Crude OIL Elliott Wave Analysis: Bulls Are In Play

The USD slowed down as US stocks turned higher on Friday, but this can be only a temporary slow down as stocks may remain in downtrend due to risks between US and Russia. However, there are RBA, BOE and ECB, scheduled for this week, which can be catalysts for some dollar resistance, especially as other CB may follow the FED.

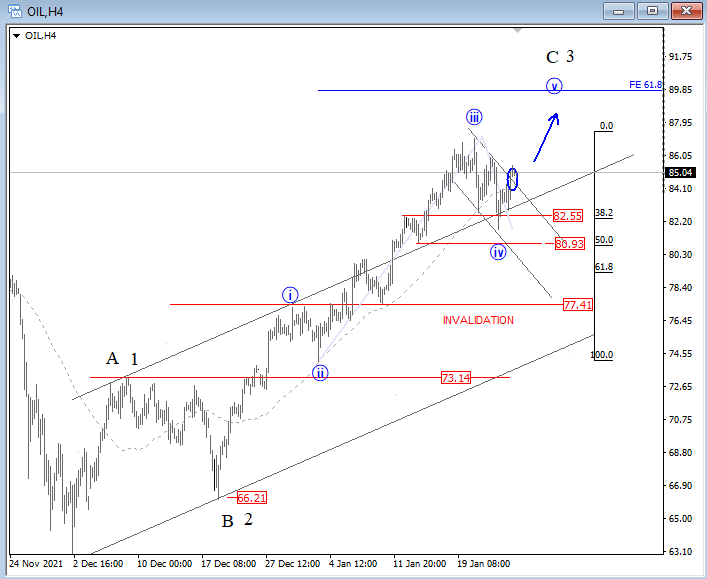

Crude oil is higher as demand continues as governments are not making any new restrictions ( yet) despite increasing covid cases. Price is now back at 2021 highs, but the question if current move up will be made by three waves or impulse, so we are still tracking wave C or 3. Well, a broken channel on 4h clearly means that bulls are in play, and we should be aware of further strength within a five-wave cycle for wave C/3.

Photo by Zbynek Burival on Unsplash

Crude OIL 4h Elliott Wave Analysis

(Click on image to enlarge)

Disclosure: Please be informed that information we provide is NOT a trading recommendation or investment advice. All of our work is for educational purposes only.