchange market earlier in the week.

EUR/USD extended its rebound and closed in positive territory near 1.0550 on Thursday. The pair, however, struggled to preserve its recovery momentum and went into a consolidation phase.

GBP/USD benefited from broad USD weakness on Thursday and advanced toward 1.2200. Early Friday, the pair fluctuates in a tight channel above 1.2150 amid a cautious market stance.

Gold price moved up and down in a narrow range at around $1,820 on Thursday. With the 10-year US yield staying relatively quiet on Friday, XAU/USD finds it difficult to gather directional momentum.

More By This Author:

EUR/USD Price Analysis: Consolidates Around Mid-1.0500s, Focus Remains On US NFPWTI Crude Oil Prices Extend Decline, WTI Barrels Slide 2% On Thursday

Gold Price Analysis: XAU/USD Consolidating On The Low End Near $1,820

Disclosure: Information on this article contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes ...

more