Daily Market Outlook - Thursday, Oct. 23

Image Source: Pixabay

Asian markets took a hit, and gold faltered, as a week that started with positive risk sentiment shifted to concerns over corporate earnings and escalating trade tensions. Following a shaky session on Wall Street, Asian stocks retreated, with gold pulling back from its record highs. Investors were left grappling with renewed fears of trade conflicts and a mixed bag of corporate earnings reports. The MSCI Asia Pacific Index, which had printed an all-time high alongside gold earlier in the week, dropped 0.4%, as most major markets in the region lost momentum. Meanwhile, gold extended its losing streak, falling by over a further 1%. Investor anxiety was fuelled by both global and regional factors. The Trump administration’s proposal to impose new restrictions on software exports to China reignited concerns of further trade disputes. At the same time, shares of Pop Mart International Group Ltd, which had more than doubled in value this year, tumbled nearly 11% amid growing doubts about the toy company’s long-term growth prospects.

In the U.S., assets favoured by retail momentum traders were hit particularly hard. AI-related stocks, cryptocurrencies, and precious metals all saw declines. The Nasdaq 100 fell 1%, weighed down by Texas Instruments Inc.’s lacklustre forecast and a steep 10% drop in Netflix Inc. Tesla Inc. also slipped in after-hours trading following earnings that missed expectations, despite a notable surge in sales. However, there was a glimmer of hope as U.S. equity futures inched higher in Asian trading on Thursday, hinting at possible stabilisation. Gold hovered near the $4,100-an-ounce mark but continued it corrective trend. On the other hand, oil prices surged by about 3% after the U.S. imposed sanctions on Russia’s largest energy producers in a bid to pressure President Vladimir Putin toward peace talks over the Ukraine conflict. The yen weakened for a fifth consecutive session against the U.S. dollar, while 10-year Treasury yields remained steady around 3.95% following a strong $13 billion auction of 20-year bonds. Meanwhile, the dollar index edged up by 0.1%. In China, officials were wrapping up the Fourth Plenary in Beijing, with a key policy announcement expected later in the day. Additionally, U.S. Treasury Secretary Scott Bessent is set to meet with Chinese officials this weekend ahead of the much-anticipated Trump-Xi summit.

The surprisingly strong September CPI report has prompted a reassessment of the UK’s rate cut outlook. Market expectations for the November MPC meeting have shifted, with the probability of a cut now at 9 basis points (roughly one in three) compared to just 3 basis points before the data release. For December, expectations have climbed to 18 basis points from 10. The rationale for a November move stems from the pattern seen this year—a quarterly rhythm of rate adjustments—guided by the updated forecasts in the BoE’s Monetary Policy Report. These updates have been paired with more cautious commentary on near-term inflation, while reaffirming that CPI remains on course to hit the medium-term target. However, that trajectory has grown less certain as the year has progressed. While September’s inflation figures offered some relief, a sustained downward trend has yet to emerge. Key indicators of core inflation still remain far from the BoE’s target, with elevated services inflation (still at 4.7% year-on-year) standing out as a persistent challenge. Hopes have been pinned on easing wage pressures to help rein in inflation, but as the more hawkish MPC members have pointed out, the issue isn’t solely demand-driven—supply-side weaknesses are also fuelling inflationary persistence. A December rate cut seems more plausible, particularly as any fiscal changes introduced in the Budget would by then be measurable. Even so, such a move would hinge on further progress in inflation and continued subdued demand. For now, it’s difficult to envision rate cut expectations pushing much further than where they currently stand.

Nigel Farage, leader of Reform UK, has called for a relaxation of the rules governing how cryptocurrency companies promote their services to consumers. His comments come as the digital asset sector faces challenges in meeting the stringent requirements. In 2023, the UK's financial promotions regime expanded to cover crypto firms, placing stricter demands on how they communicate through websites, emails, and social media. These regulations require all crypto platforms targeting UK consumers to include clear risk warnings, adhere to higher technical standards, and implement a mandatory 24-hour cooling-off period for new customers.

Today's key calendar events include France Business Confidence, Eurozone Consumer Confidence, UK CBI Industrial Trends Survey, Canada Retail Sales, SNB Minutes, and speeches from ECB’s Lane and BoE’s Dhingra.

Overnight Headlines

- Japanese PM Takaichi’s Government Kicks Off With Strong Support

- Trump Will Boost Russia Sanctions After Putting Off Putin Summit

- US Imposes Substantial New Sanctions On Russian Oil Giants

- EU Sanctions On Russian LNG To Be Adopted Thursday

- EU Says Countermeasures Possible Over China Rare Earth Curbs

- BoE’s Woods Slams ‘Highly Risky’ Bank Push To Ease Capital Rules

- Republicans Divided Over Next Steps To End US Shutdown

- Treasury Yields Slip As Government Shutdown Extends

- IBM Sales Jump As Clients Scale AI, But Stock Falls On Red Hat Growth

- SAP Cloud Revenue Misses Estimates In ‘Uncertain’ Economy

- Tesla Profit Drops, Q3 Sales Surge; Musk Highlights Samsung Role

- SoftBank Taps Dollar, Euro Bond Markets To Raise $2.9B

- Turkish Central Bank Watchers Are Split On Bets For Rate Cuts

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

- EUR/USD: 1.1450-55 (377M), 1.1500 (429M), 1.1515 (894M)

- 1.1525-30 (816M), 1.1550-60 (1.31BLN), 1.1565-75 (2.1BLN)

- 1.1590-00 (1.02BLN), 1.1620-25 (952M), 1.1650 (1.74BLN)

- 1.1665-70 (647M), 1.1675-80 (918M), 1.1690-00 (729M)

- 1.1750-60 (2.5BLN), 1.1765-75 (752M)

- USD/JPY: 151.00 (556M), 151.20 (481M), 152.00 (1.3BLN)

- 154.00 (1.12BLN). EUR/JPY: 178.45 (361M)

- USD/CHF: 0.7875 (410M), 0.8075 (413M)

- GBP/USD: 1.3355-65 (648M)

- AUD/USD: 0.6400 (297M), 0.6490-00 (866M), 0.6550 (423)

- NZD/USD: 0.5820-25 (354). AUD/NZD: 1.1220-25 (461M)

- 1.1275 (269M). USD/ZAR: 17.50 (200M)

- USD/CAD: 1.3800-10 (1.2BLN), 1.4000 (269M), 1.4015 (307M)

CFTC Positions as of the Week Ending 9/10/25

-

October 1, 2025: During the shutdown of the federal government, Commitments of Traders Reports will not be published

Technical & Trade Views

SP500

- Daily VWAP Bullish

- Weekly VWAP Bullish

- Above 6650 Target 6800

- Below 6600 Target 6400

(Click on image to enlarge)

EURUSD

- Daily VWAP Bearish

- Weekly VWAP Bearish

- Below 1.16 Target 1.1450

- Above 1.1650 Target 1.1850

(Click on image to enlarge)

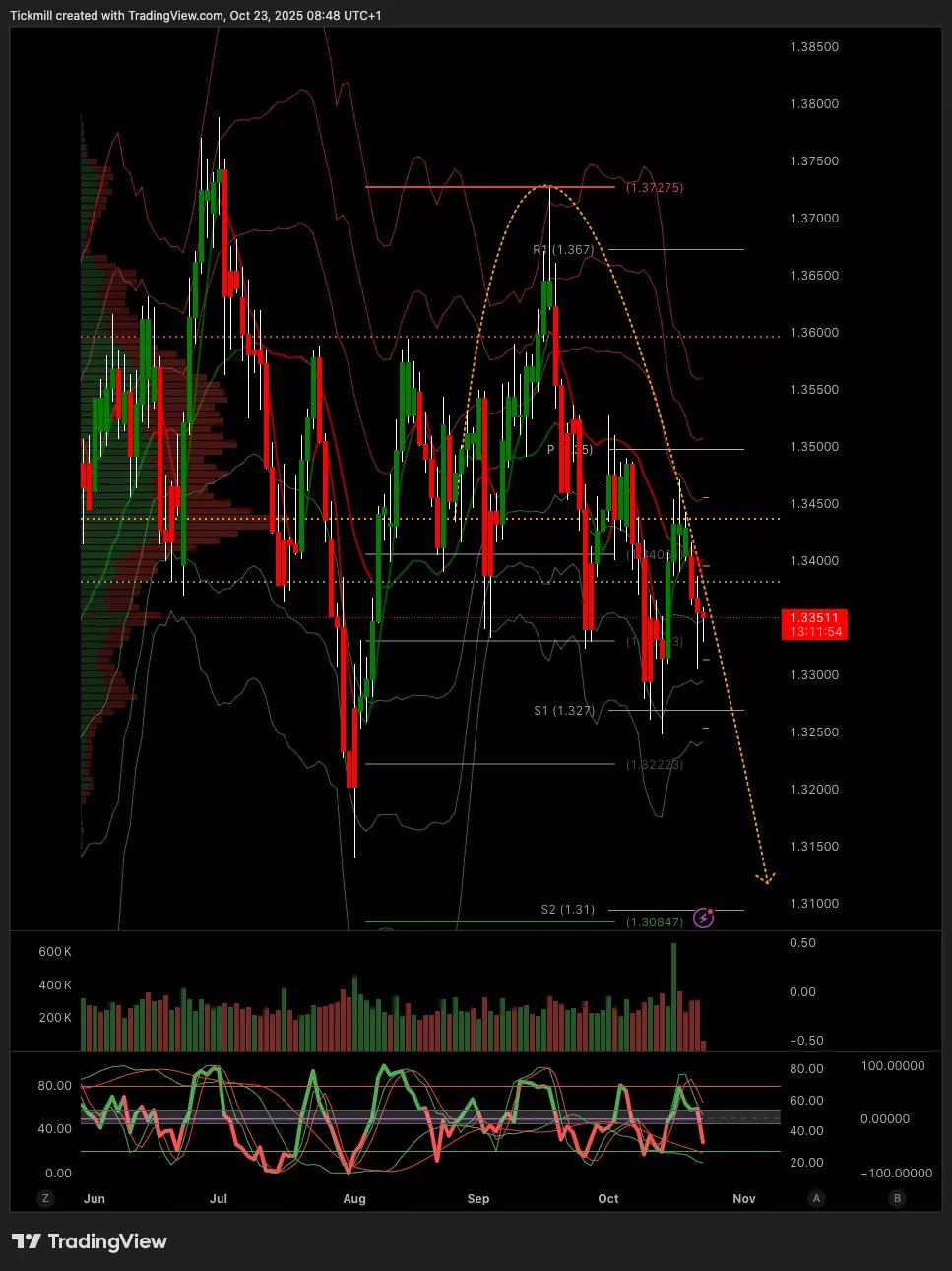

GBPUSD

- Daily VWAP Bearish

- Weekly VWAP Bearish

- Below 1.34 Target 1.31

- Above 1.3450 Target 1.3530

(Click on image to enlarge)

USDJPY

- Daily VWAP Bullish

- Weekly VWAP Bullish

- Below 150 Target 148.5

- Above 151 Target 154

(Click on image to enlarge)

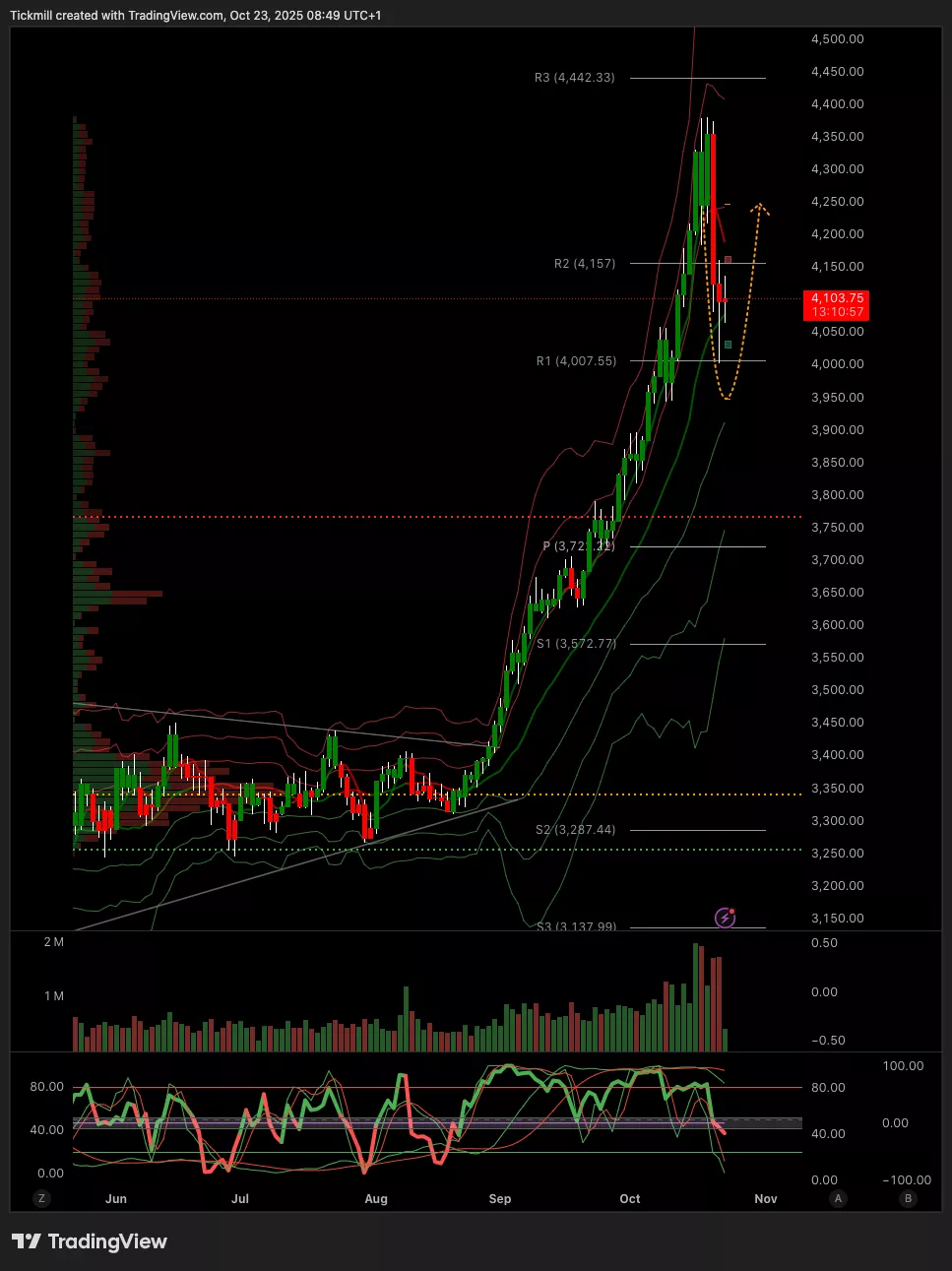

XAUUSD

- Daily VWAP Bearish

- Weekly VWAP Bullish

- Above 4200 Target 4500

- Below 4050 Target 3950

(Click on image to enlarge)

BTCUSD

- Daily VWAP Bullish

- Weekly VWAP Bearish

- Above 107k Target 116k

- Below 106k Target 100k

(Click on image to enlarge)

More By This Author:

The FTSE Finish Line - Wednesday, Oct. 22

Daily Market Outlook - Wednesday, Oct. 22

The FTSE Finish Line - Tuesday, Oct. 21