Crude Oil Futures: Downside Could Be Losing Momentum

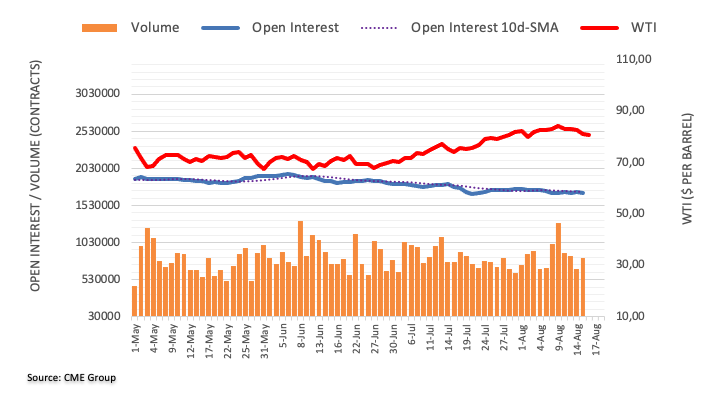

CME Group’s flash data for crude oil futures markets noted traders scaled back their open interest positions by nearly 3K contracts on Tuesday, keeping the recent erratic activity well in place. Volume, instead, reversed three straight daily drops and increased by around 147.7K contracts.

WTI: Gains seem limited near $85.00

Prices of WTI extended the weekly leg lower on Tuesday. The downtick, however, was on the back of shrinking open interest, which suggests that a deeper pullback may not be favored in the very near term. On the upside, the 2023 peaks near the $85.00 mark per barrel (August 10) emerge as the immediate obstacle for bulls for the time being.

More By This Author:

EUR/JPY Price Analysis: Next Target Now Emerges At 160.00USD Index Faces Extra Selling Pressure Near 102.20 Ahead Of CPI

EUR/USD Price Analysis: The 1.0910 Zone Holds The Downside For Now

Disclosure: Information on this article contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes ...

more