‘Everything Bubble’ And The Brewing Storm: Navigating The Bubble Burst

Image Source: Pixabay

Summary

- The global market is potentially at the precipice of a significant downturn due to an ‘Everything Bubble’, encompassing not just equities but also housing, bonds, and other asset classes.

- Overlaying this imminent crisis are two secular challenges: climate change and the end of cheap resources. These factors, combined with demographic shifts, are creating huge challenges.

- This won’t be a straight line for investors, and the playbook might not be obvious.

The cyclical dance of boom and bust has long been choreographed by central banks, an orchestration tracing back to the close of the Volcker era. It is with a sense of prophetic inevitability that we entered into a new phase of this cycle – the bubble burst – last year. With the specter of banking anxieties hovering ominously in the backdrop, markets are bracing for a period of volatility and turbulence.

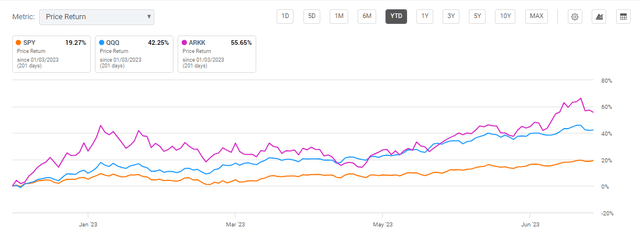

Historical glimpses into market bubbles, notably those in 1929, 1972, 2000, 2006, 2021, and Japan’s colossal misstep in 1989, reveal a pattern of common precursors: robust economic growth, heightened investor confidence, leveraging gone amok, and the malignant influence of fraudulent activities. The bubble we now find ourselves in has burst, and we’re observing the swift unraveling of the most speculative stocks. This divergence between speculative and blue-chip stocks is not just symptomatic but indicative of the bubble’s burst.

(Click on image to enlarge)

Today’s economic landscape is marred by high levels of debt, a powder keg waiting to explode with each incremental increase in interest rates. It’s not just equities that teeter precariously on the brink of a bubble. The housing market, bonds, and other asset classes are all ensnared in the tendrils of what has come to be known as the “Everything Bubble.” A simultaneous bubble across multiple asset classes amplifies the risk, a danger not unfamiliar to those who recall Japan’s historic bubble implosion.

Scarce Resources

Overlaying these immediate concerns are two secular challenges: climate change and the looming end of cheap resources. Each has the potential to detrimentally impact economies, lowering GDP and stoking inflationary fires. Resource scarcity will drive up costs, particularly for energy and raw materials. This, in turn, gives the illusion of GDP growth, but it’s a mirage caused by the increased expenditure for procuring the same quantum of resources.

The demographic shifts currently unfolding worldwide will also leave a profound imprint on the economy. In the developed world, including China, we’re observing a population deceleration, which threatens to deplete the workforce in the coming decades. Contrarily, Africa is experiencing a population boom that could strain societal stability due to inadequate agricultural resources, governance challenges, and escalating climate change issues.

The world is also experiencing a period of deglobalization, an inherently inefficient state, fostering inflationary pressure. This combined with labor scarcity could have far-reaching economic consequences. In America, capitalism is grappling with issues like monopolistic practices, dwindling capital expenditure, stagnant wage growth, and profit margins inflated by a culture of under-investment and share buybacks. These are the intersecting strands of the complex web we find ourselves in.

The stagnation of wage growth for average American workers since 1975, juxtaposed with significant wage hikes in France and the UK, highlights a significant issue. The wealth generated by GDP growth has predominantly trickled upward, leaving the average worker marooned.

Investor Action

Navigating this maze requires a keen investment approach that embraces potential recession. The focus should be on long-term secular growth stories and potential scarcities that rise above the business cycle. One should consider pivoting towards resources, climate change, and innovation-related investments. Nevertheless, this won’t be a straight lineup, and moving away from currently expensive U.S. equities (SPY) might be necessary in the short term.

Gold (GLD) and Bitcoin (BITCOMP) hold promise in anticipation of a prolonged economic downturn and bear market, a scenario some label as the “Economic Reckoning“. Intriguingly, while historical data suggests a negative correlation between inflation and the PE ratio, the recent inflation upswing hasn’t triggered the anticipated response in the PE ratio, creating an unexpected divergence.

In our macroeconomic narrative woven so far, we’ve posited that the market is inevitably heading toward a decline. This descent, though seemingly sidestepped through the orchestration of banking crisis responses and successive liquidity injections, remains a formidable concern. The market’s Pavlovian response to the impending recession – anticipating and relying on liquidity influxes – may be nothing more than a stop-gap measure. When the reality of a slackening economy and shrinking profit margins eventually hits home, we suspect bonds will emerge as the unlikely bastion of refuge.

However, there’s a fascinating twist in this narrative. Following the initial shock of solvency-led asset offloading, the high-quality assets are expected to bounce back, climbing upwards as the clarity of monetary tool debasement comes to light. At this juncture, re-evaluating U.S. equities could well be the prudent move, especially growth stocks like Ark (ARKK) in a starved-for-growth world.

This narrative, while robustly structured, is not devoid of risks. Consider the problem of wage stagnation we’ve discussed earlier. A possible solution to this quandary involves decoupling from China, potentially allowing inflation to run considerably hotter for an extended period. The implications of such a course of action could trigger substantial devaluation in bonds or even cause the dollar to lose significant value against other currencies.

In this hypothetical scenario, the conventional wisdom of bonds as safe havens and an expected downturn in stocks could be upended. I understand the contradiction inherent in this proposition, but it’s vital to recognize that the current financial system is under such tremendous strain that we must question and reevaluate even the most enduring assumptions.

While I personally lean towards the scenario I initially outlined, it’s crucial to stay vigilant and receptive to all possibilities.

More By This Author:

Banking Blunders, Fed Follies, And The Bitcoin Beacon: An Alternative Path For Investors

Crypto Blunders: SEC Showdown And The UK’s Rise

Navigating The Market In Tough Times: Why Crypto And Stocks Will Behave Differently

Disclaimer: This text expresses the views of the author as of the date indicated and such views are subject to change without notice. The author has no duty or obligation to update the ...

more

Great read, highly recommended.