Dow Pivots Lower As Fed Casts Doubt On More Rate Cuts

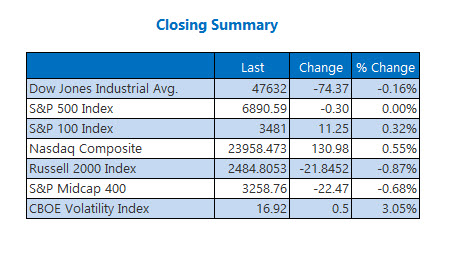

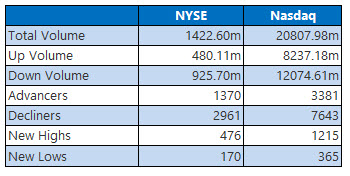

The Dow cut its impressive climb short on Wednesday, reversing a triple-digit gain to snap its four-day win streak. The S&P 500 also fell, while the Nasdaq settled at all-time highs, with its counterparts also tapping records earlier in the session. Driving this rout was Fed Chair Jerome Powell's speech, which followed the conclusion of a two-day Fed meeting that resulted in a quarter-point interest rate cut. Powell warned that another cut before the end of the year is "not a foregone conclusion," sending investors spiraling.

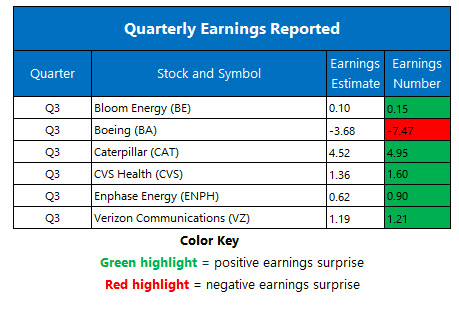

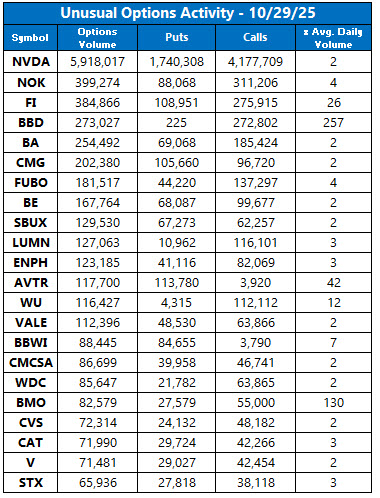

Wall Street is now eyeing "Magnificent 7" earnings, which will dominate the docket in the coming days. Alphabet (GOOGL), Meta Platforms (META), and Microsoft (MSFT) are among the giants reporting results.

CRUDE RESUMES GAINS AFTER EIA REPORT

Crude is moving higher after the Energy Information Administration (EIA) reported an almost 7 million barrel drop in U.S. crude and fuel inventories the last week, a stark difference from the expected 211,000-barrel tumble. December-dated West Texas Intermediate (WTI) crude added 40 cents, or 0.7%, to settle at $60.55 per barrel.

While the Fed decided to cut interest rates, uncertainty regarding a third cut later this year pressured gold prices. December-dated gold futures dropped 0.1% to trade at $3,977.50 per ounce.

More By This Author:

Stocks Nab More Records Ahead Of Fed DecisionMarkets Log More Record Closes Amid Rate Cut Enthusiasm

Dow Eyes 4th-Straight Triple-Digit Close After More Records