Everything You Need To Know About Gold Stocks

Image Source: Unsplash

After the introduction of Gold and Silver ETFs and a 13-year secular bear market, everyone knows gold miners suck. Just ask Hugh Hendry.

But the truth is far more nuanced.

Here is almost everything you need to know, divided into a list.

1) Gold Stocks are Options on the Gold Price

The introduction of the first Gold ETF (GLD) in 2004 and the first Silver ETF (SLV) in 2006 relegated miners to options on Gold. Before 2004, investors and portfolio managers could only gain exposure to gold or silver through mining companies.

As a result, miners were more widely owned and traded at higher valuations in the last century. Now, the opposite is true. Miners have taken a backseat to ETFs and trade like options on Gold.

2) Gold Stocks Outperform Gold During Gold Breakouts and Crash Rebounds

Gold Stocks outperform Gold when Gold makes strong trending moves because that is when mining margins quickly accelerate. This occurs during and after major gold price breakouts and significant rebounds, such as immediately after gold price lows in October 2008 and March 2020.

3) Gold Stocks Outperform During Gold Cyclical Bulls

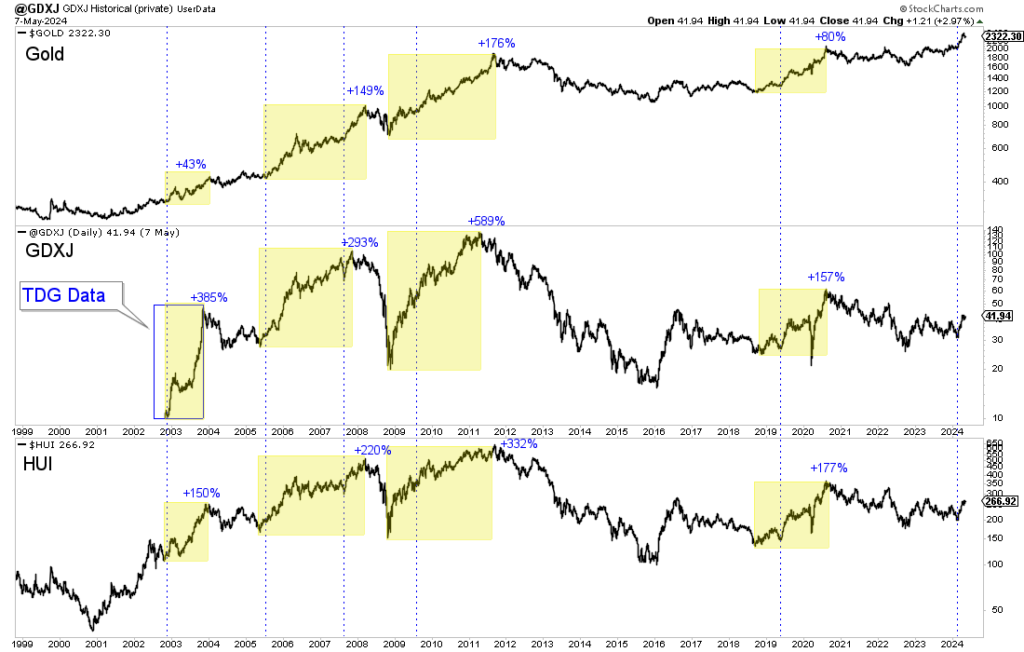

Cyclical bulls in Gold tend to last around three years and usually include a breakout in the Gold price.

The August 2018 to August 2020 cyclical bull market in Gold included the breakout through $1375 in July 2019.

The October 2008 to April 2011 cyclical bull market in Gold included the breakout through $1000 in September 2009.

The 2004 to 2007 cyclical bull market included the hugely significant breakout in the autumn of 2005 in which Gold advanced through $500/oz for the first time in decades.

The chart below plots Gold, GDXJ, and the HUI. The yellow highlights cyclical bull markets, and the vertical lines mark Gold price breakouts.

4) Gold Stock Bear Markets are Brutal

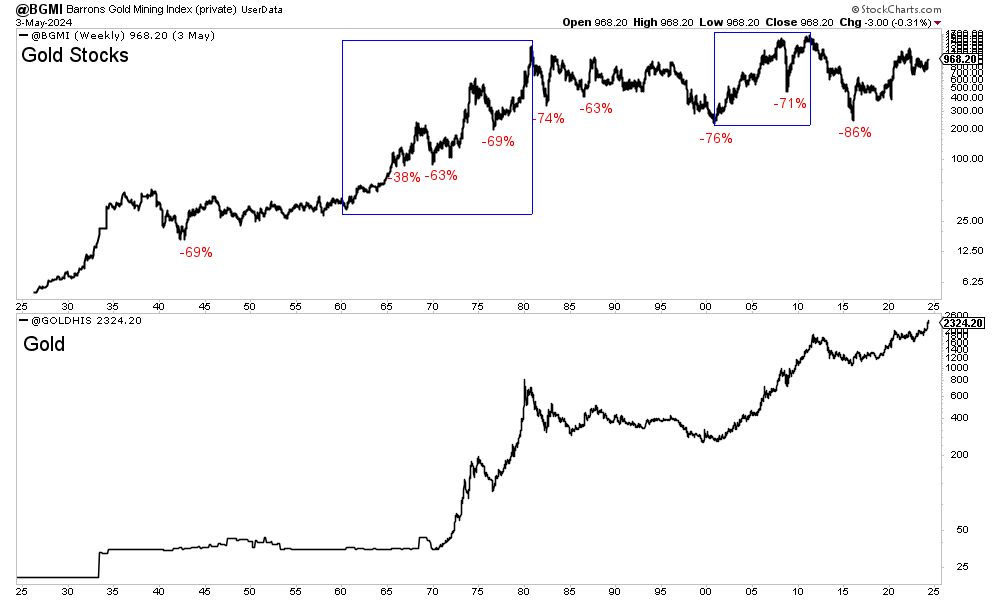

Look at the Barron’s Gold Mining Index chart going back 100 years. I have annotated the bear market declines.

The Barron’s Gold Mining Index gained roughly 40-fold from 1960 to 1980 but endured declines of 63% and 69%.

The 2000 to 2011 secular bear market included a crash during the Global Financial Crisis.

Gold Stocks could skyrocket over the next few years, but there is a good chance of a severe bear market before 2030.

5) Gold Outperforms Gold Stocks Over Very Long Periods

Gold Stocks should outperform Gold over the duration of a secular bull market. But once you look at 15-year periods and beyond, Gold is a far better option.

6) The Inflation-Adjusted Gold Price is the Best Indicator for Gold Stocks

The chart below plots the Barron’s Gold Mining Index and the Inflation-Adjusted Gold price.

The inflation-adjusted gold price (gold against the CPI) is a great indicator of gold miner margins. Gold stocks follow margins, not the Gold price.

Today, the market is two months into Gold’s breakout from its 13-year cup and handle pattern. Even as Gold and Silver correct, the miners show relative strength and hint at what will come.

If the current cyclical bull in Gold lasts another three years, I would expect miners to outperform Gold for another 18 to 24 months.

This is the sweet spot for miners. The outperformance from junior gold and silver stocks is just starting.

More By This Author:

Gold Will Go Higher Then Even HigherGold & Silver Correction Continues

The Most Important Gold Chart In 2024

Disclosure: None