Even Through Geopolitical Smoke, Gold’s Medium-Term Seems Clear

So, Russia withdrew some of its troops, but in reality, it might have not done so. One source says one thing, the other says something different. It doesn’t matter that much, because regardless of whether the troops have moved away from the border with Ukraine or not, it’s likely to happen anyway. Whatever we are seeing and reading now is probably smoke and mirrors. It’s unclear to me what the purpose is, as there are quite a few candidates.

Perhaps Biden is seeing his support wane and wants to be “the successful man of action, defender of Ukraine” – knowing that there was no real threat (come on, the reports that he gets from the U.S. intelligence might be something completely different than what is presented to the public), it’s very easy to claim “success”. Almost as easy as if someone introduced vaccines to an illness when the population was generally achieving group immunity, even though it was not apparent based on official statistics (I’m not referring to any specific illness or vaccines here; perhaps something like that happened recently, perhaps it didn’t; we won’t get official documentation for decades, probably…). This seems the most likely reason, in my view, but there could be others, connected with market manipulation.

It’s rather obvious that with the Ukraine-Russia war looming and WW3-possibility anxiety, gold and oil would soar. Those who knew in advance that the tensions would get so much attention could have easily positioned themselves in those markets. Knowing when the tensions subside (aren’t all the reports that get the spotlight coming from the U.S.? Or almost all of them?) presents another opportunity. If you had huge long positions in both of the above (and nice profits, in particular in the case of crude oil), and wanted to exit them without triggering a sharp slide, you could easily do so provided there was strong, “reasonable” buying power, ideally in the investment public, so spread across multiple buyers. All that’s needed for this to work is a good reason for an investment the public would like to buy. That’s where the supposed invasion scenario fits in.

What about today’s rally in gold, along with the extra narrative about Putin not retreating his forces?

It’s quite a nice (by that I mean “effective”) way for U.S. intelligence to save face after a failed prediction of an invasion that just didn’t happen yesterday. Providing a deadline works if one wants to create a sense of urgency and trigger action – and it worked. We’re probably seeing the “milking the very last of this opportunity” now. There’s a limited number of things (that would work) that can now be done in order to keep people scared of the conflict if it’s simply not happening and things are getting back to normal. What we’re seeing now are likely the final attempts to both: get the most of the situation, and provide a public relations cover-up so that it all doesn’t look like market/public manipulation.

I may be too skeptical about all this, but I’ve seen these kinds of techniques used so many times in many areas, mostly in marketing and sales, but also when analyzing history books (how the masses were manipulated and so on), that I really take them at their face value. Of course, it’s just my opinion, and I might be wrong. Also, I’m not saying that the U.S. is “the bad guy” here – I’m saying that politicians (from all countries) and various “groups of interest” might want to influence people, events, and narratives to fit their agendas, and it looks like something like that is taking place.

Let’s check what did the above change on the charts.

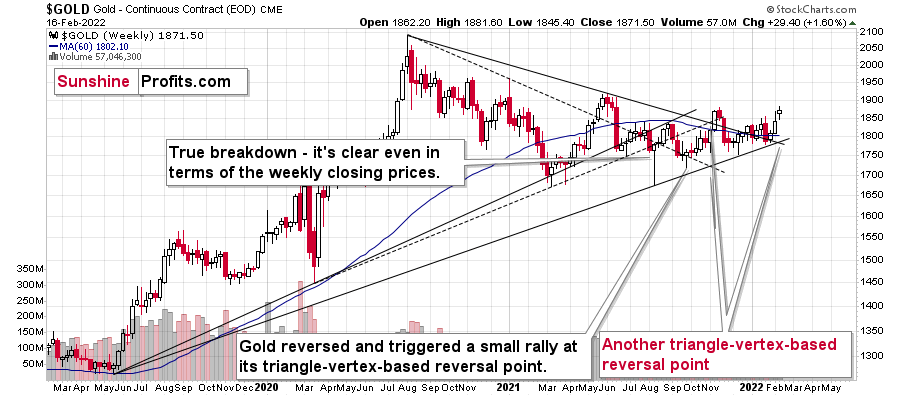

Gold’s weekly chart remains generally unchanged. Gold is visibly up this week, but since this rally is right at its important triangle-vertex-based reversal, its implications are bearish, not bullish.

Interestingly, the above information about the reversal was known in advance, just the exact direction was unclear. Well, it is clear now.

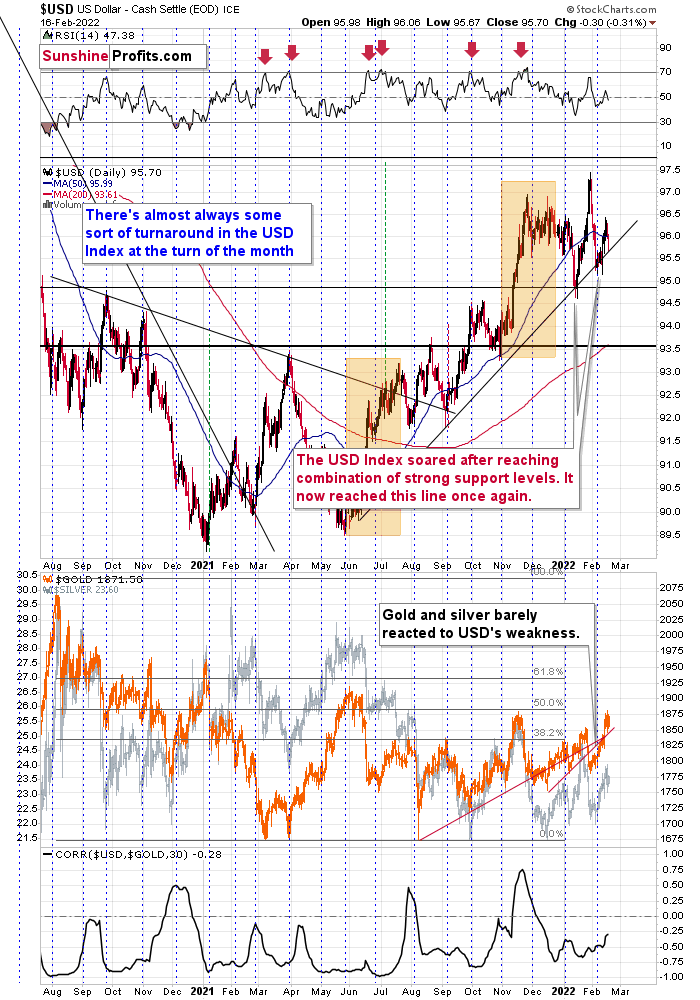

The USD Index is at its medium-term support line. All previous moves to / slightly below it were then followed by rallies, sometimes really big rallies, so we’re likely to see something like that once again.

Such a rally would be the prefect trigger for the triangle-vertex-based reversal in gold and the following slide.

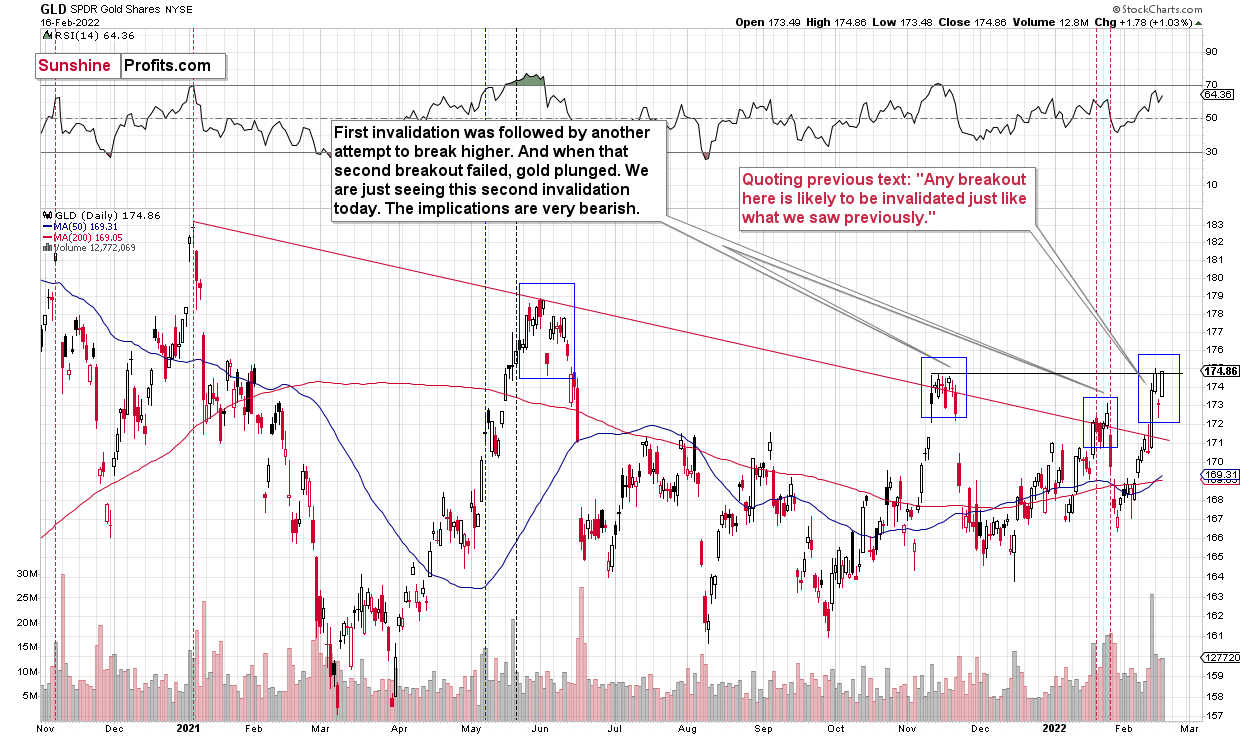

The short-term charts for GLD and GDX are not bullish either, despite the very short-term upswing.

Please note the blue rectangles. It’s common for gold to decline initially, then move back up, and start a massive slide only after the second top. Interestingly, sometimes the second short-term top is below the previous top (June 2021), sometimes it’s close to the previous top (November 2021), and sometimes it’s above the initial top (January 2022).

For now, we see the second top being formed at the level of the previous top, but given today’s pre-market upswing in gold (about $20), GLD is likely to move to new yearly highs before reversing and triggering another powerful slide, just like it happened previously.

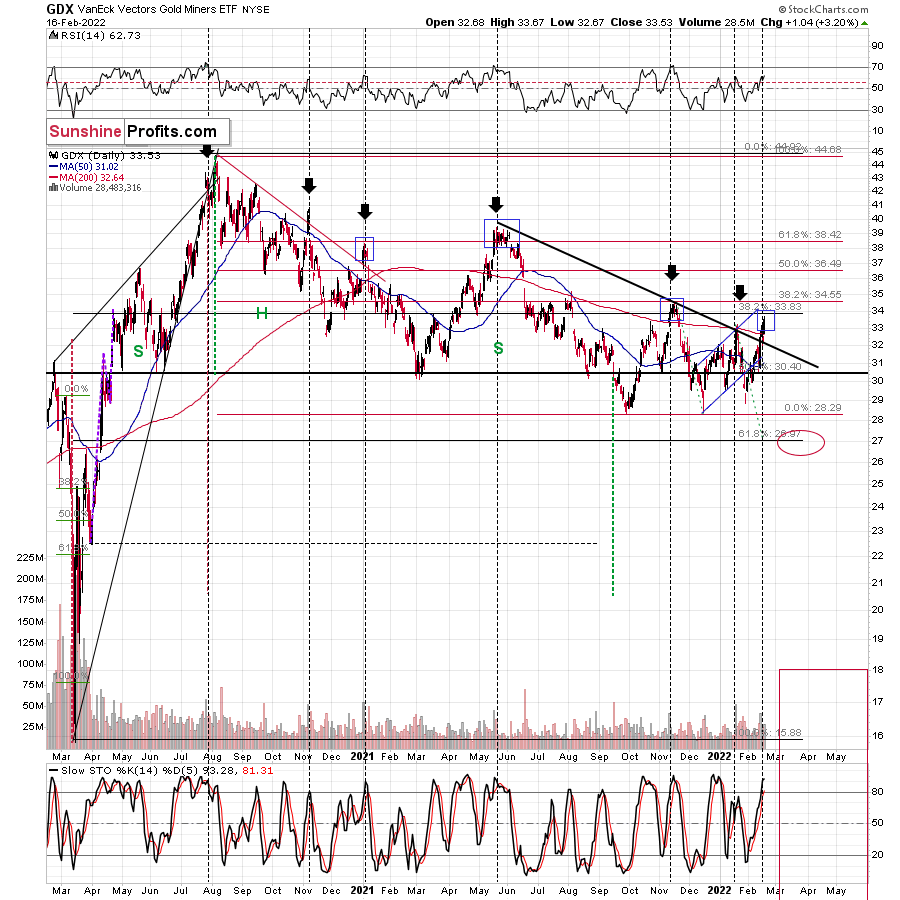

I marked similar situations in the GDX ETF as well, and I also used blue rectangles for them. Broad short-term tops are rather common.

Strong volume accompanied the early parts of the broader short-term tops that I marked. So, the big volume that we saw recently confirms the above.

Yes, the back-and-forth movement that we’ve been seeing is extremely discouraging and boring. No question about it. It’s more boring than the consolidation that we saw in 2013 as the price moves are narrower. However, as the sun always shines after a storm or cloudy days, a much bigger move will stem from this prolonged consolidation.

The bigger the base, the stronger the move.

This huge, boring back-and-forth trading is a giant base – likely for a giant move.

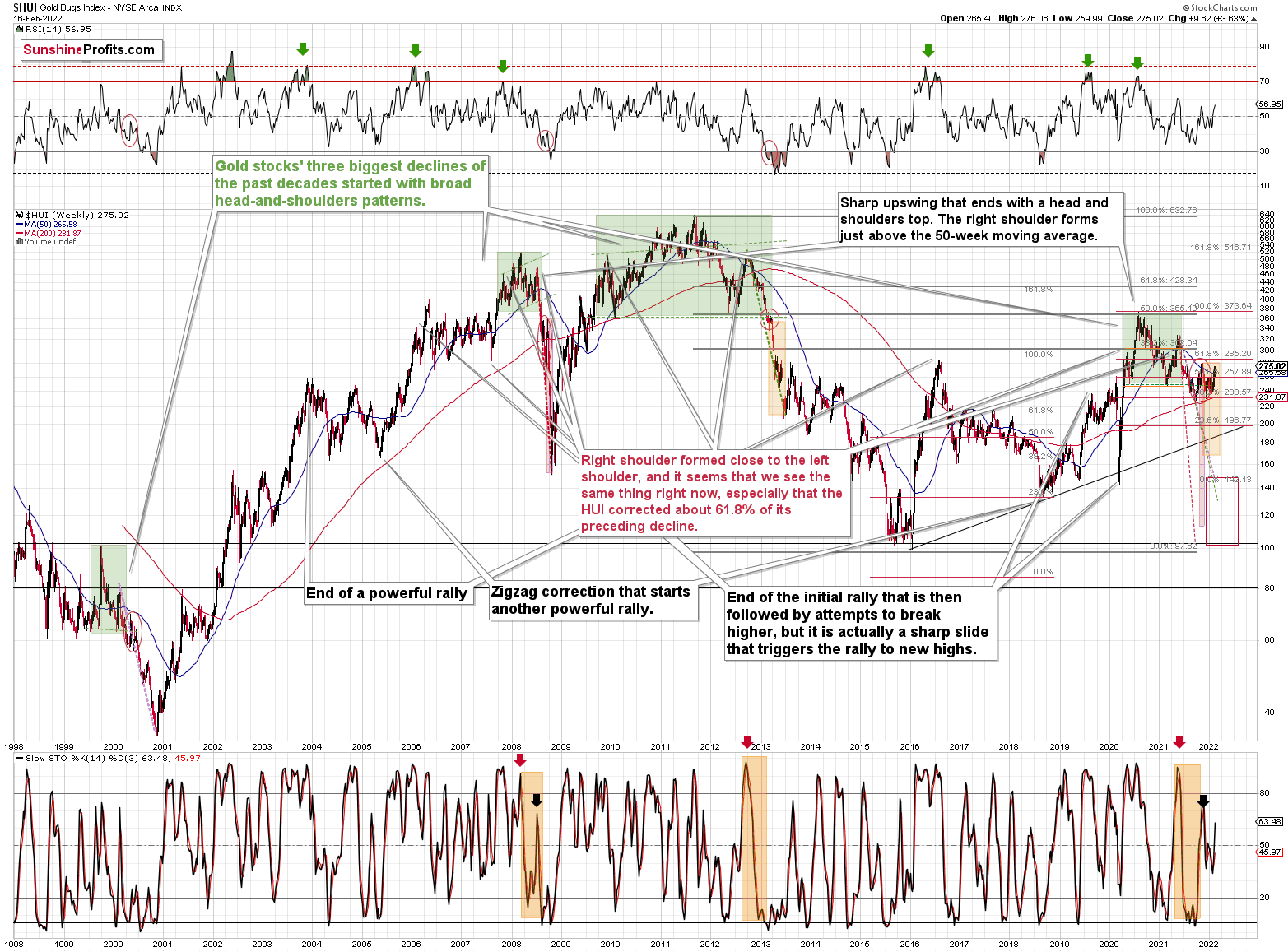

Based on the past patterns (history does rhyme, after all!), we’re about to see something huge. Namely, a profound decline is likely to follow patterns that are similar to what we saw in 2013, 2008, and – to a lesser extent – in 2000.

In my opinion, the wait will be well worth it – at least for those positioned to make the most of this upcoming slide (could be through a short position, but could also be through simply staying away from long positions and getting into them close to the bottom).

Disclaimer: All essays, research and information found on the Website represent the analyses and opinions of Mr. Radomski and Sunshine Profits' associates only. As such, it may prove wrong ...

more