Elliott Wave Analysis On Oil Looks For Short Term Weakness

Photo by Timothy Newman on Unsplash

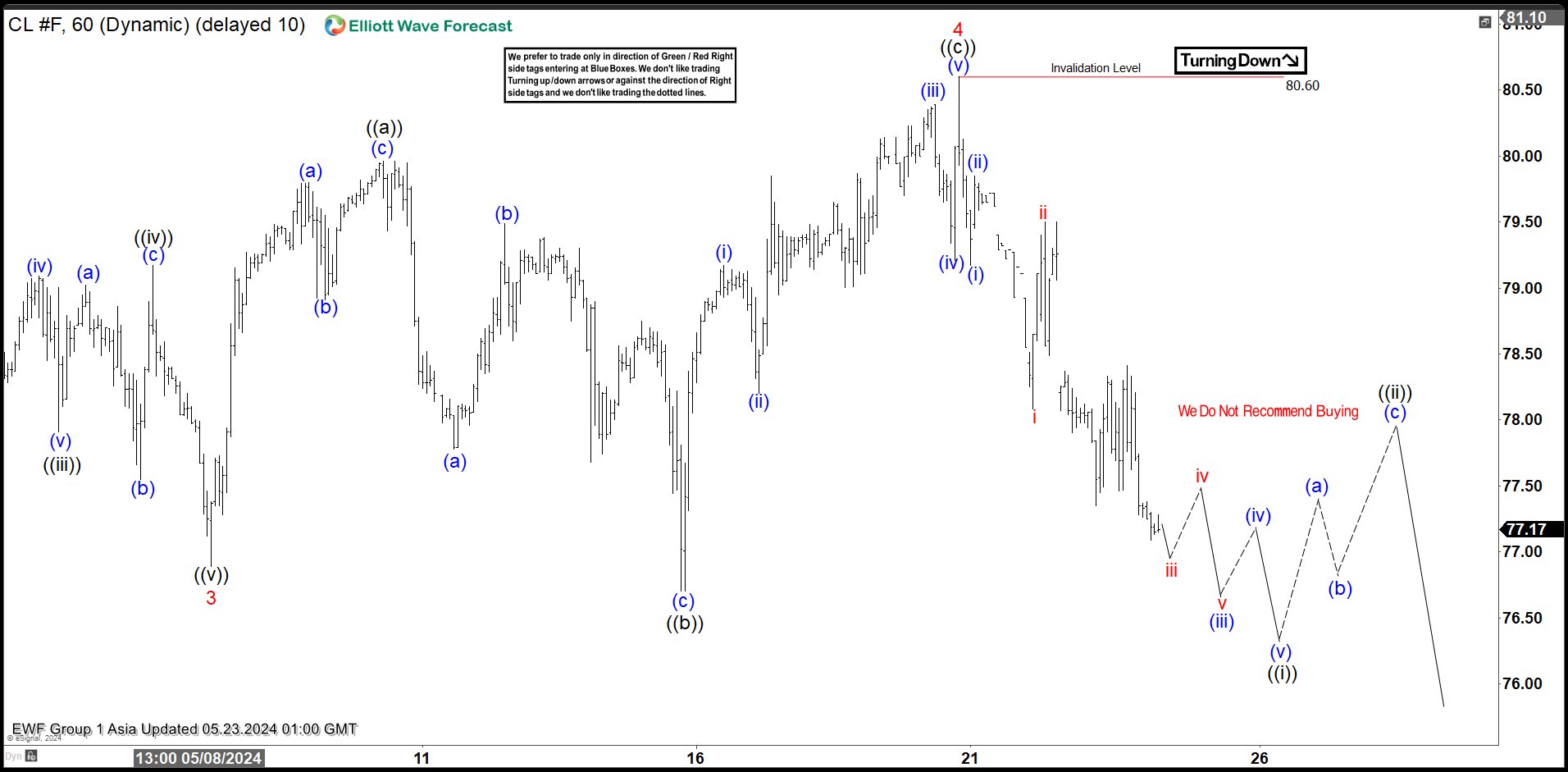

Short Term Elliott Wave in Light Crude Oil (CL) suggests the decline from 4.12.2024 high is in progress as a 5 waves impulse. Down from 4.12.2024 high, wave 1 ended at 81.56 and wave 2 rally ended at 86.28. Wave 3 lower ended at 76.89. The 1 hour chart below shows the starting point from wave 3. Wave 4 bounce unfolded as an expanded Flat structure. Up from wave 3, wave ((a)) ended at 79.96 and wave ((b)) ended at 76.70. Wave ((c)) higher ended at 80.6 which completed wave 4 in higher degree.

Oil has turned lower in wave 5. Down from wave 4, wave (i) ended at 79.17 and wave (ii) ended at 79.85. Down from there, wave i ended at 78.08 and wave ii ended at 79.5. Expect wave iii to end soon, then it should see 2 more lows to end wave (v) of ((i)). Afterwards, it should rally in wave ((ii)) to correct cycle from 5.20.2024 high in 3, 7, or 11 swing before it resumes lower again. Near term, as far as pivot at 80.6 high stays intact, expect rally to fail in 3, 7, or 11 swing for further downside.

Oil (CL) 60 Minutes Elliott Wave Chart

CL Elliott Wave Video

Video Length: 00:05:02

More By This Author:

There Is No Reason To Sell Ishares Silver Trust

Elliott Wave Analysis On S&P 500 ETF Calling For More Upside

Gold To Silver Ratio Has Resumed Lower

Disclaimer: Futures, options, and over the counter foreign exchange products may involve substantial risk and may not be suitable for all investors. Leverage can work against you as well as for ...

more