“Farewell, 2021 Levels…” - Can You Hear GDXJ’s Whispers?

In yesterday’s analysis, I emphasized that Friday’s event-driven news was… well, exactly that. And nothing more than that. As such, it was unlikely to be a beginning of a new uptrend in the precious metals sector, but rather a daily reaction more or less separate from the current (down)trend.

What happened yesterday (and what’s happening today) is in perfect tune with the above. Let’s start by taking a look at the confirmations that came from the mining stocks.

The Invalidation’s Invalidation

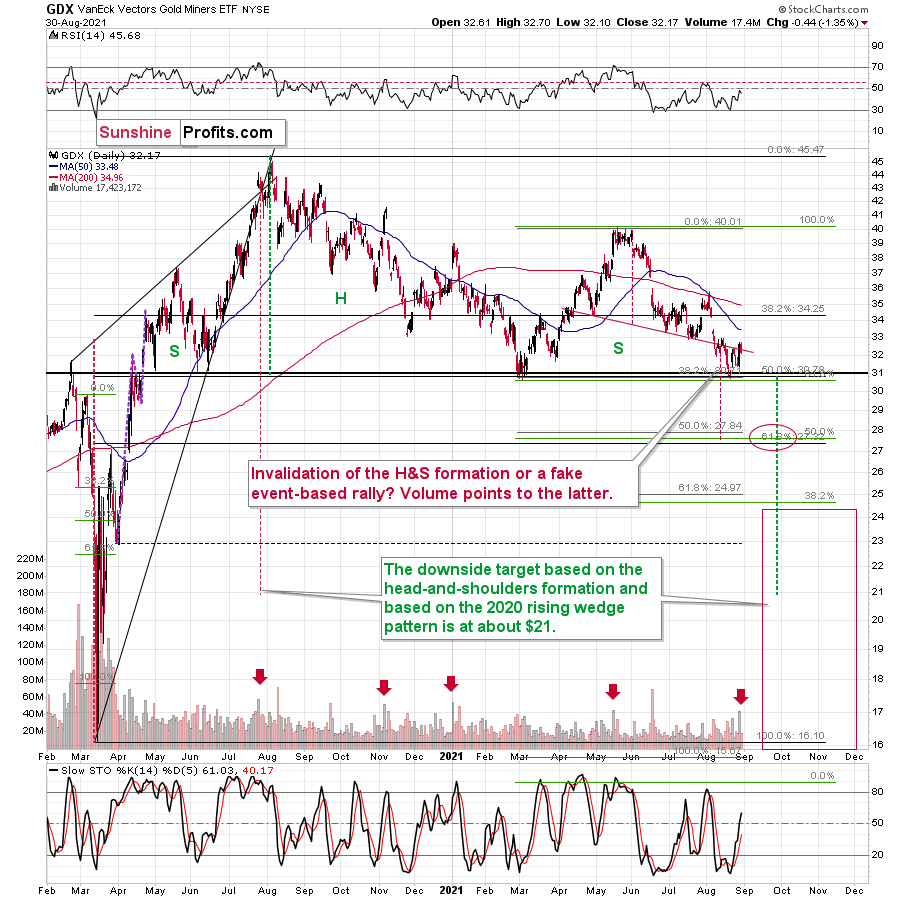

Remember the tiny move back above the neck level of the bearish head and shoulders pattern? Well, it’s been invalidated. Yes, the invalidation was invalidated. While it may sound odd, the really odd thing is that the miners managed to close the previous week above this level. If this move had been true, gold miners would have soared yesterday. Instead, they moved back down, correcting the action that was rather accidental.

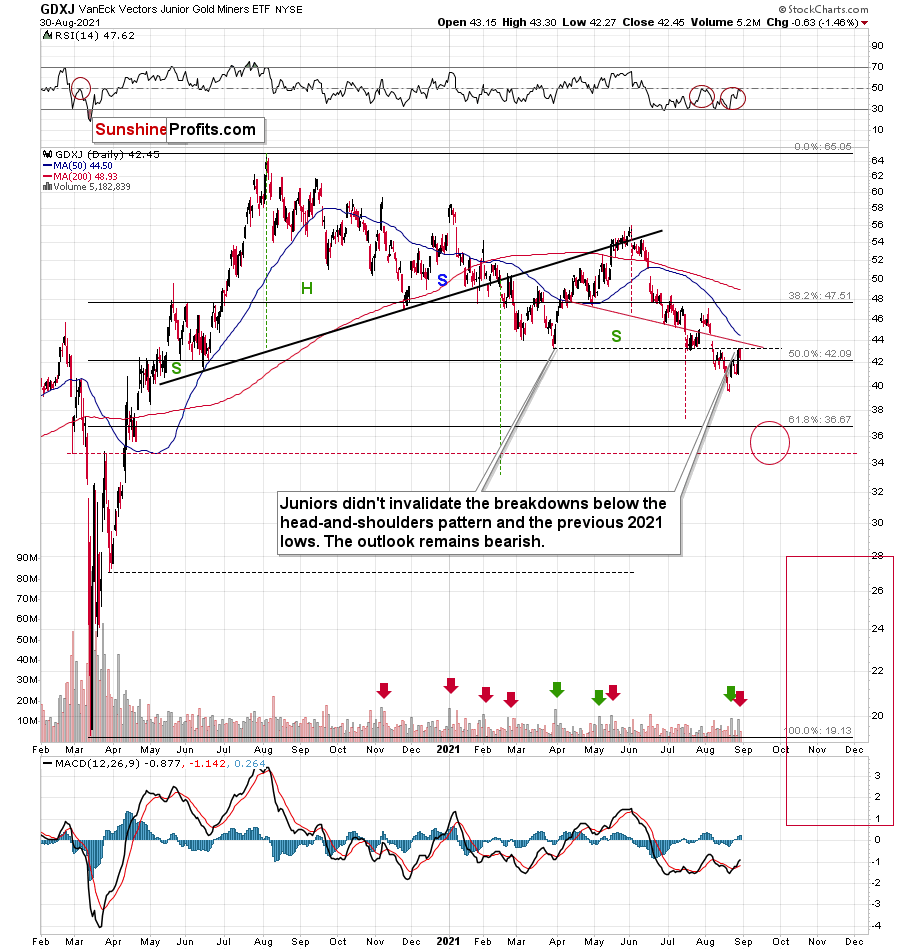

And while the senior miners (GDX) invalidated their move higher, the junior miners (GDXJ) are verifying the previous breakdowns in a classic manner.

Namely, after moving below the previous lows, the GDXJ ETF moved back up to them and then declined once again. This is a common thing for an asset to do, and it’s called a breakdown’s verification. A final good-bye kiss to the previous support, which now proved to be resistance.

“Farewell, previous 2021 lows…” – the GDXJ ETF whispered gently, hesitated for no more than a second, and looked downward, excited about the upcoming jump into the unknown. (who said analyses have to be boring?)

In other words, the outlook remains bearish.

The Gold and Dollar Dance

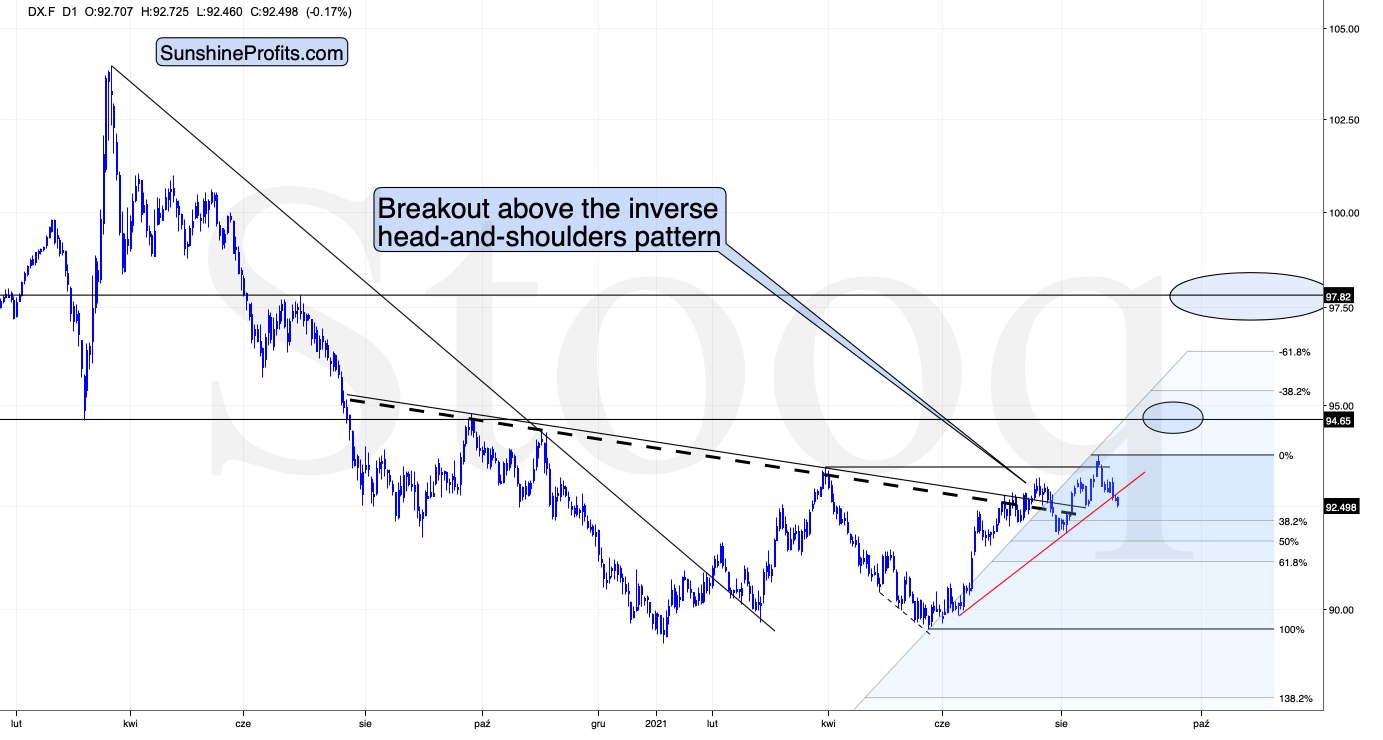

What happened in today’s pre-market trading might make you think that the move higher in the PMs could actually have legs. That’s because the USD Index moved lower.

The USDX not only moved lower, but it even managed to break below the rising red support line. But does it change much?

- I previously wrote that the USDX could fall to about 92.5, and it wouldn’t change much.

- The previous short-term lows were touched but not broken.

- The 38.2% Fibonacci retracement level based on the most recent upswing is close but hasn’t been reached yet. This level (based on a smaller rally) stopped the previous decline in the USD Index and triggered a huge slide in gold, silver, and mining stocks.

In other words, it doesn’t change much for the outlook for the USDX, it might simply delay the rally for several days.

And it changes even less for gold.

Please note that the yellow metal didn’t move to new highs, even though the USDX moved to new very short-term lows. So, gold is not really willing to react to the USD’s weakness. This means that even if the latter declines a bit, it won’t change much (if anything) for the price of gold.

Gold formed a local top at its previous triangle-vertex-based reversal, and it seems that it also formed a top this week at its current triangle-vertex-based reversal.

U.S. Labor Day Cyclicality

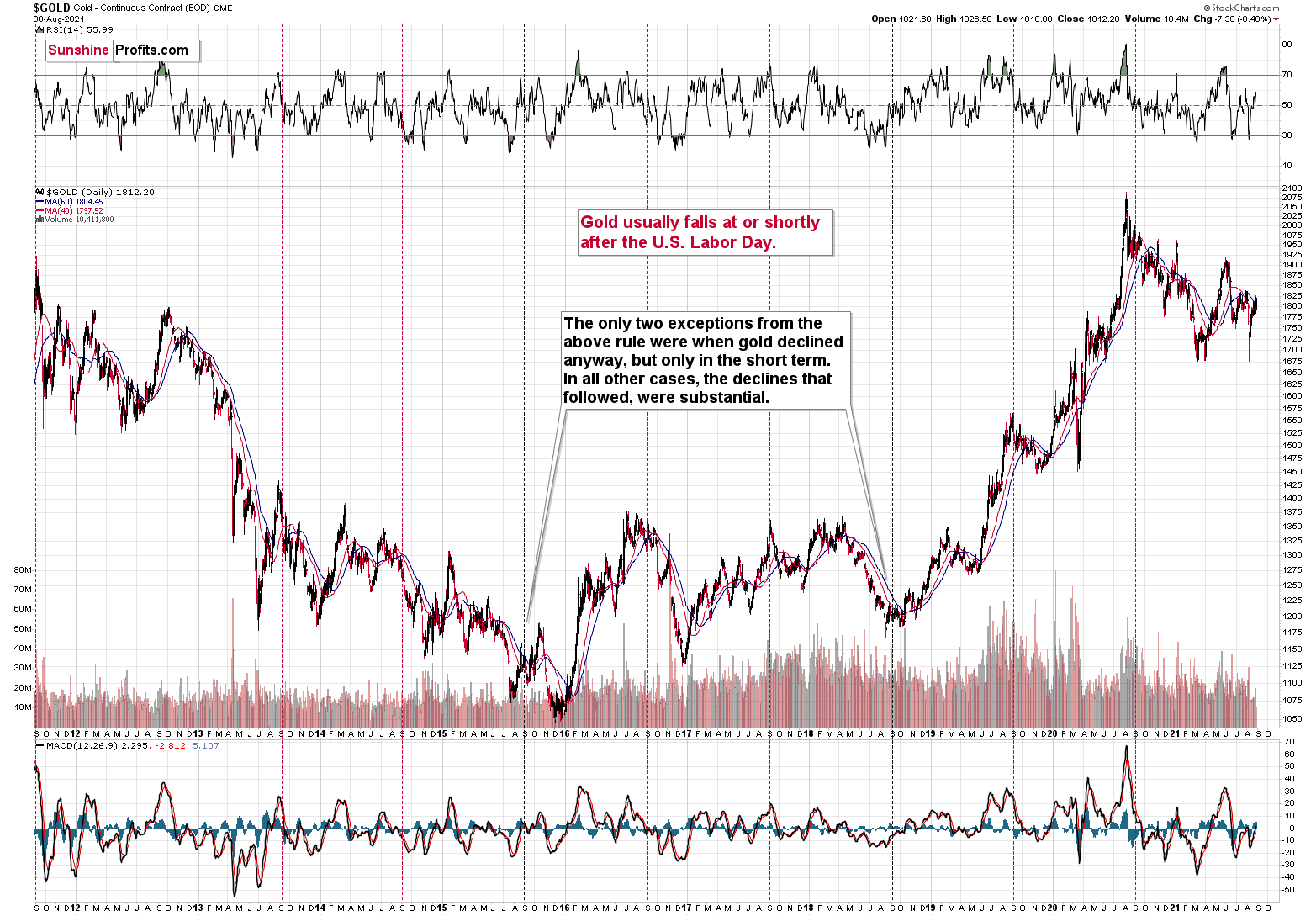

Moreover, please note that we’re just one week away from the U.S. Labor Day, which is much more important for the gold market than it seems at first glance.

In the previous 10 years, gold almost always declined profoundly right after the U.S. Labor Day — I marked that on the above chart with red, dashed lines. There were only two cases (in 2015 and in 2018) when gold didn’t slide profoundly after that day, but… it was when gold was declining in the short term anyway. There was simply no major downswing later.

This is very important, as it tells us that even if gold doesn’t decline for a week from now, it will be very likely to do so based on this surprisingly accurate cyclicality.

All in all, the outlook for the precious metals sector remains very bearish for the following weeks, even though we might need to wait a few extra days for the big declines to follow.

Disclaimer: All essays, research and information found on the Website represent the analyses and opinions of Mr. Radomski and Sunshine Profits' associates only. As such, it may prove wrong ...

more

You talk a lot about head and shoulders. But you are missing the double bottom at the pre covid highs as strong support, maybe if the broader market corrects 10% miner equities would follow but miner bears are playing with fire down here after a years long consolidation.