Elliott Wave Analysis: Gold & Silver Approach Resistance

Stocks were stable during Asian trading hours after some higher prices on US and EU stock markets yesterday. However, this may not be an important bull run yet, as sentiment and flows may change later after the important US CPI figures.

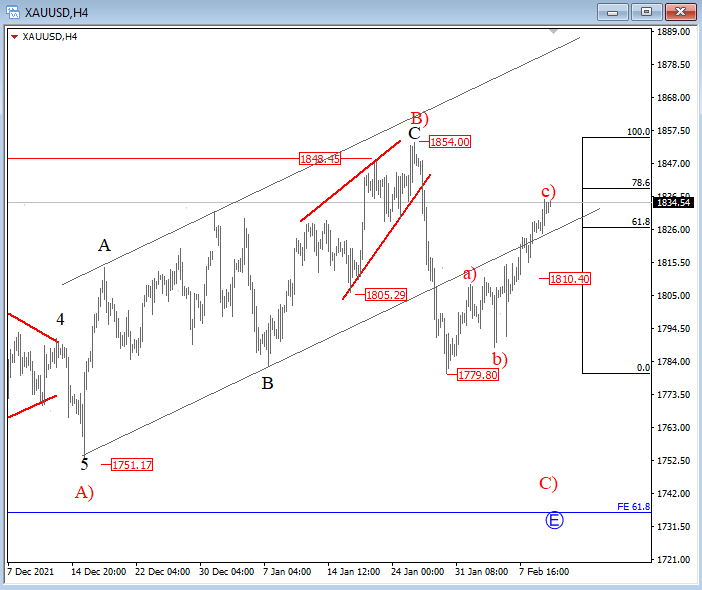

Gold made a sharp and strong turn down from the 1850 area after completing the ending diagonal in wave C of B). It's a very strong decline that can put in play more weakness into wave C) of E. Ideally we will see a continuation down now, after a)-b)-c) a corrective rally that should stop then at 61.8-78.6% Fib level. Drop back to 18710 would be the first indication for bearish resumption.

Gold 4h Elliott Wave Analysis

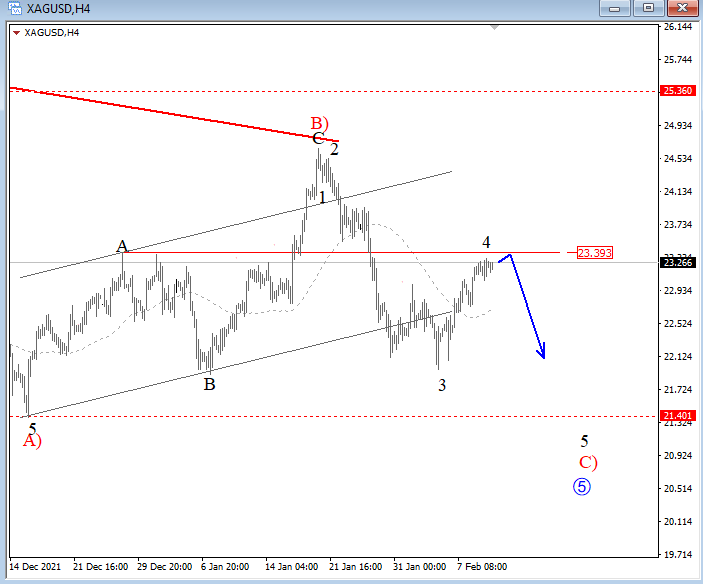

Silver has been recovering since December, but notice that recovery is made by three legs which is a corrective structure. In fact, the bearish reversal is strong and impulsive, so we are bearish and are looking for further weakness into wave C) of five; the final leg of a higher degree ending diagonal that can boom near 20/21 this year.

Silver 4h Elliott Wave Analysis

Disclosure: Please be informed that information we provide is NOT a trading recommendation or investment advice. All of our work is for educational purposes only.