Crude Oil Futures: Extra Upside Could Lose Momentum

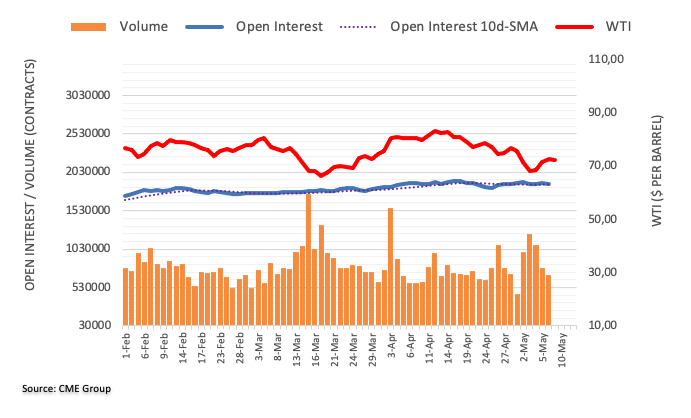

CME Group’s flash data for crude oil futures markets noted traders trimmed their open interest positions by more than 5K contracts after two consecutive daily builds on Monday. Volume followed suit and shrank for the third straight session, now by nearly 90K contracts.

WTI: Bulls lack conviction so far

Prices of the barrel of the WTI rose for the third session in a row at the beginning of the week. The daily uptick, however, was amidst dwindling open interest and volume and hints at the idea that the continuation of the upside might face some headwinds in the very near term. So far, there are provisional barriers at the 55- and 100-day SMAs at $75.43 and $76.54, respectively.

More By This Author:

USD Index Price Analysis: Rising Bets From A Break Below 101.00Natural Gas Futures: Room For Further Rebound

EUR/USD Corrects Lower To 1.0980 Post-Payrolls

Disclosure: Information on this article contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes ...

more