'Everything Is Halted': Shanghai Shutdowns Are Worsening Shortages

China's Lockdown

Shanghai shutdowns due to the COVID lockdown are worsening supply shortages globally. The shortages will probably contribute to even higher inflation. Such shortages are affecting the energy markets, zinc, palladium, metals, and the grains. We have a short squeeze, which means prices are getting caught with short supplies while demand is higher than the supply can meet. Demand does not appear to have waned in any way.

Food Crisis (Washington Post)

The US economy is recalibrating to the reality of what has happened since 2020 when the Fed started running the printing presses full tilt. We are starting to see that recalibration in prices rising across the board. The fundamentals are very bullish for gold, silver, the grains and almost all the commodities.

Ukraine Exports Threatened

The conflict in Ukraine is straining the global food supply. Food prices are soaring. Global food prices are up more than 20 percent since 12 months ago. We are just coming out of the pandemic, which significantly affected prices. Now the war in Ukraine is pushing up prices. The UN warned that we may be looking at a global food crisis not seen since World War II. The total caloric value of food exports from Russia and Ukraine are about 12 percent of the world's caloric intake. If Ukraine can't plant now in the midst of a war, they will have far less to harvest at the end of the growing season.

Russia and Ukraine are huge agricultural producers. In 2021, Russia exported $37.3 billion of agricultural products. Ukraine exported more than $27 billion.

They are a breadbasket of the world for corn (about 25% of exports in the world) and sunflower oil (74% of world exports). Ukraine has banned exports of several grains, sugar, meat, and other food. In March, Ukrainian food exports fell four times less compared to February. The Ukrainian access to seaports is also threatened or cut-off by the Russian invasion. In the midst of war, Ukraine is facing diesel shortages and since most men are in the military now, there are far fewer people to plant and harvest.

Fertilizer prices are also rising quickly. Ammonia, nitrogen, nitrates, phosphates, potash, and sulfates are up about 30 percent since the start of 2022. Russia and Belarus are big exporters of fertilizers, and with sanctions against Russia, those exports have dropped sharply. Natural gas prices are also much higher, and it is used as a feedstock for nitrogen-based fertilizers. If we produce less fertilizer, then less is used and yields are less, which could affect global food supplies.

Global warming and supply change issues had made global food supplies tight even before the war in Ukraine. North America had a drought that affected the wheat crop. Soybeans in Brazil were hurt by a drought, too.

We could face shortages of physical gold and silver. We are seeking to build long term positions in gold, silver, and other precious metals. Demand for gold and silver is probably the lowest in the United States. In China, people are urged to buy gold and precious metals on a monthly basis. Gold and silver is becoming more of a topic of conversation as fiat currencies continue to lose value and integrity.

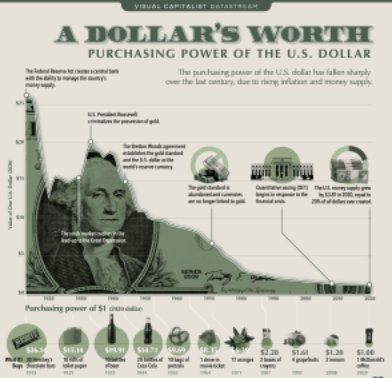

Will The U.S. Dollar Survive?

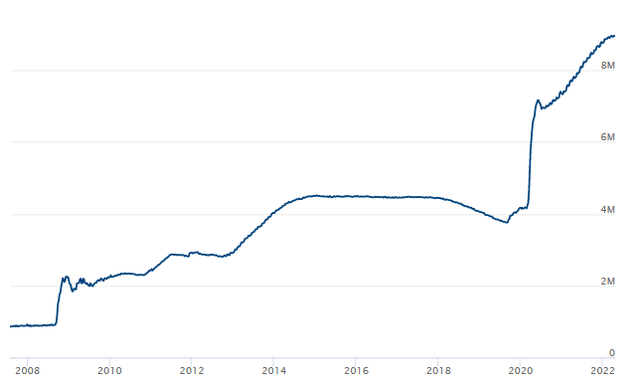

"The integrity of the US dollar is being jeopardized by the huge amount of stimulus the Fed has put into the market in the form of US dollars," Equity Management Academy, Patrick MontesDeOca said. "The Fed's balance sheet is about $9 trillion, which will have to be taken out of the market when they talk about tapering."

US Dollar (Visual Capitalist)

To taper from $9 trillion to a normal level is going to be an immense challenge. Under it all, inflation is pressing on the economy. By taking money out of the system, liquidity will decrease, and we could have another credit crunch as we had in 2008.

Balance Sheet (Federal Reserve)

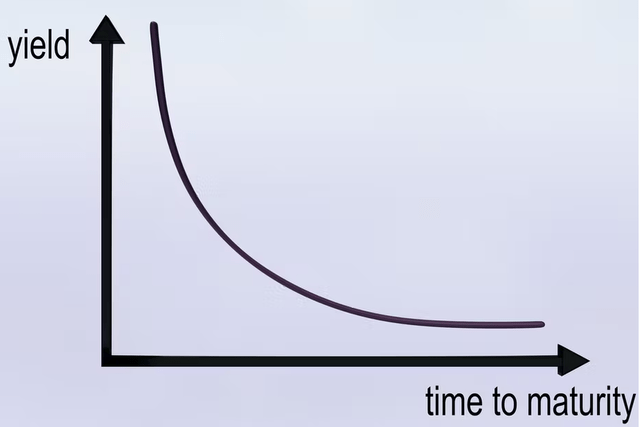

Yield Curve Inversion

The Ten-Year Note is at 2.77 or so. Even if the rates go up to 3.5 or 4 percent, which is getting into danger territory, there is still a negative yield of about 5 percent compared to inflation according to government figures. Either inflation has to come down or interest rates have to rise, or some combination of both. If interest rates go up, the entire leveraged system could collapse. The economy is highly leveraged. Real estate, land, and other assets are inflated in price as the dollar becomes less. The price of assets increases, but investors do not gain much if anything, because the dollars the assets are valued in are worth far less.

Yield Curve (theconversation.com)

The short-term rates are up substantially in the last couple of years, so the market is doing what the Fed has not. The 10-Year Note was at .33 percent in 2020 but is now at around 3 percent-a phenomenal move for interest rates in a short time. The Fed got behind the curve and the market is dictating where interest rates should go. The Five-Year Note is close to being inverted at 2.767, which means it is higher than the 10-Year Note. That relationship indicates potentially that we could see a recession.

"It is a very dangerous relationship," MontesDeOca said, "because money is going into the short-term bills from the long-term bonds proving liquidity, which is usually the first sign of a recession."

In a recession, holding gold and silver is an excellent hedge against inflation and higher interest rates.

Gold Summary

- The weekly trend momentum of 1947 is bearish.

- The weekly VCPMI of 1973 is bearish price momentum.

- A close above 1973 stop, negates this bearishness neutral.

- If short, take profits 1862 - 1873.

The trend momentum was bearish coming into this week

Gold completed the downside objective of 1873, anticipated early in the week with the market closing below the mean or standard deviation level of 1973.

The reversion from this low re-activated the weekly mean target of 1973 again. A close above it will change the bearish price momentum to bullish with the weekly target of 2053.

To learn more about how the VC PMI works and receive weekly reports on the E-mini, gold, and silver, check us out on Ticker ...

more