Crude Oil Update: Brent Tailwinds Outweighed By Recessionary Fears

Brent Crude Oil Fundamental Backdrop

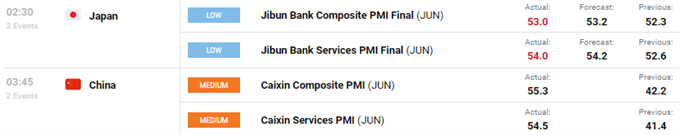

Brent crude oil is trading lower this morning as recessionary fears trump traditional fundamental support influences. This morning Brent crude received a barrage of supporting factors including PMI data from both China and Japan (among the world's largest crude oil importers). China pushed back into expansionary territory for the first time since February while Japan’s reading improved on previous data (see calendar below).

Economic Calendar

Source: DailyFX Economic Calendar

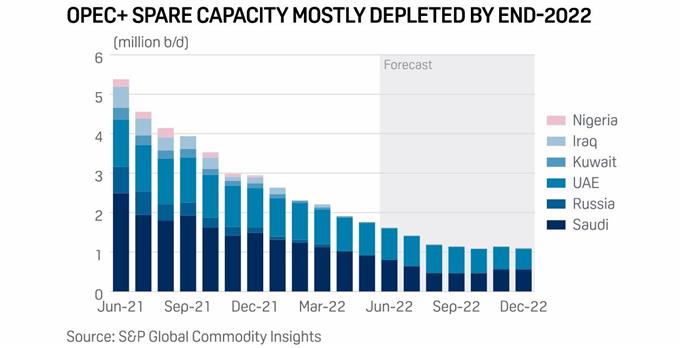

Employee strikes in Norway commenced this morning as the oil and gas workers demand higher wages to combat inflationary pressures. The strike is expected to extend throughout the week with estimates projected to dent Norwegian supply by roughly 15% (Source: Reuters). Yet another supply-side issue does not bode well for global supply and more specifically OPEC+, whose capacity is forecasted to decline rapidly as we head into the end of 2022 (see graphic below).

As has been the trend recently, OPEC+ actual production levels on a monthly basis have been well short of projected supply numbers which add to the tight market conditions going forward as I do not see this trend changing. Regardless, this morning's price action seems to have overlooked these fundamental factors in favor of the risk-off, recession-backed narrative.

Technical Analysis

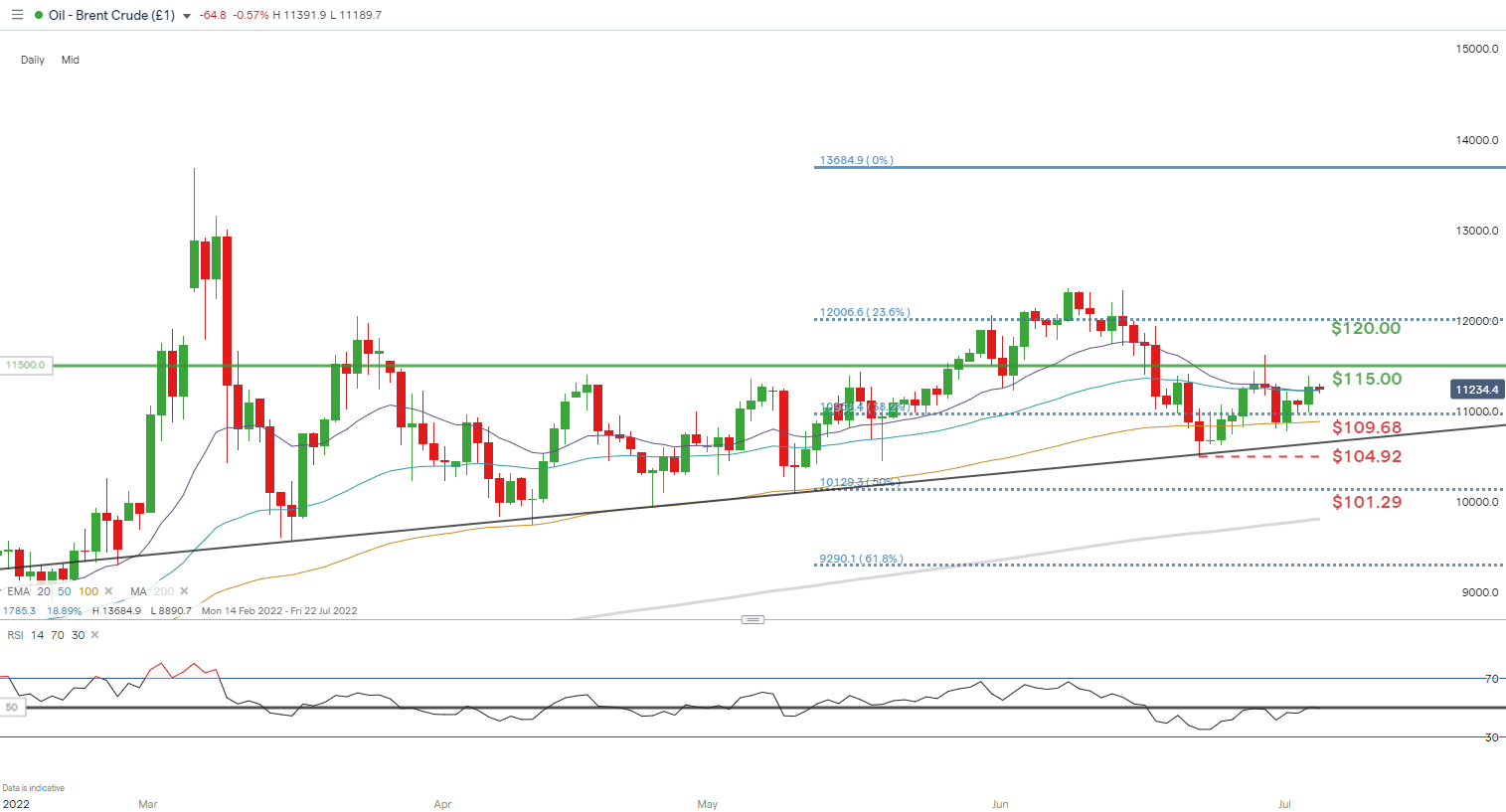

Brent Crude (LCOc1) Daily Chart

(Click on image to enlarge)

Chart prepared by Warren Venketas, IG

Price action on the daily brent crude chart shows indecisiveness by market participants starting from the Relative Strength Index (RSI) reading around the 50 mark. Although brent has incrementally swung higher, there seems to be no conviction supporting any particular directional bias. Much is dependent on fundamental catalysts such as an impending recession, Russia/Ukraine, and OPEC+. For now, the elevated crude oil prices will remain in my opinion until such time as the medium-term trendline support line (black) is breached.

Key resistance levels:

Key support levels:

- Trendline support

- $104.92

IG Client Sentiment: Mixed

IGCS shows retail traders are marginally NET SHORT on Crude Oil, with 52% of traders currently holding long positions (as of this writing). At DailyFX we typically take a contrarian view to crowd sentiment however, after recent changes in positioning we settle on a short-term cautious bias.

More By This Author:

Bitcoin Price Analysis: BTC/USD Grapples with Support Ahead of FOMCGBP/AUD May Unwind Losses as BOE/RBA Implied Rate Paths Come Together

GBP/USD Outlook: Sterling Cements Key Technical Level Ahead Of FOMC

Disclosure: See the full disclosure for DailyFX here.