Dollar Weakness Meaningless For Gold

Gold and junior miners declined alongside the USD Index for the second straight day. It doesn’t usually look like this… something is going on.

Floating Around the Rumor Mill

With the USD Index struggling for support in recent days, heavy speculation has overshadowed strong fundamentals. For example, after European Central Bank (ECB) Governing Council member Robert Holzmann said on Aug.31 that “we are now in a situation where we can think about how to reduce the pandemic special programs,” the hawkish rhetoric accelerated the ECB’s perceived taper timeline. In turn, this lit a fire under the EUR/USD – which accounts for nearly 58% of the movement of the USD Index.

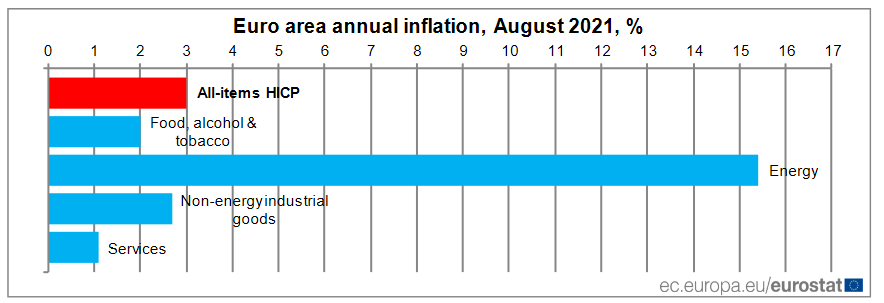

And adding fuel to that fire, Bundesbank President Jens Weidmann said on Sep. 1 that “we have to watch the risks to the outlook for prices. Accommodative monetary remains appropriate, but we shouldn’t disregard the risk to too-fast inflation.” For context, Eurozone inflation increased by 3% year-over-year (YoY) on Aug. 31 (the red bar).

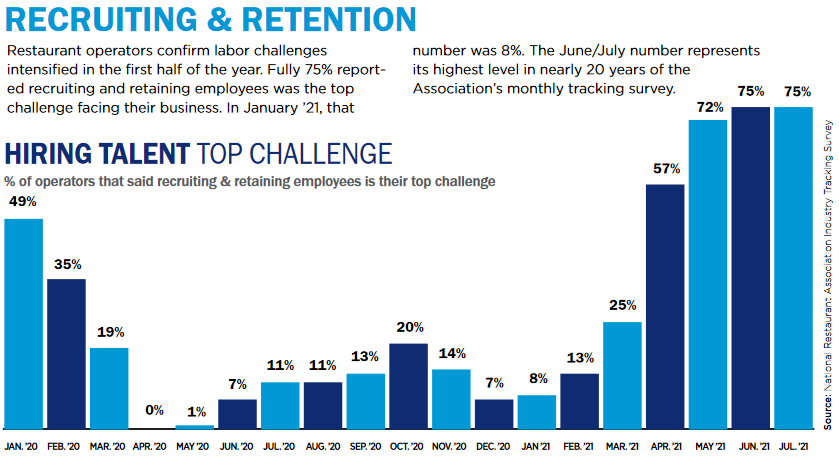

Please see below:

However, it’s important to remember that U.S. inflation increased by 5.28% YoY in July (the latest data released on Aug. 11) and realized U.S. GDP has already surpassed its pre-pandemic high. Conversely, the Eurozone still remains a relative underperformer.

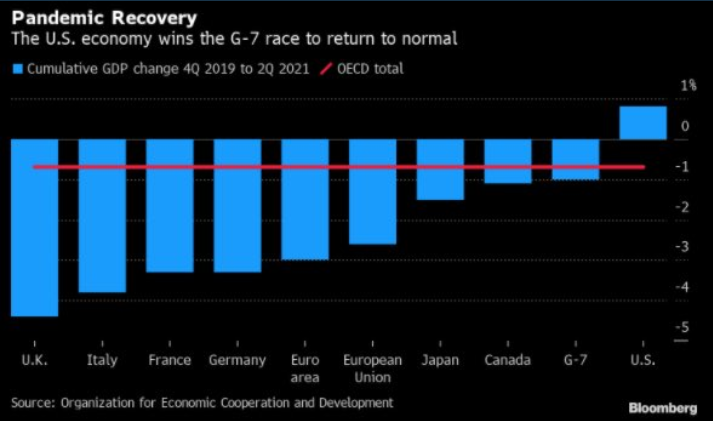

Please see below:

To explain, the blue bars above represent the percentage change in countries’ GDP levels relative to Q4:2019. If you analyze the middle of the chart, you can see that the Eurozone remains a relative laggard. Conversely, if you turn to the right side of the chart, you can see that the U.S. is the only G7 country that’s recouped (and now exceeded) what was lost during the coronavirus crisis. As a result, the U.S. dollar should benefit from the fundamental outperformance over the medium term.

In addition, while the hawks cast doubt, ECB President Christine Lagarde outlined her monetary milestones during her press conference on Jul. 22.

I quoted her remarks on Jul. 23:

“The forward guidance rests on three key criteria’s if you will:

“We see inflation reaching 2% well ahead of the end of our projection or rising, that’s like number one and number two, durably for the rest of the projection horizon. And thirdly, we judge that realized progress in underlying inflation is sufficiently advanced to be consistent with inflation stabilizing at 2% over the medium term …. So, by these three legs, we’re essentially saying, first of all, that we want to see inflation reach 3% well ahead of the end of our projection horizon.”

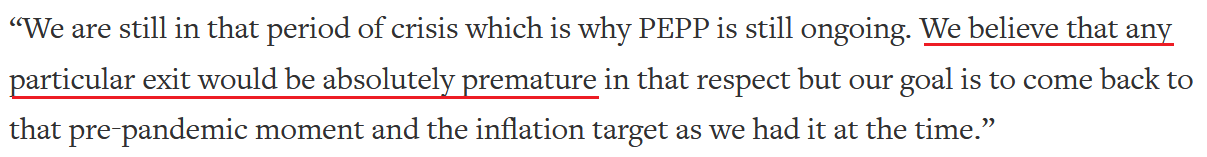

Source: Reuters

Thus, with Lagarde implying that she wants to see “inflation reach 3% well ahead” of removing policy support, hitting the milestone once in August likely means several more months of dovish observation. To that point, ECB Chief Economist Philip Lane said the following on Aug 25.

I quoted his remarks on Aug. 26:

“Regardless of when PEPP might end, that’s not the end of the ECB’s role in terms of QE. This is why we don’t need a huge lead time to think about it. We already know what we’re doing until March, which is maintaining favorable financing conditions, so we have time this autumn to work out what comes next.”

And what does this mean for a prospective taper announcement?

Source: Reuters

As a result, with the ECB hawks likely in the minority, why such a strong reaction from the EUR/USD? Well, with the Fed downplaying even higher inflation and a dovish-for-longer ECB the major consensus, the recent comments surprised investors. And with algorithms not discriminating, the mantra of ‘shoot first, ask questions later’ was on full display when the news hit the wire.

However, Stephen Gallo, European Head of FX strategy at BMO Capital Markets, said the following on Sep. 2:

“Leveraged funds were short euro-dollar, so since Jackson Hole we have seen some of those shorts being covered, but the move doesn't look violent, and there are still decent numbers of people looking to go short again. As long as the dollar doesn't have a reason to weaken, I don't think the euro on its own will break out significantly to the top side.”

Have You Seen These New Openings?

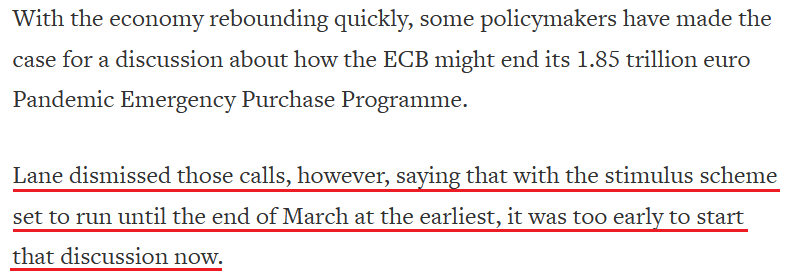

To that point, while U.S. nonfarm payrolls may disappoint today – as the spread of the Delta variant may have decelerated hiring activity – the latest coronavirus strain is unlikely to derail the medium-term momentum. For one, enhanced unemployment benefits end nationwide this month, and the lack of stimulus should accelerate U.S. citizens’ desire to reenter the workforce. Second, Indeed revealed on Sep. 1 that “[job postings] were 39.4% above February 1, 2020, the pre-pandemic baseline, after adjusting for seasonal variation. Postings were up 1.7 percentage points in the past week and 4.2 points over the past four weeks.” As a result, the Fed’s taper timeline has only been delayed by the Delta variant.

Please see below:

As further evidence, I noted on Sep. 2 that with more than 1.4 million job openings in the restaurants & accommodations sector, there are plenty of jobs available for individuals that want them.

I wrote:

With the National Restaurant Association revealing that “labor challenges intensified in the first half of the year” and that “75% [of respondents] reported recruiting and retaining employees was the top challenge facing their business,” wage inflation is poised to accelerate. For context, only 8% of respondents cited hiring as their “top challenge” in January but “the June/July number [75%] represents its highest level in nearly 20 years of the Association’s monthly tracking survey.”

Please see below:

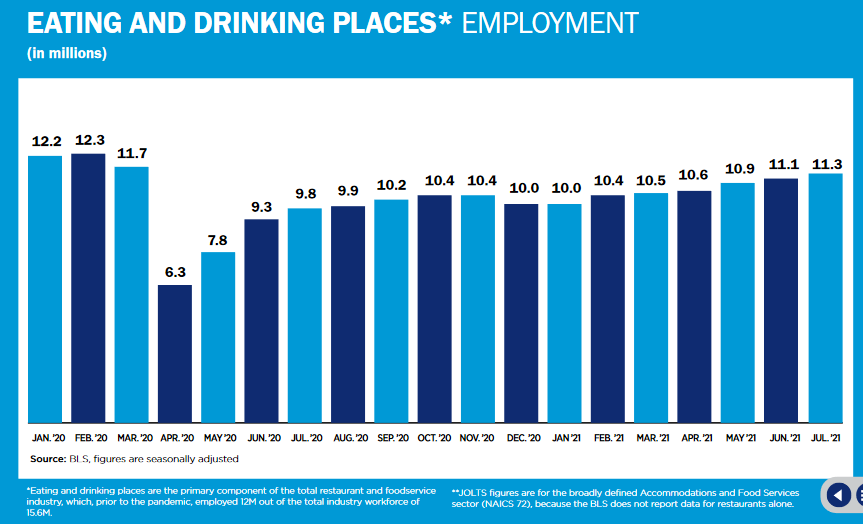

What’s more, staffing levels at restaurants are more than 8% below their pre-pandemic high of 12.3 million. And with the restaurants & accommodations sector home to more than 1.4 million job openings as of Jun. 30 (BLS data), the figure was more than double the January 2021 reading and was the highest since the data collection began in 2000.

Don’t Buy Indices When They Are Skateboarding

Also supportive of future USD Index strength, the S&P 500 is skating on a knife’s edge. And while the economic momentum should resume once the Delta variant fades, Goldman Sachs reduced its third-quarter GDP growth estimate for the second time on Sep. 2.

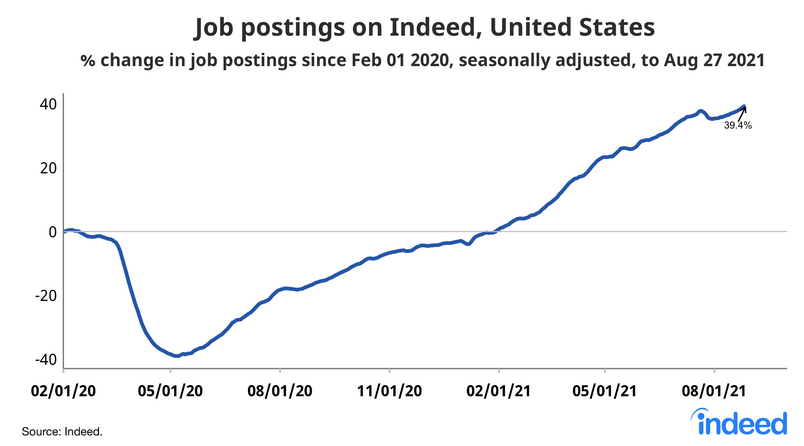

Likewise, short interest in the S&P 500 has perked up once again. For context, when short interest rallied off of the lows in January 2021, volatility spiked and the NASDAQ Composite suffered mightily.

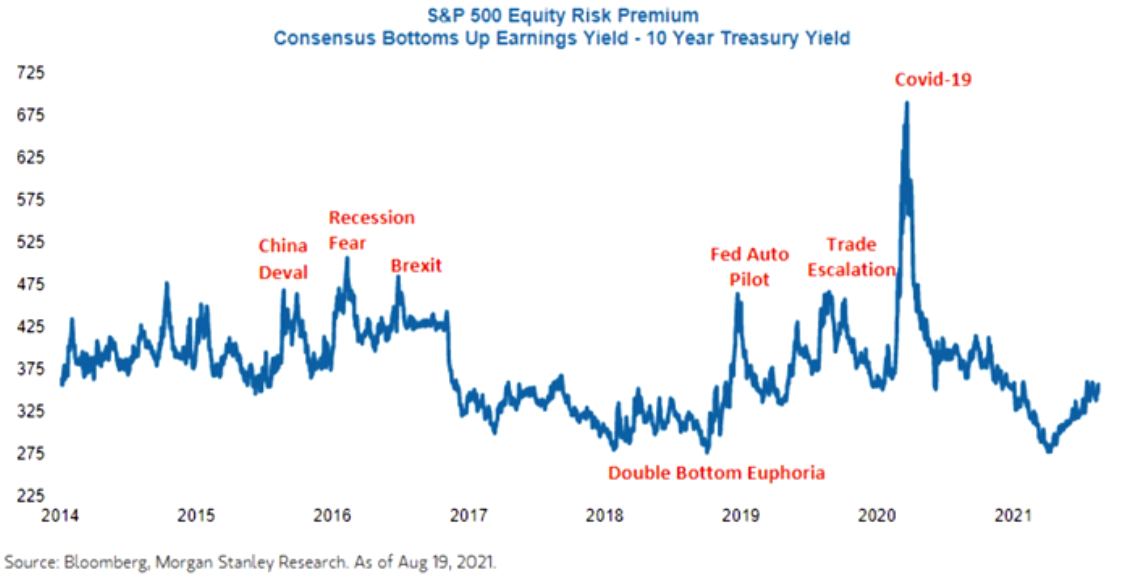

In addition, the S&P 500’s equity risk premium has also risen of extremely depressed levels (see the right side of the chart below). And with price multiples already contracting, an earnings malaise could drop the guillotine on the general stock market.

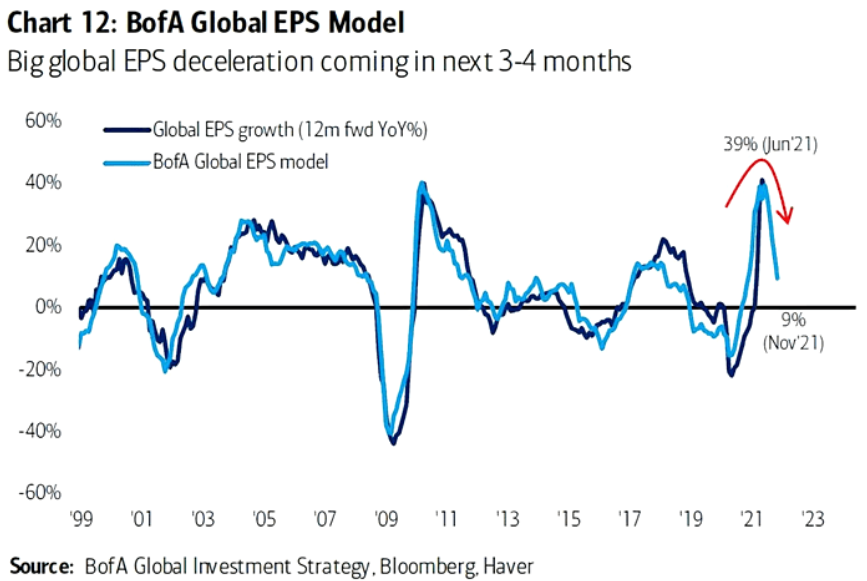

To that point, Bank of America’s global earnings per share (EPS) model signals a major slowdown in the coming months. Moreover, the combination of compressed multiples, higher risk premiums and decelerating earnings growth could create the perfect storm for the S&P 500.

Please see below:

To explain, the dark blue line above tracks the YoY percentage change in analysts’ consensus forward EPS estimates, while the light blue line above tracks the implied YoY percentage change in Bank of America’s global EPS model. If you analyze the right side of the chart, you can see that the light blue line has already moved sharply lower. And with the dark blue line still materially elevated, downward earnings revisions could severely upend investors’ optimism.

And while the wheels are in motion, even the staunchest bulls are demonstrating heightened anxiety. For example, Wharton professor Jeremy Siegel told CNBC on Sep. 2 that a significant correction could be looming.

"Personally, I think the inflation news, not tomorrow's employment report that everyone is looking at... might be more important," he said. "If they blow out the numbers, the Fed is going to have to be more aggressive going forward."

He added:

“[Stocks are] going up the staircase. I don't know when the elevator's going to come. But it looks like a momentum trade, in the sense that it just keeps on going up a little bit every day. No real news to propel it and a lot of momentum players piling on.”

The bottom line? The EUR/USD’s recent rally lacks a fundamental foundation. And with U.S. inflation and realized GDP growth outperforming the Eurozone, the USD Index should recoup those losses over the medium term. Moreover, if the general stock market suffers along the way, the pace of the USD Index’s rise could accelerate rather quickly.

In conclusion, it was the second straight day that gold and the GDXJ ETF (our short position) declined alongside the USD Index. And with dollar weakness often uplifting the PMs, it highlights their fundamental trepidation about the Fed’s taper timeline and the potential for higher U.S. real yields. Moreover, with the S&P 500 materially overbought and September a seasonal source of volatility, the PMs confront several ominous headwinds as we approach the autumn months.

Disclaimer: All essays, research and information found on the Website represent the analyses and opinions of Mr. Radomski and Sunshine Profits' associates only. As such, it may prove wrong ...

more