Dr Coppers Drop Signals Concerns For The S&P 500

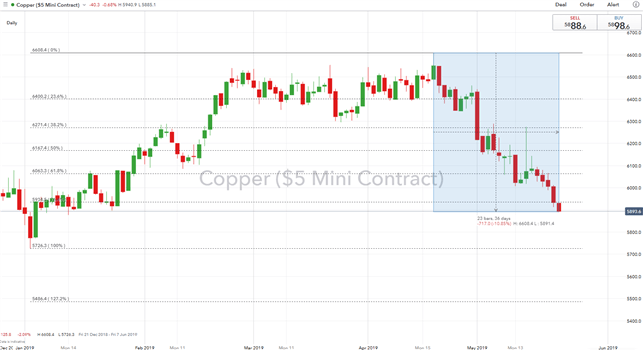

COPPER PRICES IN CORRECTION TERRITORY

Copper prices have dipped into correction territory falling over 10% since the 2019 peak reached on April 17th following the recent escalation in trade war tensions between the US and China. Consequently, given the sizeable drop in the base metal, this does raise investor angst over the health of the global economy as copper is typically regarded as an important measure of economic performance and particularly that of China, which is the largest consumer of the base metal. As such, the sizeable drop in copper prices raises concerns over equity performance.

COPPER PRICE CHART: Daily Time Frame (Dec 2018 – May 2019)

COPPER SHORTS HIGHEST SINCE FEBRUARY 1ST - COT

Rising trade war tensions have caused investors to maintain its bearish positioning on the base metal as net shorts increase by over 8.5k lots as gross longs are liquidated, while gross shorts had also been added. Total net shorts (-35k lots) is now the highest since February 1st. (Full report)

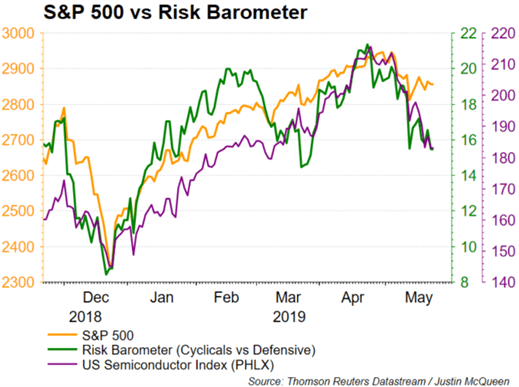

RISK BAROMETER AND TRADE SENSITIVE STOCKS POINT TO GLOOMY OUTLOOK

As the economic outlook remains fragile, the risk barometer continues to show investors moving towards defensive stocks over cyclical, while trade sensitive equities have also edged lower. Consequently, this suggests that risks remain on the downside for the S&P 500.