Elliott Wave Analysis: Gold And Palladium Complete The Recovery

Markets are slow with US stocks trapped in range as everyone waiting on the US CPI tomorrow.

Gold made a sharp and strong turn down from 1850 area as expected after we noticed a completed ending diagonal in wave C of B). It's a very strong decline with a break below the trendline support that suggests more upcoming weakness into wave C) of E. Ideally we will see a continuation down now, after a)-b)-c) a corrective rally into 61.8% Fib. Drop below 1800 will suggest we are on the right track.

Gold 4h Elliott Wave Analysis

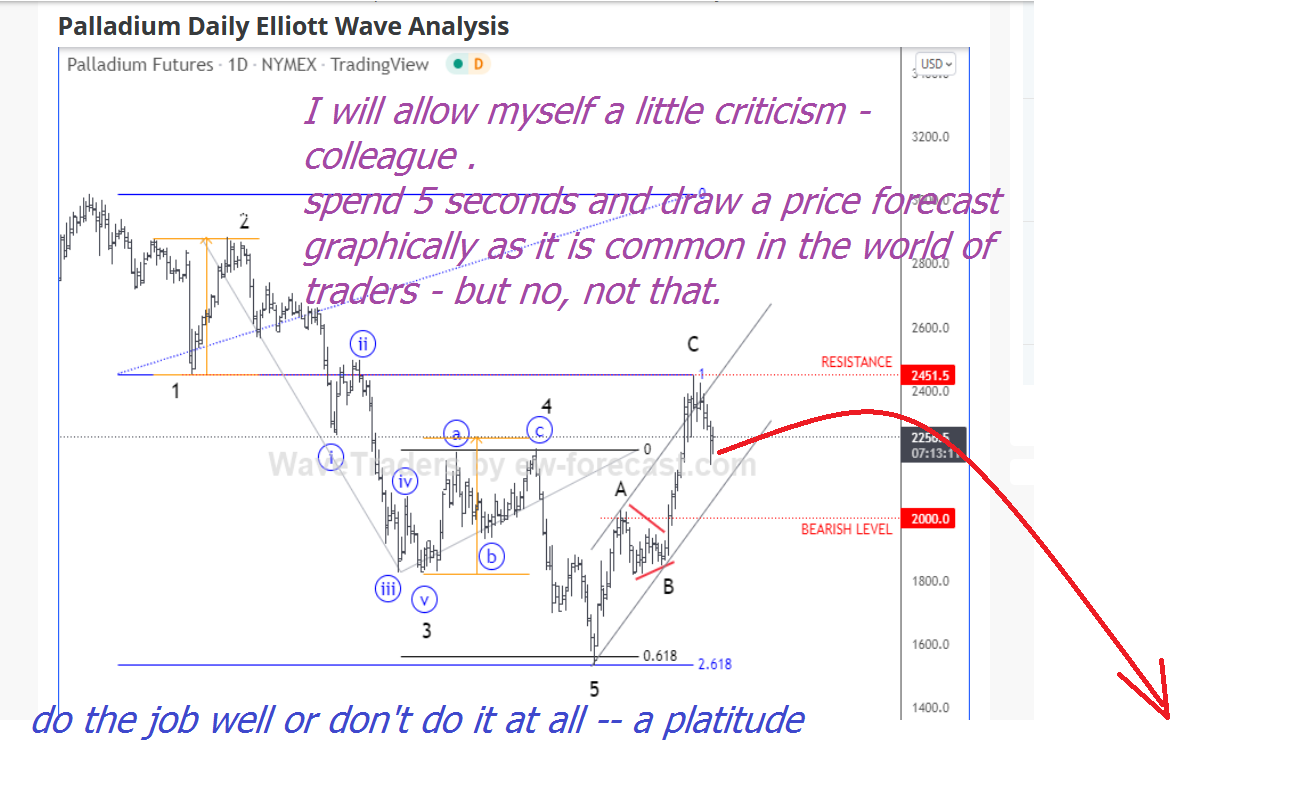

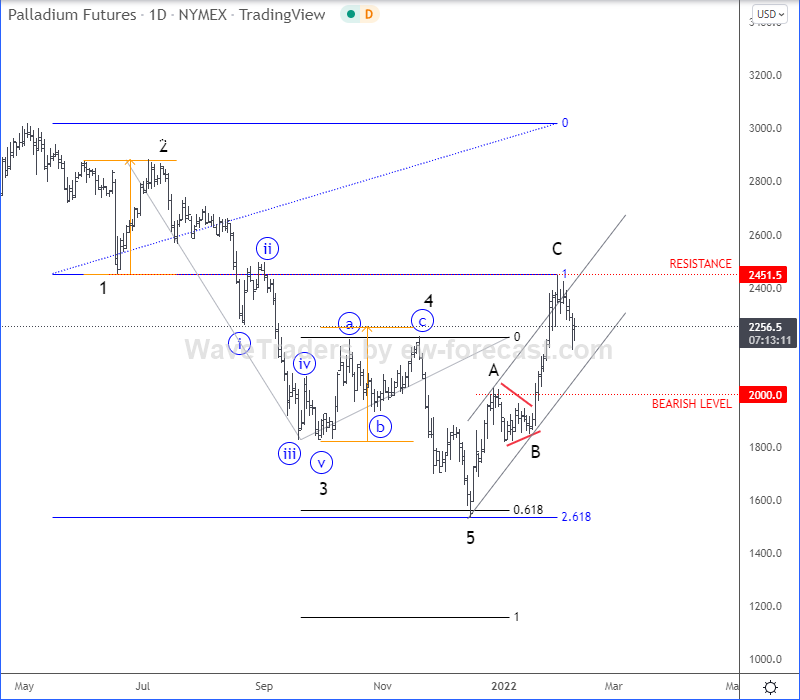

Palladium made a nice three-wave A-B-C correction after we noticed five waves of decline from the highs, so we may now have a nice bearish setup formation. If we are right about bearish-looking gold and silver, then even Palladium could sells-off, but keep in mind that bearish confirmation is only below 2000 level.

Palladium Daily Elliott Wave Analysis

Disclosure: Please be informed that information we provide is NOT a trading recommendation or investment advice. All of our work is for educational purposes only.