Crude Oil Update: Brent Propped Up By Uneventful Biden Trip And Uncertainty Around Nord Stream

Brent Crude Oil (LCOC1) Talking Points

- Bidens leave the Middle East without increased supply results.

- Russia’s political situation could see the Nord Stream pipeline remain closed come Thursday.

Brent Crude Oil Fundamental Backdrop

Brent crude oil extended last week's Friday’s positive close in early trading on Monday morning after U.S. President Joe Biden’s visit to Saudi Arabia failed to deliver anything concrete. The trip was aimed at coaxing the Saudis to increase oil production thus easing inflation pressures. The response from the Saudis and other key officials reiterated the fact that production scheduling and/or increases remain with the OPEC+ consortium leaving President Biden without a deal. This being said, the upcoming OPEC+ meeting on August 3, 2022, could see a revision in the production outlook but with OPEC+ currently struggling to meet quota, it is difficult to see how a higher figure could be met. Existing tight crude oil conditions are likely to endure acting as a support for elevated crude prices.

Later this week (Thursday), the expected reuse of the Nord Stream 1 pipeline will be under the spotlight. If Russia does not bring the pipeline back online as anticipated, we could see energy prices soar as the markets concerned around and the energy crisis grows. The political uncertainty is a positive for Brent crude prices for now but the demand-side fears from an indeterminate Chinese economy, global recession doubts, and a strong U.S. dollar are keeping crude under control.

Technical Analysis

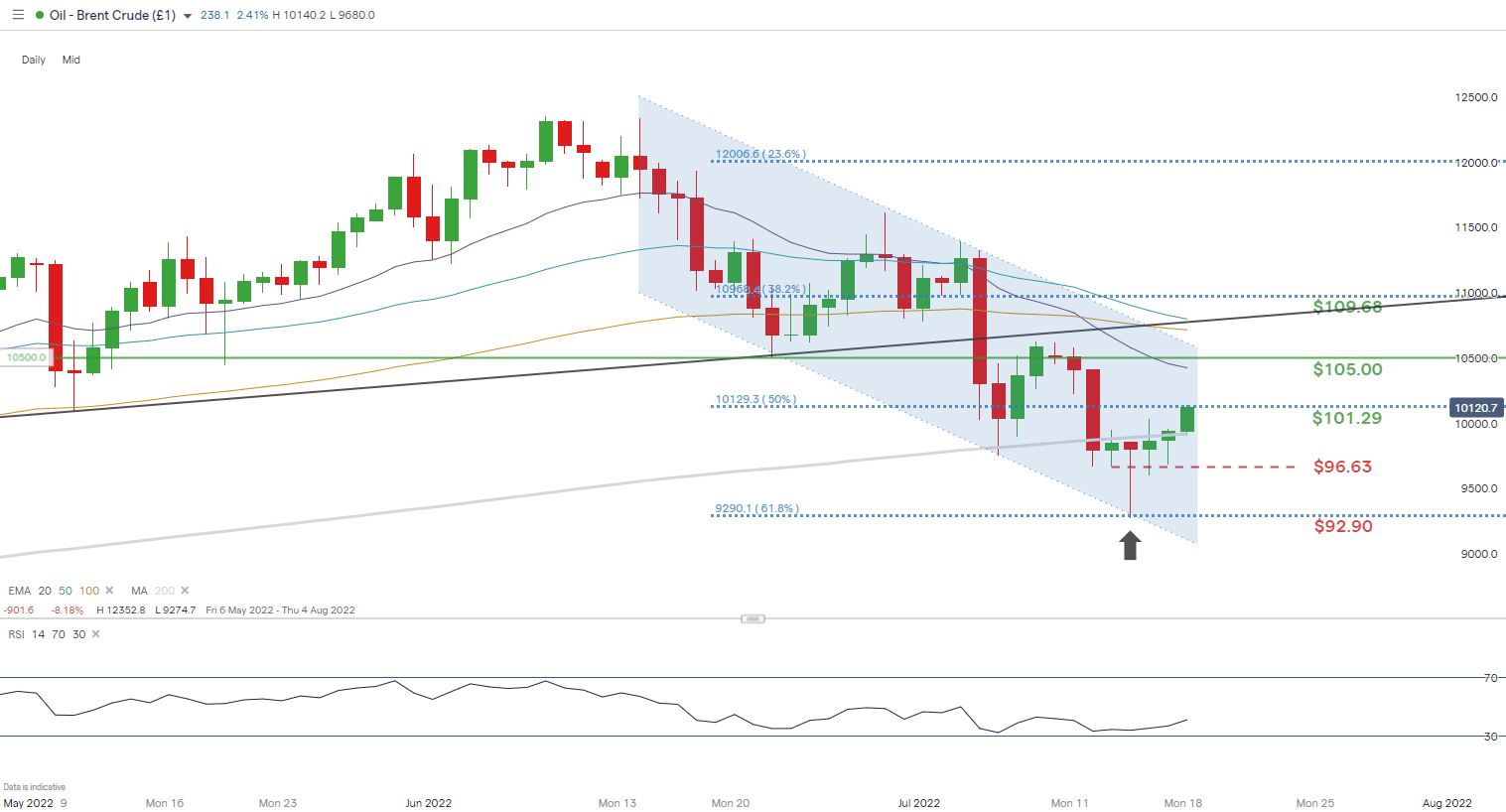

Brent Crude (LCOc1) Daily Chart

(Click on image to enlarge)

Chart prepared by Warren Venketas, IG

Price action on the daily brent crude chart shows bulls reacting to Thursday’s extended lower long wick and now testing the 50% Fibonacci level at $101.29 (Taken from November 2021 low – March 2022 high). This move higher has kept the descending channel (blue) pattern in play as we look for a breakout.

Key resistance levels:

- $105.00

- 20-day EMA (purple)

- $101.29

Key support levels:

- $96.63

- $92.90 (61.8% Fibonacci)

IG Client Sentiment: Bearish

IGCS shows retail traders are NET LONG onCrude Oil, with 63% of traders currently holding long positions (as of this writing). At DailyFX we typically take a contrarian view to crowd sentiment resulting in a short-term downside bias.

More By This Author:

AUD/USD At Key Technical Level As APAC Trading Kicks OffStock Market Weekly Forecast: S&P 500 & DAX 40

Canadian Dollar Weekly Forecast: CAD At The Behest Of Crude Oil And Rampant U.S. Dollar

Disclosure: See the full disclosure for DailyFX here.