Crude Oil Futures: A Deeper Drop Seems Not Favored

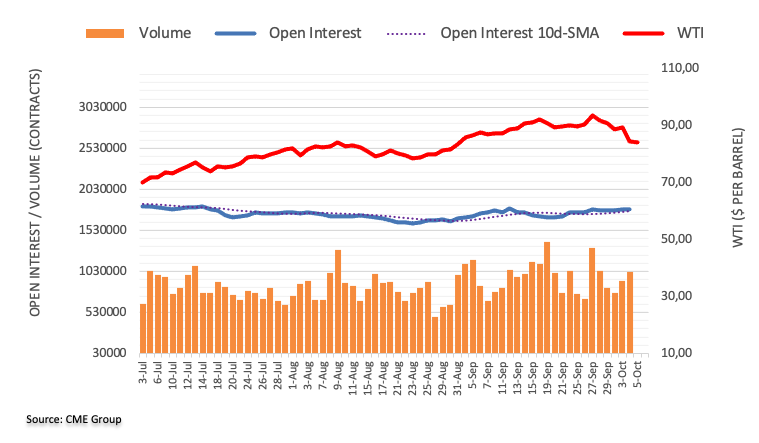

CME Group’s flash data for crude oil futures markets noted traders scaled back their open interest positions by around 2.6K contracts on Wednesday, reversing the previous daily build. On the other hand, volume increased for the second session in a row, now by 105.7K contracts.

WTI: Next on the downside emerges the $78.00 region

Prices of WTI retreated markedly on Wednesday, flirting with the interim 55-day SMA around the $84.00 zone. The sharp downtick was on the back of shrinking open interest and suggests that a sustained decline is not favored for the time being. on the downside, the next support of note emerges at the August low of $77.64 (August 24).

More By This Author:

EUR/JPY Price Analysis: Further Losses Appear On The Cards Below 154.30EUR/USD Price Analysis: Next On The Upside Comes 1.0617

USD Index Price Analysis: The Bullish Outlook Remains In Place

Disclosure: Information on this article contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes ...

more