Crude Oil Futures: Extra Downside Is Not Ruled Out

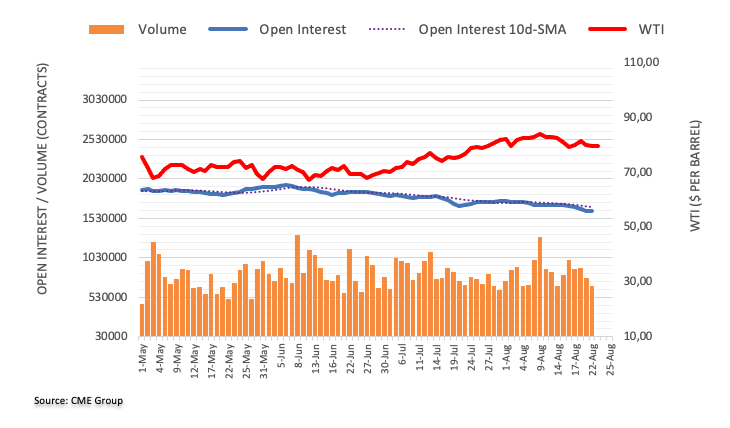

CME Group’s flash data for crude oil futures markets noted traders added around 2.8K contracts to their open interest positions after five consecutive daily pullbacks on Tuesday. Volume, instead, shrank for the second straight session, this time by around 103.1K contracts.

WTI: Immediate support emerges at the 200-day SMA

Prices of WTI dropped for the second session in a row and closed below the key $80.00 mark per barrel on Tuesday. The daily pullback was amidst rising open interest, which indicates that there is still scope for a further decline in the very near term with an immediate contention at the key 200-day SMA, today at $76.10 per barrel.

More By This Author:

USD Index Price Analysis: Immediately To The Upside Comes 103.70

USD Index Extends The Decline And Challenges 103.00

EUR/USD Price Analysis: Still Scope For Extra Losses

Disclosure: Information on this article contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes ...

more