Europe Paralyzed By First Inflationary Shock

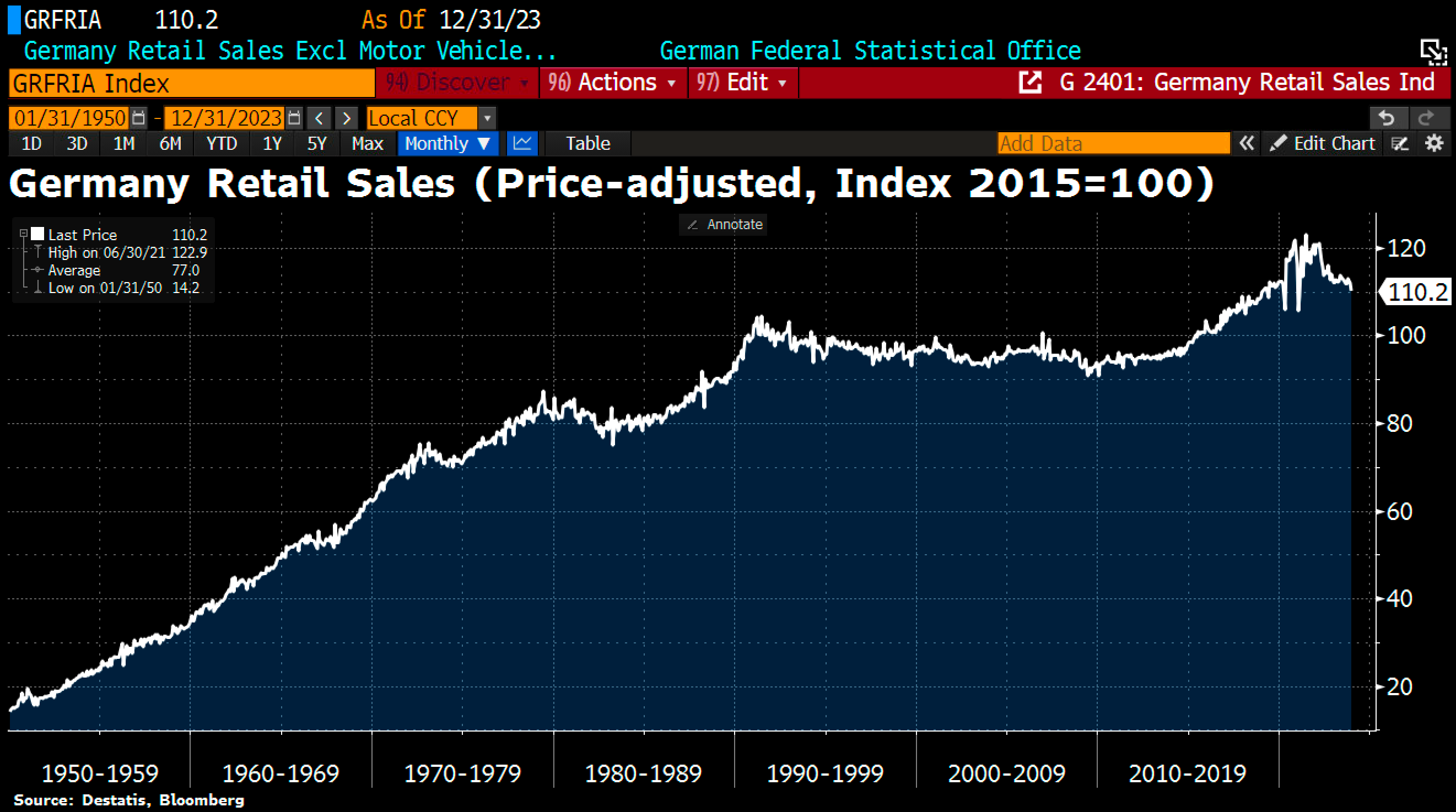

Since the reawakening of inflation, retail sales in Germany have been in free fall.

German purchases were down 4.4% year-on-year in December, marking a decline in Christmas sales compared to the previous year.

It seems that the resurgence of inflation has prompted German consumers to practically stop shopping:

(Click on image to enlarge)

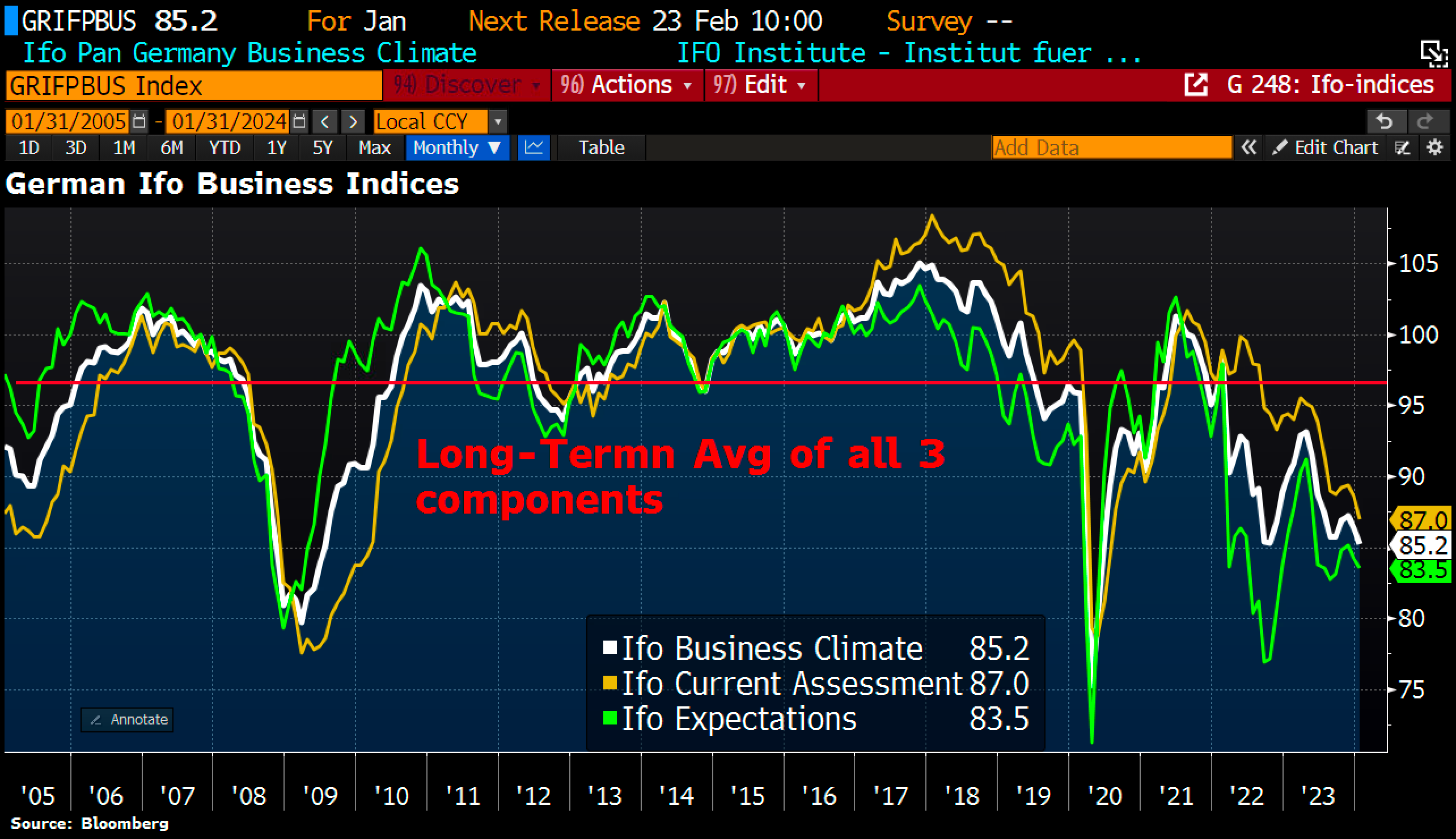

The country faces particularly fierce competition in Europe's retail sector, with some of the lowest profit margins. This reduction in consumption is having repercussions on the economy as a whole, as evidenced by the sharp drop in the IFO index measuring the business climate:

(Click on image to enlarge)

Recent rises in inflation have plunged the continent into an unprecedented stalemate: the farmers' protest movement is mainly attributable to the consequences of this general decline in purchasing power recorded in Europe over recent quarters. However, according to Brussels, one of the solutions to counter inflation also involves negotiating free-trade agreements to contain the rise in prices of agricultural raw materials. But these agreements are highly unfavorable to farmers, who have already seen their real wages plummet in 2022 and 2023. The anti-inflationary cure is worse than the disease! In the past, open borders were an effective recipe for containing price rises. However, now that inflation has woken up, this approach no longer works.

Supporters of these free-trade agreements argue that abandoning them would logically rekindle inflation. In their view, deglobalization would be inflationary, and refusing the free movement of agricultural raw materials would rekindle inflation.

But for farmers, increased competition from non-European agricultural products would have devastating consequences for European agriculture. Farmers are fighting for survival while Brussels is fighting inflation, which explains the current impasse.

If this stalemate persists, the decline in real wages is likely to continue in Europe.

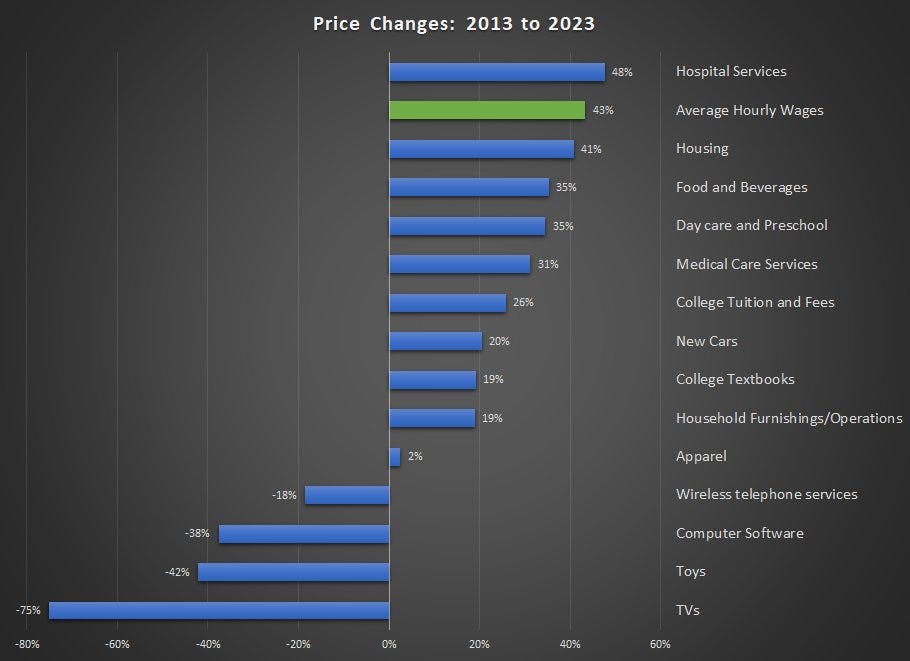

Over the same period, real wages in the United States have fallen, albeit less sharply.

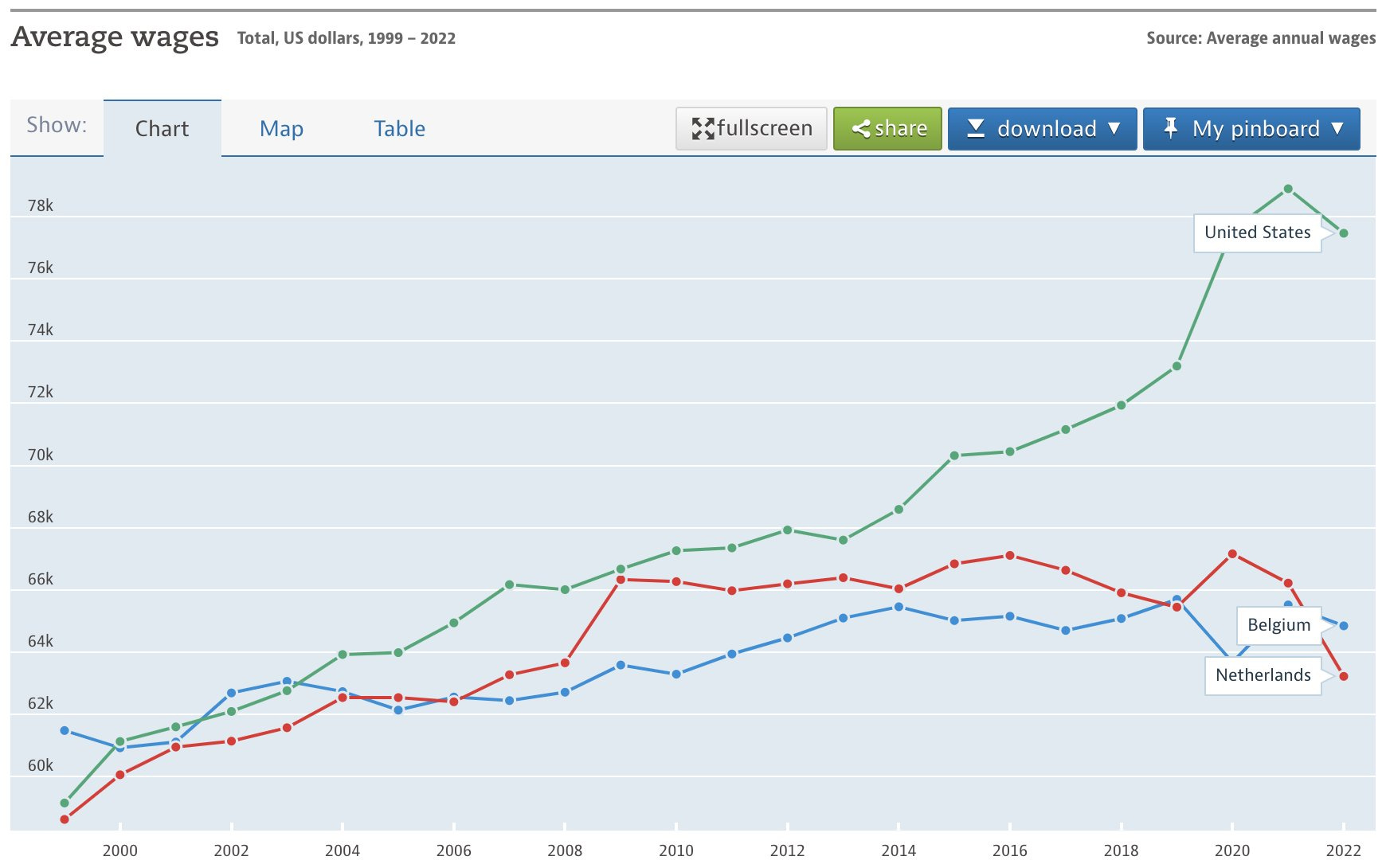

It is important to note that wages in the USA have risen over the last decade, following almost the same trend as other essential expenses:

(Click on image to enlarge)

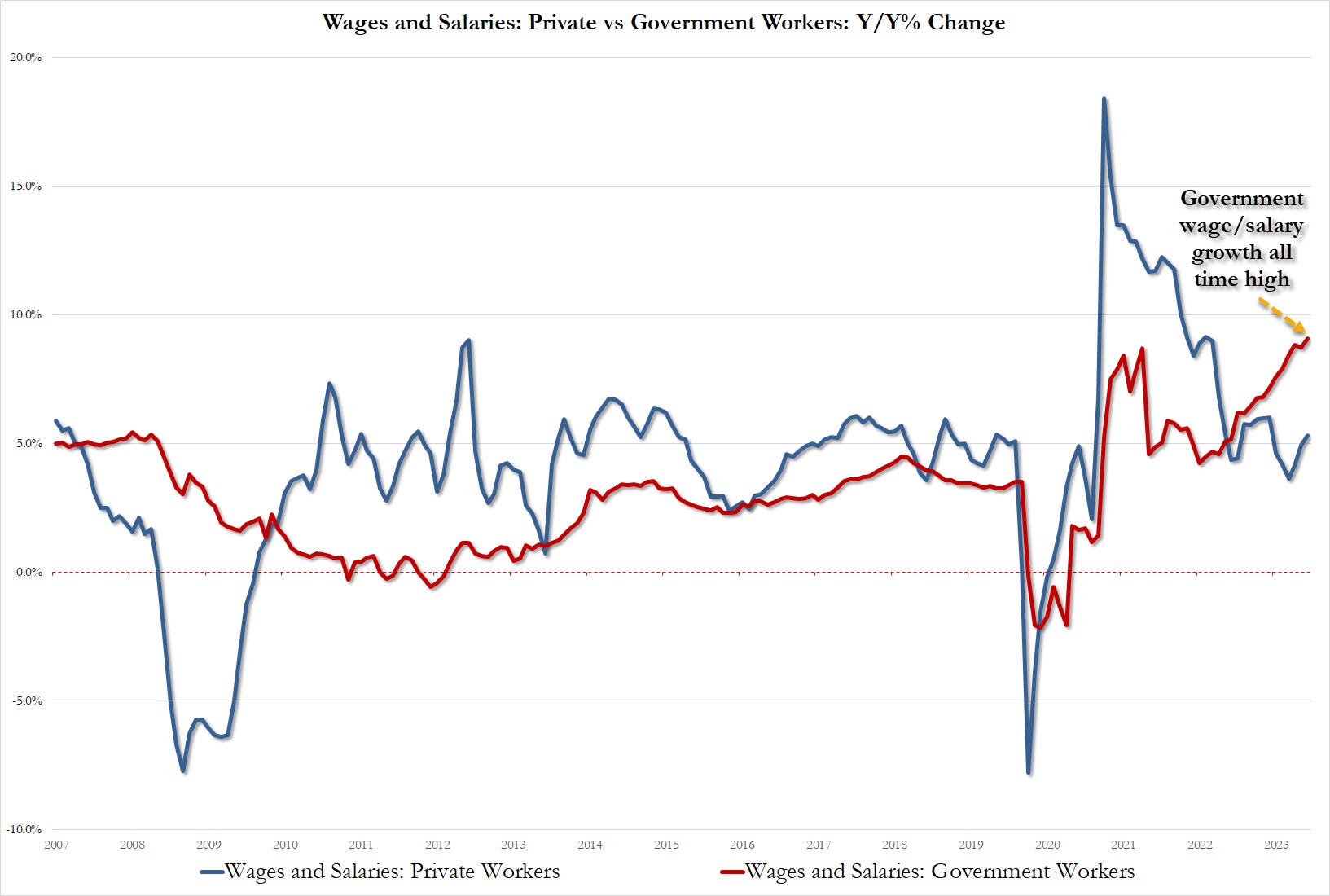

Pay increases have even increased in the public sector:

(Click on image to enlarge)

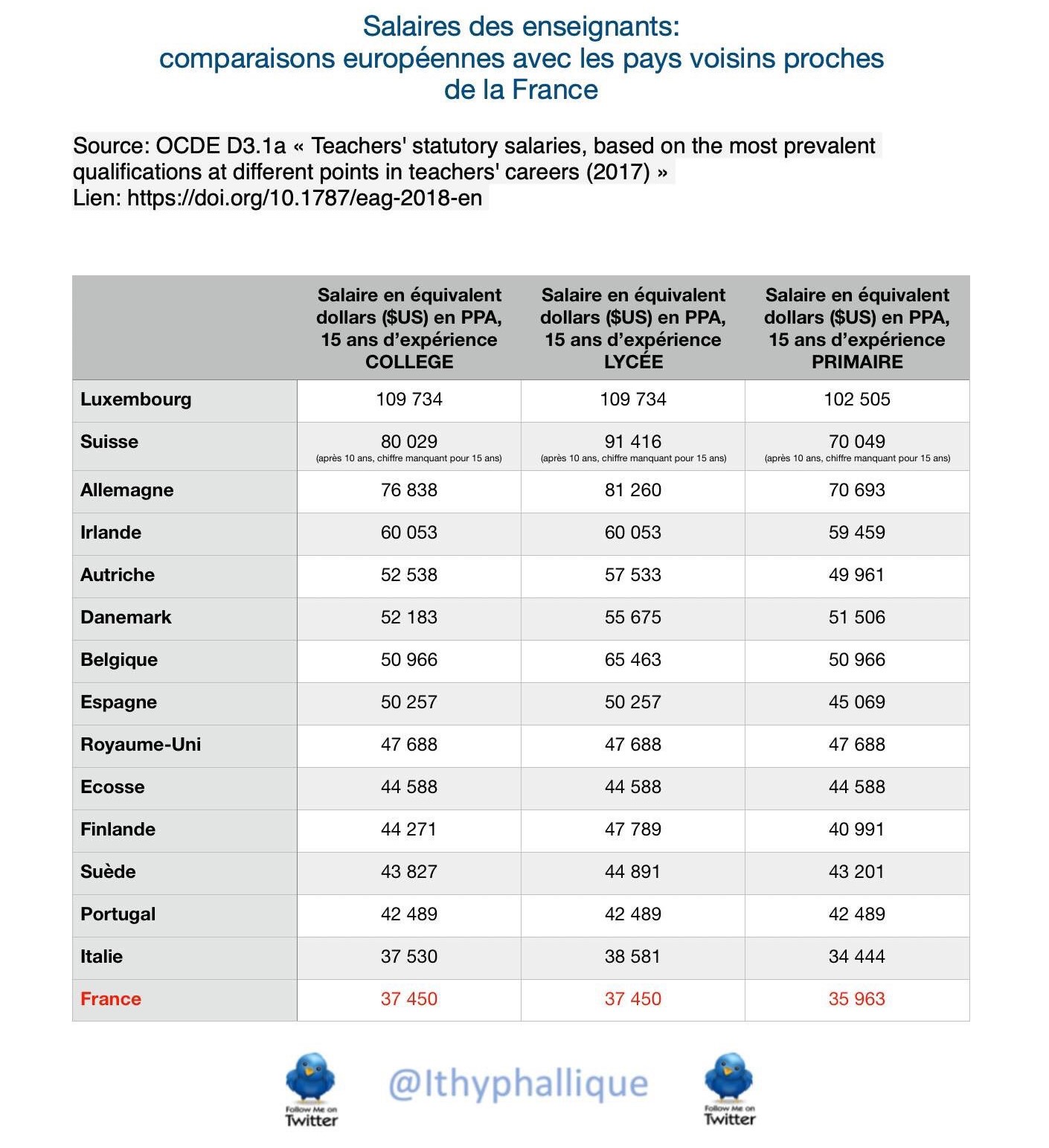

By comparison, public sector pay in Europe has stagnated, leading to a collapse in purchasing power, particularly among French teachers:

(Click on image to enlarge)

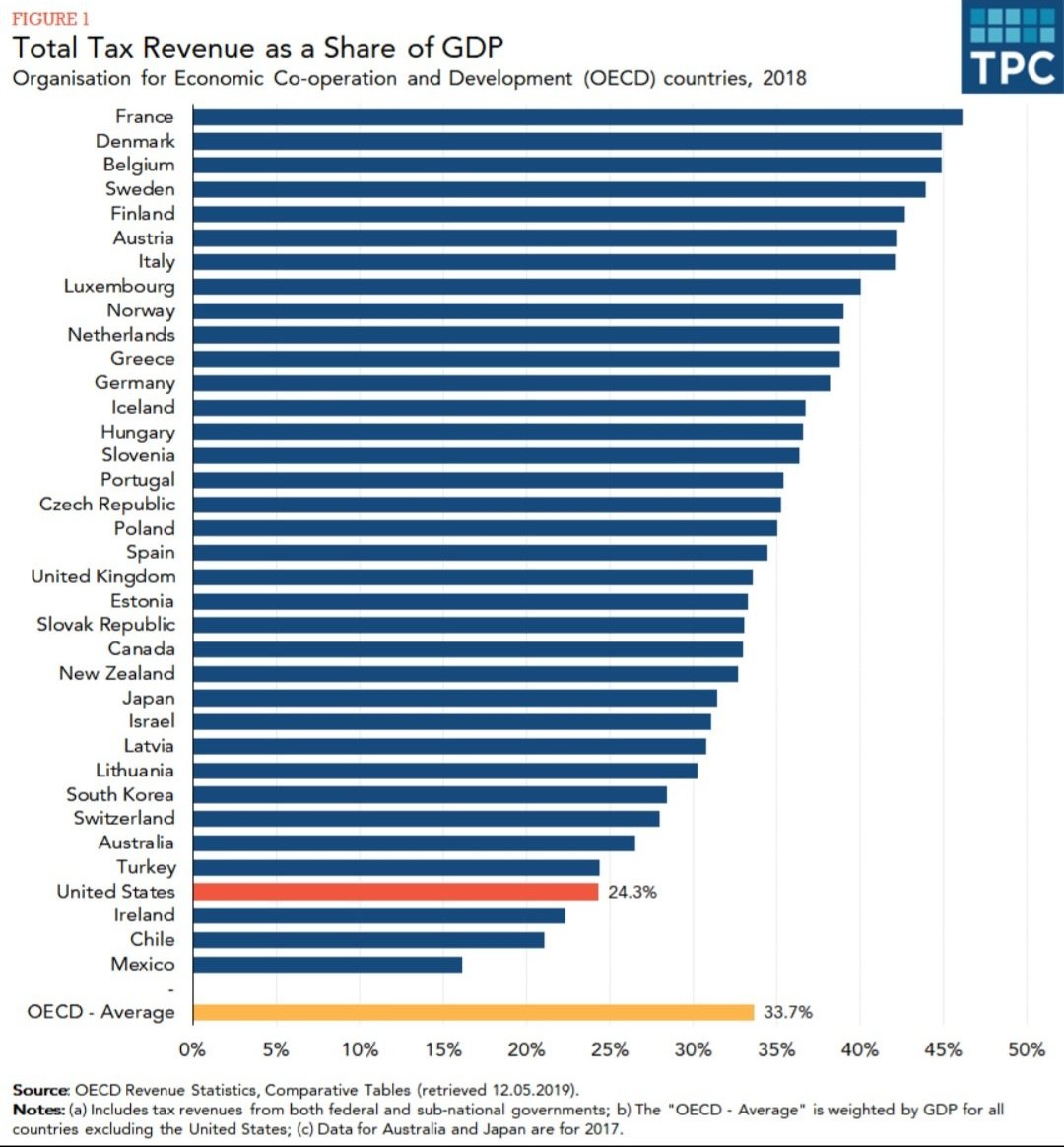

France's fiscal situation makes it impossible to increase the number of civil servants: the exploding deficit and record tax levels leave no room for maneuver.

Until 2018, wages in Europe and the USA were broadly following the same trend. However, the response to inflation on wage levels has been different on either side of the Atlantic. The Netherlands and Belgium, which had been following the same wage dynamics as the United States, have experienced a significant fall-off since the reawakening of inflation. The inflationary shock has further impoverished Europe, and strikes by consumers and farmers reflect this impoverishment.

The European consumer strike had an impact on economic activity and corporate profit margins.

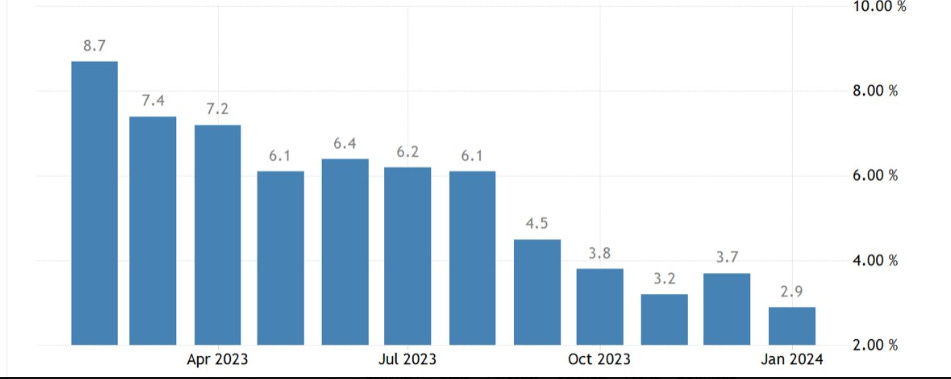

Lower commodity and energy prices have begun to bring inflation down.

In January, inflation in Germany continued to fall significantly:

This drop in inflation could prompt the ECB to lower rates again.

Will the ECB act before the Fed?

The Fed is expected to cut rates to avoid too sharp a slowdown in the economy and to facilitate more favorable refinancing of public and private debt.

However, this will not happen immediately. The spectre of inflation is worrying central bankers. Jerome Powell even suggests that the long-awaited drop in March is unlikely to materialize as quickly as the markets had anticipated.

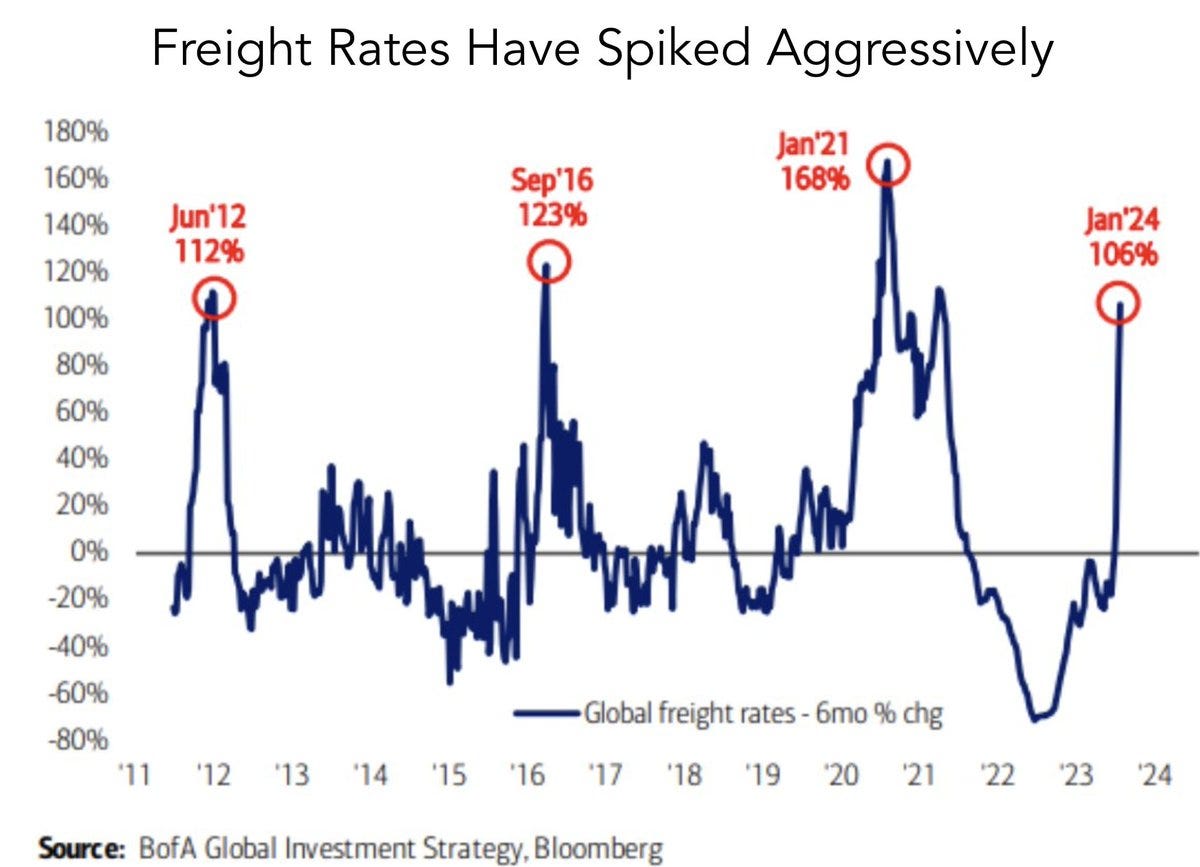

Unfortunately, the long-awaited pivot by central banks is likely to come at a time of renewed inflation, exacerbated by an increasingly complex geopolitical situation. The blockage of traffic in the Red Sea has rekindled the rise in shipping costs. The last upward shock to these costs was one of the causes of the reawakening of inflation:

A new surge in inflation in a Europe already socially bogged down by the latest inflationary phase could represent a significant danger to the continent's political and social stability.

This stalemate reflects a wider impasse: that of central banks, caught between the risk of renewed inflation, which could exacerbate the social crisis in Europe, and the risk of a recession or serious credit event resulting from a prolonged period of rates left at levels incompatible with the levels of debt to be refinanced.

In the long term, gold should benefit from the impasse in which central banks find themselves. The price of gold remains above $2000 for the tenth consecutive week, despite falling real interest rates and the market optimism that drove the stock market euphoria of recent weeks.

Gold's exceptional resilience also serves as a signal of the current stalemate in monetary policy.

More By This Author:

The New Creditors Of Developing CountriesCan The Market Euphoria Last?

The Silver Shortage Worsens

Disclosure: GoldBroker.com, all rights reserved.