Even The Stock Shopping Frenzy Didn’t Dethrone Resilient Dollar

After another (likely) short squeeze helped propel the S&P 500 higher on Dec. 21, silver and mining stocks benefited from the bulls’ enthusiasm. However, immense relative strength of the USD Index was hidden beneath the surface.

To explain, the frenzy on Dec. 21 was broad-based: the ARK Innovated ETF jumped by 3.84%, Tesla jumped by 4.29%, Uber rallied by 5.72%, and crude rallied by 3.66%. As a result, investors bought anything that had a ticker symbol – whether it was the bubble basket (ARK and Tesla) or the cyclicals that have been hurt by the Omicron variant (Uber and crude).

Despite that, though, the USD Index barely flinched. In the past, risk-on sentiment occurred at the U.S. dollar’s expense. Moreover, the euro, commodity, and EM currencies often caught a bid. However, with the greenback’s recent rally built on a solid fundamental foundation, the S&P 500’s surge couldn’t knock the dollar off of its lofty perch.

Please see below:

To explain, the green line above tracks the USD Index, while the red line tracks the S&P 500. If you analyze the intersections of the gray vertical lines, you can see that the S&P 500's daily surges (red line rises) often coincide with the USD Index's daily declines (green line falls).

Furthermore, while these short-term swings reversed once sentiment settled, it's essential to understand the importance of the then-and-now price action. To that point, if you analyze the right side of the chart, you can see that the USD Index completely ignored the S&P 500's rally on Dec. 21. As a result, the USD Index's relative strength signals that a renewed sense of confidence underpins the greenback.

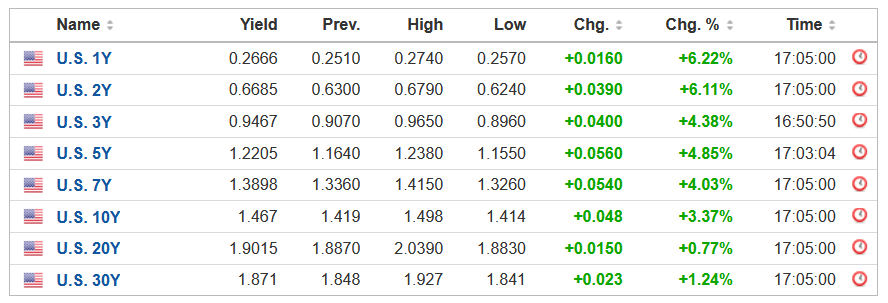

In addition, while gold was the only precious metal to notice on Dec. 21, U.S. Treasury yields awoke from their slumber. For context, the Omicron variant's negativity has helped depress U.S. interest rates. However, with the U.S. 10-Year Treasury yield rallying without the S&P 500 on Dec. 20 and with the S&P 500 on Dec. 21, a resumption of its uptrend is fundamentally bearish for the PMs.

Please see below:

Source: Investing.com

To that point, Bloomberg reported on Dec. 21 that the U.S. Food and Drug Administration (FDA) is preparing to green-light Pfizer and Merck's COVID-19 pills. The article claimed that "an announcement may come as early as Wednesday, according to three of the people [that] asked not to be identified ahead of the authorization and cautioned that the plan could change."

For context, Pfizer's pill showed an 89% reduction in hospitalization for patients who received the medicine within three days of developing symptoms. Thus, if the drugs are formally approved, they could provide additional medical ammunition to help fight the pandemic.

More importantly, though, with milder symptoms present in each new variant and more treatment options available for those who want them, each outbreak's economic impact should decelerate. As a result, consumer mobility and economic growth should improve in the coming months, placing upward pressure on U.S. interest rates.

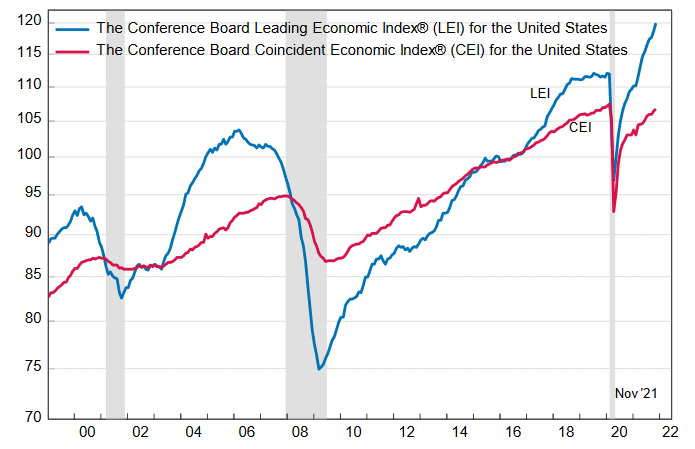

To that point, The Conference Board released its Leading Economic Index (LEI) on Dec. 21. After recording month-over-month (MoM) increases of 0.3% in September, 0.9% in October, and now, 1.1% in November, the U.S. economy remains on solid footing. The report revealed:

“The U.S. LEI rose sharply again in November, suggesting the current economic expansion will continue into the first half of 2022. Inflation and continuing supply chain disruptions, as well as a resurgence of COVID-19, pose risks to GDP growth in 2022. Still, the economic impact of these risks may be contained. The Conference Board forecasts real GDP growth to strengthen in Q4 2021 to about 6.5 percent (annualized rate), before moderating to a still healthy rate of 2.2 percent in Q1 2022.”

In addition, The Confidence Board revealed separately that they “forecast that the US economy will grow by 3.5 percent (year-over-year) in 2022 and 2.9 percent (year-over-year) in 2023.”

Please see below:

Source: The Confidence Board

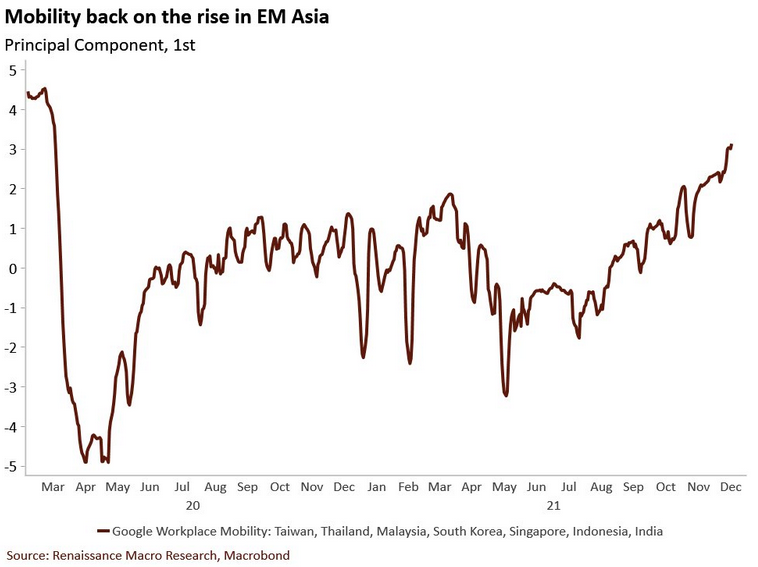

Also supporting the thesis, Asian countries have been hard-hit by coronavirus outbreaks, and for better or worse, regions often impose restrictions to reduce case counts. Moreover, when the Delta wave hit them before it reached the U.S., workplace mobility sank like a stone. However, with workplace mobility now on the rise, the development could uplift economic growth and alleviate some of the U.S. supply chain issues.

In a nutshell: the lower the economic impact of each coronavirus outbreak, the more pressure it puts on the Fed to tighten monetary policy. Thus, if Asia’s momentum is replicated in the U.S., the Fed’s foot should remain on the hawkish accelerator.

Please see below:

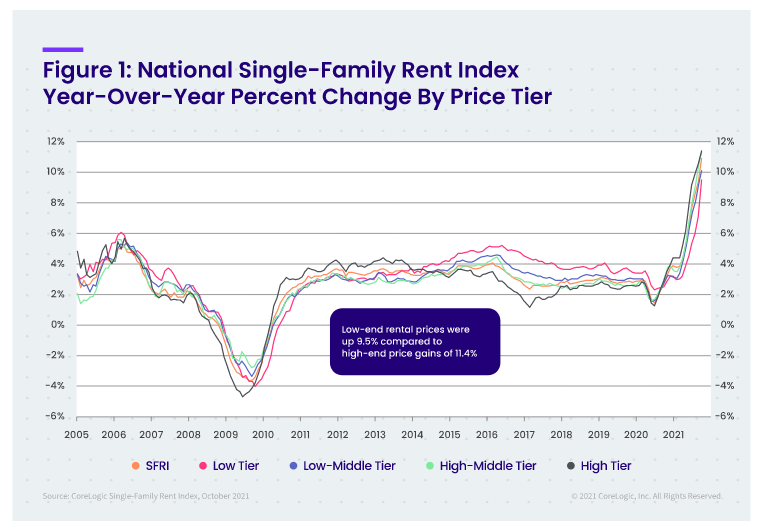

Speaking of a hawkish Fed, I’ve been warning for months that rent inflation would put upward pressure on the headline Consumer Price Index (CPI). With the Shelter CPI rising by 3.9% year-over-year (YoY) on Dec. 10 (a new 2021 high), the Fed’s inflationary margin for error is shrinking by the day.

To that point, CoreLogic released its Single-Family Rent Index (SFRI) on Dec. 21. After “U.S. single-family rent growth increased 10.9% in October 2021”, it marked “the fastest year-over-year increase in over 16 years.”

The report revealed:

- Lower-priced units: rent inflation was 9.5% in October 2021 versus 2.8% in October 2020.

- Lower-middle priced units: rent inflation was 10.1% in October 2021 versus 2.8% in October 2020.

- Higher-middle priced units: rent inflation was 11.3% in October 2021 versus 3% in October 2020.

- Higher-priced units: rent inflation was 11.4% in October 2021 versus 3.5% in October 2020.

Please see below:

For context, Molly Boesel, principal economist at CoreLogic, said:

“Single-family rent growth hit its sixth consecutive record high in October 2021, mirroring record price increases in the for-sale housing market. Rent growth in October 2020 had already recovered from pre-pandemic lows and rent growth this October was more than three times that of a year earlier.”

The bottom line? The USD Index continues to demonstrate immense resilience. With inflation running hot and U.S. economic growth poised to re-accelerate in the coming months, the Fed’s tightening cycle should continue to uplift the U.S. dollar. Moreover, with U.S. Treasury yields slowly creeping higher, interest rates should mirror the greenback’s ascent over the medium term. With this fundamental cocktail extremely bearish for the PMs, a realization should help push the GDXJ ETF to new lows.

In conclusion, the PMs were mixed on Dec. 21, and gold was the daily underperformer. While the S&P 500 helped uplift the GDXJ ETF (which is often the case), hyper-growth technology stocks are no fans of rising interest rates. As a result, if the Omicron variant fades and the U.S. economy records a solid recovery, the bullish economic outcome is profoundly bearish for the NASDAQ Composite, and to a lesser extent, the S&P 500. With the PMs often upended by similar fundamental developments, a re-acceleration of U.S. economic growth will likely sour their performances as well.

Disclaimer: All essays, research and information found on the Website represent the analyses and opinions of Mr. Radomski and Sunshine Profits' associates only. As such, it may prove wrong ...

more