Despite Big Bounce, Banks & Crude End Week Down Hard; Gold At Record Highs

Image Source: Pixabay

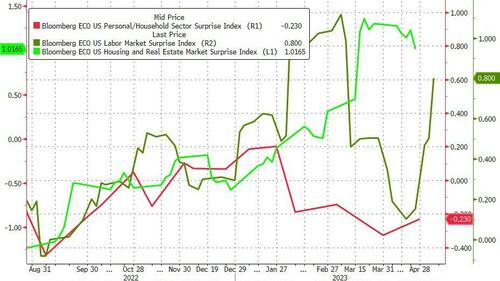

This past week was an odd one, as it was full of data that surprised many. Housing data was great, labor data was also great, and personal/household data was anything but.

Source: Bloomberg

After a narrative shift that the banking crisis is not real and is instead all due to short-sellers, Friday saw a gigantic short-squeeze in several regional banks (PACW was even up almost 100% at one point).

However, regional banks were still down hard on the week.

Source: Bloomberg

Someone tell those evil stock shorts to stop shorting PACW bonds. That's ok, the short selling ban will fix this. https://t.co/SiSR7PepVw pic.twitter.com/6eBl33XToF

— zerohedge (@zerohedge) May 5, 2023

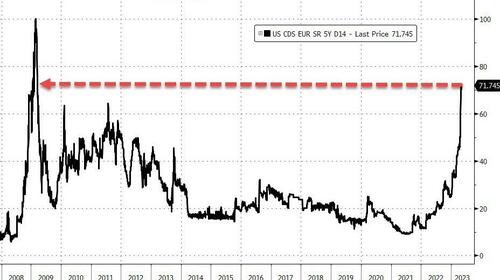

Oh, and don't forget the debt ceiling is looming ever closer.

Source: Bloomberg

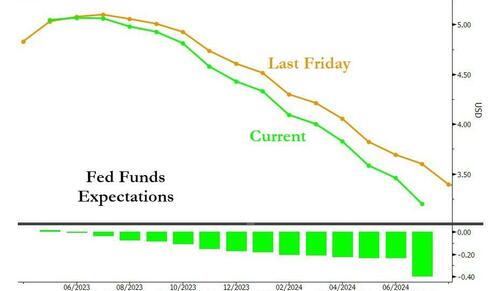

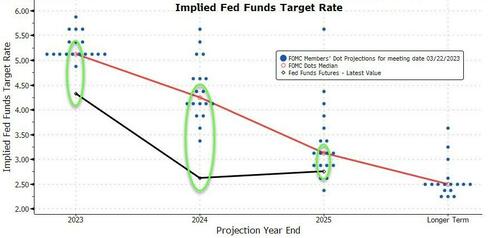

The market's expectations for The Fed tumbled dovishly this week as Powell hinted that it was over.

Source: Bloomberg

Markets were seen pricing in rates being 75 bps lower than current levels by year-end.

Source: Bloomberg

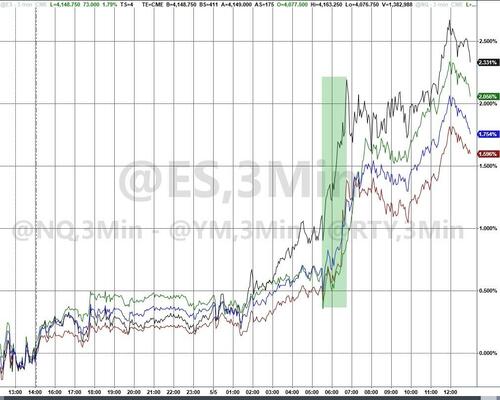

But it was Friday, so the day saw heavy squeezing that seemed to ignore Bullard's comments.

Bullard's message was clear - this is not a pivot. “The aggressive policy we pursued in the last 15 months has stemmed the rise in inflation, but it is not so clear we are on” a path to 2%, Bullard told reporters following an event in Minneapolis Friday. He said he is willing to assess the economic data as it comes in, but he would need to see “meaningful declines in inflation” to be convinced higher rates aren’t necessary.

However, despite the bounce, only the Nasdaq made it back into the green for the week (but the last few minutes saw selling push it back into the red), while the Dow was the ugliest horse in the glue factory.

The big short squeeze on Friday took the 'most shorted' stocks back to being unchanged on the week.

Source: Bloomberg

But notably, 0DTE was aggressively fading the early gains in stocks before reversing.

Source: SpotGamma

Most notably, the early action was all put buying while the late surge was call-buying instead of not covering.

Source: SpotGamma

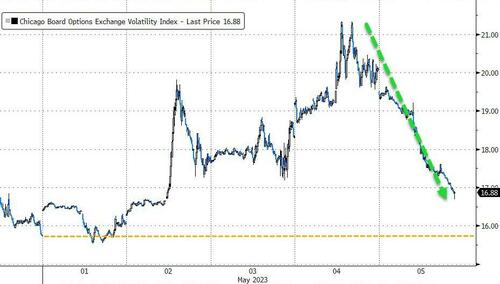

Despite a big tumble on Friday, equity risk (VIX) appeared higher on the week for the first time in two months.

Source: Bloomberg

Credit risk was higher on the week.

Source: Bloomberg

Bonds were mixed on the week.

Source: Bloomberg

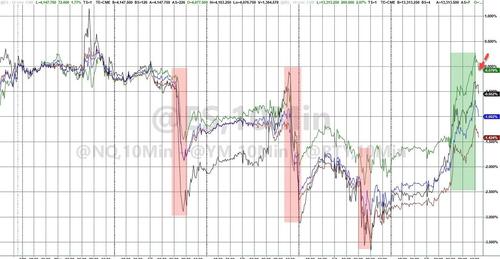

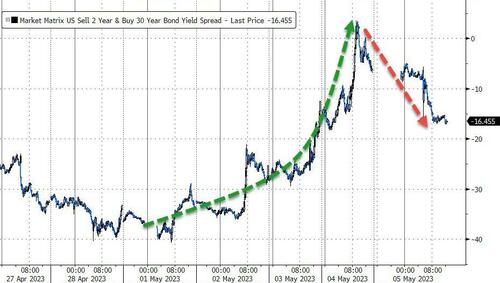

Meanwhile, the yield curve steepened significantly on the week.

Source: Bloomberg

The US dollar was notably down again for the seventh week in the past nine weeks.

Source: Bloomberg

Bitcoin was flat on the week while Ethereum notably outperformed (topping $1950).

Source: Bloomberg

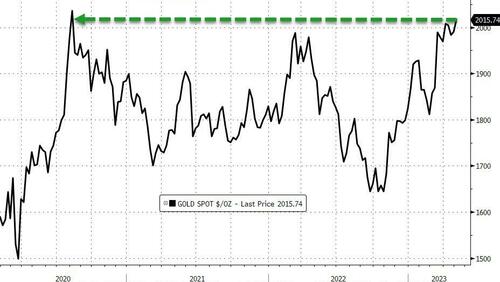

Gold & silver were up on the week, with the latter outperforming (amid a lot of choppy market action).

Oil & natural gas were down hard on the week despite the bounce seen on Friday. Oil's mid-week crash seemed to flush some hands out.

Natural gas was just a sell throughout the week.

Gold ended just shy of a weekly closing record high.

Source: Bloomberg

Finally, bear in mind that the market is still massively more dovish than the Fed's expects (the market sees a 38% chance of a cut in July).

Source: Bloomberg

More By This Author:

Ignore The Noise: Job Market Is Cracking As Birth-Death Model "Adds" Near Record 378,000 Jobs

Goldman: Has Ethereum Become A Deflationary Asset?

Microsoft Teams Up With AMD To Dethrone Nvidia From AI Chip Throne

Disclosure: Copyright ©2009-2023 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more