Despite The War In Europe, Gold Remains Below Its 2011 High

Can gold's recent short-term rally be considered bullish, or can we expect a decline like in 2008?

Gold and silver are moving higher today, but nothing really changed despite that. Silver moved to its previous highs, while gold didn’t (chart courtesy of https://GoldPriceForecast.com).

Yes, the silver price is once again outperforming on a very short-term basis, and it makes the previous bearish indications stronger.

As a reminder, silver is much more popular with the investment public than gold is (relative to how they are both popular with institutional buyers, that is), quite likely due to multiple theories surrounding its mispricing and also quite likely due to the fact that the silver market is much smaller than the gold market and big buyers can’t easily enter the silver market without moving its price too much.

Since the investment public tends to buy close to the tops (and sell close to the bottoms), silver’s outperformance relative to gold is what we often see as an indication that both precious metals are about to move lower.

Yes, there is some fundamental sense to PMs’ moving higher – China is ending its zero-COVID policy, which means some extra uncertainty for the markets, but overall, it’s unlikely to change that much.

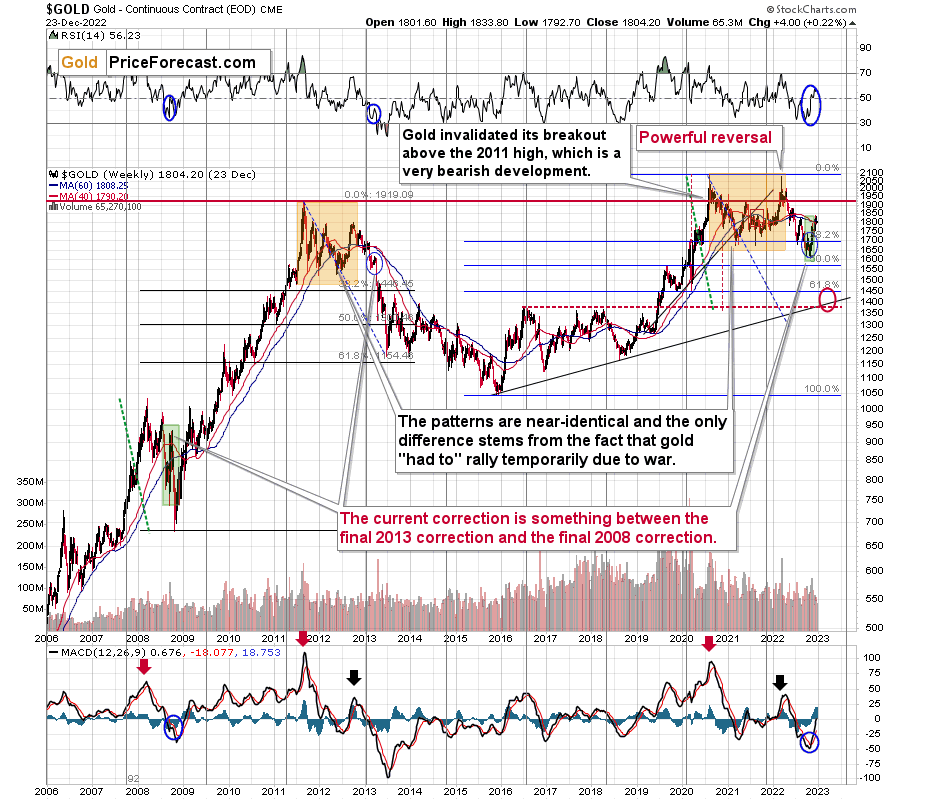

Aside from the day-to-day price swings, the big picture for gold and the USD Index (one of gold’s price key drivers) should make it clear that whatever we have seen in the recent months was not bullish, but rather a regular correction within a medium-term downtrend.

The size of the recent short-term upswing may seem significant, but only until one zooms out and notices that the correction that we saw in 2008 was even bigger. It was then followed by a huge decline. I marked both rallies – 2008 one and the current one – with green rectangles.

The 2008 correction ended with gold above its 40- and 60-week moving averages. That’s where gold has moved recently as well.

Why would the current situation be similar? In both cases, there is major trouble ahead for the stock market due to tighter financial conditions. Back in 2008, it was the subprime crisis that started it all, and while the circumstances were different this time, interest rates (nominal and real) are now on the rise (globally!), which is likely to contribute to people's rapidly decreasing motivation to hold anything that doesn't provide interest or a decent yield. Also, speaking of the big picture, did you notice that gold is NOT above its 2011 high despite so many dollars, euros, yen, and other currencies being printed since that time? Gold is not above its 2011 high even though there’s now a war in Europe!

Silver is not even trading at half of the value that it had at its 2011 top…

And gold stocks… The HUI Index is trading below its 2003 (yes!) high.

All these are not signs of a strong market. Conversely, these are indications that the precious metals market wants to move lower in the following months, and (probably) weeks.

While the precious metals sector doesn’t need a specific trigger to decline, getting one would speed up the decline, and it seems that it’s about to get one from the USD Index.

The USDX moved to its 2016 and 2020 highs and is now trading slightly above them. It’s normal for any market to verify breakouts by moving back to the previously broken levels before the main move continues. Consequently, it’s no wonder that the USD Index did exactly that.

It’s also normal that the recent corrective downswing was sharp – because that’s how the preceding rally was, too.

As very strong support was reached, the USD Index is now likely to rally once again. Since the USDX and the precious metals market tend to move in opposite directions, it implies lower precious metals values in the future, and it seems that we won’t have to wait too long, either.

More By This Author:

The Breakout That’s Really Important For GoldGold Price: Real Implications Of Yen’s Strength

Gold’s Most Important “Hammer”

Disclaimer: All essays, research and information found on the Website represent the analyses and opinions of Mr. Radomski and Sunshine Profits' associates only. As such, it may prove wrong ...

more