Daily Market Outlook - Wednesday, Dec. 17

Photo by Chris LeBoutillier on Unsplash

Oil prices surged on Wednesday after U.S. President Donald Trump announced a "total and complete" blockade on all sanctioned oil tankers entering or leaving Venezuela. This bold move has heightened geopolitical tensions amid ongoing concerns about global oil demand. The action represents Washington's latest effort to ramp up pressure on Venezuelan President Nicolas Maduro's administration, targeting its primary revenue source. Meanwhile, the broader financial markets appeared directionless as a much-anticipated U.S. jobs report came and went without much impact. Investors are now shifting their attention to upcoming interest rate decisions from the Bank of England, the European Central Bank, and the Bank of Japan later this week, alongside key U.S. inflation data. In China, the market told two very different stories. AI chipmaker MetaX Integrated Circuits made a spectacular debut, with its shares skyrocketing 700%. Investors are eager to seize opportunities tied to China's push to reduce reliance on AI chips from major U.S. companies. On the flip side, property developer China Vanke is requesting an extension for a 2 billion yuan ($283.6 million) bond payment grace period, increasing it from five trading days to 30. This highlights ongoing struggles in China's troubled real estate sector.

The U.S. dollar slightly rebounded from its lowest levels since early October on Wednesday, following data that indicated a sluggish labour market, leaving investors anxious about the timing of the next interest rate cut from the Federal Reserve. The euro dipped yet remained close to the 12-week high it achieved during the previous session, ahead of Thursday's European Central Bank policy decision, where it is anticipated that rates will remain unchanged. The dollar index, which gauges the U.S. currency against six other currencies, increased by 0.18% still near its lowest level since October 3, which was recorded on Tuesday. The index has fallen around 9.5% this year, on course for its largest annual drop since 2017.The combined October/November payrolls report showed mixed results, signalling a softening labour market. November added 64k jobs (above the 50k estimate), but October saw a sharp decline of -105k jobs, with a downward revision pulling the 3-month average to just 22k. Fed Chair Powell may interpret this as a contraction, given his view that job growth is overstated by 60k/month. October’s weak data partly reflects mechanical adjustments, such as deferred resignations during the DOGE frenzy and cutting government jobs by 162k. Private payrolls added 69k jobs in November, raising the 3-month average to 75k, driven by health care (+46k) and construction (+28k), while most sectors shed workers. Unemployment rose to 4.6% (from 4.4% in September), with nearly a million more unemployed since the year’s start. A favourable CPI report on Thursday could support further Fed rate cuts early next year.

Domestically, UK inflation in November saw a notable drop, with headline CPI falling to 3.2% y/y, 0.4ppts lower than October and undershooting consensus by 0.3ppts. Core CPI also declined to 3.2% y/y, while services CPI eased to 4.4% y/y, slightly below market and BoE forecasts. Food price inflation dropped significantly to 4.0% y/y, aided by decreases across categories like clothing and footwear, influenced by Black Friday sales and pre-Budget consumer constraints. Markets now expect a BoE rate cut tomorrow, though hawkish MPC members may see this as a one-off event rather than a trend.

Overnight Headlines

- German Biz Confidence Set To Drift Sideways Amid Growth Worries

- Germany Set To Approve €50B In Military Purchases

- UK PM Starmer Pushes Back On Delayed Defence Spending Plan

- Japan Exports Expand For Third Month, Led By US And EU Demand

- Trump Orders Venezuela Oil Tanker Blockade, Oil Prices Jump

- US Threatens To Retaliate Against EU Firms Over Digital Tax

- Trump Weighs Pressuring Defence Firms To Cut Buybacks, Dividends

- Dallas Fed Paper Warns Fed Funds Rate Less Effective

- RBNZ Expects Capital Rules To Lower Rates

- China’s Market Revival Hinges On Gloomy Economy Turning Corner

- Warner To Urge Shareholders To Reject Paramount Offer

- Spirit Airlines Eyes Merger With Frontier Amid Restructuring

- Lennar’s Outlook Disappoints In ‘Challenged’ Market

- Chinese AI Chipmaker MetaX Shares Jump 600% On Debut

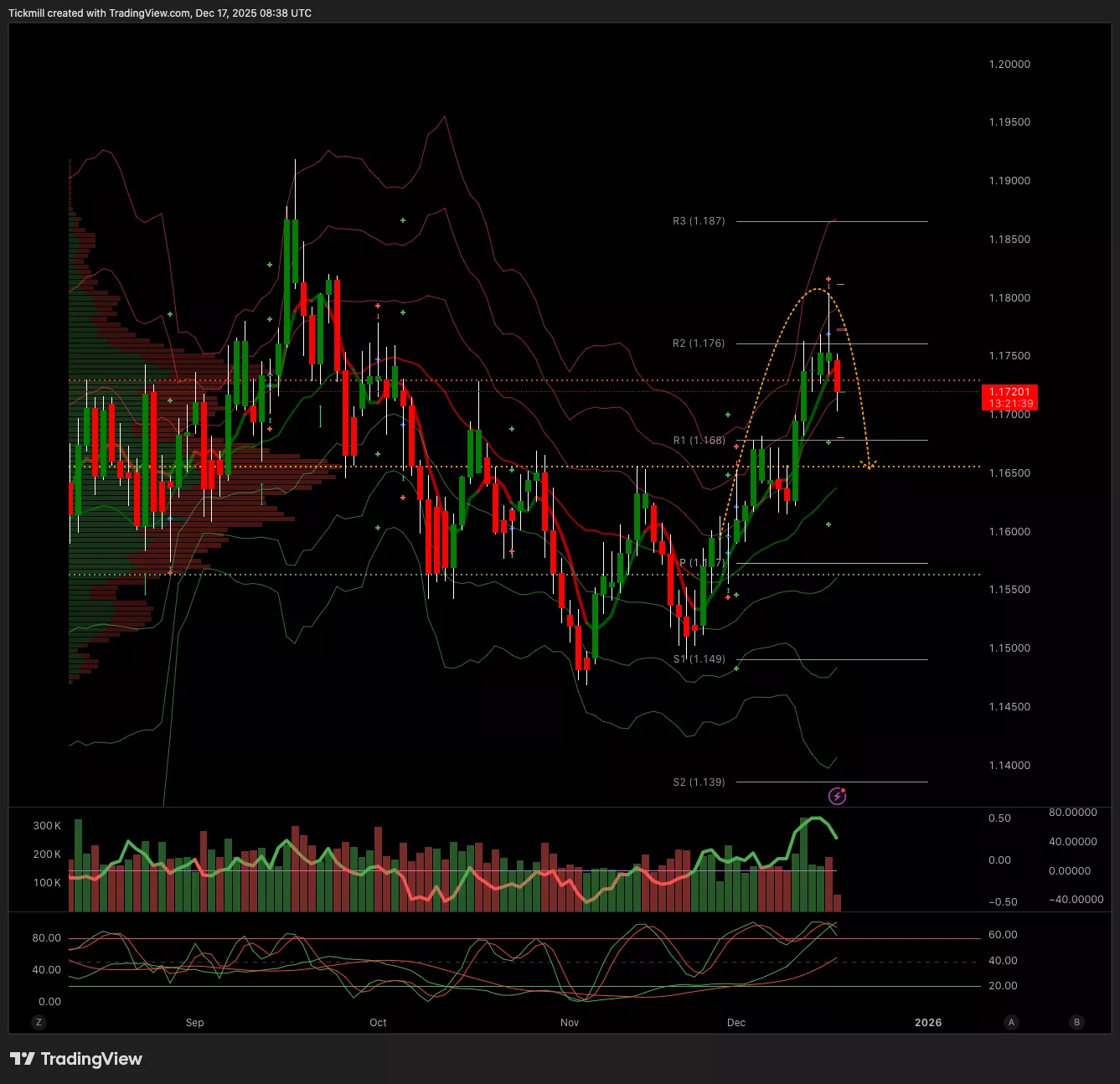

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

- EUR/USD: 1.1600-10 (1.41BLN), 1.1620-30 (1.74BLN), 1.1635-45 ( 585M)

- 1.1650-55 (733M), 1.1665-75 (512M), 1.1700 (1.7BLN), 1.1725-35 (371M)

- 1.1740-50 (1.6BLN), 1.1775-85 (1.7BLN), 1.1800 (2.2BLN), 1.1825 (468M)

- 1.1850 (641M)

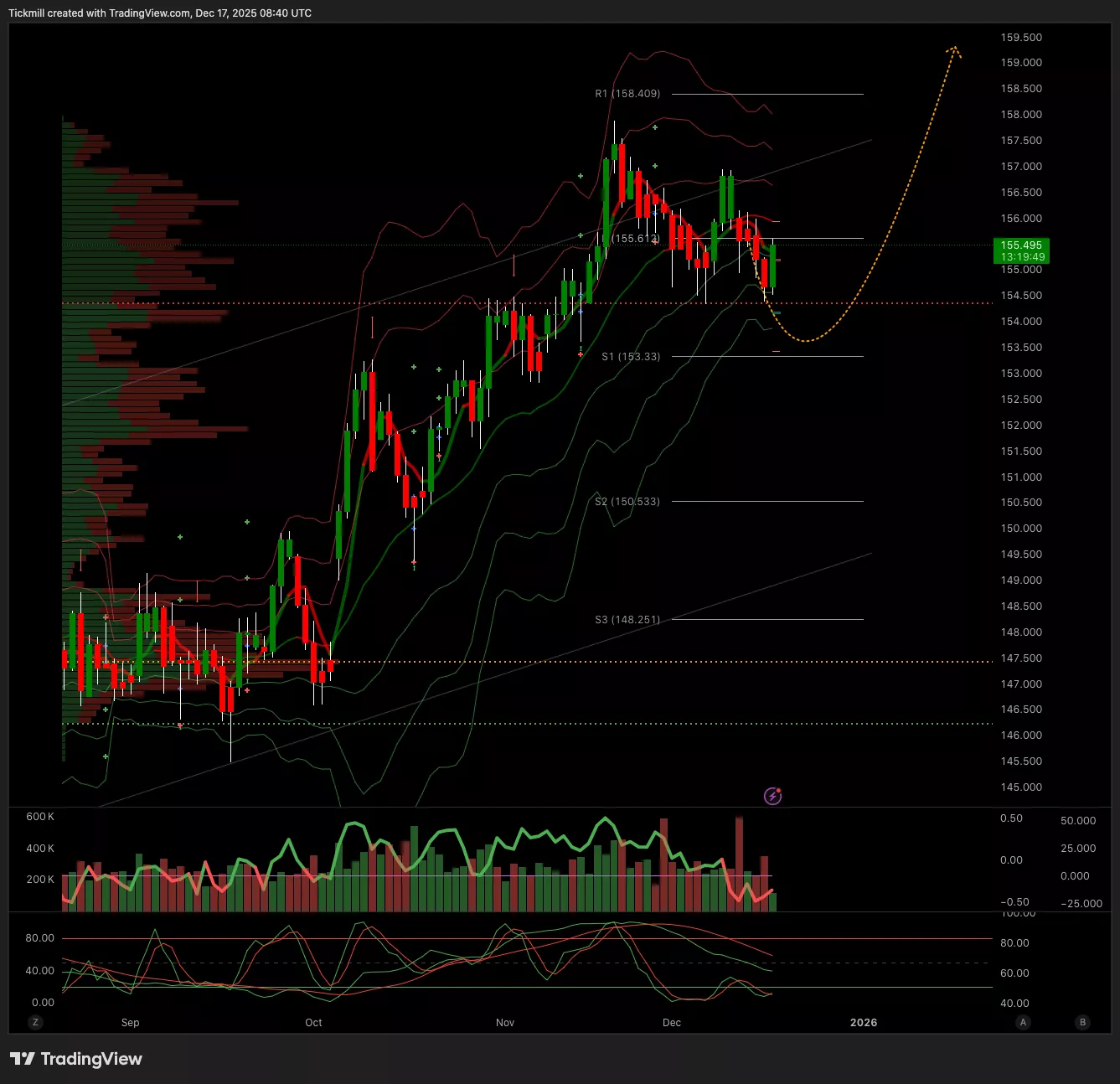

- USD/JPY: 153.75 (750M), 154.00 (715M), 154.75 (676M), 155.00 (449M)

- 155.20-25 (611M), 156.00 (850M),

- USD/CHF: 0.7800 (350M), 0.7940-50 (336M), 0.7975 (274M), 0.8100 (442M)

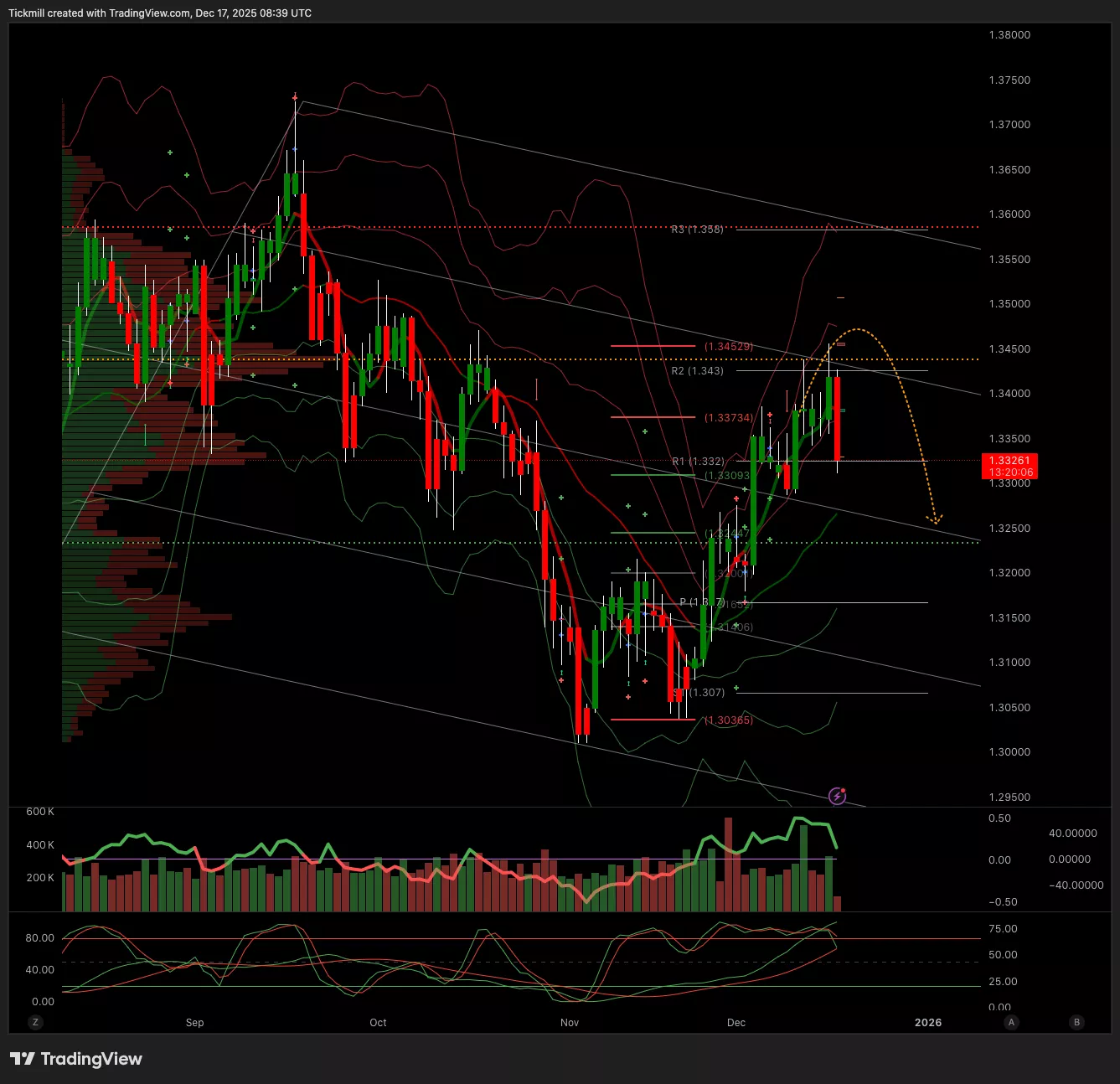

- GBP/USD: 1.3200-10 (583M),. EUR/GBP: 0.8650 (338M), 0.8675 (325M)

- AUD/USD: 0.6530-40 (430M), 0.6550 (300M), 0.6575-80 (673M)

- 0.6590-00 (783M), 0.6620-30 (876M), 0.6650-60 (1.12BLN), 0.6700 (938M)

- NZD/USD: 0.5780 (422M), 0.5800 (366M), 0.5845-50 (453M)

- AUD/NZD: 1.1450-60 (565M)

- USD/CAD: 1.3700-10 (300M), 1.3775 (230M), 1.3790 (240M)

CFTC Positions as of the Week Ending 7/10/25

- CFTC FX positioning data backlog clears January 20. Upcoming data on December 12, 16, 19, 23, 30, followed by January 6, 9, 13, 16, 20. Normal service resumes January 23.

- CFTC Positions as of November 25, 2025:

- - S&P 500 CME net short position rises by 26,722 to 380,984; net long position falls by 1,702 to 905,745.

- - CBOT US 5-year Treasury futures net short decreased by 90,691 to 2,291,322.

- - CBOT US 10-year Treasury futures net short increased by 27,686 to 781,383.

- - CBOT US 2-year Treasury futures net short decreased by 78,603 to 1,266,676.

- - CBOT US UltraBond net short down by 2,025 to 283,658.

- - CBOT US Treasury bonds net short decreased by 35,910 to 31,601.

- - Bitcoin net short position: -83 contracts.

- - Swiss franc: -35,360 contracts net short.

- - British pound: -93,221 contracts net short.

- - Euro: 94,071 contracts net long.

- - Japanese yen: 26,517 contracts net long.

Technical & Trade Views

SP500

- Daily VWAP Bearish

- Weekly VWAP Bullish

- Above 6865 Target 7030

- Below 6850 Target 6700

EURUSD

- Daily VWAP Bullish

- Weekly VWAP Bullish

- Above 1.1750 Target 1.1780

- Below 1.1740 Target 1.1870

GBPUSD

- Daily VWAP Bearish

- Weekly VWAP Bullish

- Above 1.34 Target 1.3550

- Below 1.3380 Target 1.3250

USDJPY

- Daily VWAP Bearish

- Weekly VWAP Bullish

- Above 155.69 Target 157.79

- Below 155.36 Target 154.59

XAUUSD

- Daily VWAP Bullish

- Weekly VWAP Bullish

- Above 4274 Target 4380

- Below 4260 Target 4151

BTCUSD

- Daily VWAP Bearish

- Weekly VWAP Bearish

- Above 90.8k Target 95.7k

- Below 87.9k Target 80.6k

More By This Author:

The FTSE Finish Line - Tuesday, Dec. 16

Daily Market Outlook - Tuesday, Dec. 16

Emini S&P 500 Weekly Live Market & Trade Analysis - Monday, Dec. 15