Copper Prices Slip Below Scrap For First Time Since April 2020

Industrial metals staged a comeback in the last five sessions as China's containment of COVID infections has brought new optimism to the demand outlook.

China has historically been the world's largest buyer of copper on the physical market suggests its appetite for the valuable metal used in automobiles, electronics, and many other applications that power the global economy is growing.

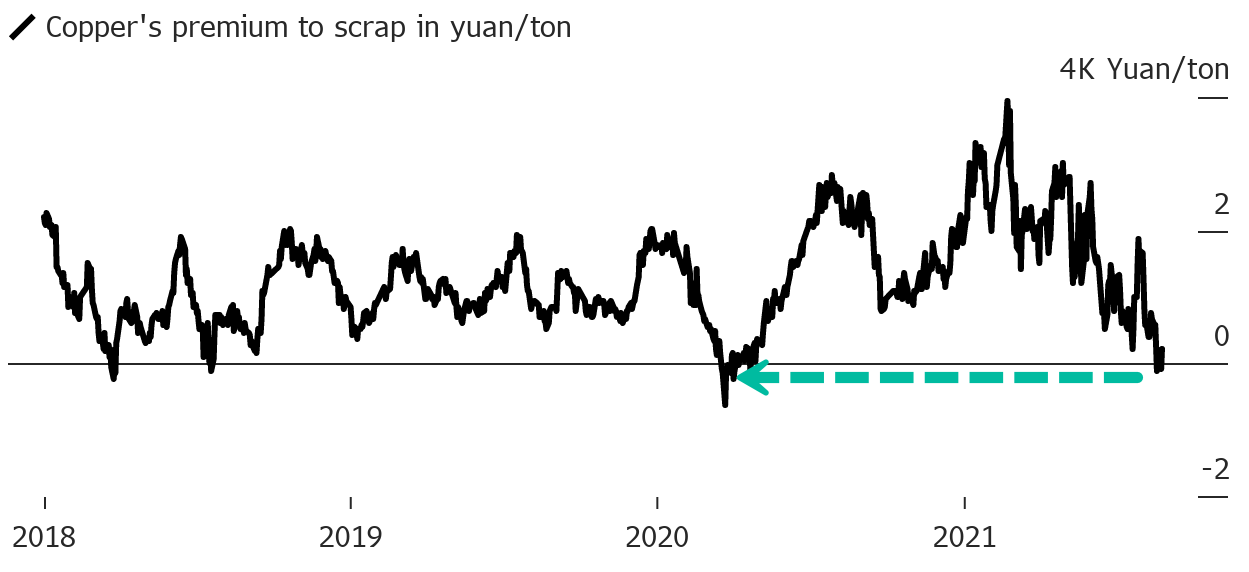

Colin Hamilton, managing director for commodities research at BMO, told Bloomberg that after months of slumping copper prices, it appears buyers are back in the market. He said, at the end of last week, high-grade copper scrap in China recorded a spot price at a premium to refined metal, a powerful indication that scrap supply is quickly dwindling. The same thing happened in early 2020 when central banks and governments injected trillions into the global economy.

Hamilton said the dynamics at play with elevated scrap prices and waning demand could boost prices for the refined metal.

"That dynamic is obviously unusual and doesn't make economic sense, but it's a sign that perhaps the selloff was getting ahead of fundamentals", Colin Hamilton, managing director for commodities research at BMO, told Bloomberg.

"We do have some initial signs that Chinese buyers have stopped destocking and are coming back to the market," Hamilton said.

Goldman Sachs's Christian Mueller-Glissmann recently told clients that copper prices could go higher by the end of the year.

"Our strategists think deficits can help copper break out of its range by Q4."

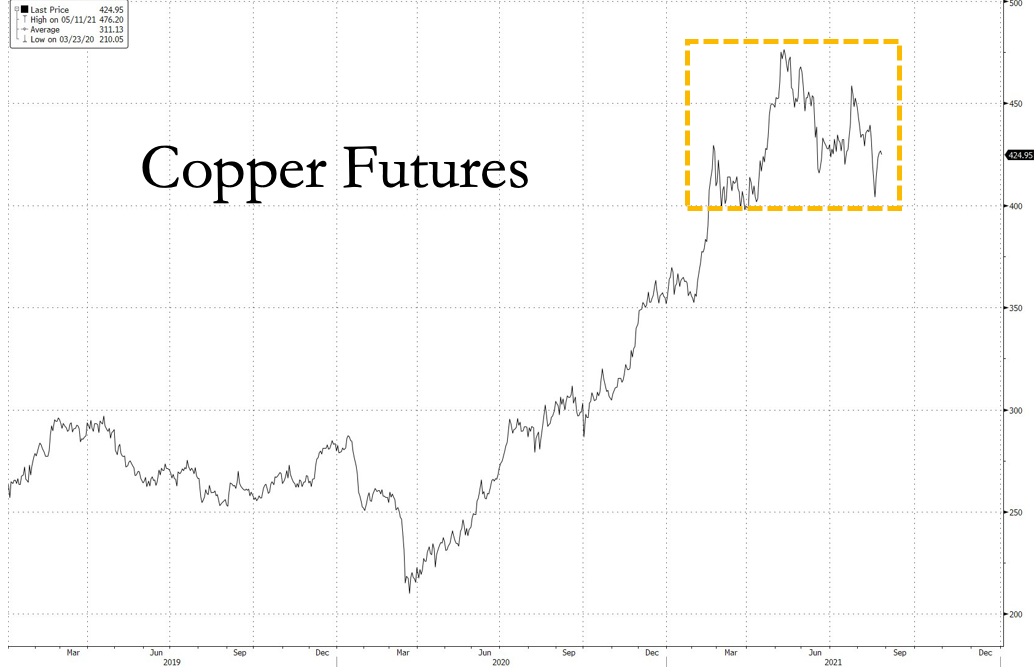

After a 126% upswing from the COVID lows, copper futures have remained in a holding pattern since the beginning of the year.

Bloomberg Industrial Metals Index remains range-bound as well.

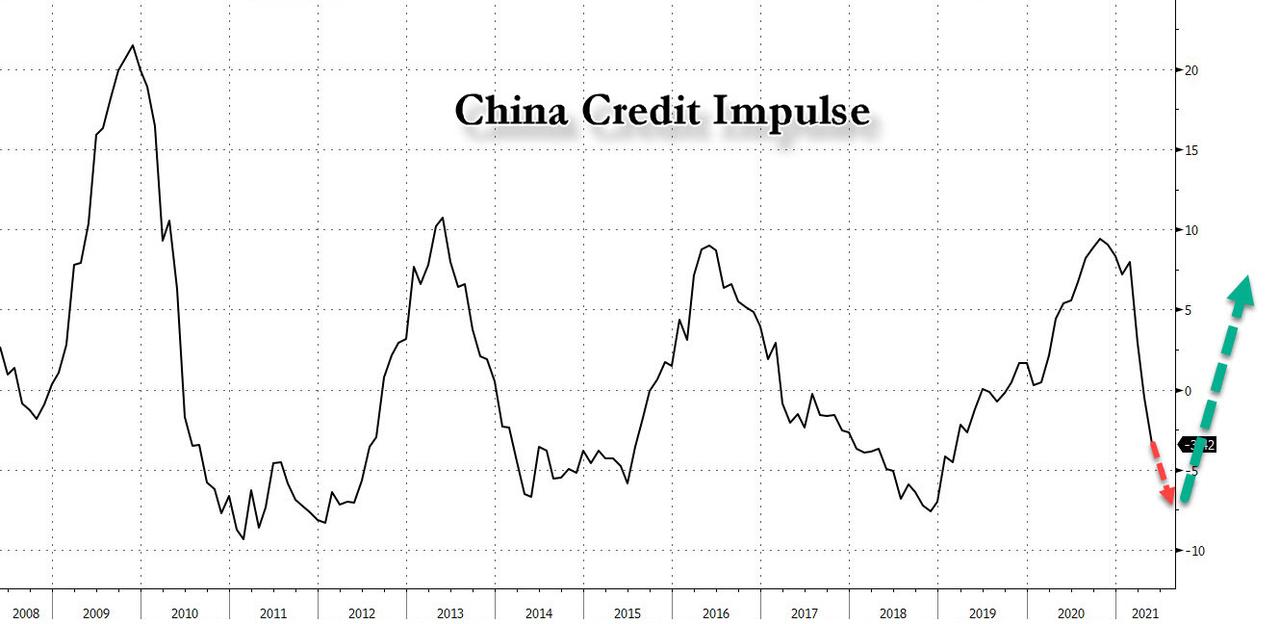

Premium subs may recall in a credit note titled "China's Credit Impulse Just Bottomed With Profound Implications For Global Economies And Markets," China's credit impulse bottomed in June and is now poised for a rapid rebound, breathing a new life - with the usual 6 or so month lag - into the reflation trade.

So much for the Federal Reserve's "transitory" narrative as it appears inflationary forces will be sticky around.

Disclosure: Copyright ©2009-2021 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more