Fear Before Thursday Fed Showdown

I’m quite tortured about what to do this week, particularly on Thursday before Janet Yellen comes out spitting blood and declaring the need for Yet More Data in order to lift interest rates.

Anyway. Charts.

Some folks have been stacking stuff to SocialTrade indicating that an explosive move higher is imminent. It’s irrational, but I deeply resent those posts. I am the living god of confirmation bias, I realize, but posts like that just prod at my worst fears.

The thing I’ve realized for this entire year, though, is that the one regret that keeps coming up again and again and again is that I didn’t hold on long enough. I wimp out too early. I see the charts; I interpret the charts; I’m right about the charts; but fear causes me to take cover.

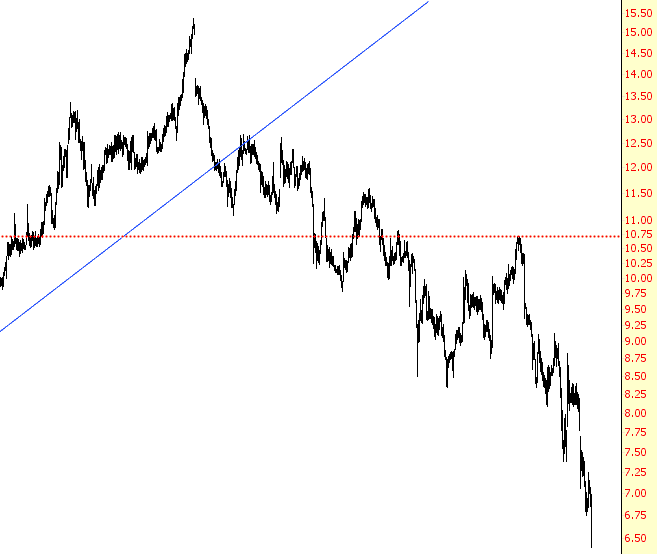

Here, let me cite one small example: the symbol TAXI. I wrote about this company many times (such as here, in July of 2014), and I quite rightly pointed out that Uber was going to ruin the taxi industry, and that TAXI should be shorted. Well, it’s lost about 33% of its value since then (and even when I did the post, it had already been trashed), but did I hang on? Absolutely not! (And I suspect it’ll just keep working its way toward $0).

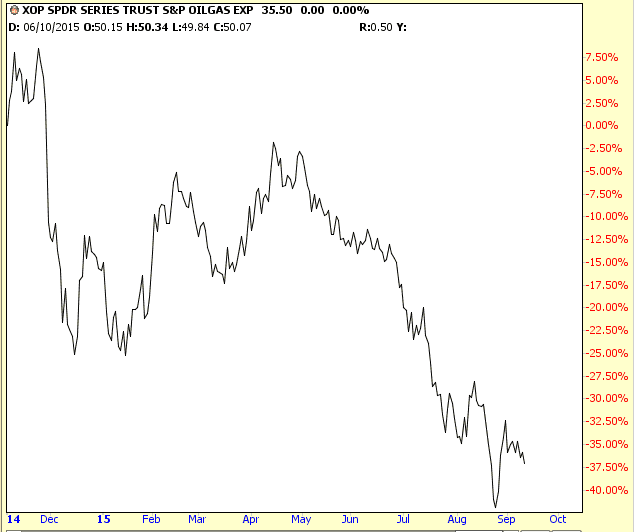

And don’t even get me started on energy producers. My Shifting Sands post from ten months ago boldly declared that “oil producers are the new gold miners” (in other words, headed for collapse). Let’s take a peek at the last ten months of the XOP in a percentage chart, shall we?

So, again, spot-on – dead spot on – but I only captured a portion of the move.

And so my “regret” over the past year has far more to do with premature closings than initial openings, so my temptation to cover all my positions and cower under a blanket while Yellen does her thing on Thursday is probably, shall we say, ill-advised. Again, I’ve laid out for Slope Plus folks what my strategic plan is, but that doesn’t mean I’m not still tied up in emotional knots about it.

I’ll say this, though – – hear me now and believe me later (those words are most effective played in your head with an Arnold Schwarzenegger accent) – the damage…is…done.

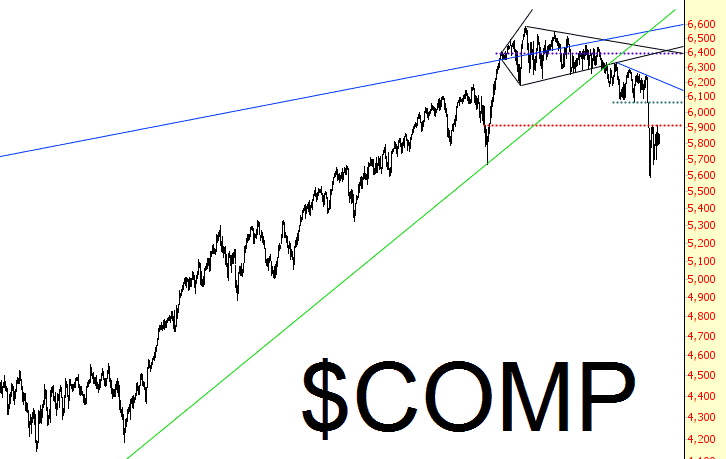

Yellen can raise rates or delay raising the as she awaits “further data”…or declare that rates will never go up again during the remainder of her natural life, but the damage is done. The chart above isn’t a bullish setup. It isn’t in the same ZIP code as bullish. It is jumping-up-and-down bearish, and even a hearty rally starting on Thursday isn’t going to change that.

Yellen is, in the end, doomed, just like this Frankenstein “market” she has created. It’s only a matter of time, and my principal concern at this moment, frankly, is to make it to the other side of this week in one piece and with some semblance of my sanity intact.

This blog is not, and has never been, investment advice. It is a place that allows me to express my own views on the market and specific securities – as well as make whatever cultural ...

more

Lol, entertaining article. Yellen is a symbol of easy money for Wall Street. But the stock market is most vulnerable to her reasonings.