Do We Need A Recession?

Are we in a recession? do we need one?

I want to talk about several things in this piece - but first, I want to highlight that a lot of these talking points are emotional and it’s very difficult to be 100% objective around them. I have respect for both sides of most arguments, and I’ve tried my best to get that across here. However, I understand if there is disagreement with some points (of course).

Humans are the Economy

The weird thing about economics and the market is those bad things are sometimes perceived to be good. For example, from Bank of America -

The good news is that high frequency data is showing hints of [job market] cooling off… job posting on Indeed are down 8.5ppt from the high on December 31, 2021

Well, hmm.

This is not really good news. It’s good news in the sense that it's good that the labor market is slowing down so there isn’t that pesky ol’ problem of wage inflation, but it's terrible news in the sense that these are people.

-

Economics is largely the study of humans and money - it’s what we do with our paychecks, where we choose to allocate and spend, the companies that we build, and the government regulating and stuff. That’s the System of the Economy.

In all Systems, there has to be some sort of mechanism to implement just in case it overheats. Your Microwave System will automatically shut down if the high voltage parts get too hot. The Economy System has to operate like this too.

And that’s where we are now. Things are too hot.

-

We have mega inflation, home prices are incredibly high (~50% of the increase can be explained by WFH!), mortgage rates are ticking up (which might not matter), retail companies are flashing red bells (or at least are bifurcating), VCs are doing bear market threads on Twitter, there are layoffs, and energy costs are continuing to increase.

Those are all signs of an oncoming recession, right? Or some sort of downturn?

-

But the flip side is that there is a lot of data that says that we are doing okay.

-

This is a tough statement because of course, it doesn’t feel that way for a lot of people. A lot of people are going through hard times right now - job loss, being priced out of homes, or maybe not being able to afford their grocery bills.

And that’s a weird thing to parse because you can point to data and say “well, you should be feeling good, look at these industrial production metrics” but the average person doesn’t really care about that.

The avg rent is $2000 and we’re supposed to make 3x the rent which is $6000, which is $72,000 …… the avg salary in U.S is $51,000 …… y’all seeing the issue ?

— King J 🖤 (@BrotherMan24_) May 31, 2022

So the Fed is stepping up and trying to implement the mechanism to ensure that the Economy System doesn't overheat (any worse than it already has). They’ve already raised rates, and now - now, they are doing QT.

Quantitative Tightening. The squeeze. The balance sheet diet.

After two years of bulking, the Federal Reserve is going into the maintenance phase. And they are very serious about it, with Lael Brainard, Vice-Chair of the Fed, stating that inflation was the #1 priority, and Jerome Powell hinting that the party was over.

What is Fed doing?

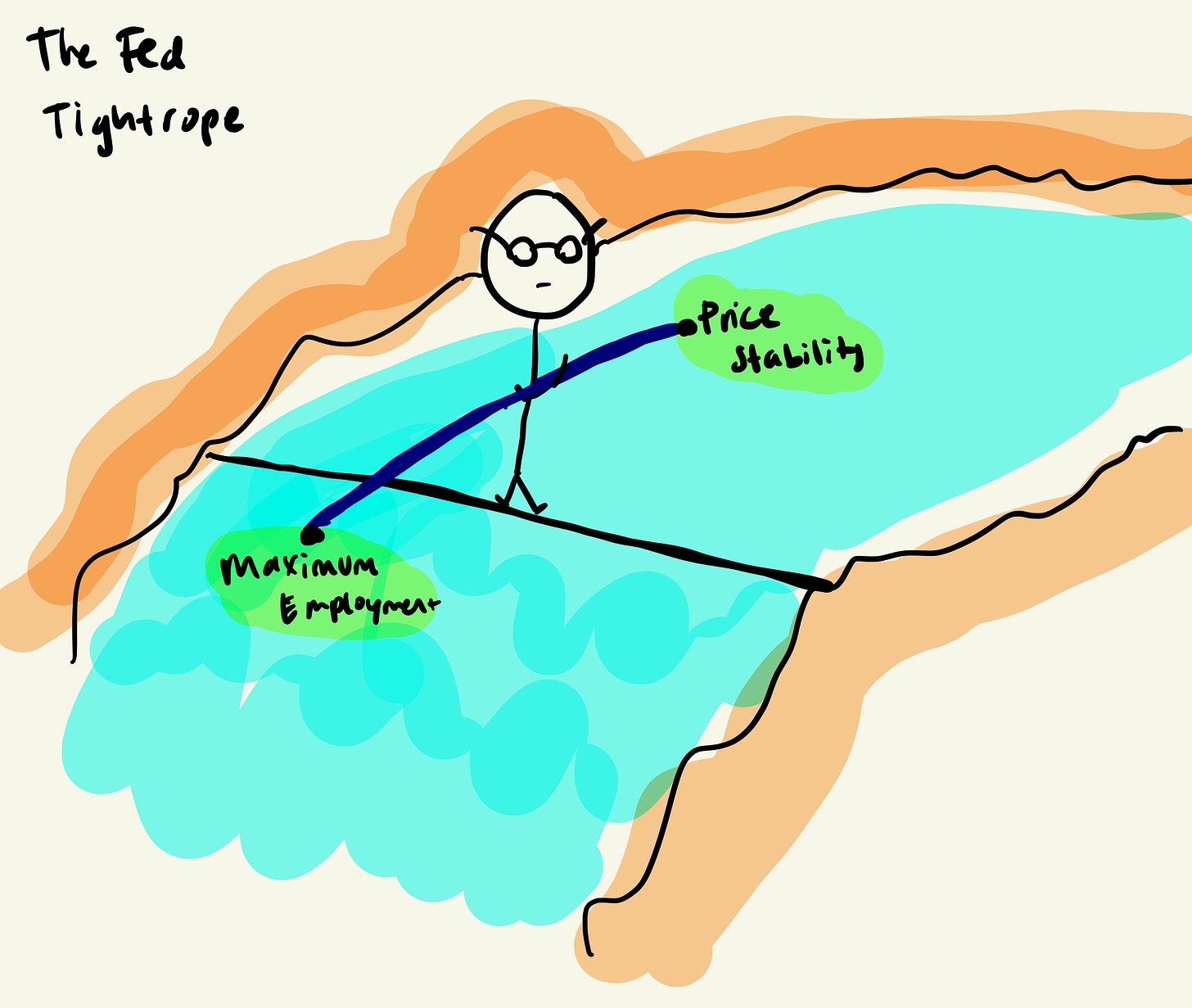

So as we all know, inflation has been raging. It causes a lot of uncertainty and worry because everyone is like “wow, what is going on I can’t afford anything” and the Fed is responsible for ‘fixing’ that - their dual mandate is (1) price stability and (2) maximum employment.

-

The way that they control price stability and maximum employment is through their Fed Toolkit - they roll up and do open market operations, nudge the discount rate, the reserve ratio, etc.

They’ve already whipped out their interest rate tool and are likely to continue on a 50 bps per meeting path. And now, they are pulling out the power saw. QUANTITATIVE TIGHTENING.

The Fed accumulated a lot of assets on its balance sheet during the pandemic. They swooped in to save the market, and that involved buying up a lot of securities - which resulted in their balance swelling to $9T. They need to shrink that now. They do that through Quantitative Tightening.

Now - it is very important to understand that this doesn’t mean *selling* right away. The Fed will not be *selling* assets (as of right now). They will be *reduced through roll-off*. The power saw is set to one of the lower settings - they aren’t letting that thing rip just yet. So what does that mean -

-

Runoff: They are letting securities mature and roll off their balance - no reinvestment of the proceeds.

-

So for June, they are going to receive $128b in proceeds from maturing treasuries and bills, but only reinvest $98b of that, which means that there will be a $30b air pocket that someone else will have to fill.

-

But there are a lot of questions left from this -

-

Who will fill that $30bn air pocket?

-

What impact will the loss of the Fed buyer have on markets? There are worries that the loss of the Fed as a buyer will lead to turbulent Treasury market liquidity (which the Fed themselves highlighted).

-

Is this even an impactful thing to do to try and stem inflation?

-

The main focus is to essentially weaken asset prices so there is less speculative spending (and ideally, less spending in general)

-

The estimate from the Fed is that $2.5T of tightening will equate to about ~50 bps of rate hikes. So it’s really more of a nudge nudge tool.

-

As we all know, the Fed can’t plant corn. They can’t make boats go faster. They can only nudge things around to try and impact what people do. They can only sternly say “hey, stop buying so much stuff” in an attempt to normalize the forces of supply and demand.

It’s just how it is.

The Fed discovered some of these monetary policy tools on accident so it’s honestly not super surprising that we are flopping around. And there are all these theories and papers describing tradeoffs and counterbalances and how the System needs this to function - but at the end of the day, inflation is high, and people will likely end up losing their jobs in the process of bringing it back down.

Could the Fed have moved faster? Yes, absolutely, and they know that too. But we are here now. So what’s going on?

Is the economy even doing okay?

Inflation is a political weapon, and with midterms on the way, the Politicians have an incentive to make sure that people are Feeling Better. Biden said that he would be letting the Fed make these inflation decisions in their meeting earlier this week, but it was very much a “Hey, it’s This Guy, Jerome Powell’s fault”.

Labor costs have increased 8.2% and worker productivity has fallen, both of which are not very good. People are hiring less. Small businesses are feeling the pain, with payrolls shrinking by 91k in the most recent ADP report.

Elon Musk stated that everyone would need to come back from WFH, which likely resulted in some leaving. He then announced 10% layoffs and said he was feeling super bad about the economy. He indeed plays chess.

But the pain is real.

-

There are announcements of new layoffs almost every day at this point, with Coinbase actually rescinding accepted offers. Most of the newer job openings are in lower paying roles. Inflationary pressures are coming from industry concentration.

-

The Beige Book highlighted that economic growth (along with price increases) were beginning to slow down. The personal savings rate has fallen.

-

Consumer sentiment is falling. 43% of BNPL users are subprime borrowers. Even some making $250k are living paycheck to paycheck apparently. More than 20 million households are behind on utility payments (adding up to $23 billion)

-

Natural gas prices continue to tick up, making electricity, fertilizer, manufacturing etc more costly. Chicken prices are exorbitant.

-

Apple’s privacy changes wrecked many companies. Tiger Global is in hell.

-

Then you’ve got Jamie Dimon saying a hurricane is coming?

But then there is data that shows almost the exact opposite sentiment.

-

The private labor market is almost completely recovered to pre-pandemic levels (not the public labor market though!), we added a substantial number of jobs (no sign of a recession there), unemployment is sitting at 3.6%, and the prime-age employment rate is really strong. As Brian Deese highlighted, “we have seen the strongest labor market rebound of any modern recovery”. That’s amazing.

-

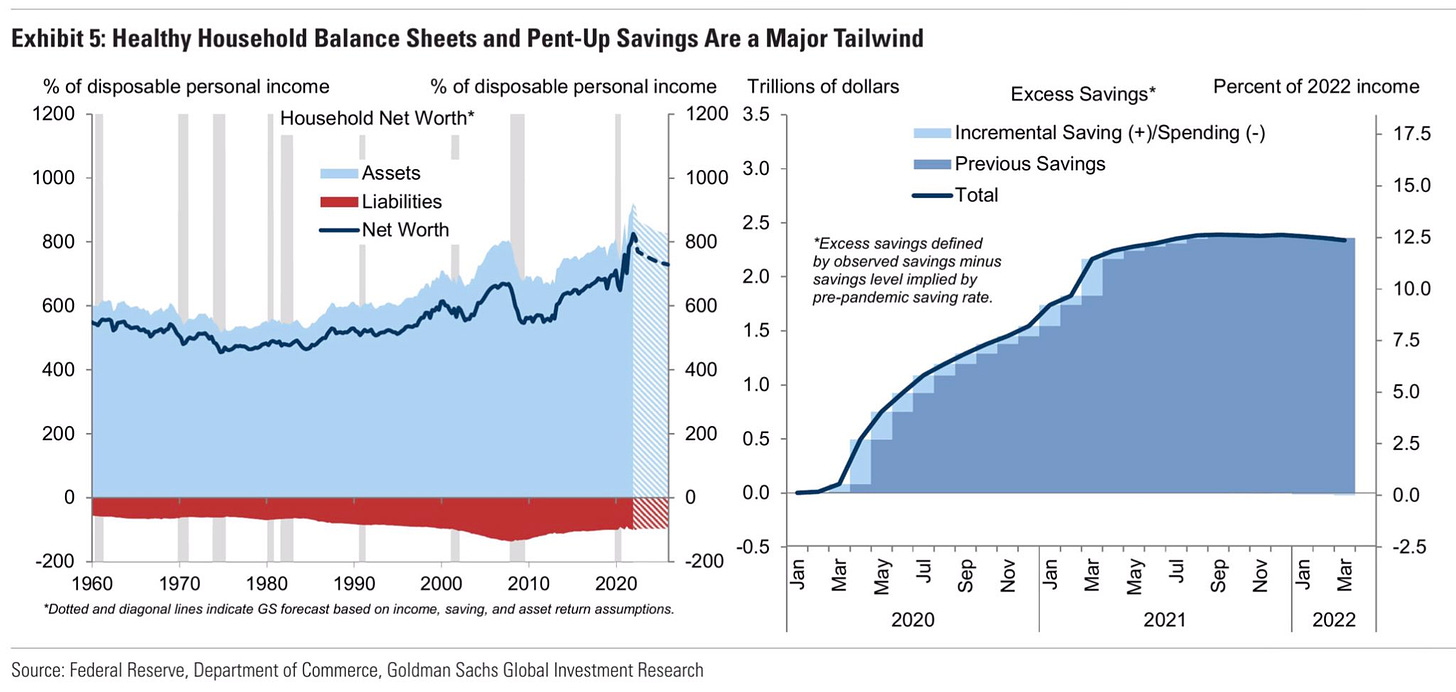

Excess savings are a huge stockpile - it’s going to take a LOT of spending to bit into the $2.4T that people accumulated over the past two years (even if the savings rate has fallen).

(Click on image to enlarge)

Source: Wasteland Capital

-

American Airlines raised guidance for Q2 under the expectation that people will be spending more to travel (which is a positive sign).

-

Wage growth is slowing down (which is gross to say), but it is good from the perspective of moderating inflation and no wage price spiral, as more people enter the labor market

-

CVX highlighted that we are not in complete demand destruction mode yet, so people are still out there spending (although gas prices are very high)

So that’s slowing down. Prices are kind of slowing down as we rotate away from goods and into services, but once again we are facing that mismatch between supply and demand.

seeing companies cancelling 2022 summer internships... this week. that is absolutely brutal

— Matt Slotnick (hiring!) (@matt_slotnick) June 3, 2022

Things are good, but things are bad.

I really liked how Jack said it - “companies should be better companies”. It’s really easy to blame the Fed for everything going on, but like, you can’t blame the paintbrush company for a terrible painting (although, if they sell you a bad brush, it definitely contributes). But you’re the one ultimately creating the Thing - and you have responsibility for it.

VCs also have a responsibility to actually invest on a 5-10 year time horizon and not start shaking at the knees as soon as market conditions froth around. As Shahram said “you should have never bet on a bubble as your exit”.

But do we *need* a recession?

I recently made two TikTok videos (one and two) explaining that we did not need a recession in order to proceed as a society. It was surprisingly controversial! Honestly, it upset me at first (the key to content is having zero emotion, but alas) but as I thought about it more, I could at least see the argument that was being made (along with calling me a capitalist pig).

-

As a note, I am 24 and viscerally remember 2008, but do not have any experience investing in a recession, unless you count sitting on a high yield credit desk in 2020

I want to note that my earlier points about the economy/stock market sometimes ignoring that humans need things (especially in the United States, which is a very zero-sum, individualistic culture) makes some of these points mechanically icky - it can often be advocating for the downfall of others so you can climb a bit higher (at the most simplified level).

I also want to note that there are different types of recessions! Not everyone has to be like in 2008, and if the main goal is an economic slowdown and a minor system reset, that’s different than millions losing their homes and their jobs.

Inside us, there are two wolves - the stock market and the economy.

First - the stock market

-

On sale: People seem to think that things will go on sale during a recession, which will open up the opportunity for them to buy a home (which it honestly might not) or get their favorite stocks on sale.

-

There seems to be a conflation between the stock market going through a bear market (which yes, is a great time to buy stocks) and the economy going through a recession (where friends and family lose their jobs). Ask any millennial who entered the job market in 2008 - they didn’t get ahead. Instead, they got left perpetually behind.

-

-

In the dumpster: But some often seem to not consider the *direct impacts* from a recession, including job loss, higher mortality rates, and exacerbated inequality which will directly impact said valuations of stocks.

-

Homes are a different story - but a fire sale from the losses of others is a tough thing to root for. Also, banks don’t lend as much, and the loans they do lend out will likely be at much higher rates.

-

We already see Blackstone buying up nearly every real estate property they can, so it even home fire sales are not promised. Things might be on sale, but that doesn’t mean you can get access.

-

-

Second - policy and emotion

-

Mistrust - Gen Z and Millennials have a right to not trust the system. Authority keeps on failing us (and everyone) and there doesn’t seem to be a way out of that. It’s really difficult to tell what’s true versus what’s not.

-

Nihilism: This pops up a lot, especially in the finance universe. The New York Times had a whole article on it.

-

Many think that we are past the point of no return, where our policymakers have completely played the game in their own hand. A lot of people are advocating for total system collapse. There is a thread of accelerationism in these ideas - why not create more chaos - the system is already failing.

-

-

It’s a tool: A recession would address the issues we are facing. It would make people stop spending as much, that’s for sure. It would freeze hiring. It would result in a slowdown. It would result in some sort of reset. A recession would pour cold water on the fire, but the problem is - when would the water stop?

-

Individualism: That’s really the core component of what’s going on here - people are realizing that the world isn’t really rolling out the red carpet for them, and there is a lack of perceived support from older generations. Why *not* step on everybody?

Third - zero-sum

-

Chaos is a ladder - Take the bad times to climb even higher.

-

If others lose, I will get ahead: That seems to be what most people in the comments who want a recession are advocating for. “I can get a house on sale” or “Recessions lead to creative destruction” which like, sure. Sure! But it’s very similar to burning down the entire house to paint it a different color. There are other ways to create change than just forcing wreckage.

-

There is a lack of caring about others (which circles back to individualism). Working-class people are most impacted by a recession. But there is a sense of insulation that some people have, which is very difficult to parse against what might actually happen.

-

Kurt Vonnegut’s quote encapsulates this well (h/t jesse)

-

“Americans, like human beings everywhere, believe many things that are obviously untrue. Their most destructive untruth is that it is very easy for any American to make money. They will not acknowledge how in fact hard money is to come by, and, therefore, those who have no money blame and blame and blame themselves. This inward blame has been a treasure for the rich and powerful, who have had to do less for their poor, publicly and privately, than any other ruling class since, say, Napoleonic times.”

-

Leveling the playing field: When you’re a young person without a home or kids, it’s a pretty easy move to want to watch the world burn. There is an idea that a Recession would do this, create equal opportunities for people to try and make it. It feels like there is no choice but a recession as a way to get ahead. It is really sad and unfortunate that we resort to that model of thinking.

-

Zombie company clean out: With that being said, there is a fair point to be made that we have a lot of very stupid companies that took both 1) talent and 2) money, and it would be very ideal to clean the brush from them and reallocate capital.

-

Corporate profits: It’s also a narrative that companies have made a substantial amount of money on the backs of consumers, raising prices when many could least afford it. And that’s honestly a whole different piece, but I wanted to highlight that this does indeed suck. Margins are falling, so this is changing but the sentiment likely will remain.

-

I think that the people that are advocating for a recession are doing a few things - conflating a bear market (assets on sale) with a time where people lose their jobs, advocating for themselves above others, thinking that cleaning the brush out of the forest should involve burning down the whole thing, and conflating innovations and recessions (innovation does happen during a recession but it doesn’t need to be that way). Of course, Schumpeter and his thoughts on creative destruction come in where recessions are an adjustment to change and the phoenix rises from the ashes or whatever. WeForum has good thoughts on how to make creative destruction less destroy-ey - to make sure it’s more creative than destructive.

Final Thoughts

We are not in a recession. The recent GDP print was a bit fluky from inventories and other drags, but most metrics are positive and encouraging. The labor market is recovering and is slowing where it needs to so we don’t get excess inflation. Things are broadly just very difficult, and a recession isn’t going to fix most of it.

we are reaching a real breaking point: pandemic fatigue, inflation, a housing crisis, the narrowing of women’s rights, mass shootings. all this (and much more) as a conservative SCOTUS remaps every progressive law. and with no time to properly process because we are busy working

— jason (@nonlinearnotes) May 25, 2022

But I have sympathy for those who somehow think that a recession is a way to get ahead. It underscores hopelessness and frustration and anger that has become all too common over the past many years. It makes sense. But a recession is not the solution to fixing our problems. The system needs to change, but burning it all to the ground will just create a pile of rubble. I also want to underscore that wealth inequality is a massive issue, and even to argue that a recession is good vs bad is a privilege.

It’s difficult, and many people much smarter than I am wrestling with how to fix this every single day. But we can make it better.

Solutions

These are not comprehensive. I would love to hear others’ thoughts.

-

Stop companies from doing buy-for-rent. Private equity is like, not the best thing to happen to the world, and some constraints might go far.

-

Hold venture capital firms accountable for what they invest in. For example, carbon credits are a fine start but it’s not the best way to solve climate change

-

As Brian Chappatta said, create better savings vehicles. Modernize TreasuryDirect.

-

Invest in green energy alternatives so we are not as reliant on fossil fuels

-

Finally,

Source: Haus of Decline

Links

-

Upslope Capital Management - Core Investment Tenets

-

Bluegrass Capital - Most Valuable Lessons

-

The DSR - Shifts in growth, inflation, risk premium and positioning

-

Liberty Street Economics - What do consumers think will happen to inflation?

-

Scott Duke Kominers - Metaverse Land

-

Morgan Housel - Different Kinds of BS

-

Liberty Street Economics - Housing Boom and the Decline in Mortgage Rates

-

John C Williams - The Song Remains the Same

Disclaimer: These views are not investment advice, and should not be interpreted as such. These views are my own, and do not represent my employer. Trading has risk. Big risk. Make sure that you can ...

more