Crude Oil Futures: Room For Extra Bounce

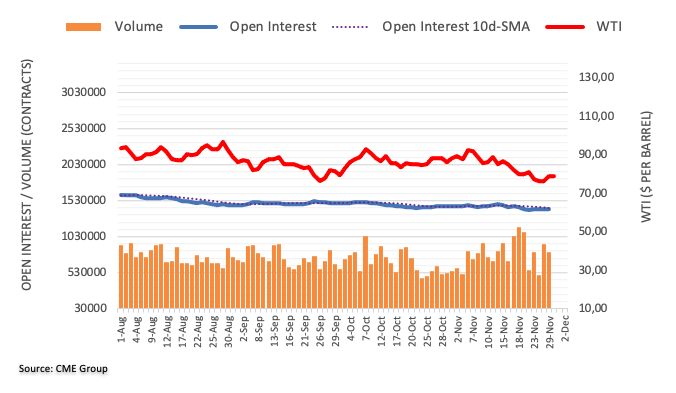

CME Group’s flash data for crude oil futures markets noted traders added around 5.4K contracts to their open interest positions on Tuesday, reversing the previous day’s pullback. Volume, instead, reversed the prior build and shrank by around 121.4K contracts.

WTI: Downside still targets the $70.00 mark

Prices of the WTI rebounded markedly on Tuesday amidst rising open interest, which opens the door to potential gains in the very near term. Despite the bounce, crude oil remains well under pressure and extra losses could now revisit the key $70,00 mark per barrel sooner rather than later.

More By This Author:

Asia Roundup: January 6th, 2020Nasdaq Index Remains Near All-Time High As DOJ Starts Review On Big Tech

Week Ahead: Busy Week Expected As Bulk Of S&P 500 Companies Release Earnings

Disclaimer: The information found on forex.info are intended only to be educational, is not advice nor a recommendation and thus should not be treated as such. We strongly recommend that you ...

more