Fed Concerns Send Major Indexes Lower

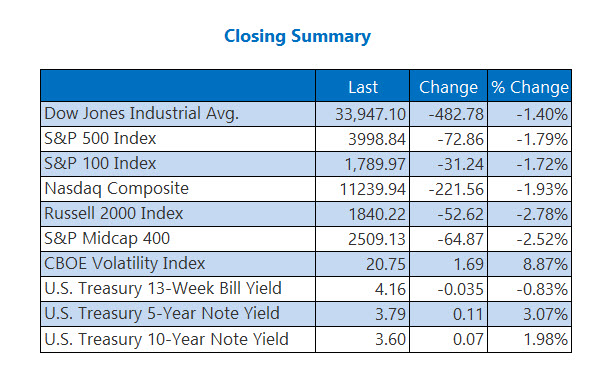

Stocks landed firmly in red ink today, with the Dow closing 482 points lower, after hotter-than-expected ISM services index data for November had Wall Street concerned over future rate hikes from the central bank. The 10-year Treasury yield surged after the news, last seen up 10 basis points. Elsewhere, the Cboe Volatility Index (VIX) snapped a four-day losing streak and logged its largest single-session gain since Sept. 23.

The Dow Jones Industrial Average (DJI - 33,947.10) lost 482.8 points or 1.4% for the day. Boeing (BA) was the only Dow winner, adding 1.2%, while Salesforce.com (CRM) landed at the bottom of the list with a 7.4% loss.

The S&P 500 Index (SPX - 3,998.84) dropped 72.9 points, or 1.8% for the day, while the Nasdaq Composite Index (IXIC - 11,239.94) shed 221.6 points or 1.9% for today's session.

Lastly, the Cboe Volatility Index (VIX - 20.63) lost 1.6 points or 8.2% for the day.

GOLD, OIL FALL FOR THE DAY

Oil prices settled lower today, the first day of trading after the European Union (EU) ban on Russian seaborne oil. West Texas Intermediate (WTI) crude for January delivery fell $3.05, or 3.8%, to settle at $76.93 a barrel -- the lowest finish for a front-month contact since Nov. 25.

Gold futures settled below $1,800 after hitting their highest level since Aug. 10 during the trading day. February-dated gold dropped $28.30, or 1.6%, to settle at $1,781.30 per ounce.

More By This Author:

Dow Down Triple Digits Midday As Wall Street Keeps Eye On FedStocks Brush Off Jobs Data, Secure Weekly Wins

Major Indexes Tumble Amid Hot Jobs Data, Fed Concerns