Elliott Wave Analysis: Gold & Silver Eye Downside

Metals are in sharp sell-off as USD turns higher with yields following Biden's decisions to re-nominate Jerome Powell as Federal Reserve chairman. Gold made a very sharp and strong sell-off through 1830 level where broken trendline support suggests that the market is in impulsive decline.

Gold is coming sharply down from the upper side of a triangle range, so it appears that wave D) is finished and that market is already in a wave E) pullback that can stop after three-wave drop at 1720-1760 area.

Gold 4h Elliott Wave Analysis

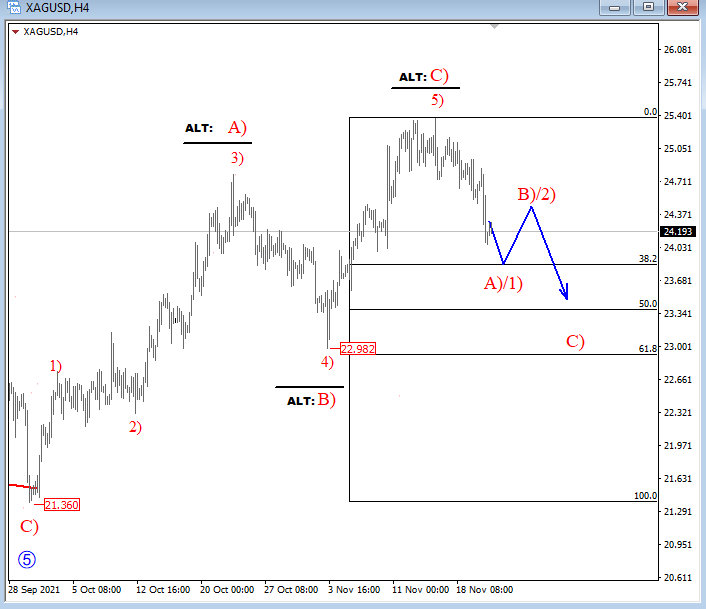

Silver is coming down on the 4h time frame from 25.40 resistance, much more than we thought, so it appears that metal is in a higher degree three-wave drop. Ideally, that will be an A)-B)-C) decline, either a corrective one down to 23.00 support or maybe even as part of the final leg of an ending diagonal pattern that can retest September lows as shown on daily Alternate count.

Silver Elliott Wave Analysis

Disclosure: Please be informed that information we provide is NOT a trading recommendation or investment advice. All of our work is for educational purposes only.