Crude Oil Prices Plunge As Iraq Readies Output Boost

Talking Points:

- Crude oil prices fall on Iraq output boost, look to API next

- Gold prices hold range floor as Yellen pre-positioning slows

- US PMI, Home Sales data may not generate follow-through

Gold prices made another run at range support but selling pressure fizzled intraday, leaving the metal stuck in familiar territory. Initial selling pressure appeared rooted in a hawkish shift in Fed policy bets ahead of a much-anticipated speech from FOMC Chair Janet Yellen. Follow-through proved absent however, with early momentum seemingly reflecting Asian markets’ efforts to play catch-up to Friday’s Wall Street moves rather than deepening conviction (as suspected).

Meanwhile, crude oil prices plunged, with the WTI contract recording its largest daily decline in two weeks. The selloff appeared to follow news that Iraq – OPEC’s second-largest producer – will increase output by 5 percent after state-run Northern Oil Co. (NOC) settled a dispute with the Kurdistan Regional Government (KRG). The resolution will allow the resumption of shipments from three oil fields in Kirkuk. Besides boosting global supply, the announcement dimmed hopes for a supply freeze deal at informal OPEC meeting next month. The prospect of an accord has been instrumental in driving crude higher in August.

Looking ahead, gold is likely to remain tied to pre-positioning ahead of Chair Yellen’s speech on Friday. That may put the focus on US Manufacturing PMI and New Home Sales data due to cross the wires. US economic news-flow has increasingly disappointed relative to consensus forecasts since late July, opening the door for soft results that weigh against rate hike speculation. Lasting follow-through seems unlikely however, with traders probably leery of directional conviction until hearing from the Fed chief herself. Crude oil may find its next catalyst in the weekly inventory estimate from API.

GOLD TECHNICAL ANALYSIS – Gold prices continue to tread water in a familiar range. From here, a breach of the August 8 low at 1329.79 on a daily closing basis opens the door for a test of the 38.2% Fibonacci retracementat 1308.00. Alternatively, a move above the 1367.15-77.74 area (double top, 38.2% Fib expansion) exposes the 50% threshold at 1398.45.

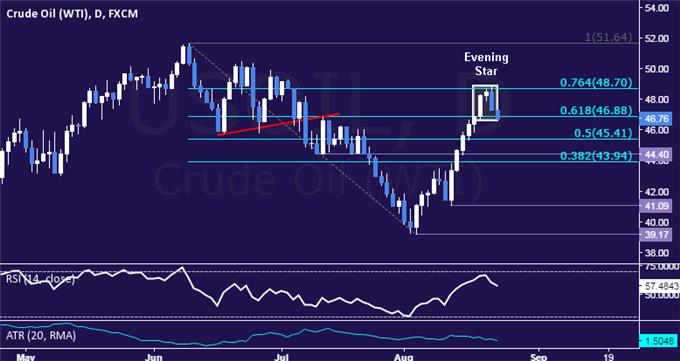

CRUDE OIL TECHNICAL ANALYSIS – Crude oil prices put in a bearish Evening Star candlestick pattern, hinting a top may be taking shape. A daily close below the 61.8% Fibonacci retracement at 46.88 exposes the 50% level at 45.41. Alternatively, a push above the 76.4% Fib at 48.70 targets the June 9 high at 54.61.

Disclosure: None.

Thanks for sharing