Crude Oil Outlook: Oil Prices Rise As Inflation Jitters Loom

Following the release of the latest API (American Petroleum Institute) report, an unexpected decline of 2.5 million barrels of oil has allowed bulls to drive prices higher.

This comes after the recent decision by OPEC+ (Organization of the Petroleum Exporting Countries and allies) to continue limiting supply to 400,000 barrels per day despite soaring prices.

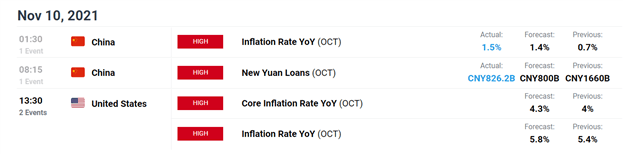

With supply constraints currently supporting energy prices, inflation data from China earlier today came in higher than expected, bringing the US CPI data to the forefront of risk sentiment.

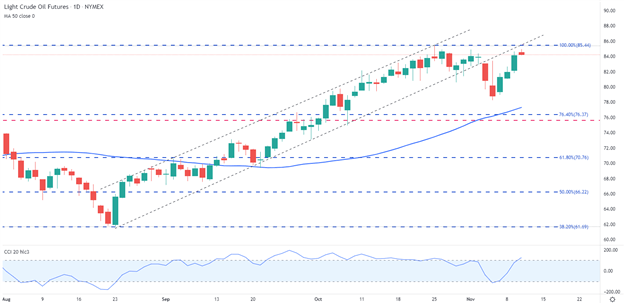

Oil – US Crude (WTI) Price Action

After pricing in the fundamental factors which remain at the forefront of risk sentiment, oil prices may likely continue to sustain the upward trajectory, at least for now.

If bulls are able to push through the key level of resistance at $85, a breakout towards $90.00 may be in the cards. However, fears of higher wage inflation and increased production could result in a resumption of the bear trend and a possible retest of psychological support at $80.00.

US Crude Oil (WTI) Daily Chart

Chart prepared by Tammy Da Costa using TradingView

Disclaimer: See the full disclosure for DailyFX here.