Crude Oil And Silver Elliott Wave Analysis: Look Further Higher

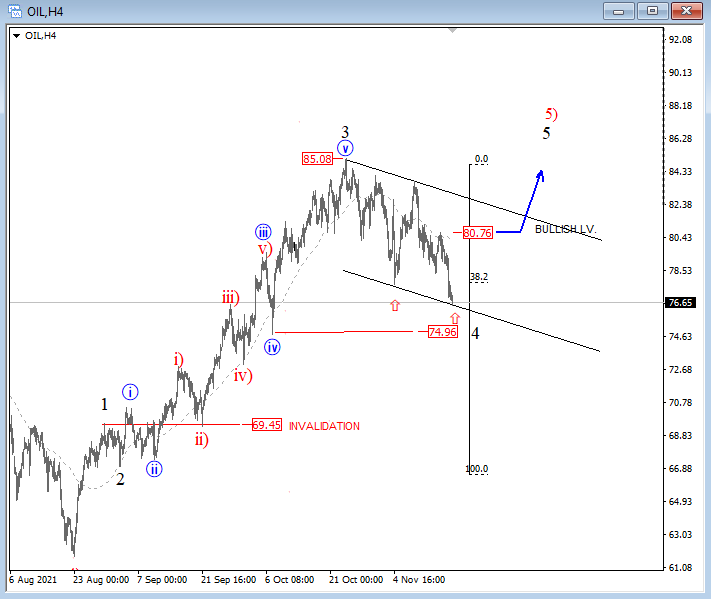

No change on oil since yesterday's US session, when energy came sharply to the downside, so it appears that energy is making a complex correction away from the highs which can still be a seven swing move for the fourth wave. Support is now at 75-76, but we need to rally back above 80.73 to change the direction of an intraday trend.

on 4h chart, Crude oil is making a bigger decline, but still looks corrective as part of wave 4, however, we see key do/die support here in the 76-75 area, so only in case of strong bounce and recovery back above 80.76, only then we can expect it back to highs for wave 5. Any early and big drop below 75 region towards 70 level would be definitely signal for deeper, higher degree correction on a daily chart.

Crude Oil 4h Elliott Wave Analysis

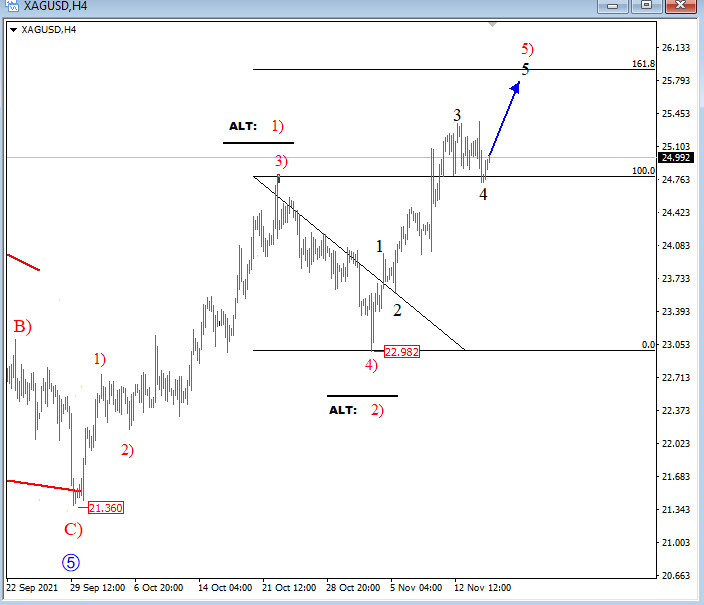

Silver remains bullish and looks like it has room for further strength as we see current price action as a potential fourth wave set-back into 24.80 support.

On the 4h chart Silver is higher, now at a new high as expected, possibly in wave 5) of an impulse from September low which can be still in progress as we see an unfinished five-wave cycle. At the same time, we see the price at the neckline of H/S bottom formation now so we would not be surprised if current levels near 25.50-26.00 will act as a strong resistance for a new potential corrective setback.

Silver 4h Elliott Wave Analysis

Disclosure: Please be informed that information we provide is NOT a trading recommendation or investment advice. All of our work is for educational purposes only.