Copper Short Term Pullback Should Find Buyers

Image Source: Pixabay

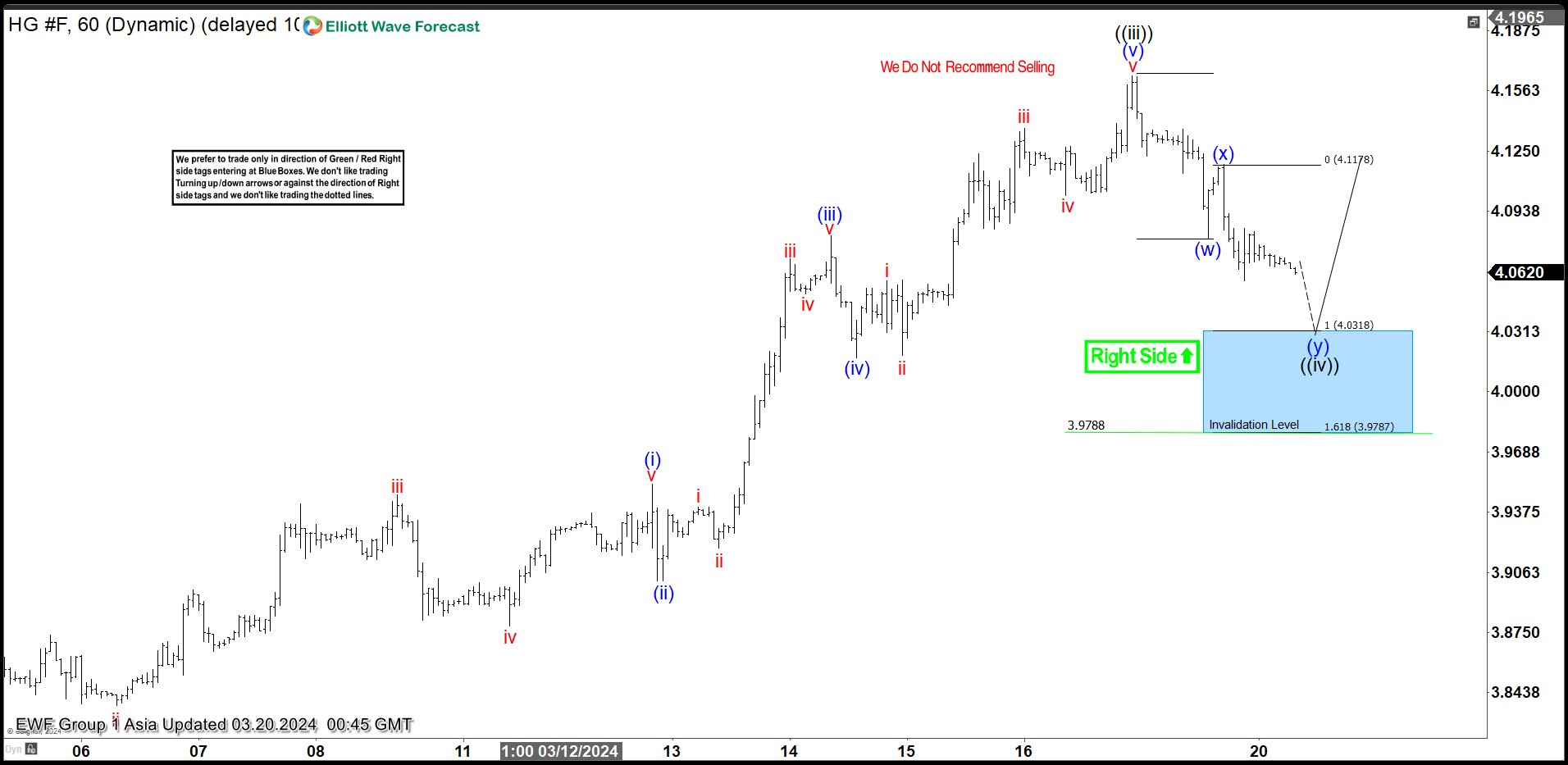

Short Term Elliott Wave view in Copper shows that the rally from 2.9.2024 low is in progress as a 5 waves impulse. Up from 2.9.2024 low, wave ((i)) ended at 3.9085 and dips in wave ((ii)) ended at 3.8015. The metal extended higher in wave ((iii)) towards 4.164. Subdivision of wave ((iii)) unfolded in another impulsive structure in lesser degree as the 1 hour chart below shows. Up from wave ((ii)), wave (i) ended at 3.952 and dips in wave (ii) ended at 3.902. The metal extended higher in wave (iii) towards 4.081 and pullback in wave (iv) ended at 4.0175. Final leg wave (v) ended at 4.164 which completed wave ((iii)).

Wave ((iv)) pullback is in progress as a double three Elliott Wave structure. Down from wave ((iii)), wave (w) ended at 4.08 and wave (x) ended at 4.118. Wave (y) lower is in progress and target lower is 100% – 161.8% Fibonacci extension of wave (w). The area comes at 3.98 – 4.03 which is shown with a blue box area. From this area, the metal should extend higher or at least bounce in 3 waves. Near term, as far as the pullback stays above 3.978 (1.618 extension), expect the metal to turn higher from the blue box area.

HG 60 Minutes Elliott Wave Chart

Copper (HG) Elliott Wave Video

Video Length: 00:08:28

More By This Author:

Amazon Looking For 7 Swing CorrectionCostco Wholesale Grand Super Cycle Upside Target

Buying Opportunity In Marathon Digital Holdings In 7 Swings

Disclaimer: Futures, options, and over the counter foreign exchange products may involve substantial risk and may not be suitable for all investors. Leverage can work against you as well as for ...

more