Crude Oil Forecast: Bullish Trends In Focus

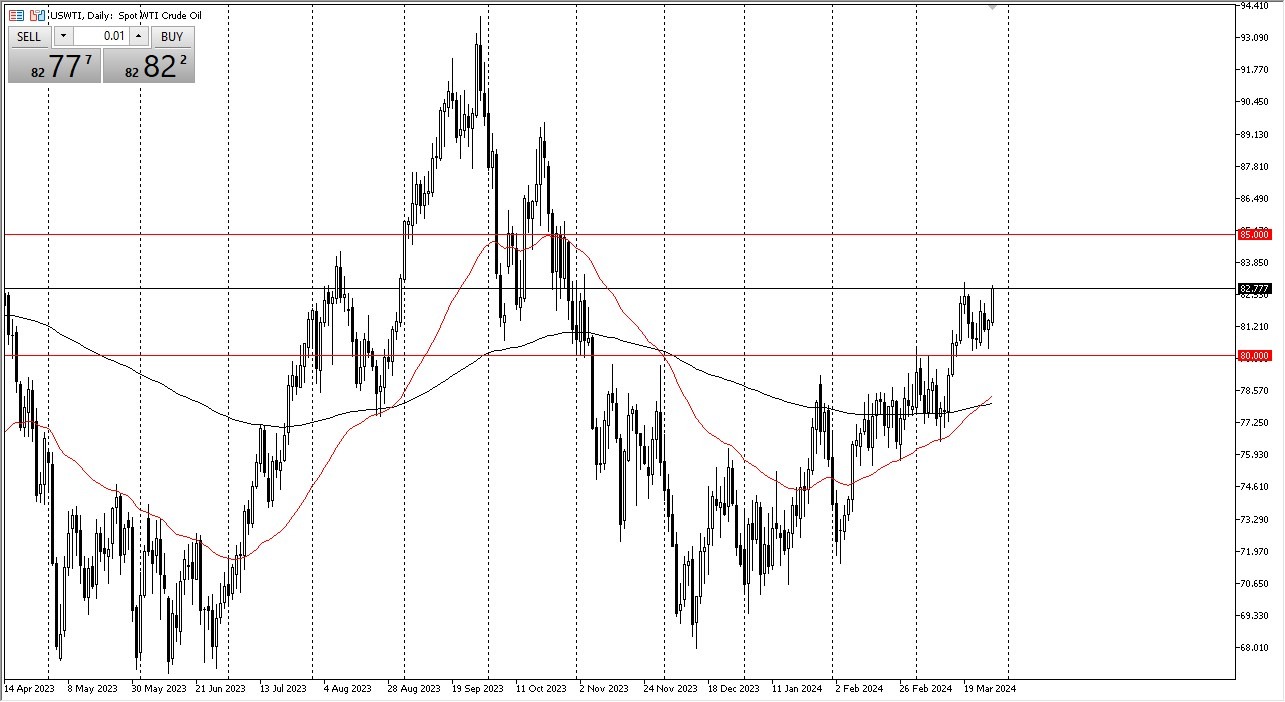

It looks like a break above the $83 level opens up the possibility of a move to $85 above, possibly even higher than that. Short-term pullback should continue to be buying opportunities.

- Crude oil markets continue to look strong overall, but at this point in time we need to pay attention to how the markets closed on Thursday, because I think that’s the greatest signal as to what could happen next.

- Keep in mind that crude oil does tend to be very noisy and does have a lot of volatility week to week, but on the whole it looks like a buyers’ market.

WTI Crude Oil

Now it's worth noting that crude oil was closed on Friday. However, having said that, I think you've got a situation where you can look at the Thursday candles that can get a good grasp on what's probably going to happen on Monday. Ultimately, it looks like a market that is trying to do everything it can to break out to the upside, so you need to pay close attention to Crude Oil.

It looks like a break above the $83 level opens up the possibility of a move to $85 above, possibly even higher than that. Short-term pullback should continue to be buying opportunities. The $80 level underneath is a huge support level as it was a massive resistance level previously broken above the 200 day EMA recently to kick off a massive signal that people refer to as a golden cross that is bullish.

(Click on image to enlarge)

Brent

Brent looks very much the same. It looks like we are trying to do everything we can to break out to the upside as well. And if we do break the highs of the previous week, it's likely Brent will go looking to the $90 level, $84 50 cents underneath is massive support. And of course, we've had the golden cross here as well.

(Click on image to enlarge)

Keep in mind that crude oil has to worry about geopolitical events and of course cyclical trade. After all, this is a time of year that momentum does pick up in pricing due to the fact that demand typically picks up as well. A lot more traveling and flying of course means more oil use. Furthermore, we have geopolitical issues as there is a hot war in the eastern part of the European Union and the Middle East. And of course, India has just stopped taking Russian imports. So, it's going to put more strain on the system. I believe crude oil ends up being one of the better trades this year going through summer.

More By This Author:

Pairs In Focus - Sunday, March 31BTC/USD Forecast: Continues to Look Bullish

Silver Forecast: Respecting Same Area