Every Gold Investor Needs To See This

In yesterday’s article I noted that while stocks are clearly forming a top, there are, as of right now, ZERO signs that it is THE top.

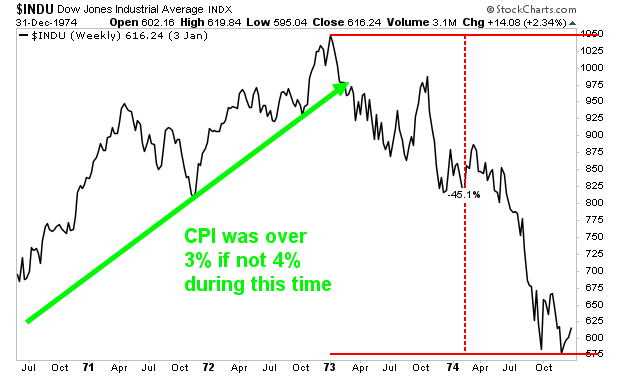

Remember, the fact that inflation is running hot doesn’t mean stocks have to crash right now. During the last major bout of hot inflation in the 1970s, stocks roared higher for two years before they finally came crashing down. Throughout that time, the Consumer Price Index (CPI) was clocking in over 3% if not 4%.

So, the fact CPI just hit 3% doesn’t mean stocks have to crash right here and now. And as we’ve assessed over the previous two days, unless the S&P 500 breaks below 4,000 on a monthly basis, things are risk-on.

But what about gold? What can we expect of it as inflation gets hotter and hotter?

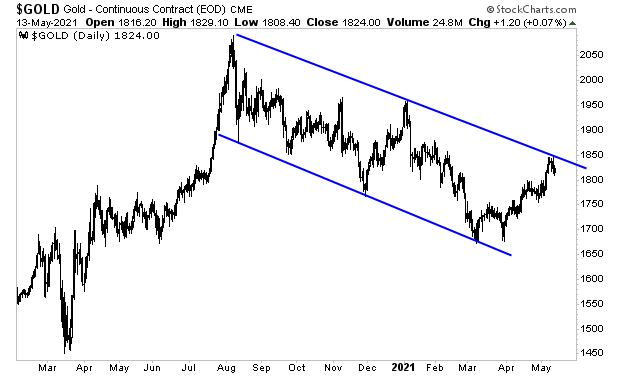

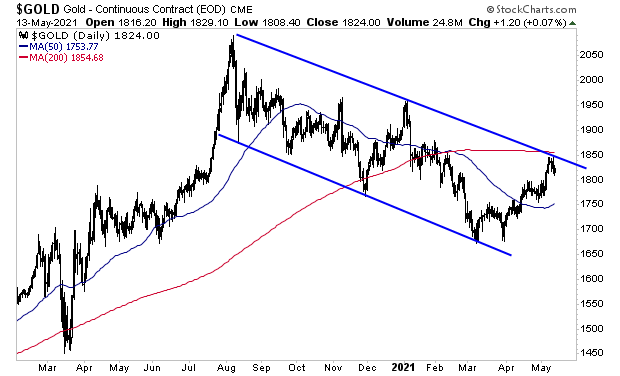

The precious metal has been forming a clear bull flag over the last nine months. As I write this, gold has just completed its third test of the top trendline.

This coincides with the 200-day moving average (DMA and red line) so gold faces a major challenge here. But with the 50-DMA turning up (blue line) momentum is building.

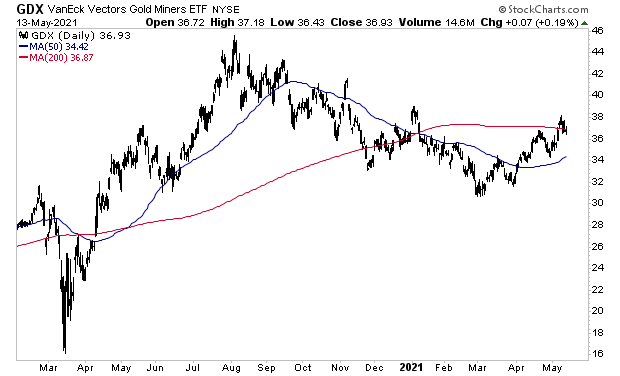

During bull runs, gold miners typically lead bullion and the gold miner ETF (GDX), has already broken above its 200-DMA.

If gold can follow, the upside for this breakout of the bull flag is an incredible 65 on GDX and $2450 on gold.

For more market insights and investment ideas, swing by our FREE daily e-letter at www.gainspainscapital.com.