EU To Set $60 Price Cap On Russian Oil; Kremlin Vows To Ignore, Cut Supply

The European Union reached a deal on Friday to cap Russian oil at $60 a barrel, paving the way for G7 nations to launch an 'unprecedented mechanism', as the Wall Street Journal reports.

The move came after overcoming a last-minute push by Poland to lower the cap, for which the European Commission had originally proposed between $65 and $70 per barrel. In short, the EU came down to Poland's price, which had become a point of contention for more than a week.

The cap - designed to punish Russia financially for invading Ukraine, while still allowing enough oil into the market, is significantly below benchmark Brent prices, which traded around $86 a barrel Friday morning, but bear in mind that Urals crude trades basically around these levels...

It will also mean that any country which agrees to the policy will only be allowed to purchase ship-borne Russian oil products at, or below the cap - and any maritime firm that violates the price cap would face harsh sanctions.

Russia Says Nyet

One day before the $60 decision, a Thursday press conference, Moscow threatened to ignore the price cap set by the West - saying they will continue to charge buyers regular prices. Those unwilling to pay will be cut off, according to Russian Foreign Minister Sergey Lavrov at a Dec. 1 press conference reported by state news agency, Tass.

"We have no interest in what the price cap will be. We will reach direct agreements with our partners. The partners working with us will disregard these caps and will give no guarantees to those who impose such caps illegally," said Lavrov.

Russia, meanwhile, is looking for new buyers for its energy exports. According to Lavrov, they are courting nations such as Brazil, India, China, and South Africa (which together with Russia are the BRICS nations), along with allies such as Turkey.

"Every time we negotiate with China, India, Turkey and other big buyers of ours, there is an element of balancing interests in terms of time, volume, and prices," Lavrov added, before warning other states about the need to gravitate away from Western-dominated financial institutions.

"This is certainly an interesting development of events, which, among other things, sends a very powerful long-term signal to all states without exception … to consider abandoning the mechanisms imposed by the West within its globalization systems," he said, adding "However, decisions need to be mutual, between the producer and the buyer, rather than made by a guy wishing to punish someone."

"This is not about earning a bit more from selling our oil. It’s just that we need to start building a system independent from these neo-colonial methods. This is what we are doing together with BRICS colleagues and about a dozen other countries that wish to coordinate their efforts with BRICS," Lavrov continued (via the Epoch Times).

"We are doing so in the SCO and, clearly, in the EAEU, alongside bilateral relations with China, Iran, India, and other countries."

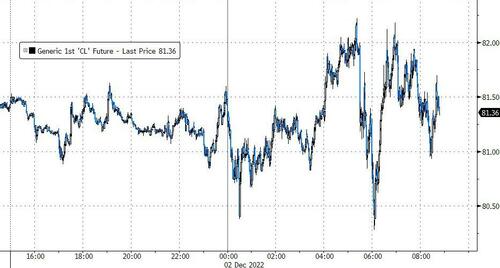

There was absolutely no reaction in crude prices to this 'deal' which probably tells you everything you need to know about the market's perception of the efficacy of it...

More via the Epoch Times;

Western sanctions on Russia have generally had little serious effect on Moscow’s revenues, which was able to benefit from higher prices, despite falling oil export volumes.

Russia became India’s top oil supplier in October, with Russian imports rising to 22 percent from just 0.2 percent in March of this year.

China’s Russian energy purchases more than doubled compared with a year ago, to $10.2 billion in October, as Moscow offered Chinese importers generous discounts on its exports.

The purpose of the G-7 price cap is designed to rectify the West’s failure to hit Russian energy revenues, without punishing poorer countries that are heavily dependent on Russian energy sources.

Moscow Threatens to Penalize Any Country Supporting Price Caps

The foreign minister restated the Kremlin’s position that Russian energy companies would not supply oil to any country that favored such a price cap.

Russia “will not be supplying oil to the countries who would follow the lead of dictators,” Lavrov declared.

Russian Deputy Prime Minister Alexander Novak also stated that Russia will not supply oil to countries under the price cap rules, even if the limits made it more profitable for the Kremlin.

“We have repeatedly said that such measures—the so-called cap on Russian oil price—are not just a non-market mechanism—this is an anti-market measure that destroys supply chains and can significantly complicate the situation on global energy markets,” said Maria Zakharova, a spokeswoman for Russian foreign ministry.

She claimed that any mechanism to limit prices for Russian oil exports would actually worsen the energy shortage situation in the global markets, with devastating consequences for everyone.

The White House Promotes Price Cap as Alternative to an EU Ban on Russian Oil

A far harsher, separate EU embargo on Russian crude traveling by sea or via pipeline is set to take effect on Dec. 5, in an attempt to financially curtail Moscow’s war effort.

American negotiators worry that the EU embargo, combined with the threat of cutting off insurance and other services for vessels shipping Russian oil, will send crude prices upward, unintentionally boosting the Kremlin’s revenue.

The White House hopes that the price cap will encourage the EU to relax its draconian plan to completely ban the importation, financing, and insuring of Russian oil shipments.

Last week, the European Commission (EC) recommended capping Russian oil prices at $65–70 per barrel, but Poland and the Baltic countries opposed those levels.

Greece, Cyprus, and Malta, which were are reliant on tanker traffic, wanted a higher cap or some form of subsidy to compensate for the loss.

The EC came back this week with a $60 a barrel cap, according to officials and diplomats involved in discussions, reported The Wall Street Journal.

Almost all EU members have agreed to the new cap level, save Poland, which has asked for more time to consider and that a decision would not come before Friday. Poland has pressed for the price cap to be set far below the level at which Russian oil exports are currently being sold.

Meanwhile, the Biden administration, oil traders, and investors have pressed for a higher cap that would still allow Russia to sell its oil at the capped price.

The EC issued a compromise on Dec. 1 that would promise to review the price cap every two months, starting in January 2023, and would keep the price cap at least 5 percent below the normal export price of Russian crude, reported The Wall Street Journal.

U.S. Deputy Treasury Secretary Wally Adeyemo told Reuters that the Biden administration supported reviewing the price every two months.

“The key thing to remember is we’re starting at $60, but we have the ability to move the price cap, to further use the price cap to constrain Russia’s revenues over time,” Adeyemo said.

As of Dec. 1, Russian Ural crude stood $58.38 a barrel, well below the Brent crude international benchmark, which is at $86.88 a barrel.

Any price cap would set Russian crude prices well below the international benchmark.

More By This Author:

Q3 GDP Revised Higher As PCE Comes In Hotter Than Expected

WTI Extends Gains After API Reports Large Crude Draw

Oil Dips After OPEC+ Headlines

Disclosure: Copyright ©2009-2022 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every time ...

more