Daily Market Outlook, Thursday, September 12

Munnelly’s Macro Minute…

"Inflation Data Leads To Market Whipsaw, ECB On Deck Next ”

On Wednesday, US stocks experienced a significant decline at the outset of the trading session; however, a vicious short squeeze led to a V-shaped recovery intraday. The Nasdaq drove the recovery, as all major US averages concluded the day in positive territory. The Nasdaq soared by 2.2% after falling by as much as 1.4% in early trading. The S&P 500 increased 1.1%, while the Dow rose by 0.3% after reaching its lowest intraday level in nearly a month.

Asian markets are primarily trading higher on Thursday, as traders respond to a critical US inflation report that revealed a higher than anticipated increase in core inflation. This report has heightened expectations for a quarter-point rate cut at next week's US Federal Reserve's monetary policy meeting. The Fed's likelihood of reducing interest rates by 50 basis points appeared to be diminished by the data; however, it is anticipated that the Fed will continue to reduce rates in the months ahead. Following the report, the FedWatch Tool from CME Group is forecasting an 83% likelihood of a quarter-point rate reduction and a mere 17% probability of a half-point rate cut. The post inflation report reaction caused the yen to decline from its highest level versus the dollar since December, and the Nikkei index in Japan ended a seven-day losing streak. TSM was among the top gainers, as a regional index of technology equities rose by over 3% following Nvidia Corp.'s 8.2% increase overnight.

The European Central Bank policy decision is the primary risk event of the day in the European session. A quarter-point reduction is already entirely anticipated; however, it is unclear whether the central bank will implement additional reductions in October and December. The market is currently pricing a move next month at approximately 40%, indicating that inflation-wary conservatives remain in the majority. The most probable outcome is that ECB President Christine Lagarde will adhere to the most recent narrative, which states that decisions are made on the basis of incoming data at each meeting, in her post-meeting briefing. In this context, it is probable that the movement of the US curve will continue to dominate cross-market spreads between euro area and US rate expectations.

Subsequently, the focus will return to the United States, where weekly unemployment claims and producer price data are scheduled. The Federal Reserve's singular emphasis on the labor market's health has resulted in an increased emphasis on jobless claims. A negative result, which surpasses the anticipated 230,000, could raise the possibility of a 50 basis point reduction. The PPI is anticipated to have increased by 0.1% last month, according to economists. Several components of the data will assist analysts in the refinement of inflation forecasts for the Personal Consumption Expenditures Price Index, the Federal Reserve's preferred inflation indicator.

Overnight Newswire Updates of Note

-

Trump Hints At Another Debate With Harris, Eyes NBC & FOX

-

ECB To Cut Rates As Growth Slows, Outlook Uncertain

-

Europe's Privacy Watchdog Probes Google’s AI Data Use

-

Surveyors Report Rise In UK House Prices For First Time In ~2 Years

-

US Bond Market’s Bet On A Half-point Rate Cut Is Over

-

Blackstone CFO Chae: US Inflation Is 'At Target'

-

RBNZ Seen Cutting Rates Further, Than Forecasts

-

Japan’s Aug Inflation Slows, Eases BoJ Pressure

-

Oil Tumbles Out Of Range As Recession Fears Grow

-

XAU Bulls Sidelined As Larger Fed Rate Cut Bets Fade

-

Putin Urges Russia To Consider Limiting Metal Exports

(Sourced from reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

-

EUR/USD: 1.1000 (4.4BLN), 1.1025-30 (3.2BLN), 1.1035-40 (2BLN)

-

1.1045-55 (5.2BLN), 1.1100-10 (2.2BLN), 1.1175-80 (892M), 1.1200-10 (3.4BLN)

-

USD/CHF: 0.8455 (815M), 0.8595-0.8600 (865M)

-

GBP/USD: 1.2990-1.3000 (338M), 1.3050 (415M), 1.3140 (313M)

-

EUR/GBP: 0.8420 (250M), 0.8435-40 (472M), 0.8470 (622M)

-

AUD/USD: 0.6645-55 (900M), 0.6675 (1BLN), 0.6710-15 (1.7BLN)

-

0.6725 (455M), 0.6750 (1.2BLN)

-

EUR/AUD: 1.6560-75 (695M). NZD/USD: 0.6175 (267M)

-

USD/CAD: 1.3590 (1.4BLN). EUR/JPY: 156.75 (576M)

-

USD/JPY: 141.40 (1BLN), 142.00 (1.5BLN), 144.15 (500M)

CFTC Data As Of 6/9/24

-

Bitcoin net long position is 108 contracts

-

Swiss Franc posts net short position of -21,882 contracts

-

British Pound net long position is 108,078 contracts

-

Euro net long position is 100,018 contracts

-

Japanese Yen net long position is 41,116 contracts

-

Equity fund managers raise S&P 500 CME net long position by 1,368 contracts to 991,219

-

Equity fund speculators trim S&P 500 CME net short position by 85,360 contracts to 271,561

-

Speculators increase CBOT US 10-year Treasury futures net short position by 88,390 contracts to 1,002,827

Technical & Trade Views

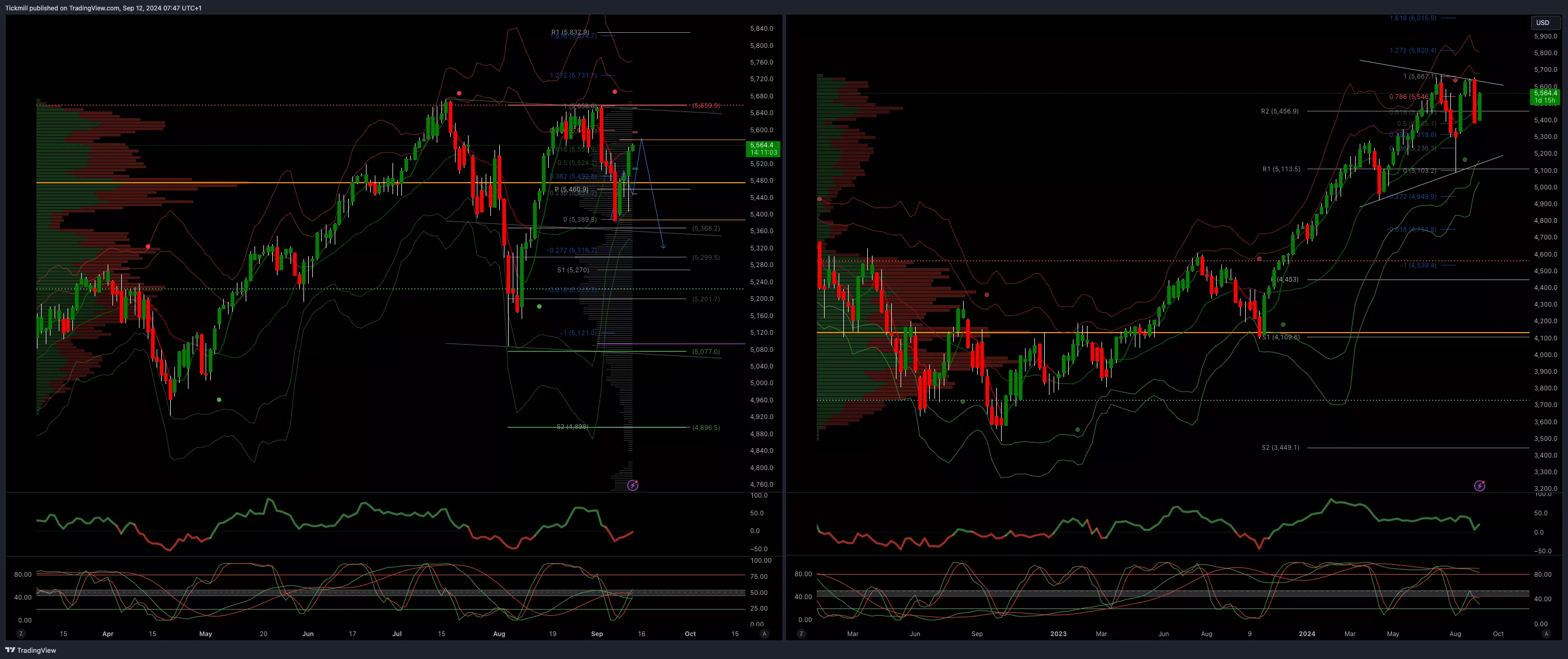

SP500 Bullish Above Bearish Below 5600

-

Daily VWAP bullish

-

Weekly VWAP bearish

-

Above 5610 opens 5660

-

Primary resistance 5600

-

Primary objective is 5325

(Click on image to enlarge)

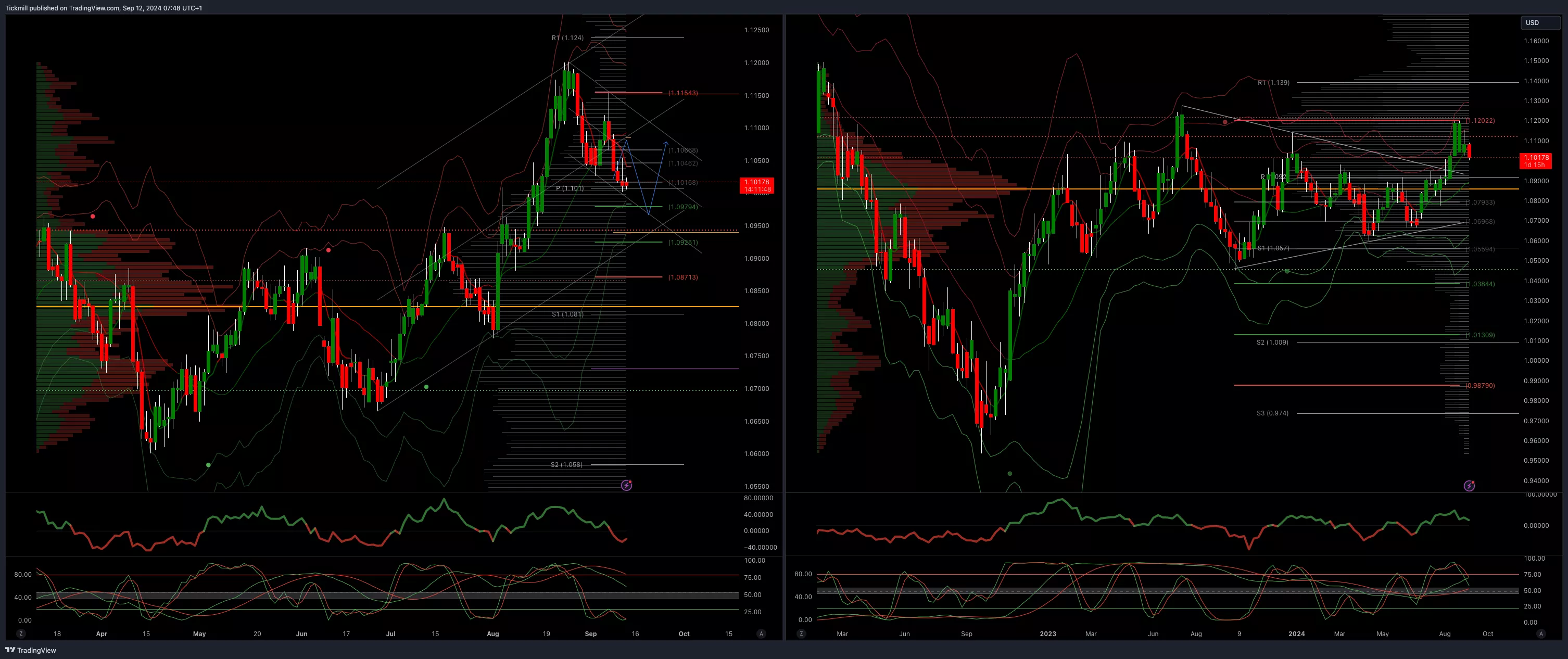

EURUSD Bullish Above Bearish Below 1.1140

-

Daily VWAP bearish

-

Weekly VWAP bullish

-

Below 1.09 opens 1.0850

-

Primary resistance 1.1150

-

Primary objective 1.0950

(Click on image to enlarge)

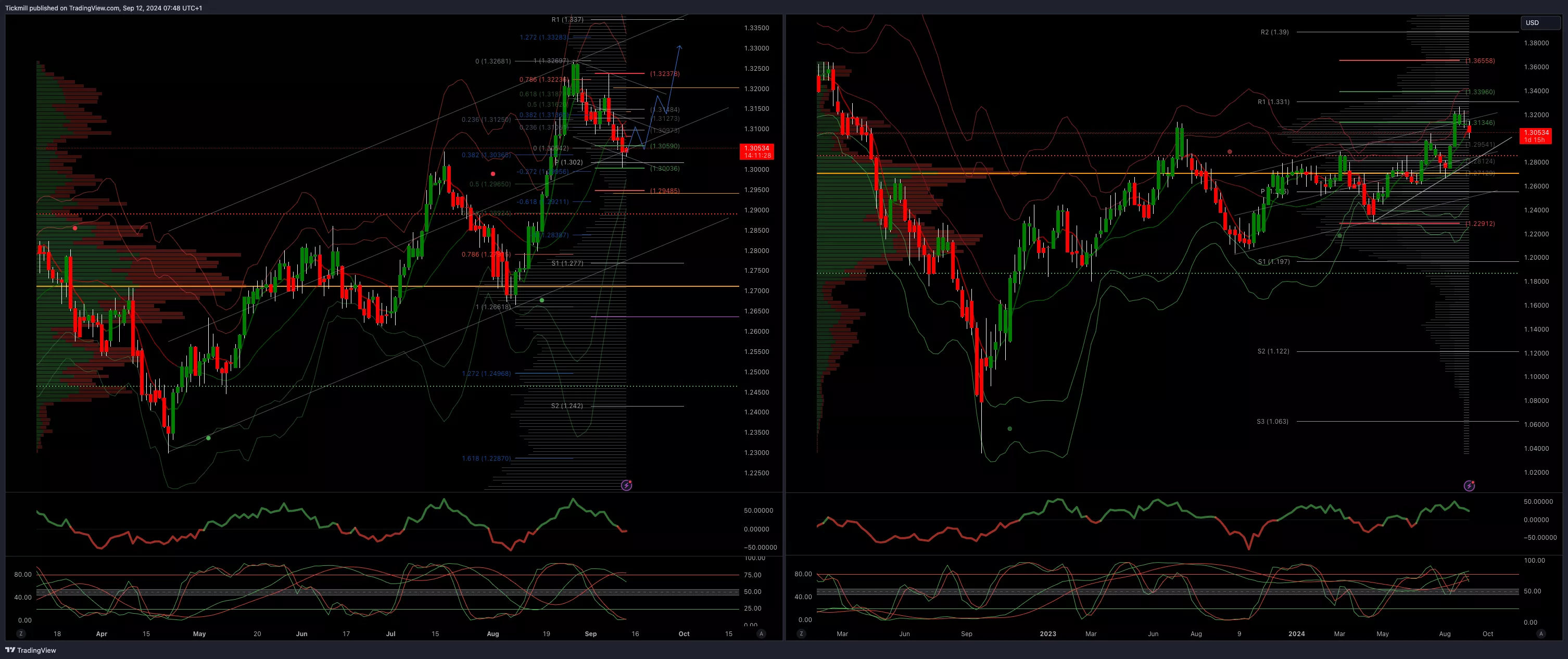

GBPUSD Bullish Above Bearish Below 1.3190

-

Daily VWAP bearish

-

Weekly VWAP bullish

-

Below 1.3050 opens 1.2960

-

Primary support is 1.2730

-

Primary objective 1.3390

(Click on image to enlarge)

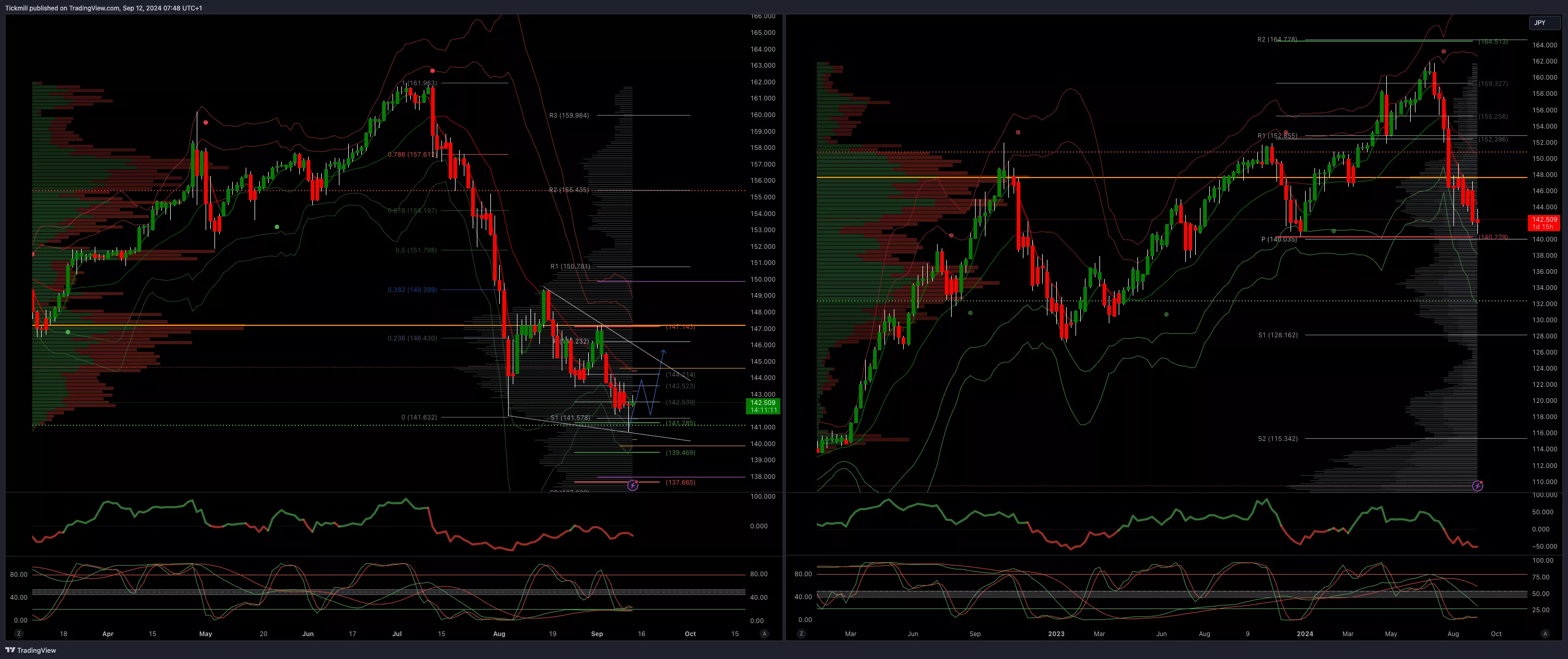

USDJPY Bullish Above Bearish Below 143.70

-

Daily VWAP bearish

-

Weekly VWAP bearish

-

Above 146 opens 150

-

Primary support 140

-

Primary objective is 139.60

(Click on image to enlarge)

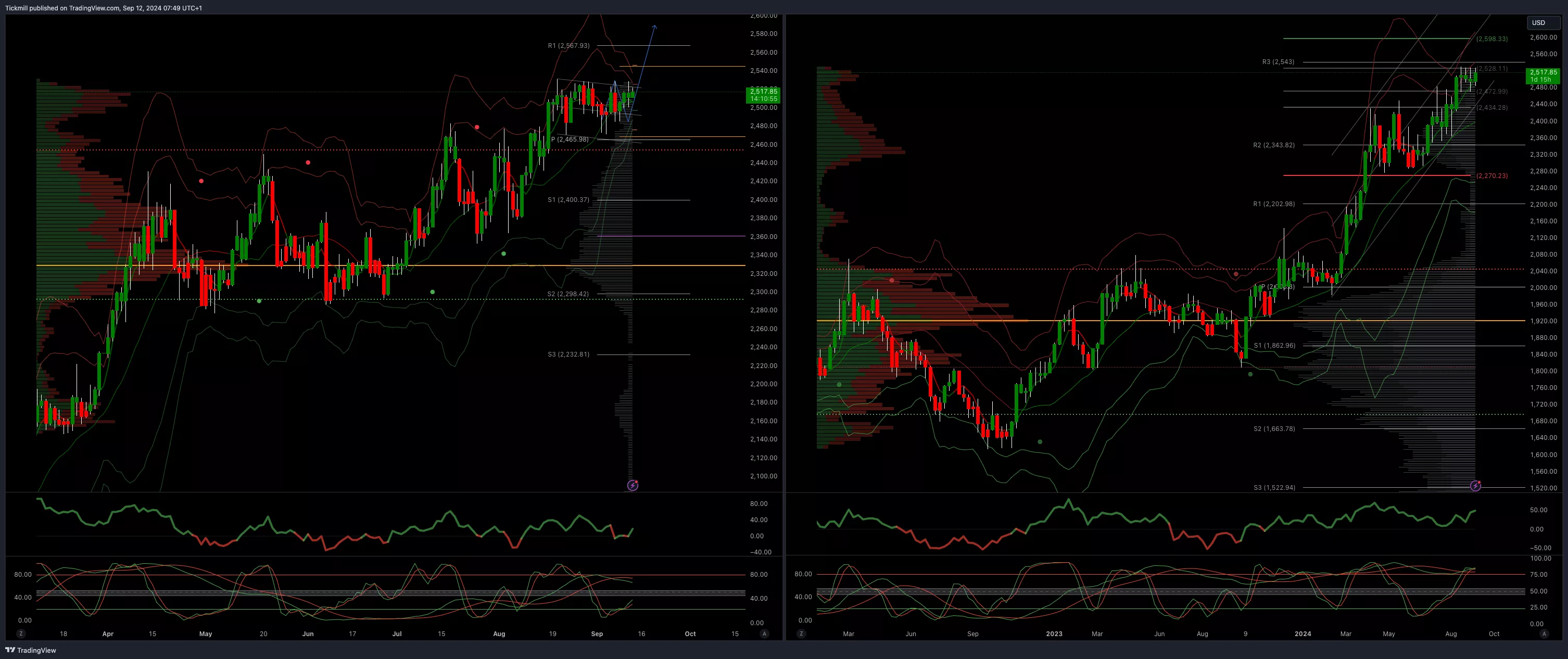

XAUUSD Bullish Above Bearish Below 2500

-

Daily VWAP bullish

-

Weekly VWAP bullish

-

Below 2450 opens 2400

-

Primary support 2300

-

Primary objective is 2598

(Click on image to enlarge)

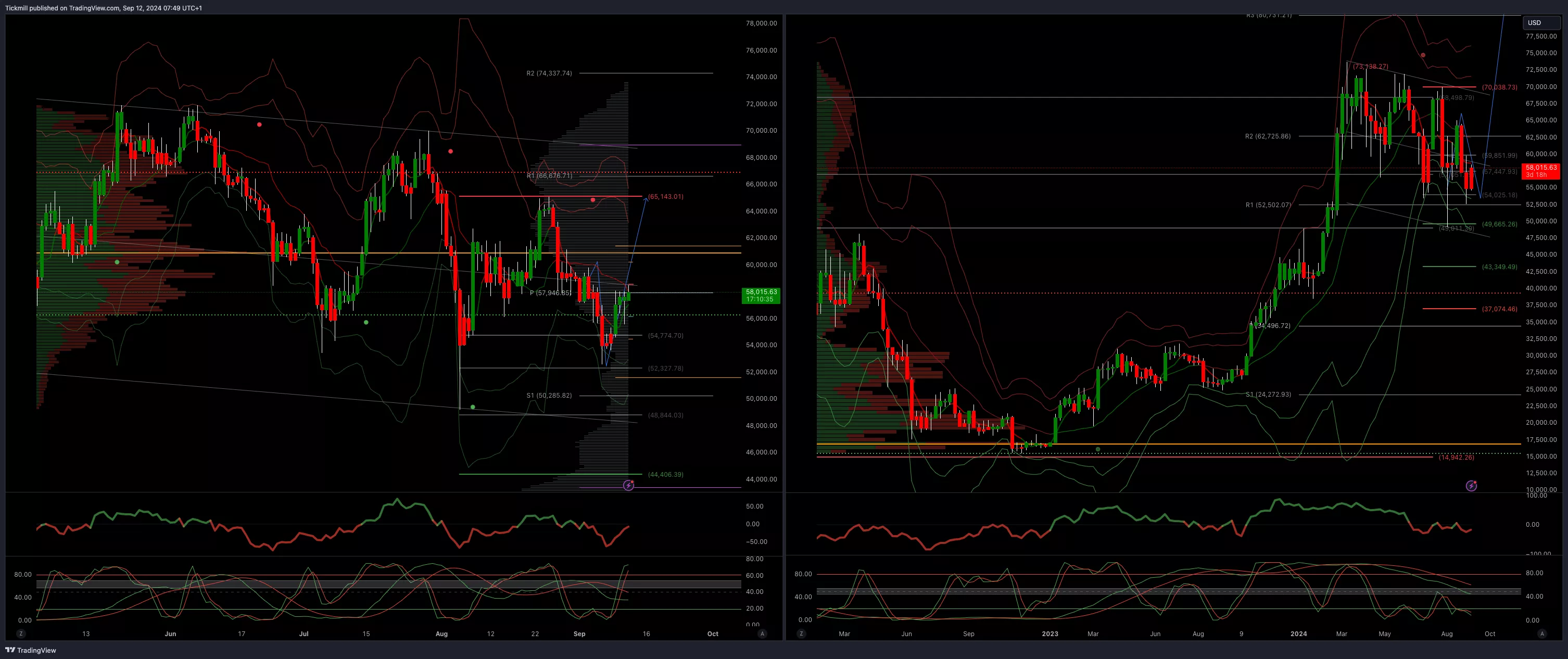

BTCUSD Bullish Above Bearish Below 54000

-

Daily VWAP bullish

-

Weekly VWAP bearish

-

Below 50000 opens 444400

-

Primary support is 500000

-

Primary objective is 700000

(Click on image to enlarge)

More By This Author:

SP500 & US500 Daily Trade Plan - Wednesday, September 11SP500 Daily Trade Plan - Tuesday, September 10

Daily Market Outlook - Tuesday, September 10