Crude Oil Forecast: Continues To Rally

At the end of the day, the recent rally in the crude oil market signifies bullish sentiment, with key technical levels playing a pivotal role in shaping the trajectory.

The crude oil market staged a remarkable rally during Tuesday's trading session, underscoring the presence of substantial bullish pressure as it looks like Federal Reserve policy is starting to take center stage here.

WTI Crude Oil

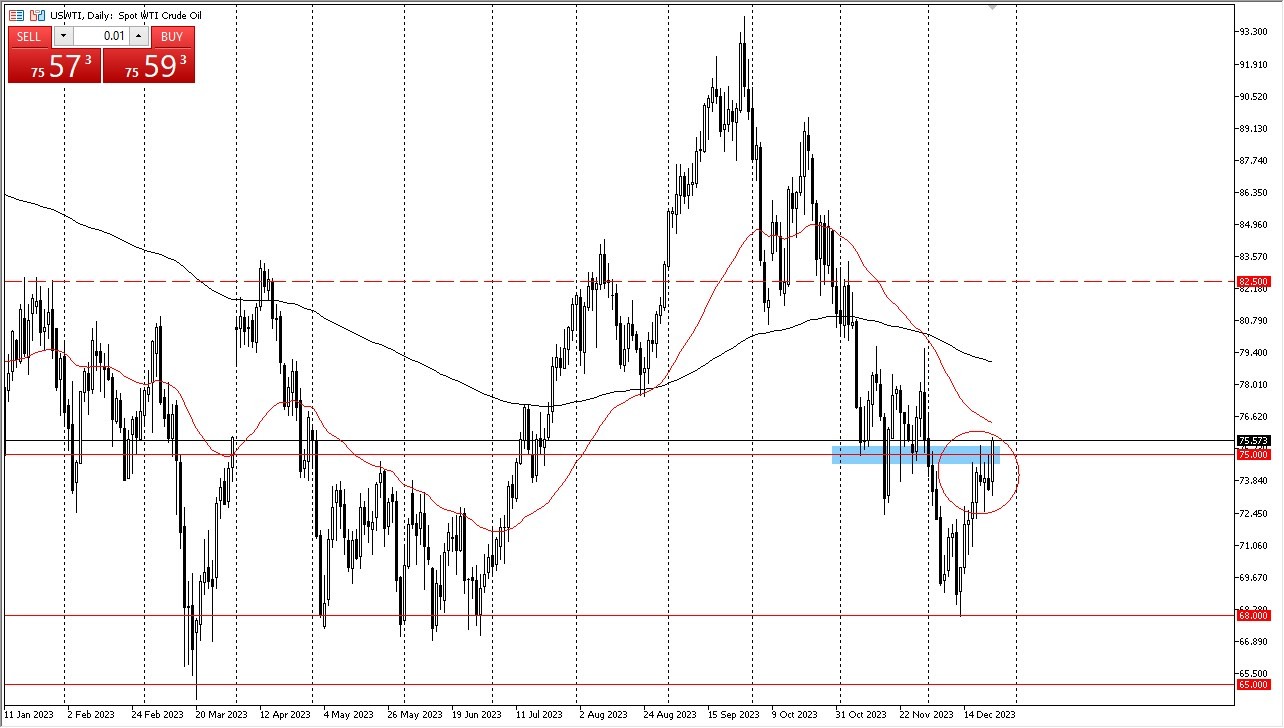

In West Texas Intermediate Crude Oil, prices surged significantly, breaching the crucial $75 level. This level, marked by its psychological significance and round-figure status, succumbed to the market's upward momentum. Notably, the 50-day Exponential Moving Average lies just above, potentially acting as a resistance point in the near term. Therefore, traders should remain mindful of this technical factor.

A potential breakthrough of the 50-day EMA could propel the market toward the 200-day EMA, a pivotal trend-defining point for many traders. Beneath the current price action, the $73 level persists as a formidable support zone, having recently facilitated a strong bounce. This development suggests the potential for a shift in the prevailing trend.

(Click on image to enlarge)

More By This Author:

S&P 500 Signal: Looks To The Upside Longer-TermCrude Oil Forecast: Shows Vigor on Friday

AUD/USD Forecast: Continues To March Towards 0.68

Disclosure: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more