Crude Oil Gains Ground As Energy Markets Hope For Us-China Trade Solutions

Image Source: Unsplash

US West Texas Intermediate (WTI) Crude Oil prices are testing fresh seven-week highs on Monday, punching further above $64.00 per barrel. Energy traders are banking on a double upswing in demand from the summer travel season and an eternally elusive upswing in Chinese barrel demand to offset a potential overhang as the Organization of the Petroleum Exporting Countries (OPEC) ramps up Crude Oil production quotas.

US-China trade talks are ongoing in London this week, and investors are hoping that the Trump administration will be convinced to take the gun away from its own foot on tariffs and trade restrictions. President Donald Trump has made it a habit of threatening, imposing, and then canceling or delaying steep import taxes during the first few months of his second term. Investors are expecting a similar pattern to emerge from US-China negotiations on neutral ground, following several weeks of heightened trade war rhetoric.

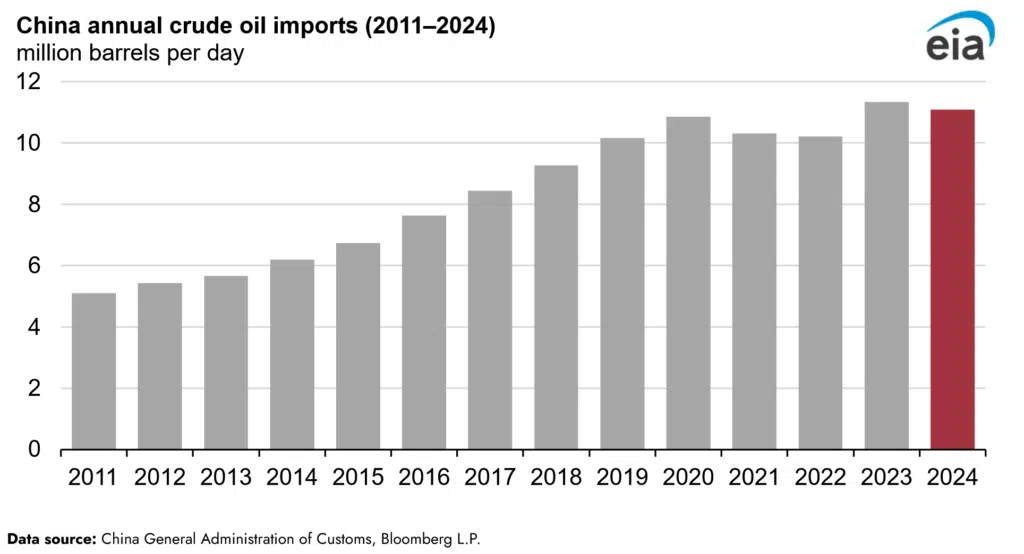

The summer travel season is expected to spike Crude Oil demand, and energy traders are hoping that a successful trade resolution will finally spark that surge in Chinese barrel demand that they have been waiting for years to see. Chinese Crude Oil demand plateaued in 2020 and has yet to return to the pattern of yearly consumption increases that occurred during the 2010s.

OPEC has begun ramping up Crude Oil production in a bid to regain market share. The Crude Oil cartel hammered down production quotas last year in an effort to keep global energy prices supported, but now the global conglomerate of barrel fillers is ready to stop losing money hand over fist. Analysts have noted that despite the increase in OPEC production limits, oversupply still hasn’t hit energy markets, and investors are hoping that upshot factors in demand will drag down any supply imbalance risks before they start.

Crude Oil price forecast

WTI barrel bids have hit seven-week peaks near $64.50, however further upside remains limited as the 200-day Exponential Moving Average (EMA) sinks into $68.00, marking a firm technical ceiling. Near-term price action has risen back above the 50-day EMA near $62.80, however Crude Oil prices are poised perfectly for another bearish swing in a repeat of April’s technical rejection from the 200-day EMA.

WTI daily chart

(Click on image to enlarge)

More By This Author:

EUR/USD Ticks Up As Impact From US Nonfarm Payrolls Wanes

GBP/JPY Price Forecast: Bullish Momentum Builds After Rising Above 195.00

EUR/USD Retreats To 1.1430 As The Impulse From A Hawkish ECB Ebbs

Disclaimer: Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only ...

more