Forex Friday: NFP, Gold, Guppy And Bitcoin

Image Source: Pixabay

In this week’s edition, we discuss the dollar, as well as gold, the pound, and the bitcoin

Welcome to another edition of Forex Friday, a weekly report in which we discuss selected currency themes mainly from a macro viewpoint, but we also throw in a pinch of technical analysis here and there.

In this week’s edition, we discuss the dollar, as well as gold, pound, and bitcoin, and look forward to the key events coming up in the week ahead.

- Concerns over the US banking system intensifies

- All eyes on NFP for FX Traders

- CPI next big event

- Gold testing a key level

- GBP/JPY is today’s big mover in FX

- Bitcoin tumbles below 20K

Concerns over the US banking system intensifies

The US dollar has lost some ground in the last couple of days, with bond yields also dipping as investors have sought safety in government debt. Concerns grew over the health of the US banking system this week. Silicon Valley Bank (SVB) saw its shares plunge after it announced plans to shore up its finances, while Silvergate Capital collapsed amid the crypto turmoil. Shares in global financial companies fell on fears of contagion. If the Fed continues its rate hikes, more problems might surface as people struggle to pay debt amid high-interest rates. Those concerns may intensify if Fed opts for a 50 basis-point rate hike this month. And that could be determined by the outcome of today’s nonfarm payrolls report and/or CPI next week – although in the short-term, above-forecast data should provide the dollar another shot in the arm.

All eyes on NFP for FX Traders

So, a lot hinges on the soon-to-be-released NFP data. The US jobs market is strong, and this is a worry for the Fed looking to reign in on inflationary pressures. The question is, will we see another above forecast print on the headline jobs data after last month’s 500K+ reading?

Well, that’s the million-dollar question, but in terms of leading indicators for the NFP, we had better-than-expected JOLTS Job Openings, ADP private sector payrolls report, and the employment component of the ISM services PMI.

The official non-farm payrolls reports have been beating expectations every month since last April. The January print was super-hot at over 500K when less than 200K was expected. This time expectations are that 224,000 net new jobs were created in the economy (except the farming sector).

CPI next big event

Once today’s US jobs report is out of the way, it is all about CPI next week. If both of these macro pointers come in hotter, or at least match expectations, then that could further raise bets over a 50-basis point rate increase at the Fed’s March 22 meeting.

The market has started to price in a more hawkish Fed after Chairman Powell warned that the US central bank could ramp up the pace of rate hikes and could keep a tight policy in place for longer. This sent the odds of a 50-basis point rate hike for the March 22 meeting to above 70%. Those expectations could rise further in the event of above-forecast readings for CPI and/or NFP. You would feel that CPI needs to be significantly lower than expectations to cause a big sell-off in the US dollar.

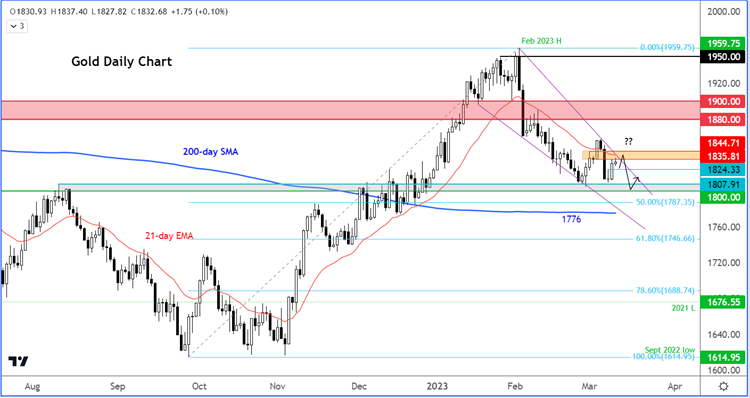

(Click on image to enlarge)

Gold testing a key level

For gold to make a stronger recovery, we will have to see a surprise miss in NFP today and/or CPI next week. If that happens, it could support stocks, gold, and bonds as traders question the likelihood of a 50-basis point rate hike, especially in light of the SVB troubles. On a side note, the market may have gotten ahead of itself as Powell did not explicitly say that a 50bp is on the cards. So, there’s definitely room for disappointment if it ends up being a mere 25bp hike on March 22. This, therefore, makes the upcoming NFP and inflation data very important indeed.

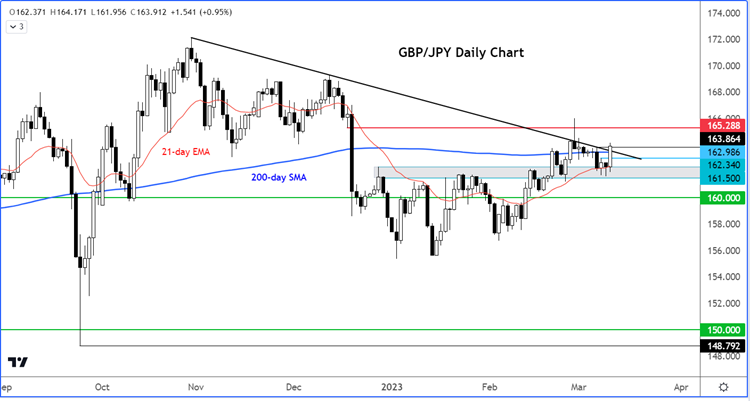

(Click on image to enlarge)

GBP/JPY is today’s big mover in FX

The Guppy was up more than +1% and was leading GBP pairs higher after the UK economy grew more than expected (+0.3% month-over-month) and the Bank of Japan kept policy settings unchanged. But the bearish trend line could cap the gains in this pair if risk appetite sours again later in the day. Still, the bulls would remain happy for as long as key support around 163.00 remains intact. Lose that and it is a different picture completely.

(Click on image to enlarge)

Bitcoin tumbles below 20K

Bitcoin was down for the fourth day and third week at the time of writing, after breaking $21.4K support, which led to following up selling to $20K as we had expected. Sentiment towards crypt assets have been negative and that hasn’t changed after Powell ramped up the Fed’s hawkish rhetoric earlier this week, weighing on all non-interest-bearing assets, including cryptos and gold. But crypto assets have been hurt further after Silvergate, a bank that has been at the center of the industry’s growth, decided to shut down. With BTC/USD breaking lower, we expect any bounces to be short-lived until the price starts to form higher highs again. So, watch out below!

(Click on image to enlarge)

Looking ahead to next week

UK Average Earnings Index

Tuesday, March 14

07:00 GMT

UK wages including bonuses have been stuck around a 6% annual pace in nominal terms for several months. But annual CPI has been around 10%, meaning that real wages have fallen as the cost-of-living crisis has deepened. The Bank of England is watching incoming data closely. This data release could certainly sway the MPC’s vote at the next meeting. BoE Governor recently said that “some further increase in Bank Rate may turn out to be appropriate, but nothing is decided.”

US CPI

Tuesday, March 14

12:30 GMT

The latest inflation data comes after Fed Chair Powell warned that the central bank could ramp up the pace of rate hikes and could keep a tight policy in place for longer. This sent the odds of a 50-basis point rate hike for the March 22 meeting to above 70%. Those expectations could rise further in the event of an above-forecast inflation reading. CPI needs to be significantly lower than expectations to cause a sell-off in the US dollar.

ECB Policy Decision

Thursday, March 16

13:15 GMT

Most analysts are expecting the European Central Bank to raise the main refinancing rate by 50 basis points to 3.5%, keeping up the 50-bps hiking pace for the third consecutive month. Since the ECB’s last meeting, Eurozone data has been mostly positive and core inflation rose to a fresh record high of 5.6%, even if headline CPI eased a tad to 8.5%. These inflation readings are way too high for ECB to be comfortable.

More By This Author:

S&P 500 Analysis And Trades Reviews

Gold Finds Relief As Dollar Rally Pauses – For Now

S&P 500 On The Edge After Powell-Inspired Drop

Disclaimer: The information on this web site is not targeted at the general public of any particular country. It is not intended for distribution to residents in any country where such ...

more