Falling Real Yields Suggest Gold Price Will Continue To Rise

Rising economic and political uncertainty has boosted everyone’s favorite precious metal in 2020. An ounce of gold was priced at just over $1,781 on Thursday (June 29), the highest since 2012, based on the continuous contract reported by Stockscharts.com. Year to date, gold is up 17% vs. a 5.5% loss for US stocks (S&P 500 Index).

By some accounts, the recent bull run has more room to run. “We are still in the early stage of this next bull market, which is probably going to be the most violent and in percentage terms biggest bull market since it began in 1999-2000,” predicts Thomas Puppendahl of Chancery Asset Management.

Regardless of where gold’s price is headed, for many investors considering the metal an age-old question bedevils: what drives the metal’s price?

There is no shortage of answers, ranging from inflation/deflation expectations to rise and fall of political and economic turmoil to shifts in central bank purchases and sales, to name a few possibilities on the short list. Perhaps the leading factor is the real (inflation-adjusted) yield.

“While many factors influence the price of gold, PIMCO believes there is one that can explain the majority of changes in gold prices over the past several years: changes in real yields,” the bond shop advised several years ago.

Suisse Gold, a bullion dealer, explains the relationship:

When real yields go down gold goes up, and when real yields go up, gold goes down. This correlation explains why inflation is gold’s best friend while rate hikes are its worst enemy.

When interest rates increase, real yields also increase because higher rates defray inflation. On top of this, higher rates tend to enhance the value of the Dollar by making it a higher yielding asset. Both of these things are bad for gold.

A practical advantage of looking at real yields for insight into the gold market starts with the fact that this data, as with gold’s pricing, is available in real time on a daily and intra-daily basis. Crunching the numbers reveals that gold and real yields are closely correlated, particularly in recent years.

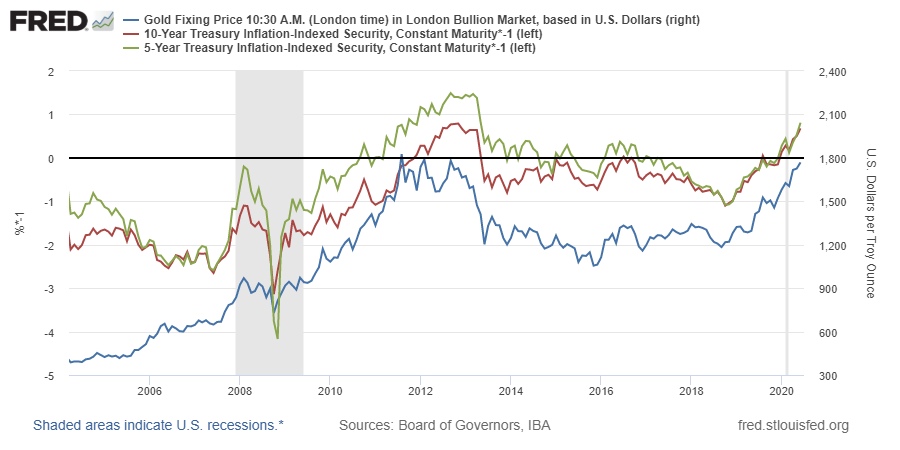

Consider how the metal’s price compares with two real-yield proxies: current yield on 5- and 10-year inflation-indexed Treasuries (TIPS). The chart below suggests that the inverted TIPS’ yields and gold’s price are tightly linked.

(Click on image to enlarge)

The correlation has strengthened recently. Based on rolling 10-day changes, gold and the 10-year TIPS yield posted a 0.75 correlation for the year so far. That’s up from 2019’s 0.59 correlation. (A correlation of 1.0 indicates a perfect positive corrlation; zero indicates no correlation.)

Part of reason (perhaps the leading reason) that the correlation is rising for gold and real yields: interest rates and inflation have declined in the wake of the coronavirus crisis. In turn, the latest disinflation wave has been a bullish shift for gold.

It hasn’t been lost on the gold market that the Federal Reserve is expecting to keep interest rates low and monetary supply unusually flush for the foreseeable future. After cutting rates to near zero and buying (or committing to buy) trillions of dollars of bonds, the central bank has made it clear that ultra-dovish policy is here to stay for an extended period.

“Output and employment remain far below their pre-pandemic levels,” Federal Reserve Chairman Jerome Powell says in remarks released ahead of his testimony in Congress today (June 30). “The path forward for the economy is extraordinarily uncertain and will depend in large part on our success in containing the virus.” He adds: “A full recovery is unlikely until people are confident that it is safe to reengage in a broad range of activities.”

The 5-year TIPS yield has been negative for much of the year so far and in recent weeks has been sliding deeper into the red. On Monday, June 29, the 5-year real yield dipped to -0.86% — the lowest since 2013.

This trend looks like manna from heaven for gold, given the historical record vis-a-vis real yields. The future’s still uncertain, of course, perhaps more so than usual. But for the moment, the downside pressure on real yields doesn’t appear set to ease, which suggests that it’s premature to predict the end of gold’s upside momentum.

Disclosure: None.